Former President Donald Trump’s return to Washington after four years has been the focus this past week and there’s now been enough time to reflect and provide some takeaways from the market’s reaction. At the time of writing, the S&P 500 has climbed almost 4% since its close on Tuesday, before the election results were tabulated. The yield on the 10-year Treasury initially climbed from 4.28% to about 4.5% before drifting down later in the week.

This initial reaction – dubbed the “Trump trade” in financial markets – provides some insight into what the Trump administration might mean for markets and the broader economy.

Our intention here isn’t to praise or denigrate either candidate or their respective economic policies; our goal is simply to provide post-election commentary on their likely economic impact. A recurring theme of our commentary around the election has been that politics and investing don’t mix. In other words, neither excitement nor disappointment about an election outcome should prompt one to overhaul their investing strategy. We still believe this to be the best course of action for long-term investors.

Lessons from Equity Markets

Many have been quick to attribute the climb in the stock market to the prospect of business-friendly policies, less regulation, and lower taxes. Indeed, over the long-term we would expect a mix of pro-business policies to support higher valuations.

However, markets also value certainty. The fact that the election had a clear winner is, arguably, a critical attribute pushing markets higher. The prospect of political violence, drug out court cases, and potentially days, weeks, or months of uncertainty regarding the election’s outcome was swiftly resolved with President-elect Trump’s commanding lead in both the popular vote and electoral college.

Lessons from Bond Markets

However, bond markets arguably told a very different story in the immediate aftermath of the election. Yields and interest rates climbed 18 basis points as the election results came into focus.

This increase is remarkable when considered against the fact that the Federal Reserve cut short-term interest rates by 0.5% in September and followed up with another 0.25% cut on Wednesday, Nov. 6 (a move that had been widely telegraphed well in advance of the election).

Put these facts together and we’re in a situation where short-term interest rates have dropped 0.75% since September, while the 10-year Treasury yield has risen 0.6% over that same period. Why?

A cursory read of the tea leaves suggests the bond market is perhaps growing increasingly concerned about the size of our nation’s debt and deficits, with concern that full Republican control of government could lead to a very high increase in federal debt. Indeed, during President Trump’s first term, the national debt climbed from $19.9 trillion the day he took office to $27.75 trillion the day he left office. This rise is due, in part, on the pandemic response. But even prior to COVID-19, during the first three years of the Trump administration, the federal government borrowed an average of over $1 trillion a year to fund a mix of tax cuts and increased government spending. The onset of a global pandemic only exacerbated already high federal deficits.

