We’ve spent much of the past two months marveling at the “Great Rotation” in markets – where investors have been exiting those high flying, mega cap growth stocks that had powered the market over the past two years and moving into small-cap and value stocks.

This trend became apparent in early July, which means the Great Rotation has now been underway for about two months. Now is a good time, on the cusp of widely anticipated interest rate cuts, to take stock of a trend that seems predicated, to a large degree, on the prospect of lower future interest rates.

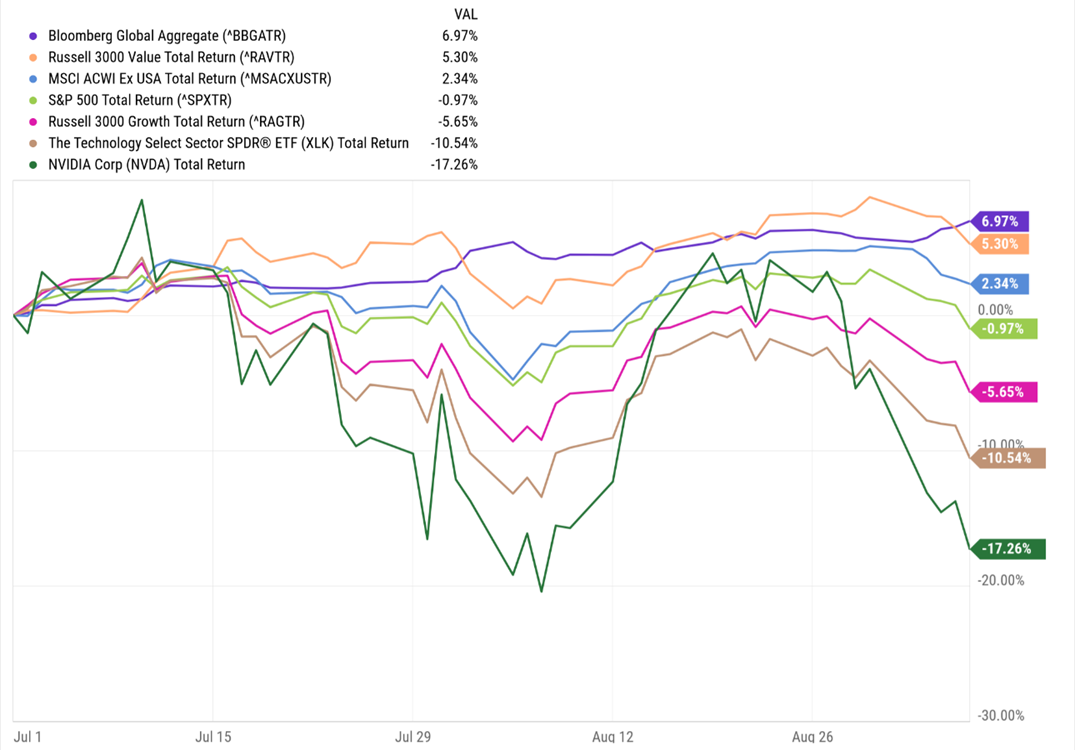

Winners and Losers over the Past Two Months

For nearly two years, investors watched as money poured into the Magnificent Seven stocks – Tesla, Nvidia, Alphabet, Meta (Facebook), Microsoft, Apple, and Amazon – but over the past two months an entirely different set of assets have been the leaders.

On the downside, Nvidia, which had been the early winner of the Artificial Intelligence boom and had been central to the Magnificent Seven story, has declined over 17% since July 1. Tech stocks overall are down over 10% (as measured by the iShares’ Technology Select Sector SPDR®, XLK.)

For the quarter-to-date period ending September 6, global bonds, up nearly 7%, are at the top of the leader board. The Russell 3,000 Value Index, capturing the broad universe of value stocks, is up about 5%. International stocks have also outperformed – returning just over 2% (as measured by the MSCI ACWI ex USA index). Over the same period, the S&P 500 has declined about 1%.

