Ready to learn more?

Explore More

Home » Insights » Personal Finance » Elections & Markets: What should investors do?

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

Every four years, investors are faced with the same questions: “Should we make any portfolio changes given its an election year? And what if the other side wins?” While many would like to believe that one party results in better market returns than the other, a look at history suggests politics have little to no effect on stock market performance. There’s no way to predict the outcome during these uncertain times, but the riskiest thing investors can do is respond by making drastic changes to their portfolios. The safest move is to put a strategy in place—one that focuses on your long-term investment goals and a solid financial future.

With the 2020 elections fast approaching, you may be wondering how presidential elections will affect your portfolio. The good news is, you’re not alone. There’s a widely held belief that elections influence stock market performance. This seems logical enough—elections can and do have implications for business, tax, and regulatory policies that invariably affect the economy and markets. Further, those with deeply held political beliefs like to think their chosen political party is “best” for markets. But to paraphrase a quote from Mark Twain, it’s not what we know that gets investors into trouble; it’s what we know for sure that just isn’t so. Despite what many of us want to believe, there’s no evidence that presidential elections or who occupies the White House have any effect on stock market returns.

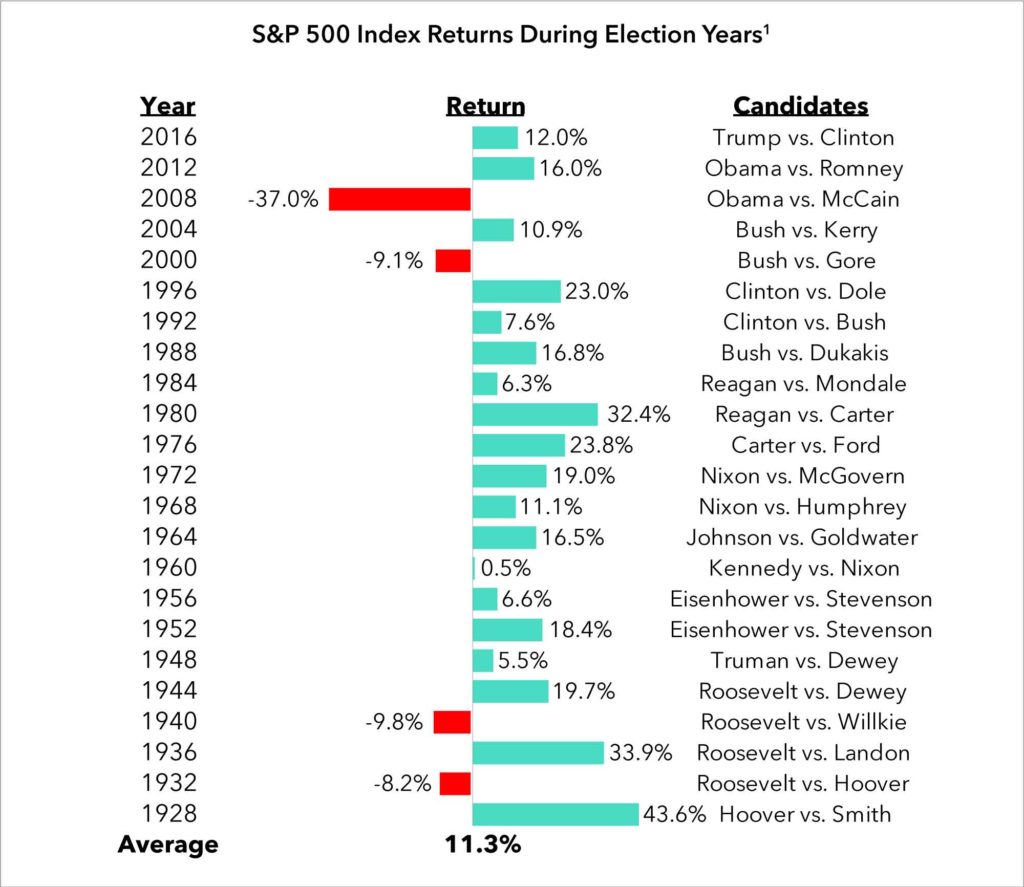

Since 1928, there have been 23 elections resulting in 14 different presidents. In in each of those years, the average return for the S&P 500 Index was 11.3%, a return that closely mirrors the average non-election year return of 11.8%. Further, returns were positive 87% of the time versus only 67% of the time in non-election years. Subsequently, there’s no evidence that presidential elections either negatively or positively influence year returns, but there is evidence that investors should remain invested in stocks during election years.

