Ready to learn more?

Home » Insights » Family & Finance » Bridging the Generational Gap: Money Lessons for All Ages

Alan D. Thomson, CFP®

Sr. Wealth Advisor

Generations differ in wealth-building, investing, and work-life balance. But three key lessons help bridge the generation gap.

It’s been said that age is just a number. However, age matters when understanding how different generations approach wealth-building, investing, and saving money.

Defining generations

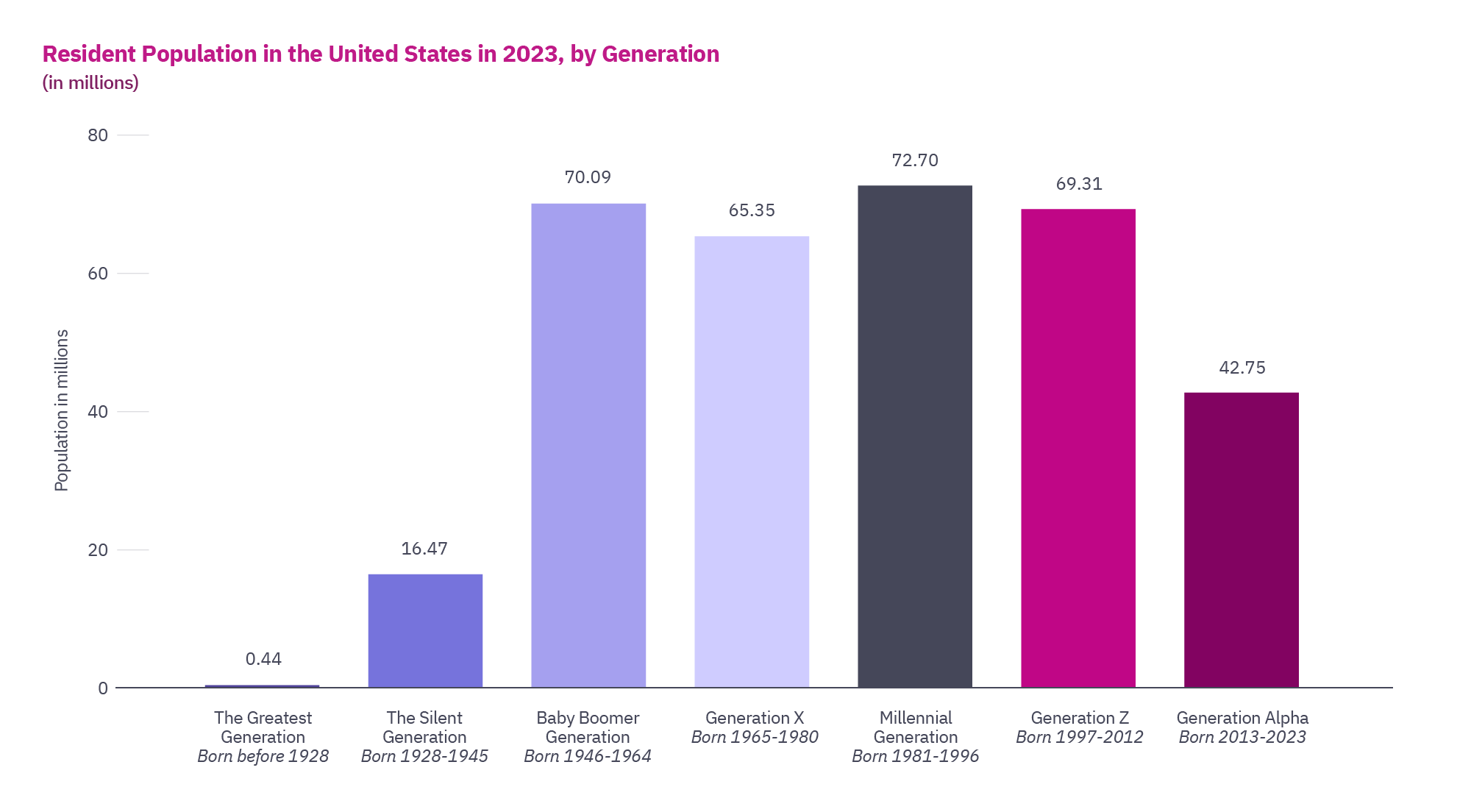

As shown, in 2023, millennials were the largest generation group, with an estimated population of 72.7 million. Born between 1981 and 1996, millennials surpassed baby boomers as the largest demographic, making them a major part of the population for many years.

