Ready to learn more?

Explore More

Home » Insights » Estate Planning » Strategies to Help Safeguard Your Wealth and Family Legacy

Logan Baker, JD, LL.M., MBA

Lead, Sr. Wealth Strategist

Discover how exemptions, gifting tactics, and trust benefits can help safeguard your wealth and ensure family legacies thrive.

Navigating the intricate landscape of estate taxes is paramount for those with substantial assets. Understanding estate-tax exemptions, exploring strategic gifting options, and considering the advantages of irrevocable trusts can help individuals protect their wealth and provide for future generations. Throughout the following article, we explore these crucial facets of estate planning, providing insights, examples, and proactive strategies to assist individuals in safeguarding their legacy, minimizing tax liabilities, and ensuring a smooth transition of assets to their heirs.

An estate-tax exemption, sometimes called the estate-tax exclusion or the unified credit, is the amount of an individual’s estate that isn’t subject to federal or state estate taxes upon their death. Both the federal government and some states can impose estate taxes on the transfer of a person’s assets and property to their heirs or beneficiaries after they pass away. If the total value of an individual’s estate is below the exemption thresholds, their heirs don’t have to pay any estate taxes. However, if the estate’s value exceeds exemption amounts, hefty estate taxes are assessed on the portion that exceeds the exemption or, in some states such as New York and Illinois, the entire estate.

The 2017 Tax Cuts and Jobs Act (TCJA) almost doubled the federal estate tax exemptions, from $5.6 million per person, to $11.2 million per person (or from $11.2 million to $22.4 million for married couples). Currently, adjusted for inflation, the federal exemption is $12.92 million ($24.84 million for married couples). However, a provision in the Build Back Better bill will roll the figures back to the previous law’s $5 million cap. After adjusting for inflation (and assuming no new laws are passed between now and then), the expected exemption post 2025 will be approximately $6 million to 7 million (or twice that for married couples). Anything beyond the exemption amount is subject to a lofty 40% federal estate tax.

Individuals with a net worth under $7 million (or married couples with less than $14 million) probably don’t need to make any rush decisions ahead of the estate-tax exemption sunset, as changes likely won’t impact them. On the other hand, for those with larger estates, it makes a lot of sense to contemplate today’s historically high exemptions as they won’t be accessible after 2025. Here are a few thoughts to bear in mind.

For those with estates exceeding 2026 exemption amounts, planned gifting can help with estate-tax reduction. Such strategies can encompass different levels of giving:

Let’s consider the example of John and Jane Smith. Both John and Jane pass away in 2026, leaving behind a $50 million combined estate. A total exemption of $14 million applies and the difference of $36 million is taxed at the federal estate tax rate of 40%, or $14.4 million in tax owed. Beneficiaries receive $35.6 million of the after-tax $50 million estate.

John and Jane Smith are a married couple, who both pass away in 2026

|

Tax Calculation Without Gifting |

Tax Calculation With Gifting to Exclusion |

||

|

Combined gross estate prior to gifting |

$50,000,000 |

Combined gross estate prior to gifting |

$50,000,000 |

|

Taxable gifts in 2025 |

$0 |

Taxable gifts in 2025 |

$28,000,000 |

|

Less unused exemption |

$14,000,000 |

Less unused exemption |

$0 |

|

Amount subject to federal estate tax |

$36,000,000 |

Amount subject to federal estate tax |

$22,000,000 |

|

Federal estate tax rate |

40% |

Federal estate tax rate |

40% |

|

Projected estate tax libility |

$14,400,000 |

Projected estate tax liability |

$8,800,000 |

|

Beneficiaries receive |

$35,600,000 |

Beneficiaries receive |

$41,200,000 |

Now, suppose John and Jane give gifts of $28 million in 2025 (which is their combined lifetime gift exemptions, indexed for inflation). The amount subject to federal estate tax falls to $22 million. At the same 40% federal tax rate, the liability to the IRS is $8.8 million, leaving a total of $41.20 million to beneficiaries. Importantly, these gifts must be made before the estate tax sunset and prior to the sharp reductions in tax exemption amounts slated for 2026.

