Streamlined access to private market investing with our integrated team

High-net-worth-individuals have had access to private markets, but typically not at these levels and costs. Our new fund-of-funds platform offers:

- Institutional-grade access and selection from an experienced specialist team with extensive, established networks

- Low cost (0.19%) access to proprietary strategies with no additional performance fees

- Low minimum investments (starting at $100,000), making it easier to diversify

- A simple and streamlined experience from pre- to post-investment

Contact Us

High-net-worth-individuals have had access to private markets, but typically not at these levels and costs. Our new fund-of-funds platform offers:

- Institutional-grade access and selection from an experienced specialist team with extensive, established networks

- Low cost (0.19%) access to proprietary strategies with no additional performance fees

- Low minimum investments (starting at $100,000), making it easier to diversify

- A simple and streamlined experience from pre- to post-investment

As your net worth grows, you enjoy greater possibilities — and face more complex decisions.

Mercer Advisors delivers comprehensive solutions through a team of specialists dedicated to you. With our family office model, you receive white-glove service, dedicated guidance, and access to exclusive offerings.

- May increase diversification

- Can boost returns

- Highly calibrated exposure

- May reduce portfolio volatility

- Institutional-grade access and selection

- Low costs

- Low minimum investment

- Streamlined digital experience

- A chat with your advisor to determine whether (and if so, what) private markets funds are right for you

- Minimal additional administration via our streamlined platform

Want to learn more about the right questions to ask a potential advisor?

Download our free guide for a financial advisor interview!

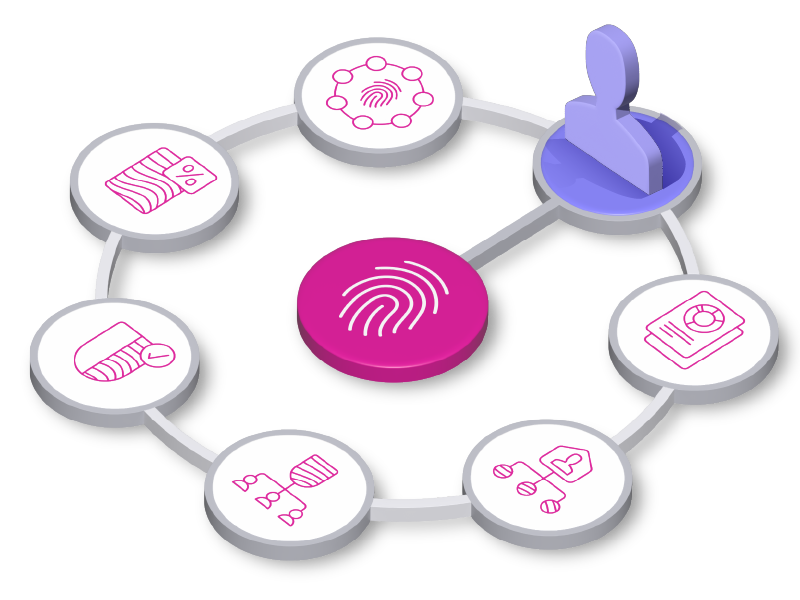

SOURCING

RIGOUROUS DUE DILIGENCE

HIGH-QUALITY INVESTMENTS

The best ideas from across the Mercer Advisors network, rigorously put through due diligence

Access to proprietary strategies for 19bps, which may reduce as fund size grows

Diversified exposure for as little as $100,000 to funds that have $5-$25 million minimums

A streamlined digital experience replaces clunky investment and admin processes

of planners, investors, accountants, and estate strategists that designs – and executes – your financial plan.

who is focused on serving you, not on finding new clients.

that is tailored specifically for you and managed by a team of 100+ investment professionals (not just one advisor).

that combines intimate service and sophisticated capability, and only acts in your best interest.

Mercer Advisors’ team of experienced financial advisors, CPAs, investment professionals, and estate strategists work together to provide comprehensive and personalized advice to clients. As one of the largest, and fastest growing advisory firms, we are dedicated to guiding clients through all life stages, offering personal financial advice tailored to their unique needs at their specific life stage. Mercer Advisors provides experience that spans the scope of your financial journey, whether you need general financial planning or tax help, advice for key life events or decisions such as inheritance management, or ways to maximize your retirement savings.

What Exactly do We do for You?

Financial Planning

Investment Management

Tax Planning & Preparation1

Estate Planning2

Insurance Solutions3

Trustee Services4

Mercer Advisors. A boutique fiduciary with national strength.

1 Tax preparation and tax filing are a separate fee from our investment management and planning services.

2 Mercer Advisors is not a law firm and does not provide legal advice to clients. All estate planning document preparation and other legal advice is provided through select third parties unaffiliated with Mercer Advisors.

3 Mercer Global Advisors has a related insurance agency. Mercer Advisors Insurance Services, LLC (MAIS) is a wholly owned subsidiary of Mercer Advisors Inc. Employees of Mercer Global Advisors serve as officers of MAIS.

4 Trustee services are offered through select third parties with which a client would engage directly, as such additional fees may apply.

Company data as of December 31, 2024. Client Assets refers to client assets under management (AUM) and client asset under advisement (AUA) by both Mercer Global Advisors Inc. and Regis Acquisition Inc. Client Assets includes assets gained from recent acquisitions where the advisory agreements have been properly assigned to Mercer Global Advisors, but the custodial accounts have yet to be transferred and/or the accounts have yet to be migrated to Mercer Global Advisors’ portfolio management system. Mercer Global Advisors Inc. and Regis Acquisition Inc. are affiliated SEC registered investment advisers and deliver investment advisory and family office related services. Mercer Global Advisors Inc. and Regis Acquisition Inc. are subsidiaries of Mercer Advisors Inc., a parent company not involved with investment services.

Mercer Advisors was ranked #1 for RIA firms with up to $70 billion in assets. The Barron’s top RIA ranking is based on a combination of metrics — including size, growth, service quality, technology, succession planning and others. No fee was paid for participation in the ranking, however, Mercer Advisors has paid a fee to Barron’s to use the ranking in marketing.

The Mercer Advisors private markets platform is available to Qualified Purchasers only. This material is provided for informational purposes only and is not intended as a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Mercer Advisors. Investing in private funds is speculative and will entail substantial risks.