Gold has been perceived as a store of value for thousands of years and is often seen as a haven during economic uncertainty. When stock, bond, and real estate prices fall, gold is believed to hold, or even increase, in value as investors seek stability. Many turn to gold as part of a diversified portfolio, and there are several ways to invest, including gold bars, coins, jewelry, stocks, futures, and funds.

While many perceive gold to offer diversification in times of crisis, it has underperformed compared to other asset classes, especially over the long term. Over fifty years ago, you could turn in paper money and get an ounce of gold for $35, however, then President Nixon ended the convertibility of gold in 1971. Gold does not generate cash flows, and, thus, cannot be valued using methodology we use across most asset classes including stocks, bonds, and real estate. As Howard Marks, Co-Chairman of Oaktree Capital Management wrote, “We can talk about the fact that gold’s value isn’t intrinsic or quantifiable. But the question really comes down to whether people’s faith in gold will increase or erode.” So, should you include gold in your portfolio? Opinions are mixed, but the data is interesting.1

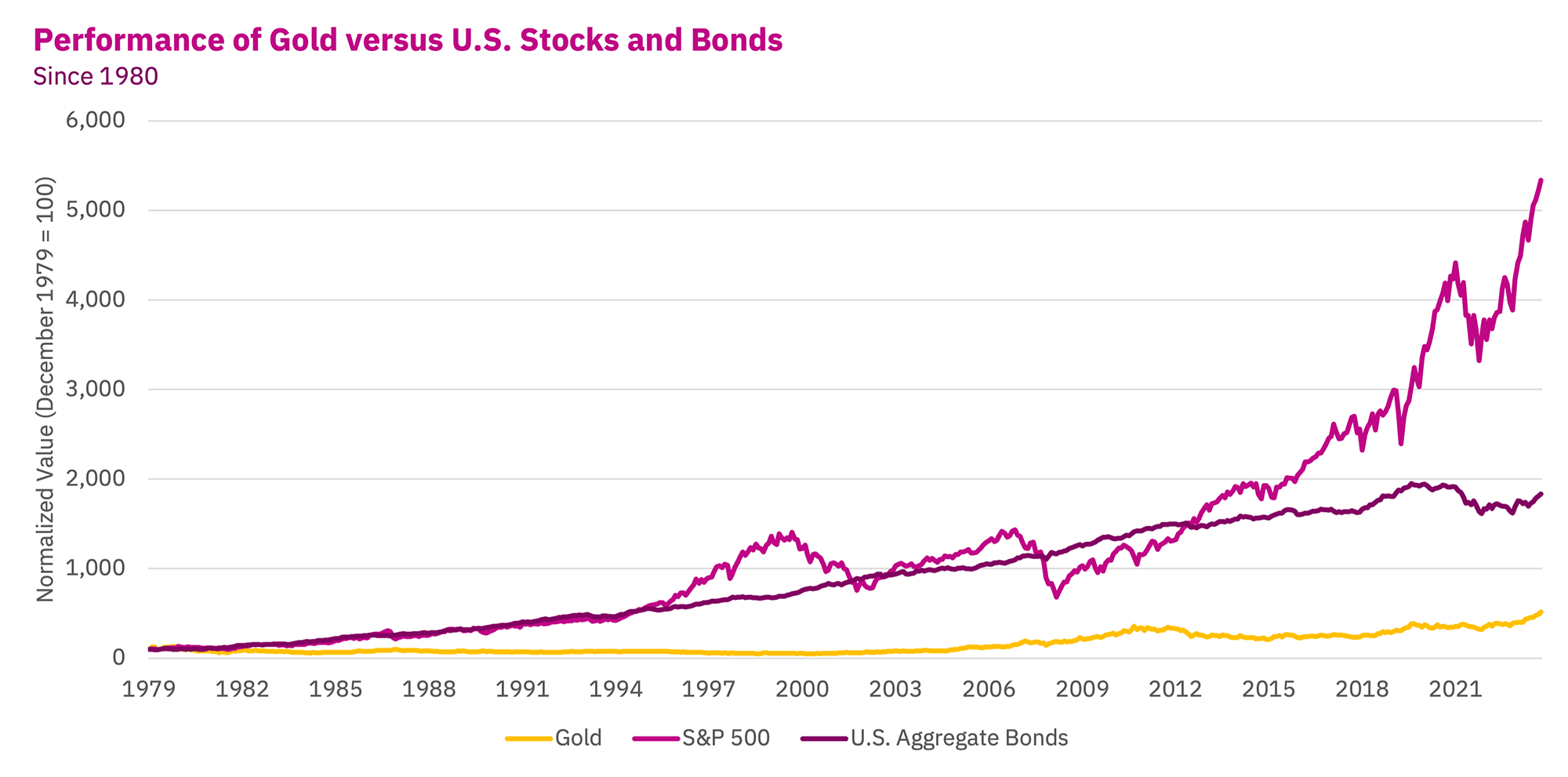

Since 1980, which investment has generated the best returns?