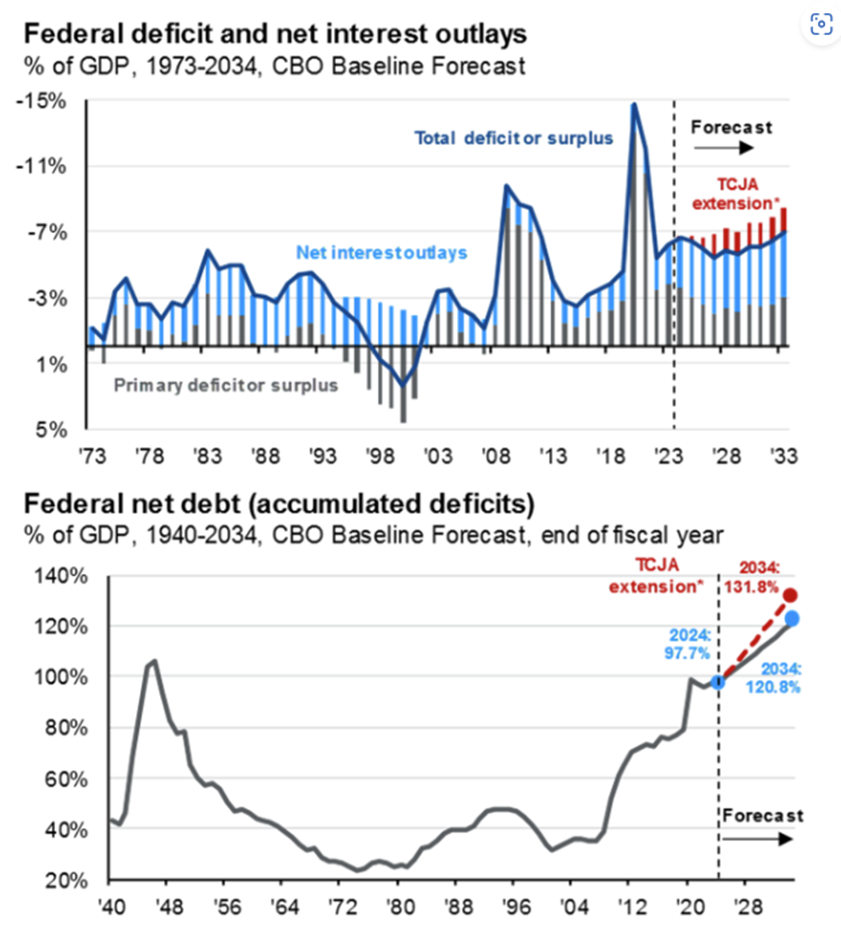

To be fair, and to be clear, neither candidate campaigned on a platform of fiscal responsibility. Under President Biden, federal debt has continued to climb further, to $35.9 trillion. Our nation’s growing, unsustainable deficits simply weren’t in focus as a major issue during this election cycle. Thus, the bond markets’ concern reflects, in part, questions around whether either party, at any point in the near or medium-term future, will take meaningful steps to reduce what can only be described as a staggering increase in federal debt. According to the Congressional Budget Office, the incoming administration’s promise to extend TCJA’s tax cuts will only accelerate the rise in federal debt.

Source: JPMorgan Guide to the Markets

The Policy Outlook

There is little question among economists that the direct effect of tariffs would be an increase in consumer prices. At a fundamental level, tariffs on imports are a form of taxation; those higher prices are naturally born by consumers. There is an open question of how large the tariffs will be that the administration might implement, but the higher they are, the greater their inflationary impact is likely to be.

Whether one agrees or disagrees with the use of tariffs to protect American industry is a political view; there is no right or wrong answer. However, economic logic suggests that, all things equal, higher inflation will lead the Fed to raise interest rates; higher interest rates would result in higher interest for the federal government (interest on our debt outstanding); which would subsequently lead to still higher deficits. Higher interest rates would also be a headwind for consumers and may therefore (likely) lead to lower gross domestic product growth.

Takeaways

As we said at the outset, our intention here isn’t to praise or denigrate either candidate. What’s important is to remember our recurring theme that politics and investing don’t mix.

Moving past the election, we believe it’s important to keep three lessons in mind:

1. Equity markets have done well over the long-term. This has been the case under both Republican and Democratic administrations. Markets have increased most years, and the economy has grown most years. Downturns are inevitable, but when they will occur is hard to predict and trying to time the market has been a fool’s errand.

2. Keep politics out of your portfolio. It is tempting to think that our preferred political outcome should lead to better returns and that, conversely, our undesired electoral outcome will lead to poor returns. If only markets were that simple. Picking winners and losers based on electoral outcomes is virtually impossible. Companies and sectors that initially appear in favor do not always remain so. The best strategy – the one we articulated before the election and continue to advocate today – is to remain fully invested in a broadly diversified portfolio that’s aligned with your family’s need, tolerance, and capacity to assume financial risk.

3. Check your family’s financial plan. Finally, it’s wise to work closely with your advisor to make sure that your family’s financial plan is well positioned to respond to or capitalize on any potential changes in tax laws.

Visit the Mercer Advisors website for past insights from our CIO about the impact of the election on markets and other interesting topics. Not a Mercer Advisors client but interested in more information? Let’s talk.

Home » Insights » Market Commentary » Implications of The Market Response To the Election: Insights From Our CIO

Implications of The Market Response To the Election: Insights From Our CIO

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

What should long-term investors consider from the market’s reaction to the election results?

Former President Donald Trump’s return to Washington after four years has been the focus this past week and there’s now been enough time to reflect and provide some takeaways from the market’s reaction. At the time of writing, the S&P 500 has climbed almost 4% since its close on Tuesday, before the election results were tabulated. The yield on the 10-year Treasury initially climbed from 4.28% to about 4.5% before drifting down later in the week.

This initial reaction – dubbed the “Trump trade” in financial markets – provides some insight into what the Trump administration might mean for markets and the broader economy.

Our intention here isn’t to praise or denigrate either candidate or their respective economic policies; our goal is simply to provide post-election commentary on their likely economic impact. A recurring theme of our commentary around the election has been that politics and investing don’t mix. In other words, neither excitement nor disappointment about an election outcome should prompt one to overhaul their investing strategy. We still believe this to be the best course of action for long-term investors.