Irrevocable trusts, specifically grantor trusts, can offer effective means for leveraging the exemption and relocating assets outside of estates. The Spousal Lifetime Access Trust (SLAT) is one example. SLATs are irrevocable trusts where a spouse is the beneficiary, and assets correctly transferred into the trust are excluded from the estate.

SLATs can sometimes help ease the concern of couples who aim to minimize estate taxes while retaining access to their assets and are most beneficial when both spouses (and their relationship) are in good health.

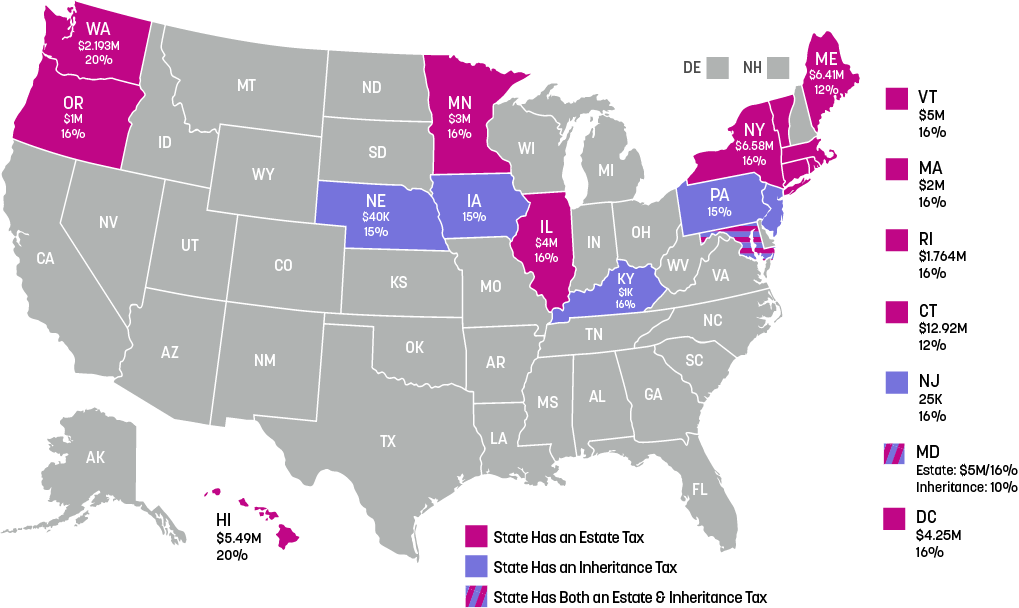

State estate tax laws, rates, and exemptions can vary widely from one state to another. Some states have no estate tax, while others have their own estate tax laws with exemptions and rates that differ from the federal estate tax. If you’re concerned about estate taxes, it’s important to be aware of the specific laws in the state of your primary residence.

Twelve states and the District of Columbia levy estate taxes and six impose inheritance taxes. Maryland is the only state to impose both estate and inheritance taxes. Exemptions will vary depending on the state. For example, while Connecticut has a 12% state estate tax, the exemption is up to $12.9 million, while Massachusetts imposes a 16% estate tax and a $1 million exemption. Washington and Oregon also have relatively high tax rates and low exemptions.

Note: Exemption amounts are shown for state estate taxes only. Inheritance taxes are levied on the posthumous transfer of assets based on the relationship to the decedent; different rates and exemptions apply based on the relationship.

Credit shelter trusts (CSTs), also known as bypass trusts or family trusts, are commonly used to help shield some assets from state estate taxes. Married individuals often set them up through a will or revocable living trust. The trust is funded with assets valued up to the state’s estate tax exemption threshold, or to the federal exemption threshold if there is no state estate tax. These trusts are set up jointly by spouses, which allows the surviving spouse to utilize the deceased spouse’s unused exemption through portability to the extent the credit shelter trust is not used.

Let’s look at another example. Randy and Regina Long live in the high estate tax state of Washington, which has a roughly $2.2 million exemption and a 20% estate tax rate. Their combined estate is $24 million. Randy passes away without a CST in place and, through portability, Regina inherits his $12 million in deceased spousal unused exclusion (DSUE).