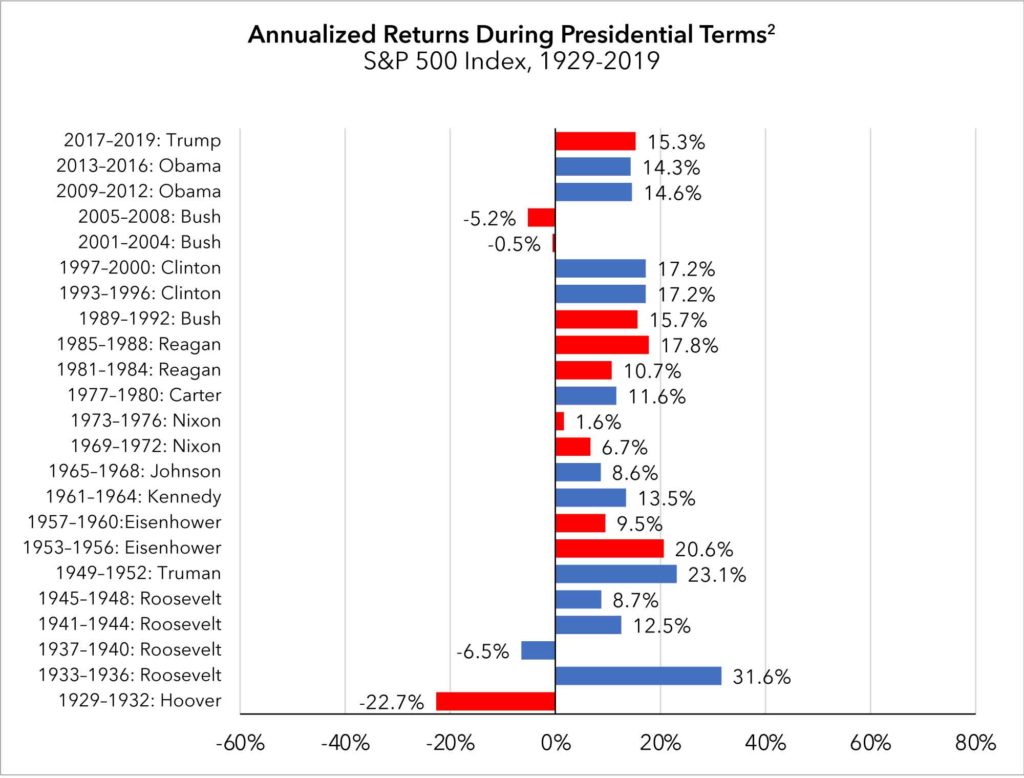

Since 1928, market returns under Democratic administrations have averaged 13.9% annually versus 6.3% annually under Republican administrations. For some investors, this is all the information they need; however, it’s important to realize that there’s a significant difference between simply describing historical results and drawing conclusions from historical results. To draw reliable conclusions from any data, a scientific approach would require the data to be statistically significant and definitionally precise. We’ll see in a moment that this data is lacking in both these areas. It’s also important to take into account whether other more complex factors might explain market returns under various administrations, such as Congressional control, an economic depression, or a sub-prime mortgage crisis. Subsequently, there are at least three major problems with drawing conclusions from this data:

First, the sample size is exceptionally small. We’ve had only 14 different presidential administrations since 1928; 7 Democrats and 7 Republicans (8 if we count President Ford as his own administration). Suffice it to say, we don’t have enough information to reliably draw any material conclusions. For example, had Gore won in 2000 instead of Bush, or had Republicans won in 1932 or 2009, the difference in average returns between the two parties goes away almost entirely (or even flips). My point isn’t to rewrite history, but to highlight just how sensitive the averages are to changes in only one or two data points.

Second, it’s exceptionally difficult, if not impossible, to draw any cause and effect relationships between a given political party and specific market returns because presidents and political parties are poor proxies for economic policies. For example, President Bill Clinton signed the North American Free Trade Agreement (generally viewed as pro-business) whereas President Trump killed consideration of the Trans-Pacific Partnership (a NAFTA-like free trade agreement) and erected a number of protectionist trade barriers (generally viewed as anti-business). Additionally, President John F. Kennedy cut taxes whereas President George H. Bush increased taxes. Even if political parties were reliable proxies for specific economic policies, it’s not even entirely clear which economic policy prescriptions are best for markets. Even professional economists often disagree.

