Planning for a secure retirement requires intentional actions and consistent effort. However, many Americans face challenges in achieving their financial goals, and it’s no surprise that 39% of working households are at risk of being unable to maintain their standard of living in retirement, according to Boston College’s National Retirement Risk Index.1

The good news? You can follow six clear steps successful savers use to get on track for a financially secure retirement, no matter your age or financial situation.

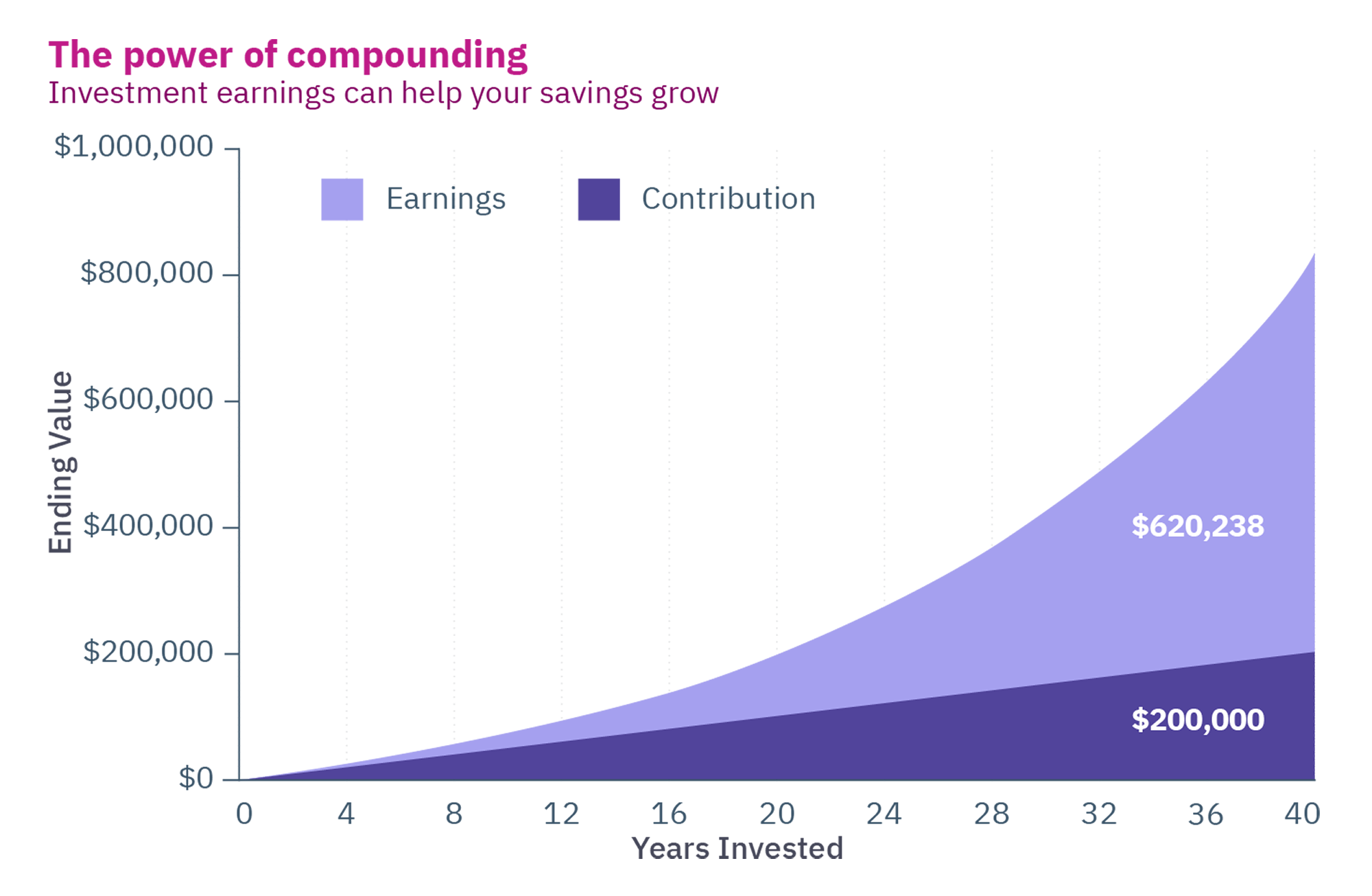

1. Start saving early and maximize compound growth

One of the most impactful habits of successful savers is starting early. By saving consistently over time, you leverage the power of compound interest. Investment gains grow exponentially when reinvested, building wealth faster. The higher your starting amount and the higher your investment return, the faster your savings compound. And over time, the savings can seriously add up. If you’re starting later, don’t worry – consistent contributions still have a meaningful impact.

Source: Schwab Center for Financial Research. This chart shows the outcome of saving $5,000 per year for 40 years. Savings are assumed to be placed in a hypothetical portfolio that earns 6% per year. Taxes and fees have not been considered in this analysis. Including them will impact the ending value. This is a hypothetical example for illustrative purposes only. The actual annual rate of return will fluctuate with market conditions. Investing involves risk, including loss of principal.

2. Make saving a priority

Successful retirement savers treat saving like a fixed expense, automating contributions to retirement accounts to ensure consistency. They prioritize future security over non-essential spending, often increasing their contributions by 1–2% annually to maximize growth without significantly affecting their current budget.

3. Diversify savings and income sources

To minimize risk and optimize growth, successful savers use multiple accounts, such as workplace retirement plans, individual retirement accounts (IRAs), health savings accounts (HSAs), and emergency funds. They also invest in passive income opportunities, like dividend-paying stocks or rental properties, to build additional streams of income beyond employment.

4. Avoid high-interest debt and plan for emergencies

Carrying high-interest debt can derail even the best financial plans. Focus on paying down debt while maintaining an emergency fund of three to six months of expenses. This helps avoid dipping into retirement accounts for unexpected costs.

5. Stick to a long-term strategy

A long-term perspective is crucial for financial success. Resist the urge to time the market or withdraw funds prematurely. A steady, disciplined approach to saving and investing builds resilience and ensures you stay on track toward your goals.

6. Build a comprehensive financial plan

A tailored financial plan provides clarity and direction for your retirement journey. Partnering with an advisor can help you refine your strategy, monitor your progress, and make adjustments as needed.

Planning for retirement requires careful consideration and strategic planning. Learn how Mercer Advisors can work with you to create a retirement plan that helps you achieve your long-term goals. Not a Mercer Advisors client but interested in more information? Let’s talk.

1 Yin, Yimeng, et al. “The National Retirement Risk Index: An Update from the 2022 SCF.” Center for Retirement Research at Boston College, Boston College, 27 February 2024.