Women have distinct financial planning needs that deserve attention, regardless of whether you are single, married, a parent, a stay-at-home partner, the breadwinner, or a business owner. For example, a growing number of women are becoming the primary or sole income providers in their households.1 However, if you’re over age 55, you’re one of nearly 25% who are also providing unpaid care to a family member as part of the sandwich generation.2 As a result, you may find yourself juggling work and caregiving responsibilities, leaving little time to focus on planning for your financial success and security.

Being financially independent becomes even more critical for women later in life — we live six years longer than men and are most likely going to experience the financial implications of losing a spouse during our lifetimes.3 The household income for widows typically declines 30% after their spouse dies.4

But you can help mitigate the negative impacts of these challenges by acting now to achieve financial independence for the rest of your life, no matter your age or circumstance. Below are four tips to get you started.

1. Have a plan

Start by determining your short- and long-term financial goals — they help with building a financial plan, which is a roadmap to your goals. A basic plan may address budgeting and saving, but a comprehensive financial plan should also include investments, tax strategies, an estate plan, insurance coverage, and more. Whether you’re partnered or single, it’s important that you are proactively managing your own journey towards financial independence. Consulting with a registered investment advisor (RIA) — a fiduciary that is legally obligated to always act in your best interests — can help jump-start the process by educating you and ultimately giving you more confidence. An advisor will also continue to track the plan with you and help update it as you hit life milestones and short- or long-term goals. They will help you with the heavy lifting and execution of your goals to help give you reassurance.

