Ready to learn more?

David Simpson, CFA, CFP®

Sr. Investment Strategist

Discover the potential benefits of private investments for your diversified portfolio, their illiquidity premium, and the importance of a financial plan.

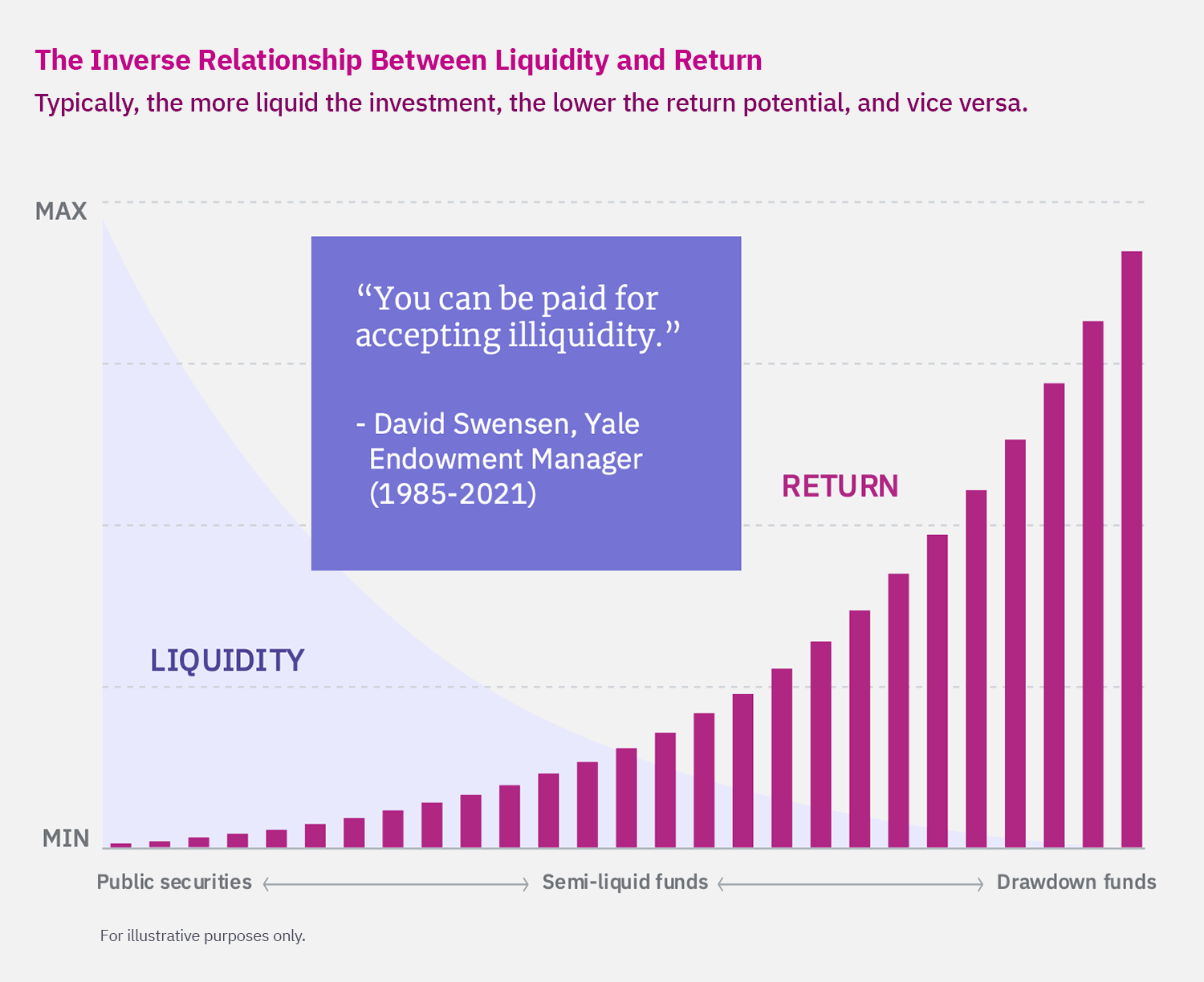

Incorporating private investments into your portfolio begins with a solid financial plan. Given their illiquid nature and the potential lack of early exit opportunities, careful planning is essential when considering private markets. Private investments can leverage the “illiquidity premium” to potentially achieve higher returns than public markets, if investors are comfortable with investment capital being locked up for the long term.

Public investments (stock, bonds, mutual funds, ETF’s) typically trade daily and are then available as cash the next day. Money market funds and higher-grade bonds that mature under twelve months generally have the benefit of lower volatility (or nearly none in the case of a money market fund), in addition to the liquidity to turn them into cash. Equity-based investments, directly or through an investment vehicle such as an ETF, should have at least a five-year time horizon in our view, but are available as cash the next business day after the sale. With many private investments, they do not trade daily or at all. Therefore, investors typically require an additional potential for return if they are locking up capital in a private investment that is not liquid. The additional return potential is referred to as the “illiquidity premium” and is the expected difference in return between a private investment and its corresponding public investment.

A discussion about a diversified investment portfolio would not be complete without considering private assets.