By 2026, when Regina passes, the value of the assets has appreciated to $30 million. Subtracting the roughly $2.2 million for Regina’s Washington exemption, leaves $27.8 million subject to Washington state estate tax (at a top rate equal to $1.49 million plus 20% for any amount over $9 million), which results in roughly $5.25 million tax owed to the state.

Estate taxes paid to the state can be deducted from the federal tax owed. In addition, Regina’s 2026 exemption of $6 million plus Randy’s $12 million DSUE are applied to the $30 million estate. So, the heirs pay 40% federal tax on $6.75 million ($30 million – $18 million in exemptions – $5.25 million paid in state estate taxes) or $2.7 million. After taxes, beneficiaries receive roughly $22 million of the $30 million estate.

|

Tax Calculation Without a Credit Shelter Trust |

|

Washington: Regina’s Washington gross estate is $30,000,000 Regina applies her Washington exemption of $2,193,000 Amount subject to Washington estate tax: $27,807,000 Washington estate tax bill (top rate: $1.49M + 20% of the amount over $9M): $5,251,400 Federal: Regina’s federal gross estate is $30,000,000 Regina applies her federal exemption of $6,000,000, the $12,000,000 DSUE, and the $5,251,400 deduction for Washington estate tax paid Amount subject to federal estate tax: $6,748,600 Federal estate tax bill (40%): $2,699,440 Beneficiaries receive: $22,049,160 (Regina’s gross estate — state and federal estate tax) |

Now, suppose instead that Randy’s unused Washington state $2.2 million exemption is used to fund a CST. Rather than $12 million, Regina now inherits $9.8 million DSUE (the $12 million minus the amount in the trust) and, along with her half of the $24 million estate, has $21.8 million in her name. Again, the value of all assets appreciates to $30 million by the time Regina dies in 2026, with $27.3 million in the estate and $2.7 million in the CST.

Regina’s $2.2 million Washington exemption is applied to the $27.3 million estate, meaning that $25.1 million is subject to state estate tax (again, at a top rate equal to $1.49 million plus 20% for any amount over $9 million) and the total amount of tax owed to Washington is $4.7 million instead of $5.25 million.

To calculate the federal tax owed, Regina’s federal exemption of $6 million, Randy’s $9.8 million DSUE, and the $4.7 million in state tax are applied to the $27.3 million gross estate, leaving roughly $6.8 million subject to the 40% federal tax. The bill amounts to $2.7 million (the same as without the CST). So, a combined $7.4 million is taken out of the $27.3 million gross estate, leaving heirs $19.9 million plus the appreciated assets in the CST, or a total of $22.6 million and roughly $600,000 more than without the trust.

|

Tax Calculation With a Credit Shelter Trust |

|

Washington: Regina’s Washington gross estate is $27,258,750 Regina applies her Washington exemption of $2,193,000 Amount subject to Washington estate tax: $25,065,750 Washington estate tax bill (top rate: $1.49M + 20% of the amount over $9M): $4,703,150 Federal: Regina’s federal gross estate is $27,258,750 Regina applies her federal exemption of $6,000,000, the $9,807,000 DSUE, and the $4,703,150 deduction for Washington estate tax paid Amount subject to federal estate tax: $6,748,600 Federal estate tax bill (40%): $2,699,440 Beneficiaries receive: $22,597,410 |

These examples are hypothetical and will vary based on factors like the size of the estate, how future exemption amounts are indexed for inflation, and the individual’s state of residence.

Acting on the exemption sunset and planning estate taxes on the state level should happen sooner rather than later. As the 2025 deadline approaches, plan ahead and work with your wealth advisor to help ensure you have enough time to execute your preferred strategy or utilize the current (and generous) exemptions to meet your goals. Similarly, if you’re planning on moving to a different state or leveraging a CST to help minimize the impact of estate taxes on the state level, please reach out to your wealth advisor today for a review of your options and to discuss ways to pass on your estate to your heirs in the most tax-efficient way possible.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. The hypothetical examples above are for illustration purposes only. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.