When a particular stock or asset class is on an incredible runup, investor FOMO (fear of missing out) kicks into high gear and it’s incredibly tempting to want to participate in the run up. But the Great Rotation has been a powerful reminder of why the best recommendation remains a broadly diversified portfolio. As the market moves through its cycles, different assets fall in and out of favor, and history has shown time and again that it’s a fool’s errand to try to time markets, asset classes, or individual securities.

Note: Past performance is not a guarantee of future results. Indices are not available for direct investment.

Will This Rotation Persist?

There are many reasons to believe that the underlying economic and market factors that have contributed to this rotation could persist.

A key factor behind this rotation has been the Federal Reserve signaling it believes the time has come to cut interest rates. As we’ve previously written, these rate cuts may tend to favor small cap companies, many with floating rate debt that should directly benefit from lower interest rates. (See: The great market rotation)

The data in recent weeks have continued to point in the direction of rate cuts.

First, there are signs that the economy is continuing to slow down. In August, the economy added 142,000 jobs, a weaker-than-expected result for the second consecutive month.

Second, inflation has continued to moderate. Prices may be higher now, but the Fed tends to focus on the pace of increase over the prior 12 months, and by that measure, several categories have even slipped into deflation territory.

The prices of core goods (excluding food and energy) have dropped. The Fed has long held the view that energy and food prices do not predict the future path of inflation given their high volatility. But so-called core prices are incredibly important to the Fed, and these prices have in fact begun to drop. For now, overall inflation is still a bit above the Fed’s target thanks to still-climbing prices of shelter and other services.

Put it together, and the combination of slowing job creation and declining inflation (including even some deflationary pressure) means the Fed is highly likely to cut rates at next week’s FOMC meeting.

Source: JPMorgan Guide to the Markets

Key Takeaways:

Diversification is typically rewarded. Globally diversified portfolios have been well rewarded over the past two months. It’s sometimes hard to know exactly when diversification is going to pay off. It isn’t about guessing when the market is going to turn or undergo a rotation; it’s about building portfolios of asset classes that behave differently in response to different market and economic environments — all with an eye towards smoothing out returns over times. It’s about being ready for any direction the market might move. The past two months are a powerful reminder of why the strategy works.

Diversify both within and across asset classes. To get the full benefits of diversification, it’s best to diversify both within and across asset classes. Holding the entire technology sector is better than holding just one technology company; holding many sectors is better than holding one sector; and investing in many countries is better than investing in just one. It is this broad mix of investments, both within and across asset classes, that’s most likely to provide superior risk-adjusted returns over time.

Diversification doesn’t have to hurt. Investors are often reluctant to diversify because they don’t want to pay hefty tax bills. This is understandable. However, this is where high-quality financial and tax planning is essential. Diversification doesn’t have to hurt. There are lots of great tools and strategies that can help investors unwind concentrated positions in a tax-friendly manner and, ultimately, help us achieve better portfolio diversification. Your trusted advisor can help you assess your portfolio and evaluate which strategy or tool is best for you given your particular situation.

Not a Mercer Advisors client but interested in more information? Let’s talk.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Diversification does not ensure a profit or guarantee against loss. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER® certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Home » Insights » Market Commentary » Two Months In, the Great Rotation by the Numbers: Insights From Our CIO

Two Months In, the Great Rotation by the Numbers: Insights From Our CIO

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

The Great Rotation out of major tech stocks has been underway for two months. We take stock of how far this rotation has gone.

We’ve spent much of the past two months marveling at the “Great Rotation” in markets – where investors have been exiting those high flying, mega cap growth stocks that had powered the market over the past two years and moving into small-cap and value stocks.

This trend became apparent in early July, which means the Great Rotation has now been underway for about two months. Now is a good time, on the cusp of widely anticipated interest rate cuts, to take stock of a trend that seems predicated, to a large degree, on the prospect of lower future interest rates.

Winners and Losers over the Past Two Months

For nearly two years, investors watched as money poured into the Magnificent Seven stocks – Tesla, Nvidia, Alphabet, Meta (Facebook), Microsoft, Apple, and Amazon – but over the past two months an entirely different set of assets have been the leaders.

