Ready to learn more?

Jerrod Dawson, CFA

Sr. Investment Strategist

Discover why now is the perfect time to reassess your portfolio and ensure it is well-diversified to help weather any market conditions.

While many investors understand that diversification is key to a solid functional financial plan and is critical for risk management and portfolio construction, it can sometimes feel counterproductive when the market is booming. With a small group of stocks accounting for most of the S&P 500’s 26% return in 2023 and an additional 14% in the first half of 2024, it’s easy for investors to forget the benefits of portfolio diversification.

The basics

Before we dive in, let’s quickly cover some background: Years ago, Nobel prize winner Harry Marcowitz introduced the concept of diversification in his Modern Portfolio Theory. In simple terms, he showed that combining different types of investments that don’t all move in the same direction can maximize return potential while mitigating risks. Despite this proven approach, many investors still overlook the importance of diversification. This is often due to human nature and some common misconceptions.

Myths and misconceptions

From a human nature standpoint, investors are often driven by two conflicting drivers: greed and fear. Unfortunately, these powerful emotions can lead to poor decision making. Behavioral Finance research shows that investors tend to avoid risk when faced with potential losses but seek risks when chasing gains. In simpler terms, we feel the pain of losses more intensely than the joy of gains, which can lead to emotional rather than rational decisions, often at the worst possible times.

To learn more about behavioral finance, we suggest reading:

