Ready to learn more?

Explore More

Home » Insights » Personal Finance » Understanding Identity Theft Protection. Is It Right for You?

John Taylor

Sr. Tax Associate

Is identity theft protection worth it? Although paid monitoring systems may catch red flags, we offer free alternative options.

Identity theft is a growing concern, with nearly a third of U.S. residents having experienced it in some form.1 Whether it involves credit card fraud, tax fraud, or other malicious activities, the consequences can be severe. Many consumers turn to identity theft protection services to help provide reassurance, but are these services truly worth it?

Identity theft protection services aim to monitor your accounts, alert you to suspicious activity, and assist in recovery if your identity is compromised. However, these services do not prevent criminals from targeting you. They primarily focus on responding to incidents after they occur.

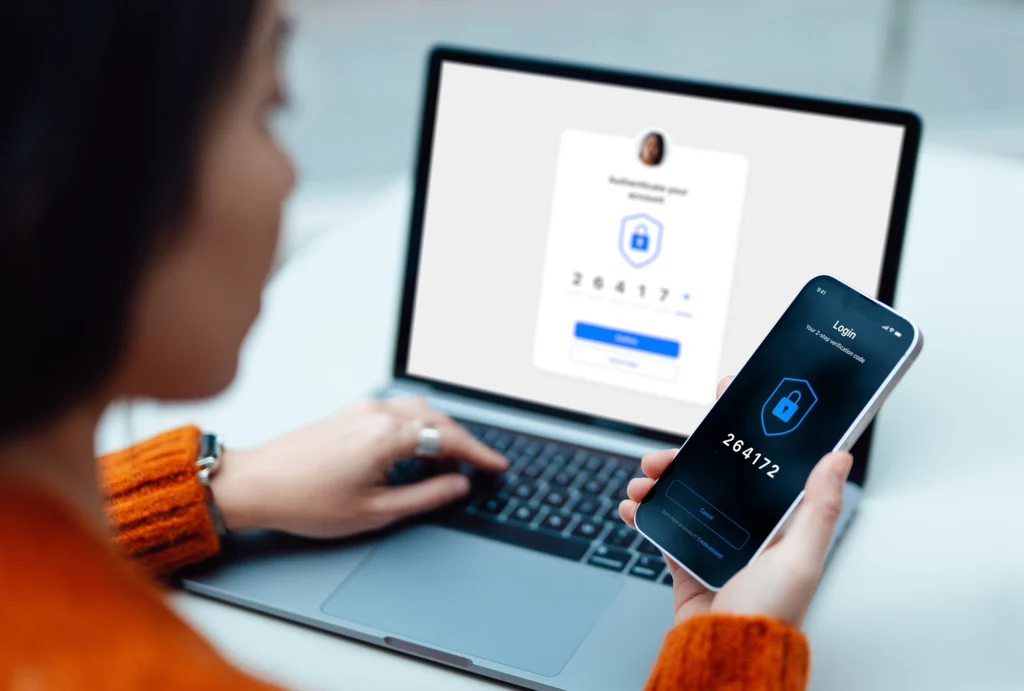

While these services can be helpful, they’re not a substitute for proactive measures like using strong passwords, enabling multifactor authentication, and regularly monitoring your accounts. Some consumers may find value in services that provide tools like VPNs, password managers, or data removal from broker sites, but it’s essential to evaluate the specific features and costs before subscribing.

If you’re considering an identity theft protection service, prioritize plans with practical and proven features:

Be cautious of flashy features that may not deliver real value, such as identity theft insurance, which typically covers recovery expenses but not financial losses.

There are effective alternatives to paid identity theft protection services. By taking advantage of these free resources, you can save money and still help protect yourself from identity theft:

Additionally, take advantage of free credit reports available weekly through AnnualCreditReport.com to monitor your accounts for unauthorized activity.

One of the most effective ways to help protect your identity is through consistent preventative actions, including:

For many, identity theft protection services offer reassurance and helpful tools, but they are not a replacement for good cybersecurity habits. Evaluate your existing resources and consider whether a paid service aligns with your needs. For more information on how Mercer Advisors protects your information and practical tips to help shield yourself from cybersecurity threats, read our Insights article.

Not a client? Let’s talk.

1 Howarth, Josh. “30+ Identity Theft Statistics for 2024.” Exploding Topics, 5 December 2023.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. The services and third-party links are presented for information and educational purposes only. Mercer Global Advisors Inc. is not affiliated with, does not guarantee nor does it endorse any of the applications or services mentioned in this article. Utilizing the services and subscriptions mentioned above are at the total discretion of the individual and are not included with any service or fee offered through Mercer Global Advisors Inc. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.