If gold was going to shine, 2022 should have been its moment. Stocks plummeted into a bear market, bonds tanked, inflation soared, and global instability rose, particularly with the Russian invasion of Ukraine. Gold did surge to over $2,000 an ounce in early 2022 but ended the year roughly where it started.2

Looking back from 1980 through 2023, the S&P 500, with dividends reinvested, returned an annualized 11.7% before inflation. Adjusted for inflation, the market’s annualized total return came to 8.2%.

As for bonds, the benchmark 10-year Treasury note delivered an annualized total return of 5.6% over the same time frame. Adjusted for inflation, the 10-year note delivered an annualized total return of 2.4%.

Gold’s returns over the same span hasn’t been quite so brilliant. From 1980 through 2023, gold generated an annualized return of 3.2% before inflation. After adjusting for inflation, gold produced an annualized return of 0.02%.

As shown, over the past four decades, large-cap stocks traded in the U.S. have outperformed both gold and U.S. bonds.

Source: Bloomberg L.P.

Gold versus inflation: 1980 – 2019

Consider the global financial crisis, when gold delivered the best returns in our 40-year sample period. Let’s assume an investor timed it perfectly and invested in gold in early 2008, just as the crisis began to unfold but before the Fed began to dramatically expand its balance sheet. For the 5-year period from 2008-2012, gold returned a staggering 14.94% annually while inflation averaged just 1.80%.

Does this cherry-picked time horizon from 2008-2012 make the case for gold as an inflation hedge? Only if we ignore gold’s track record both before and after that 5-year window. Upon closer examination, the 10-year period from 2008-2017 period includes two very different experiences for gold investors: while gold returned a staggering 14.94% from 2008-2012, gold returned -4.85% annually from 2013-2017. Subsequently, if an investor were late to the game and added gold at the end of 2012 (but before the most aggressive QE), his or her returns were considerably worse for the remainder of our crisis period. Finally, on a more practical level, why did many investors in 2008, given how gold underperformed stocks and bonds since 1980, believe gold would outperform going forward? Any decision to invest in gold in early 2008 would have relied on something other than gold’s historical track record relative to inflation. Perhaps faith?3

Is gold an inflation hedge?

Gold is often promoted as a hedge against inflation, but the data doesn’t always back this up. From 1987 to 2001, gold prices fell despite inflation averaging around 3%. Gold tends to surge during periods of extreme inflation, such as in the late 1970s and early 1980s, but in more typical inflationary periods, its performance has been inconsistent.

In 2022, despite inflation hitting a 40-year high, gold prices fluctuated but ultimately ended the year unchanged.

A safe haven, but not a steady store of value

Gold can be perceived as a haven in times of crisis, as seen during the 2020 COVID-19 market crash and previous periods of economic instability. However, its price can be volatile. For example, gold gained 36% during the first few months of the pandemic but ended the year relatively unchanged.4 Gold also experienced sharp declines in prosperous times, such as the 1990s when it lost 27% of its value.4 Gold prices can swing significantly over shorter periods, making it a less reliable store of value than some investors might expect. The volatility (risk) of gold is greater than U.S. equities as we show in the following paragraph.

How much gold should be in my investment portfolio?