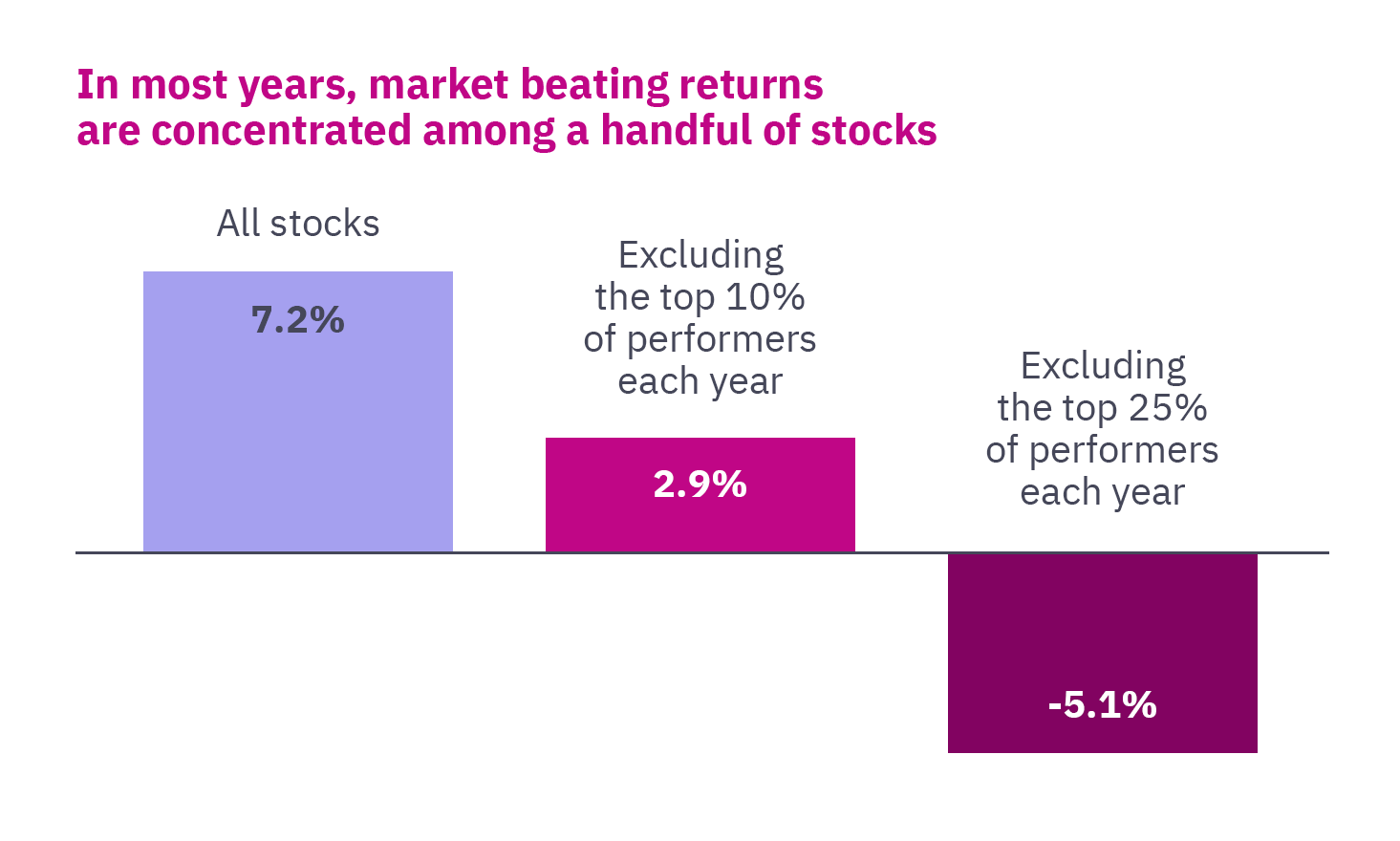

Couple the common myths, such as the idea of ‘over-diversification,’ and it’s clear how investors can neglect a fundamental tenet of investing like diversification. Without delving too deep in the math, over-diversification is a myth. Simply put, the average stock in an index generally underperforms the index itself, but because the majority of returns in an index come from a relatively small number of stocks (a concept known as skew), diversification typically improves the likelihood of out-performance. Additionally, due to the way stocks move in relation to each other (correlation) adding more securities helps reduce risks.

“All stocks” includes all eligible stocks in all eligible Developed and Emerging Markets at their market cap weights. Eligible stocks are required to meet a minimum market capitalization requirement. REITs and investment companies are excluded. Compound average annual returns are computed as the compound returns of the value-weighted averages of the annual returns of the included securities. “Excluding the top 10%” and “Excluding the top 25%” are constructed similarly but exclude the respective percentages of stocks with the highest annual returns by security count each year. Individual security data are obtained from Bloomberg, London Share Price Database, and Centre for Research in Finance. The eligible countries are: Australia, Austria, Belgium, Brazil, Canada, Chile, China, Colombia, Czech Republic, Denmark, Egypt, Finland, France, Germany, Greece, Hong Kong, Hungary, India, Indonesia, Ireland, Israel, Italy, Japan, Republic of Korea, Malaysia, Mexico, Netherlands, New Zealand, Norway, Peru, Philippines, Poland, Portugal, Russia, Singapore, South Africa, Spain, Sweden, Switzerland, Taiwan, Thailand, Turkey, United Kingdom, and the United States. Diversification does not eliminate the risk of market loss. Past performance is no guarantee of future results.

Diversification: The calm before the storm

Diversification aims to smooth out market fluctuations, but it must be implemented before it’s needed.

With markets hovering at all-time highs and volatility (as measured by VIX) well below average, many investors have been lulled into a false sense of security. In prior years, growth stocks, particularly in the technology sector, have outperformed value stocks, dominating index returns and many portfolios. In this context, the old adage, ‘diversification is like fire insurance, nobody wants it until their home is ablaze’ seems apropos. Diversification is designed to help smooth out emotional fluctuations in decision-making under uncertainty and most importantly can add stability to your portfolio. This stability can allow the force of compounding to maximum potential benefits over time. Diversification is simple but must be done in advance.

We’re not predicting a market downturn or making a specific market call; instead, we are reminding investors of the importance and benefits of diversification. Given recent market dynamics, now is an excellent time to ensure your portfolio is optimally diversified across asset class, capitalization/size, sectors, styles, and geographies). If you have questions about your portfolio’s diversification, please contact your advisor. If you are not a client of Mercer Advisors and would like a second opinion on your investment strategy, contact us. We would be happy to discuss it with you.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Diversification and asset allocation do not ensure a profit or protect against a loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.