Balancing retirement savings with living expenses can be challenging, especially when supporting children and parents, or enjoying vacations and luxury purchases. While it might seem that a small deduction from your paycheck into a 401(k) is sufficient, prioritizing current spending over savings can jeopardize your financial security. How can you determine the right amount to contribute to help ensure a comfortable lifestyle now and in retirement?

How well are Americans saving for retirement?

Let’s examine how Americans are saving for retirement. In 2023, the median age of participants in employer-sponsored plans was 43, with a median salary of $82,000, according to a Vanguard study.1 The average deferral rate was 7.4%, and the average account balance was $134,128. Surprisingly, about 86% of participants did not maximize their contributions, which were capped at $22,500 in 2023 ($23,000 in 2024).

Calculating retirement savings longevity

Next, let’s calculate how far these savings will stretch in retirement. A 45-year-old earning $82,000 annually, with a 3% expected salary increase, contributing 7.4% to their deferred compensation plan (balance of $134,128), and planning to retire at 67 with 80% of their pre-retirement income, is projected to run out of savings by age 75.2 The average U.S. life expectancy is 79.25.3 In contrast, if this individual contributed the maximum $22,500 (27.4%) in 2023, their savings could last until age 86. This highlights the importance of IRS contribution limit increases, especially for those under 50.

Increasing contribution rates

Contribution limits for retirement accounts have significantly increased over time due to inflation. The individual retirement account (IRA) limit was $1,500 per year when established in 1974.4 The 401(k) limit was initially $45,475 in 1978 but was reduced to $7,000 by the Tax Reform Act of 1986.5 As of 2025, the contribution limit is $23,500 for 401(k), 403(b), 457, and Thrift Savings Plans (TSPs), and $7,000 for IRAs.6 Individuals aged 50 and over have additional catch-up limits. The combined employer-plus-employee funding limit for deferred compensation plans is $70,000 in 2025, up from $69,000 in 2024, and $77,500 for those aged 50 and older.

In addition to commonly known retirement savings plans, there are contribution limits for health savings plans (HSAs) which can help offset rising medical expenses in retirement. In 2025, an individual can contribute up to $4,300, a family’s limit is $8,550, and individuals aged 55 and over have a catch-up limit of $1,000.

Digging deeper into contribution rates

As of Sept. 30, 2024, there are 544,000 401(k)-created millionaires and 418,111 IRA-created millionaires, according to a report by Fidelity.7 Besides increased stock market gains boosting retirement savings, the report cites starting early with contributions and maintaining consistency as key factors for individuals reaching the million-dollar mark. This is exemplified by Generation X members (born 1965-1980), who have been saving in their plans for 15 years and have an average balance of $586,100.