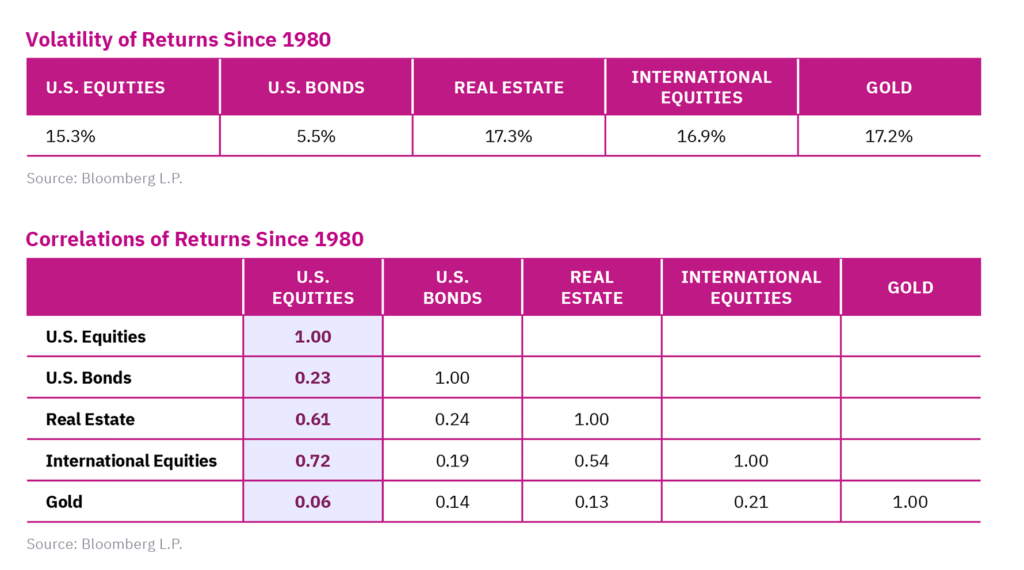

Although gold can be included in your financial plan, it should not be a large part of your investment portfolio, and there may be other asset classes that serve a similar purpose that have less risk. The rest of your portfolio should go into investments with more expected growth potential, like the stock market. In addition to expected returns of investments, one of the building blocks of building successful investment portfolios is diversification across different asset classes (e.g. stocks, bonds, real estate, private markets, gold etc.). How asset classes work together in a portfolio can be measured by their correlation with one another. Gold has a near zero correlation to the stock market, and because of this offers good diversification to stocks, and can increase portfolio risk adjusted returns over time (Sharpe Ratios). That being said, there are other asset classes besides gold that can serve a similar purpose here like bonds, which exhibit low correlation to stocks and far lower volatility.

The charts below show the volatilities (risk) and correlations for gold vs. U.S. equities, U.S. bonds, real estate, and international equities since 1980.

Gold can add diversification to a portfolio due to its low correlation and may (if you have faith) offer protection during market turmoil, but it’s also a riskier investment than stocks. Bonds also offer diversification to a portfolio and have far less volatility, and real estate still offers some diversification to stocks with much larger expected return potential that gold at the same level of volatility (risk).

| Bulk toilet paper, a $1.50 hot dog-and-drink deal… and gold bars?

Well-known for good deals and house brands, Costco has been selling 1-ounce 24-karat gold bars since the summer of 2023. According to analysts at Wells Fargo, revenue may be running at $100 million to $200 million a month.5 Our advice? Although you can make money by investing in gold, investing in stocks will likely be better from a personal finance perspective. |

The bottom line

Diversification is a key building block to portfolios. While there are other asset classes that offer portfolio diversification to core equity positions through correlation attributes, gold is one of them, it’s just a lot more volatile and its valuation is based on belief in value instead of traditional quantifiable valuation we do for stocks, bonds, and real estate. Despite its volatility, gold remains a popular option for some investors seeking to diversify their portfolios and hedge against inflation and macroeconomic uncertainty. The data suggests otherwise, but there are times gold may perform well based on some investors believing in it. The only thing certain is the consistent existence of uncertainty, and gold has been an asset that investors have used to address this for millennia. It might not serve this purpose forever, but it is still around today, and is an option for portfolio diversification for some who value non-quantifiable valuation for this part of the portfolio. If they believe in the value of gold. Ultimately, whether gold is a good investment depends on your beliefs and goals. It is a way to diversify, however, the data suggests that other asset classes may be better suited to hedge inflation with much better long-term expected return potential and lower volatility.

For more information on adding gold to your investment portfolio, contact your wealth advisor. If you are not a Mercer Advisors client and want to learn more, let’s talk.

1. Marks, Howard. “All That Glitters.” Oaktree Capital Group, 17 December 2010.

2. Pistilli, Melissa. “What Was the Highest Price for Gold? (Updated 2024).” Investing News Network, 20 September 2024.

3. Calcagni, Donald. “Gold, Don’t Buy the Hype.”

4. Burrows, Dan. “Is Investing in Gold Worth It? How Gold Prices Have Changed.” Kiplinger.com, 22 May 2024.

5. Cox, Jeff. “Costco Selling as Much as $200 Million in Gold Bars Monthly, Wells Fargo Estimates.” CNBC, 9 April 2024.