Lessons from Equity Markets

Many have been quick to attribute the climb in the stock market to the prospect of business-friendly policies, less regulation, and lower taxes. Indeed, over the long-term we would expect a mix of pro-business policies to support higher valuations.

However, markets also value certainty. The fact that the election had a clear winner is, arguably, a critical attribute pushing markets higher. The prospect of political violence, drug out court cases, and potentially days, weeks, or months of uncertainty regarding the election’s outcome was swiftly resolved with President-elect Trump’s commanding lead in both the popular vote and electoral college.

Lessons from Bond Markets

However, bond markets arguably told a very different story in the immediate aftermath of the election. Yields and interest rates climbed 18 basis points as the election results came into focus.

This increase is remarkable when considered against the fact that the Federal Reserve cut short-term interest rates by 0.5% in September and followed up with another 0.25% cut on Wednesday, Nov. 6 (a move that had been widely telegraphed well in advance of the election).

Put these facts together and we’re in a situation where short-term interest rates have dropped 0.75% since September, while the 10-year Treasury yield has risen 0.6% over that same period. Why?

A cursory read of the tea leaves suggests the bond market is perhaps growing increasingly concerned about the size of our nation’s debt and deficits, with concern that full Republican control of government could lead to a very high increase in federal debt. Indeed, during President Trump’s first term, the national debt climbed from $19.9 trillion the day he took office to $27.75 trillion the day he left office. This rise is due, in part, on the pandemic response. But even prior to COVID-19, during the first three years of the Trump administration, the federal government borrowed an average of over $1 trillion a year to fund a mix of tax cuts and increased government spending. The onset of a global pandemic only exacerbated already high federal deficits.

To be fair, and to be clear, neither candidate campaigned on a platform of fiscal responsibility. Under President Biden, federal debt has continued to climb further, to $35.9 trillion. Our nation’s growing, unsustainable deficits simply weren’t in focus as a major issue during this election cycle. Thus, the bond markets’ concern reflects, in part, questions around whether either party, at any point in the near or medium-term future, will take meaningful steps to reduce what can only be described as a staggering increase in federal debt. According to the Congressional Budget Office, the incoming administration’s promise to extend TCJA’s tax cuts will only accelerate the rise in federal debt.

Source: JPMorgan Guide to the Markets

The Policy Outlook

There is little question among economists that the direct effect of tariffs would be an increase in consumer prices. At a fundamental level, tariffs on imports are a form of taxation; those higher prices are naturally born by consumers. There is an open question of how large the tariffs will be that the administration might implement, but the higher they are, the greater their inflationary impact is likely to be.

Whether one agrees or disagrees with the use of tariffs to protect American industry is a political view; there is no right or wrong answer. However, economic logic suggests that, all things equal, higher inflation will lead the Fed to raise interest rates; higher interest rates would result in higher interest for the federal government (interest on our debt outstanding); which would subsequently lead to still higher deficits. Higher interest rates would also be a headwind for consumers and may therefore (likely) lead to lower gross domestic product growth.

Takeaways

As we said at the outset, our intention here isn’t to praise or denigrate either candidate. What’s important is to remember our recurring theme that politics and investing don’t mix.

Moving past the election, we believe it’s important to keep three lessons in mind:

1. Equity markets have done well over the long-term. This has been the case under both Republican and Democratic administrations. Markets have increased most years, and the economy has grown most years. Downturns are inevitable, but when they will occur is hard to predict and trying to time the market has been a fool’s errand.

2. Keep politics out of your portfolio. It is tempting to think that our preferred political outcome should lead to better returns and that, conversely, our undesired electoral outcome will lead to poor returns. If only markets were that simple. Picking winners and losers based on electoral outcomes is virtually impossible. Companies and sectors that initially appear in favor do not always remain so. The best strategy – the one we articulated before the election and continue to advocate today – is to remain fully invested in a broadly diversified portfolio that’s aligned with your family’s need, tolerance, and capacity to assume financial risk.

3. Check your family’s financial plan. Finally, it’s wise to work closely with your advisor to make sure that your family’s financial plan is well positioned to respond to or capitalize on any potential changes in tax laws.

Visit the Mercer Advisors website for past insights from our CIO about the impact of the election on markets and other interesting topics. Not a Mercer Advisors client but interested in more information? Let’s talk.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Diversification does not ensure a profit or guarantee against loss. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER® certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Explore More

Why Not Invest More in International Stocks: Insights From Our CIO

Understanding Qualified Small Business Stock (QSBS)

New 2026 Federal Tax Brackets: What This Means for Your Taxes