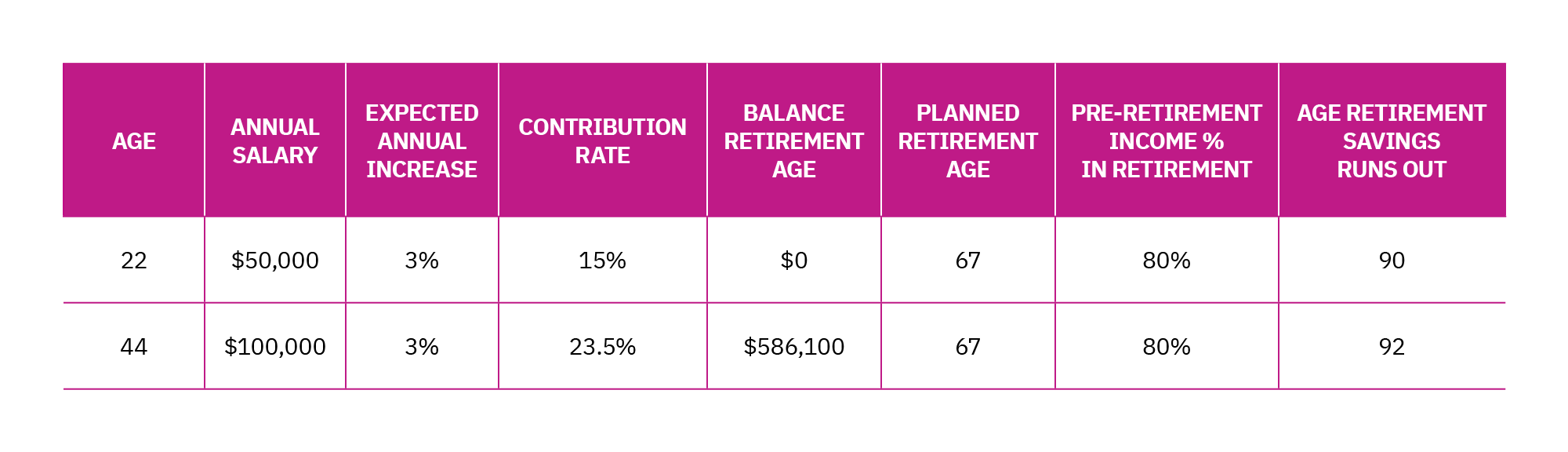

The chart below shows how starting early at age 22 with Fidelity’s recommended 15% deferral can lead to funds lasting 23 years in retirement, and how a Gen X member contributing the maximum allowed contribution of $23,500 (in 2025) starting at age 44 can have their savings last to age 92.

Taking advantage of contribution limits

While contribution limits and rates for retirement savings accounts are critical to determining how long those funds will last in retirement, it’s also important to factor them into a full picture of your current lifestyle and long-term objectives. Having a comprehensive financial plan that connects all areas of your finances can be extremely useful in accomplishing your goals. Mercer Advisors has a program called Account Bridge that allows you to consolidate your 401(k), 403(b), 457, and some TSP accounts under one integrated portfolio strategy to help align your investments and financial plan — while also helping ensure our advice tracks with your evolving personal situation.

Additionally, there are other benefits to consider when deciding how much to contribute to a plan such as a 401(k) or IRA:

- Taxes: Contributions to traditional accounts are generally tax-deductible and can reduce your taxable income. With Roth accounts, contributions are not tax deductible, but withdrawals are tax-free in retirement.

- Compound growth: Contributing more funds to your account equals more compound interest. Over time, you have growth on both your contributions and previous growth within the account which can grow significantly, having a big impact on your retirement savings.

- Employer matching: Maximizing your contributions ensures you receive the full match of your employer’s contribution, if available. This can be considered free money and is a nice boost in your retirement savings.

- Inflation protection: Contributing the maximum amount can help your savings keep pace with inflation. As living costs rise, having a larger retirement fund can help maintain your purchasing power.

Summary

Contributing more to your retirement savings accounts is typically a good move for helping to ensure financially security throughout retirement. However, your contribution decisions should consider your unique circumstances. Factors such as age, income, planned retirement age, and desired lifestyle can influence how much you should save. Maximum contribution limits are designed to help optimize the benefits of your retirement account.

When you have any changes in your life that could affect your retirement savings contributions or long-term financial goals, talk to your wealth advisor to see whether you should adjust your contribution rate. If you’re not a Mercer Advisors client and want to learn more about how your contribution rate aligns with a financial plan and overall investment portfolio strategy, and whether contributing the maximum amount is right for you, let’s talk.

- “How America Saves Report 2024,” Vanguard Institutional, 2024.

- “Retirement Calculator: How Much Do You Need?” Forbes Advisor, 20 June 2023.

- “U.S. Life Expectancy 1950-2024.” MacroTrends, 13 December 2024

- “IRA Contribution Limits Over Time: Historical Timeline.” Investopedia, 4 November 2024.

- “Tax Reform Bill 2018: Impact on 401(k) Limits.” Human Interest, 25 January 2024.

- “IRS announces administrative transition period for new Roth catch up requirement; catch-up contributions still permitted after 2023.” Internal Revenue Service, 25 August 2023.

- “Q3 2024 Retirement Analysis.” Fidelity, 2024.