Ready to learn more?

Home » Insights » Retirement » Relocation in Retirement: Key Considerations Before Making a Move

Steven Elliott, MST, CPA

Tax Director

Retiring to a warmer climate or closer to family? Before you move, evaluate these financial, practical, and emotional factors.

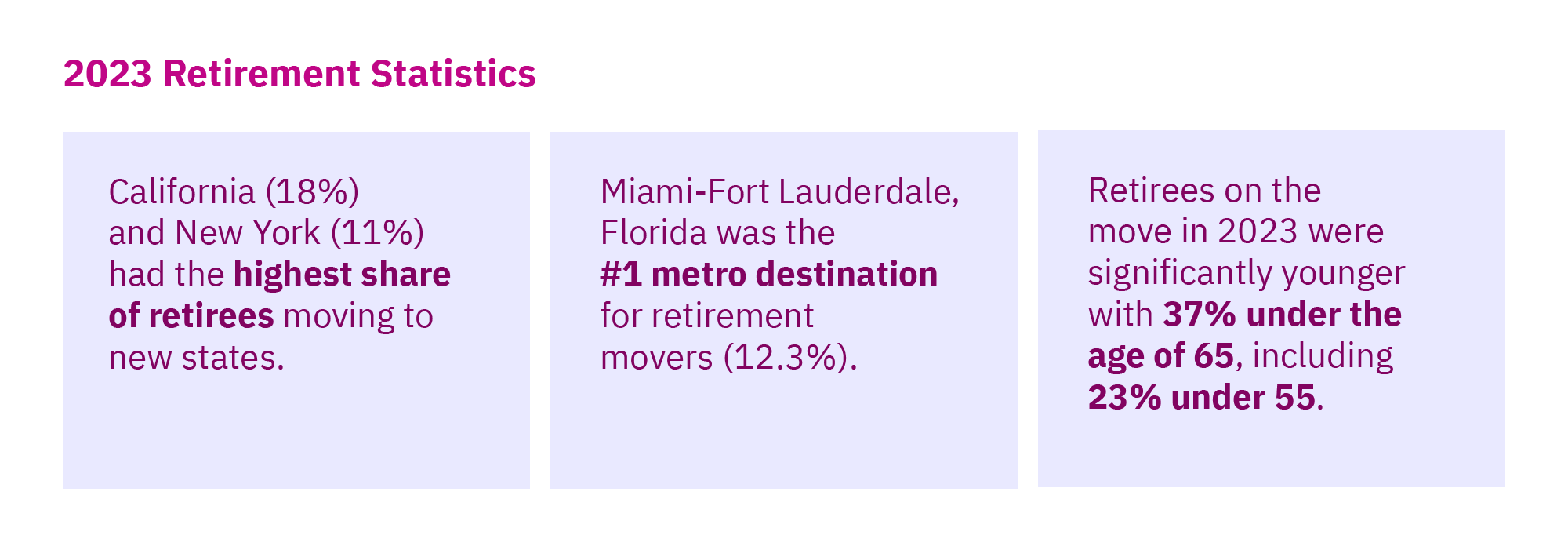

Did you know that in 2023, more than 338,000 Americans moved to a new state following retirement? Florida was the top destination, attracting 11% of retirees, followed by South Carolina (10%), New Jersey (6%), and Texas (5.8%).1 Although the allure of retiring to an area that may offer warmer weather, better healthcare, affordable housing, lower taxes, or closer proximity to friends and family can be compelling, it’s also important to thoroughly consider the financial, practical, and emotional implications before deciding if a move is right for you.

Though Social Security benefits can be elected as early as 62, the official full retirement age in the U.S. is between 66 years for those born between 1943 and 1954, which gradually increases for those born between 1955 and 1960.2 For anyone born after 1960, the retirement age is 67. While some people retire sooner than retirement age and others keep working later in life, retirees in their mid-60s or older who have left the workforce often choose to relocate for a variety of personal or financial reasons. If you are considering a relocation, keep the following in mind:

When it comes to housing, opt for practicality

According to a February 2023 study from Vanguard, 60% of relocating retirees sell homes in high-priced areas to move to more affordable locations.3 In the process, they extract on average, approximately $100,000 in home equity. Although a larger home may sound appealing, it generally comes with higher property taxes, insurance, and maintenance costs. Downsizing often results in a smaller mortgage payment, lower property tax, and utility bills.