On the downside, Nvidia, which had been the early winner of the Artificial Intelligence boom and had been central to the Magnificent Seven story, has declined over 17% since July 1. Tech stocks overall are down over 10% (as measured by the iShares’ Technology Select Sector SPDR®, XLK.)

For the quarter-to-date period ending September 6, global bonds, up nearly 7%, are at the top of the leader board. The Russell 3,000 Value Index, capturing the broad universe of value stocks, is up about 5%. International stocks have also outperformed – returning just over 2% (as measured by the MSCI ACWI ex USA index). Over the same period, the S&P 500 has declined about 1%.

When a particular stock or asset class is on an incredible runup, investor FOMO (fear of missing out) kicks into high gear and it’s incredibly tempting to want to participate in the run up. But the Great Rotation has been a powerful reminder of why the best recommendation remains a broadly diversified portfolio. As the market moves through its cycles, different assets fall in and out of favor, and history has shown time and again that it’s a fool’s errand to try to time markets, asset classes, or individual securities.

Note: Past performance is not a guarantee of future results. Indices are not available for direct investment.

Will This Rotation Persist?

There are many reasons to believe that the underlying economic and market factors that have contributed to this rotation could persist.

A key factor behind this rotation has been the Federal Reserve signaling it believes the time has come to cut interest rates. As we’ve previously written, these rate cuts may tend to favor small cap companies, many with floating rate debt that should directly benefit from lower interest rates. (See: The great market rotation)

The data in recent weeks have continued to point in the direction of rate cuts.

First, there are signs that the economy is continuing to slow down. In August, the economy added 142,000 jobs, a weaker-than-expected result for the second consecutive month.

Second, inflation has continued to moderate. Prices may be higher now, but the Fed tends to focus on the pace of increase over the prior 12 months, and by that measure, several categories have even slipped into deflation territory.

The prices of core goods (excluding food and energy) have dropped. The Fed has long held the view that energy and food prices do not predict the future path of inflation given their high volatility. But so-called core prices are incredibly important to the Fed, and these prices have in fact begun to drop. For now, overall inflation is still a bit above the Fed’s target thanks to still-climbing prices of shelter and other services.

Put it together, and the combination of slowing job creation and declining inflation (including even some deflationary pressure) means the Fed is highly likely to cut rates at next week’s FOMC meeting.

Source: JPMorgan Guide to the Markets

Key Takeaways:

Diversification is typically rewarded. Globally diversified portfolios have been well rewarded over the past two months. It’s sometimes hard to know exactly when diversification is going to pay off. It isn’t about guessing when the market is going to turn or undergo a rotation; it’s about building portfolios of asset classes that behave differently in response to different market and economic environments — all with an eye towards smoothing out returns over times. It’s about being ready for any direction the market might move. The past two months are a powerful reminder of why the strategy works.

Diversify both within and across asset classes. To get the full benefits of diversification, it’s best to diversify both within and across asset classes. Holding the entire technology sector is better than holding just one technology company; holding many sectors is better than holding one sector; and investing in many countries is better than investing in just one. It is this broad mix of investments, both within and across asset classes, that’s most likely to provide superior risk-adjusted returns over time.

Diversification doesn’t have to hurt. Investors are often reluctant to diversify because they don’t want to pay hefty tax bills. This is understandable. However, this is where high-quality financial and tax planning is essential. Diversification doesn’t have to hurt. There are lots of great tools and strategies that can help investors unwind concentrated positions in a tax-friendly manner and, ultimately, help us achieve better portfolio diversification. Your trusted advisor can help you assess your portfolio and evaluate which strategy or tool is best for you given your particular situation.

Not a Mercer Advisors client but interested in more information? Let’s talk.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Diversification does not ensure a profit or guarantee against loss. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER® certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Explore More

After the Fall: Four Questions for Investors: Insights From Our CIO

The Fallacy of Selling and Waiting Until Markets Calm Down: Insights From Our CIO

Portfolios Built for Moments Like This: Insights From Our CIO