Source: Korhonen, Veera. “U.S. Population by Generation 2023.” Statista, 6 August 2024.

Baby boomers vs. millennials and the rise of Generation Alpha

The number of baby boomers, defined by the post-WWII birth boom, has decreased by about seven million since 2010. Despite this decline, they remain the second-largest generation group. Aging baby boomers also contribute to a steady rise in the population’s median age. Meanwhile, the millennial generation is expanding, partly due to the growing number of young immigrants arriving in the U.S.

Generation Alpha is the most recent to have been named, and many group members will not be able to remember a time before smartphones and social media. However, the group already makes up around 42.75% of the U.S. population. They are the most racially and ethnically diverse of all the generation groups, with the oldest Generation Alpha members aging into adolescence in 2024.

Although investment philosophies, work-life balance values, and technology use vary, three lessons can be applied across all generations.

Have patience for bear markets and long-term investing

Many in the silent generation and baby boomers have learned patience through navigating various market conditions. Since the oldest boomers reached adulthood in the late 1960s, the country has experienced ten bear markets (typically a decline of 20% or more). Millennials have seen fewer, the most recent being the COVID-19 bear market from March to April 2020.

Younger investors often prefer the convenience of online trading and apps. The “meme stock” and crypto frenzy of 2020-2021 attracted many millennials with promises of quick returns. However, the allure of instant gratification can lead to unrealistic expectations. Older generations understand that building a nest egg for generational wealth requires time and patience. For many boomers, enduring bear markets was the price for potential long-term gains.

Strive for a positive work-life balance

Baby boomers, influenced by parents who lived through the Great Depression, often valued hard work and job stability. Many stayed with the same employer for most of their careers, prioritizing work over other aspects of life. This approach enabled them to buy homes, live comfortably, and for many, participate in pension plans.

Generation X, children of boomers, are less likely to stay with one employer for their entire careers and are more likely to prioritize work-life balance. They are more willing to switch jobs or take breaks for personal reasons. The concept of “work-life balance” is often associated with Generation X.

Millennials tend to seek employers that align with their values and provide opportunities for socializing and personal growth. In response, employers offer perks like gym memberships, happy hours, and involvement in philanthropic projects. However, the always-connected nature of modern work can make it challenging for younger generations to fully disconnect.

Today, we have four generations in the workforce. As cited by the Harvard Business Review, more than eight in 10 global leaders recognized that multigenerational workforces are key to growth, helping to improve operational efficiency and grow the bottom line.1 Learning from each generation’s approach to work-life balance can be beneficial. While changing jobs mid-career is common, staying with one employer and maximizing retirement plans (especially with company matching) can be optimal for long-term savings. Modern job markets offer competitive benefits, generous paid time off, and flexible work arrangements that help reduce stress and improve work-life balance.

Be tech-savvy but use good judgment

It’s not uncommon for people to be frustrated by articles that stereotype millennials or make broad criticisms of other generations. However, it’s clear that each generation has its typical behaviors, especially regarding technology use:

Generation Alpha has been raised in a world of high connectivity and advanced technology. This youngest generation is expected to be the most diverse, well-educated, and technologically proficient.

| While technology plays a crucial role in daily life and continues to develop, maintaining strong cybersecurity practices is essential. Being cautious about sharing personal information and using secure networks is important to help prevent fraud and protect against identity theft. |

Bridging generations

Generational values and attitudes tend to shape our perspectives, and looking through the lens of a different generation can open us up to new ideas and viewpoints. Finding a mentor from another generation and listening to their experiences can be invaluable. Whether you’re a millennial or a grandparent, sharing these insights can start a meaningful conversation. Older generations have a wealth of experience to share, and younger generations offer fresh perspectives. Working together can benefit us all and help build a stronger foundation for future generations.

At Mercer Advisors, we deeply respect and honor the values, vision, perspectives, and goals each generation brings. Our family office concept bridges generational differences, helping to ensure our clients’ wealth and values are carried forward for generations to come. Ready to learn more about how our family office for your family can help amplify and simplify your financial life? Connect with our team today.

1 Sabatini Hennelly, Debra, and Bradley Schurman. “Bridging Generational Divides in Your Workplace.” Harvard Business Review, 10 January 2023.

2 Flores-Marquez, Paola. “Data Drop: 3 Things to Know About How Baby Boomers Use Tech.” EMarketer, 25 April 2024.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER® certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.