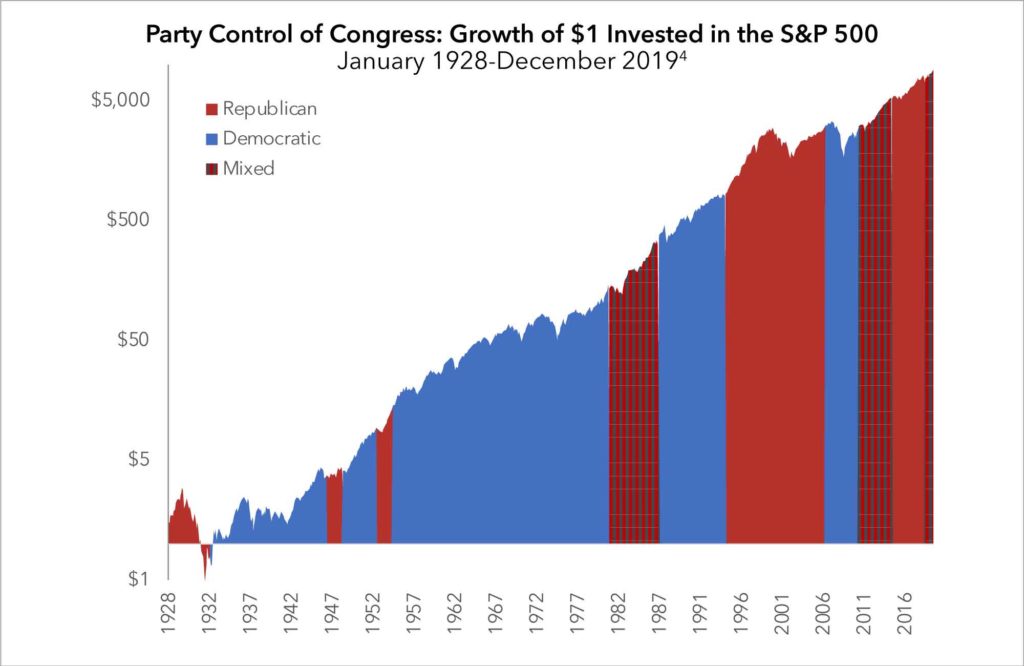

Finally, presidents don’t make and pass laws; Congress does. Laws are most often the result of political horse-trading; rarely does one party get everything it wants. For example, stock market returns were highest—15.1% annually—when Democrats occupied the White House and Republicans controlled Congress. Who owns these stellar returns, Congress or the White House? A further complication is that Congress consists of two chambers, the House and the Senate; as a result, Congress itself is often divided. These political realities only further aggravate attempts to draw cause-and-effect relationships between market returns, individual presidents, different combinations of Congressional control, or political parties.

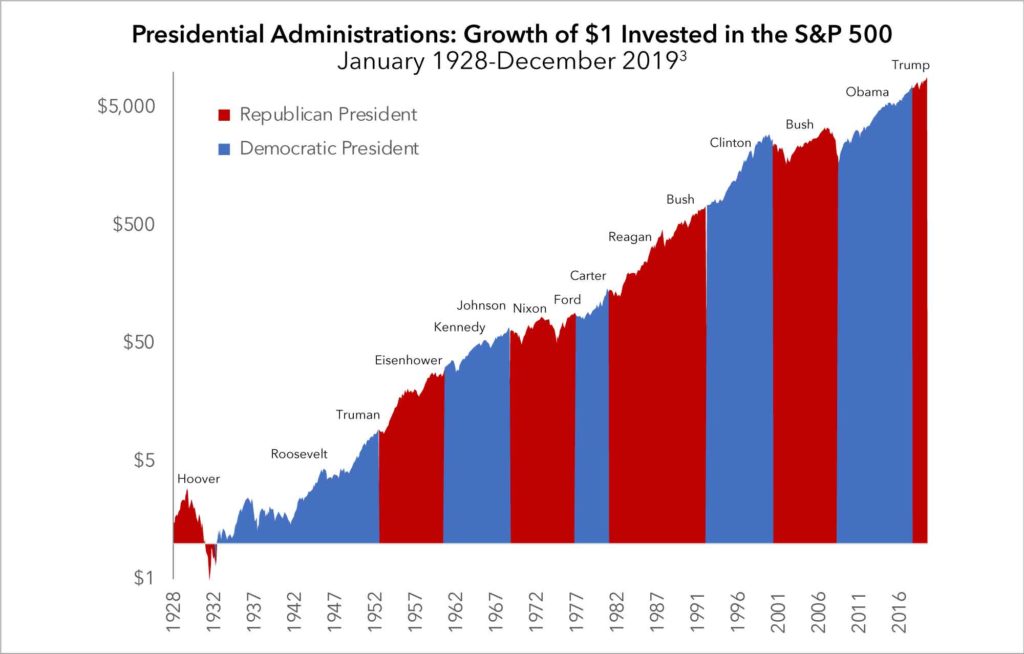

Over the past 9 decades, we have had 14 different presidential administrations that saw hotly contested elections, several impeachments, multiple wars, a number of economic and geopolitical crises, and even the terrorist attacks of 9/11. Administrations, regardless of political party, have managed to work through these and a myriad of other challenges to our democracy and economic well-being. And, through it all, the S&P 500 has delivered a compound annual return of 9.9% to investors. Overall, markets were positive in 73% of all calendar years since 1928. The only reliable conclusion one can draw is that despite who occupies the White House, markets continue to be reliable venues for building wealth over time.

1, 2 FactSet, Inc.

3, 4 Dimensional Fund Advisors, Inc.

Mercer Advisors Inc. is the parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate, but is not guaranteed or warranted by Mercer Advisors. Content, research, tools, and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors. Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark. This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control. Mercer Advisors is not a law firm and does not provide legal advice to clients. All estate planning documentation preparation and other legal advice is provided through its affiliation with Advanced Services Law Group, Inc.