2. Invest now

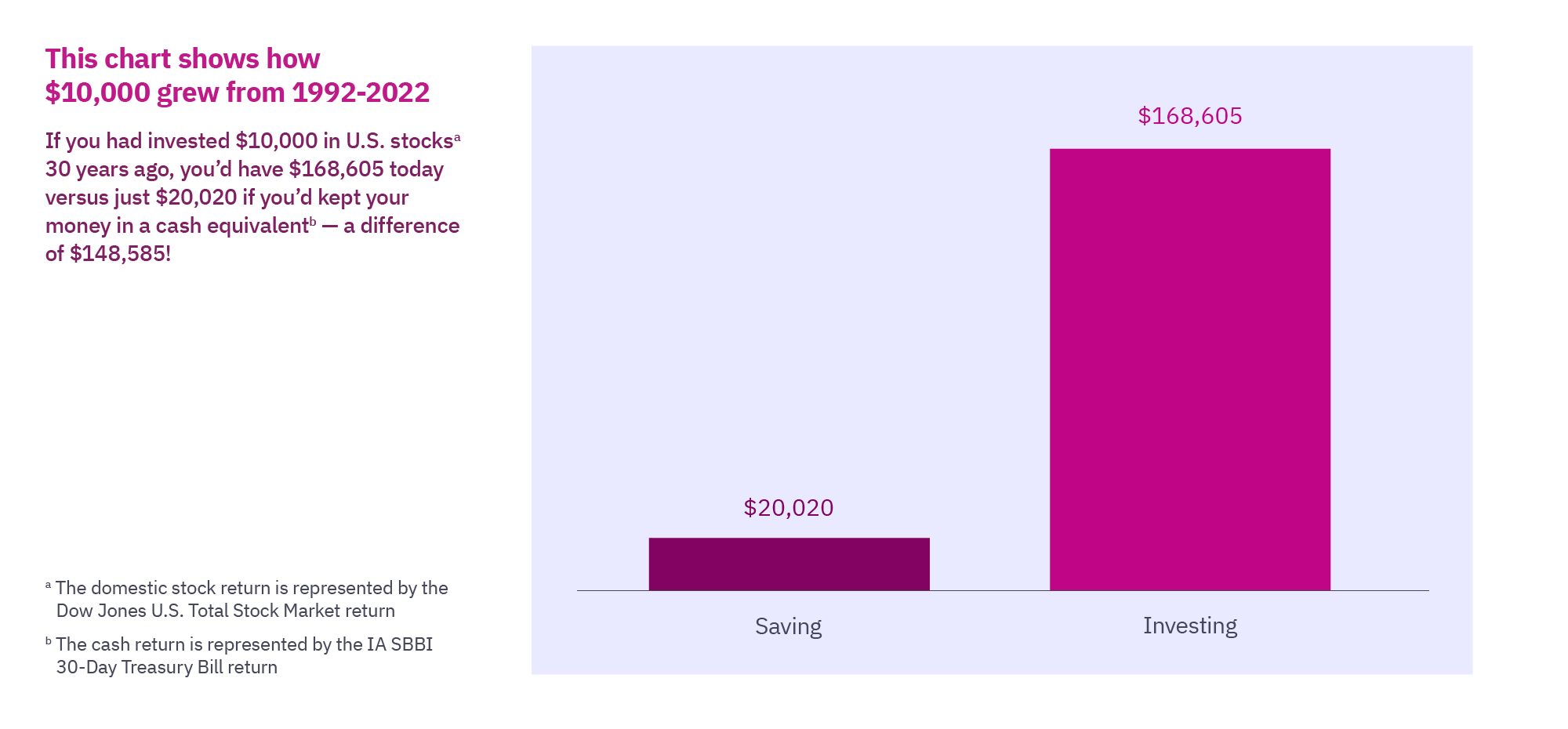

The maxim about time being money is true. The sooner you start saving — and moving those savings into investments to grow — the better. It’s easy to put this off if you don’t consider it a top priority, but the delay could lead to the loss of a significant amount money over the ensuing years. While there are many types of investment accounts, the most well-known are the employer-sponsored 401(k) or the individual retirement account (IRA), which invest your money according to the choices you make from the plan’s options.

If you’re not yet retired, it might be advantageous to contribute more, or even the maximum amount allowed, to your retirement account. And half of women underestimate their health care costs in retirement, which can cost you $165,000 on average, so also consider contributing to a tax-advantages health savings account (HSA) which invests funds similarly to a retirement account. Seek to learn more about investing options — an advisor can help with investment choices. If you’re already retired, an advisor can help with additional investment vehicle options, asset allocations, a withdrawal strategy, and tax implications.

Source: Fidelity®

Note: The above is a hypothetical example for illustration purposes only and does not represent an actual investment. Past performance may not be indicative of future results.

3. Do regular reviews

Stay engaged with your finances across all levels and on a routine schedule. A regular check-in on spending habits could reveal, for instance, a recurring charge that may be small but will add up over time. It’s a matter of monitoring your cash flow. When you understand how your cash is flowing, which is different from budgeting, you can better manage your money to build wealth.

Make sure you’re on track toward the financial future you envision with a well-diversified investment portfolio. Especially important for women is choosing investments with a rate of return that can potentially keep pace with or exceed inflation. Since women generally have longer life expectancies than men, we need the money in our portfolio to last longer. A wealth advisor can help with determining how to refine your allocations as needed.

If you have a wealth advisor, meet consistently to ensure your financial plan continues to align well with your goals and circumstances. Schedule a review sooner if you’ve had a significant change, such as receiving a financial windfall or suddenly becoming single, to make necessary adjustments.

4. Speak up

Historically, finances were considered a “man’s job”, but that is not appropriate anymore — it is a job that can be handled by anyone. Take charge of your involvement in personal finances and be proactive in becoming financially literate. It could be as simple as speaking up and asking questions about finances and investing. Learn from a professional with whom you are comfortable, a trusted friend or family member, internet resources, or academic institutions. And act upon what you learn. Almost half of women are confident about their finances, but only around a quarter of women feel empowered to act.5 You deserve a seat at the table and to be heard when it comes to determining your financial future. Start financially empowering yourself now.

Your financial partner

At Mercer Advisors almost 50% of our client-facing associates are women. We help women increase their financial literacy and create financial plans that fit their lives. If you’re already a Mercer Advisors client, refer us to a woman in your life who could benefit. Not a client? Let’s talk.

1. “In a Growing Share of U.S. Marriages, Husbands and Wives Earn About the Same,” Pew Research Center, April 13, 2023.

2.“By the Numbers: 5 Facts about Older Women Providing Unpaid Care,” U.S. Department of Labor, Nov. 20, 2023.

3.“Why women in the U.S. now have a life expectancy nearly 6 years longer than men,” Medical News Today, Nov. 15, 2023.

4.“Widowhood Statistics: Impact on Health, Finances, and Well-being Revealed,” Worldmetrics.org, July 23, 2024.

5.“Building financial independence for women through financial literacy,” Bankrate, March 27, 2024.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. All investment strategies have the potential for profit or loss. Diversification and asset allocation do not ensure a profit or protect against a loss. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER® certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.