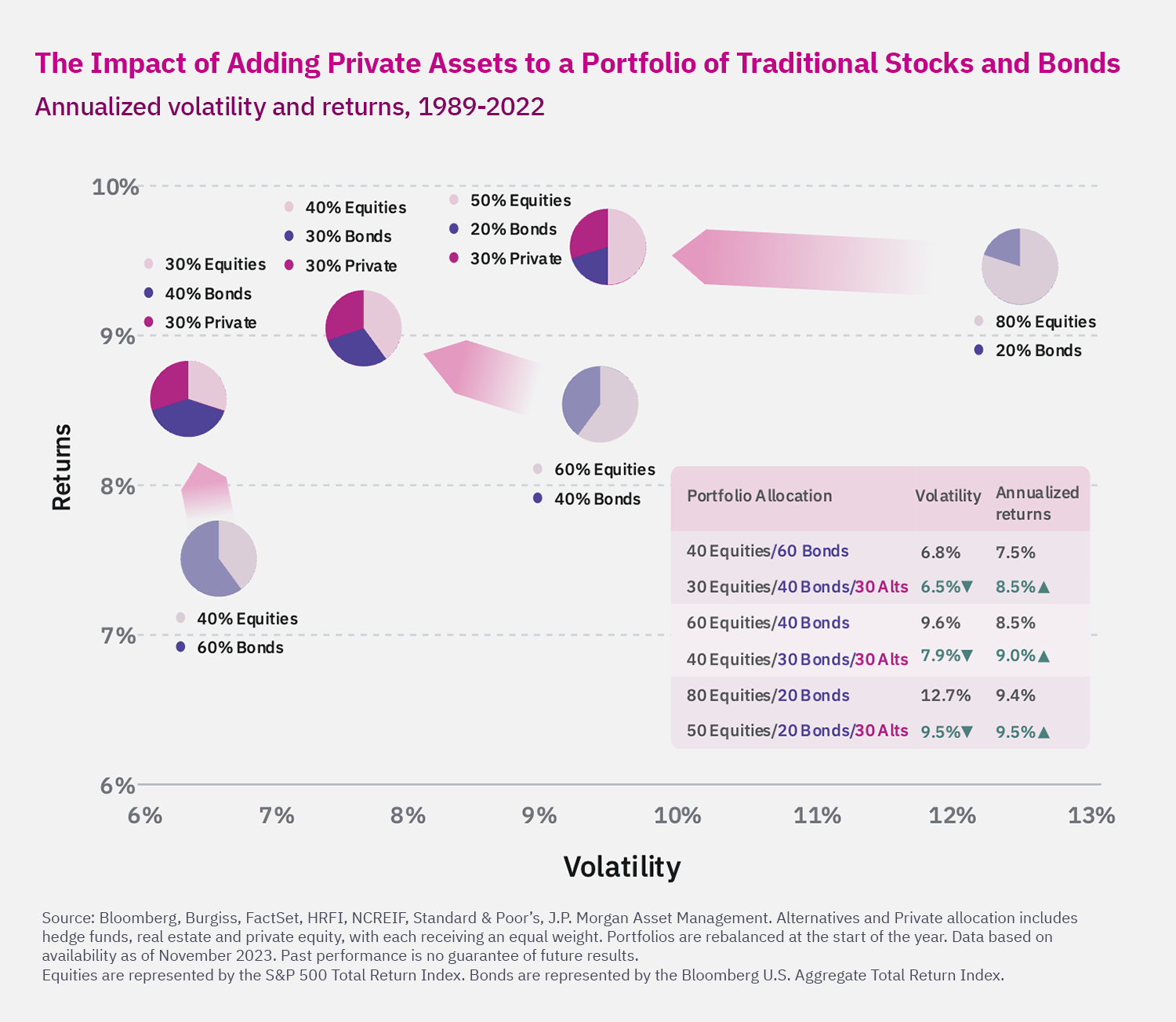

While some investors may prefer the liquidity provided by public securities, qualified investors willing to allocate a portion of their portfolio to illiquid securities can potentially benefit from an “illiquidity premium.” Including private investments offers an additional allocation choice that, when combined with effective cash flow management, can enhance diversification and/or returns. Historical data shows that private equity and private credit have outperformed their corresponding public counterparts (U.S. public equities versus private equity and private credit versus U.S. high-yield bonds).3,4

It is important to note that access to private markets is typically restricted to accredited investors, qualified clients, or qualified purchasers. This ensures that only those with sufficient financial resources can participate, given the higher risks and complexities involved in private investments.

Equities are represented by the S&P 500 Total Return Index. Bonds are represented by the Bloomberg U.S. Aggregate Total Return Index.

Private investments are available through various asset classes:

Various investment vehicles provide access to private markets, each with distinct levels of liquidity:

Due to the risks and illiquidity associated with private investments, the Securities and Exchange Commission requires private investors to meet certain criteria:

While private investments can add diversification and potentially enhance returns, it is crucial to begin with a well-built financial plan to understand your net worth and cash flow needs. Unlike stocks, bonds, ETFs, and mutual funds, which offer daily liquidity and potential capital gains, private investments may require a commitment of up to 10 years. Therefore, planning for this time horizon is essential. Private investments should be considered as long-term vehicles rather than short-term income or growth options.

Your advisor can help determine whether private investments are appropriate for your portfolio. Not a Mercer Advisors client but interested in more information? Let’s talk.

1.“The Rise and Rise of the Global Balance Sheet,” McKinsey Global Institute, November 2021.

2. Bain analysis of S&P Capital IQ data, as of December 2022.

3. Burgiss, Yahoo Finance, as of February 26, 2024. Data for period January 1, 2000, to January 1, 2020. Private fund returns are a median calculated internal rate of return, net of fees. US equity returns annualized from S&P 500 Total Returns Index. Past performance is not a guarantee of future results. Indices are not available for direct investment.

4. Burgiss, FRED Economic Data, as of February 26, 2024. Data for period January 1, 2000, to January 1, 2020. Private fund returns are a median calculated internal rate of return, net of fees. High-yield bond returns annualized from ICE BofA US High Yield Index Total Return Index. Past performance is not a guarantee of future results. Indices are not available for direct investment.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

This information is provided for informational purposes only and is not intended as, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. Any such offer can be made only via the relevant access fund’s formal offering documents. Investing in private funds is speculative and will entail substantial risks.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER® certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.