Income taxes are an essential consideration

Even in retirement, taxes remain a significant expense. States vary widely in their tax friendliness, making it crucial to understand the tax implications of your potential new home. Nine states have no income tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. Meanwhile Illinois, Mississippi, and Pennsylvania exempt retirement income. For affluent retirees, the savings from relocating to a state with no income tax can be significant. When relocating to a new state, it’s important to fully sever ties with your previous state, as partial measures can leave you vulnerable to tax claims from your former state.

Test the community and lifestyle before you invest

Leaving the workforce often means more free time to pursue activities or hobbies. Moving to a smaller town or a senior living community can sometimes enhance a retiree’s lifestyle. But before committing to buying a home, consider hotels or renting (including an Airbnb) in your desired area first, or spending an extended visit there. This trial period can reveal potential drawbacks that aren’t apparent at first glance. For example, a mountain home might prove inconvenient if it’s far from essential services. And moving into a community might come with an active homeowner’s association and strict deed restrictions which can be difficult to adjust to if you’re not accustomed to them.

Friends and Family considerations

A major reason cited for moving in retirement is to be closer to friends and family. According to a report from Transamerica Center for Retirement Studies, more than half of workers said spending more time with friends and family is a major retirement goal.4 However, although being closer to family can be rewarding it might not meet all your expectations, as family members may have their own busy schedules.

Consider the tax risks vs. benefits

Though some states may seem more attractive for retirees than others because they don’t impose income tax, there are often other costs to consider when crunching the numbers. Although living in a state without income tax might allow you to hold on to more of your hard-earned money, it won’t necessarily shield you from other taxes or a higher cost of living. For example, Washington State has no income tax, but they do impose a capital gains tax and have relatively high sales tax, including a gas tax. Similarly, although New Hampshire has no income tax, the state does impose taxes on interest and dividend income (above personal exemption amounts).

Homeowners in some areas of Florida, California, and Texas are feeling the sting of the rising cost to insure their homes due to many insurance companies no longer insuring in those states – resulting in fewer home insurance companies and increased premiums. In Florida, if a retiree has minimal income to tax, higher insurance premiums can likely negate the benefits of having no state income tax.

Many states have also witnessed rapidly appreciating home values, resulting in higher property taxes. New Jersey has the highest tax rates for owner-occupied property at 2.23%; Hawaii has the lowest at 0.32%.5

Thinking about renting instead of buying? The average rent in the U.S. has increased by more than 3% per year since 2012.6 At that pace, someone paying $2,000 per month would see their rent increase to nearly $2,700 over ten years, not to mention the likely increase in utility costs.

For many retirees who have fixed incomes during their retirement years, the rising cost of food, insurance, rent, and other expenses can have a substantial impact on their budgets and might not be sustainable over a retirement horizon that can span many decades. Therefore, before relocating, a retiree will want to ask if their income and resources can keep up with the rising cost of living that they’ll likely encounter as well as moving costs, health costs, home repairs, and any other unexpected expenses.

Why does the 183-day rule matter?

Many people relocate to a tax-advantaged state part-time, intending to reside in the new state to enjoy its tax benefits during filing season. To establish residency in most states, you must live more than half the year plus a day (183 days) to qualify as a statutory resident. The rules differ from state to state, and you also need to be able to prove it. For more information and recommendations to help remove the guesswork, view our checklist.

If you’re weighing the pros and cons of relocating in your retirement and want to place the decision strategically within a larger context, speak with your wealth advisor. If you are not a Mercer Advisors client and want to learn more, let’s talk.

If you’re weighing the pros and cons of relocating in your retirement and want to place the decision strategically within a larger context, speak with your wealth advisor. If you are not a Mercer Advisors client and want to learn more, let’s talk.

1 Hicks, Darryl. “Seniors Flocked to These States in 2023.” NRMLA, National Reverse Mortgage Lenders Association,

26 January 2024.

2 “Retirement Benefits.” Social Security Administration. 2024.

3 “Home Is Where Retirement Funding Is.” Vanguard. February 2023.

4 “Emerging From the COVID-19 Pandemic: The Retirement Outlook of the Workforce.” Transamerica Center for Retirement Studies. June 2022.

5 Yushkov, Andrey. “Property Taxes by State and County, 2023.” Tax Foundation. September 12, 2023.

6 Bitton, David. “Average Rent Increase by Year.” Doorloop. 18 March 2024.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.