Ready to learn more?

Home » Insights » Family & Finance » Strategies for Women Who Take a Career Break

Emily Messegee, CFP®, MBA

Wealth Advisor, Director

Navigate the challenges of managing long-term financial security while taking extended maternity leave or caregiving leave.

Taking a career break is a significant decision, especially for women. The “motherhood penalty” refers to the financial setbacks women face when they leave the workforce to care for their children, affecting both their immediate wages and lifetime earnings. On average, women working full-time earn about 84% of what their male counterparts make.1 This disparity can widen for those who take career breaks. For instance, in 2023, full-time working mothers earned $17,000 less annually than full-time working fathers, potentially leading to a $510,000 wage gap over a 30-year career.2 Consequently, women often have lower average incomes in retirement, resulting in reduced financial stability in their later years.

When considering extended maternity or caregiving leave, financial implications are undoubtedly significant. However, it’s equally important to reflect on the personal needs and rewards associated with each choice. A 2024 international study revealed that mothers returning to the workforce experienced better work relationships, felt more appreciated by colleagues, and enhanced their time management and problem-solving skills.3

Evaluating personal and family needs

Nearly a quarter of mothers cite their primary motivation for leaving their jobs as the desire to stay home with their children.4 If being a stay-at-home mom is a feasible and comfortable option for your family, it might be worth embracing the “motherhood advantage” rather than focusing on the so-called “penalty.” For example, 70% of stay-at-home moms report feeling less stressed compared to working mothers, and their children are 32% less likely to experience anxiety or depression.5

Mothers also highlight the importance of flexibility and affordable childcare when deciding whether to return to the workforce. Negotiating leave options, part-time schedules, or remote work with your employer can significantly aid in balancing professional and personal responsibilities.

When you decide to return to work, it’s natural to feel pangs of guilt and the urge to apologize. Instead, try transforming these feelings into expressions of gratitude. You have the opportunity to use your skills, education, and energy to support your family. It’s both a right and a privilege — take pride in earning financial compensation for your hard work. Whether driven by passion for your profession or a desire for financial independence, embrace your decision to return to paid work with confidence and satisfaction.

Considering financial strategies

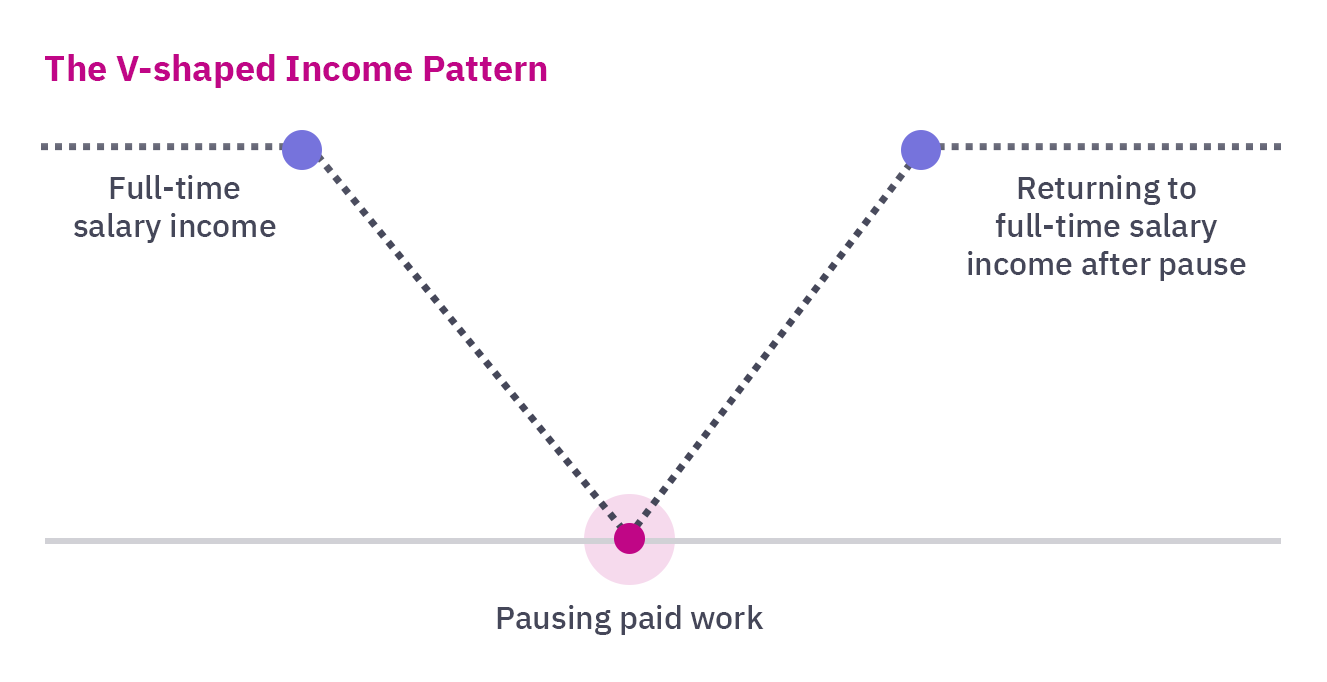

Customizing a financial plan is always important, but it’s particularly crucial for women affected by the V-shaped income pattern, which represents going from a full-time salaried position to no income and then returning to a full-time salaried position. Whether you return to the workforce months after leaving your job or take a career break for years, having a comprehensive financial plan can help you keep track of investments, retirement, or savings accounts; make strategic life decisions at meaningful milestones; guide your children’s future; and secure your own long-term financial security.

Here are a few saving strategies to incorporate into your “economic self-care routine” if you are taking a career break or caregiving leave:

|

Returning to the workforce

Perhaps you’ve had, or are, an invaluable female mentor in your professional life. The international study revealed that women supporting each other with shared experiences and expertise enable a mother’s career progression. In addition, having a support network that includes family, friends, and the community can help boost your career advancement. Closer to home, if you have a partner sharing responsibilities, asking for an equitable contribution to family and household care — if it doesn’t already exist — will likely allow you to feel more empowered to pursue your professional goals. Studies have shown that when husbands and wives are both working full-time, the woman still spends about 2 hours per week more on caregiving and 2 1/2 hours more on housework.9

You can take control of your career and earning power by seeking out organizations that accommodate women in caregiving roles, as well as offer programs for women returning to work. While your career is on pause, consider continuing your education or getting certified in a specialty. Network with professionals in your field, whether in-person, through social media, or professional online platforms.

Taking charge

Unfortunately, our society is still many years away from closing the wage gap that women experience as well as the “penalty” for having children. Women who leave full-time work have a wage drop of 5% to 20% compared to men who have a wage increase, or “fatherhood bonus,” of 6%.10 It’s up to each individual woman to determine how they will navigate the professional and financial challenges of taking a career break. While the challenges are significant, they are not insurmountable.

With careful planning and a supportive network, you can navigate extended maternity or caregiving leave successfully, ensuring that your professional and personal lives are enriched. Ultimately, recognizing and addressing these key areas can help empower you to make informed choices that align with your long-term goals and wellbeing.

At Mercer Advisors, almost 50% of our client-facing associates are women. We help women create plans that fit their needs. If you are interested in having a financial partner who understands women and wealth, let’s talk.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER® certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.