Ready to learn more?

Explore More

David Simpson, CFA, CFP®

Sr. Investment Strategist

Navigate financial risk with confidence. Learn about risk tolerance, diversification, and Monte Carlo Analysis.

Imagine you’re about to embark on an exciting adventure. You wouldn’t set off without your phone, your GPS, and a clear understanding of the route, right? The same goes for investing. Risk is an inevitable part of the journey, but with a well-crafted financial plan, you can navigate the twists and turns with confidence. Let’s explore the different dimensions of risk and how they impact your financial journey.

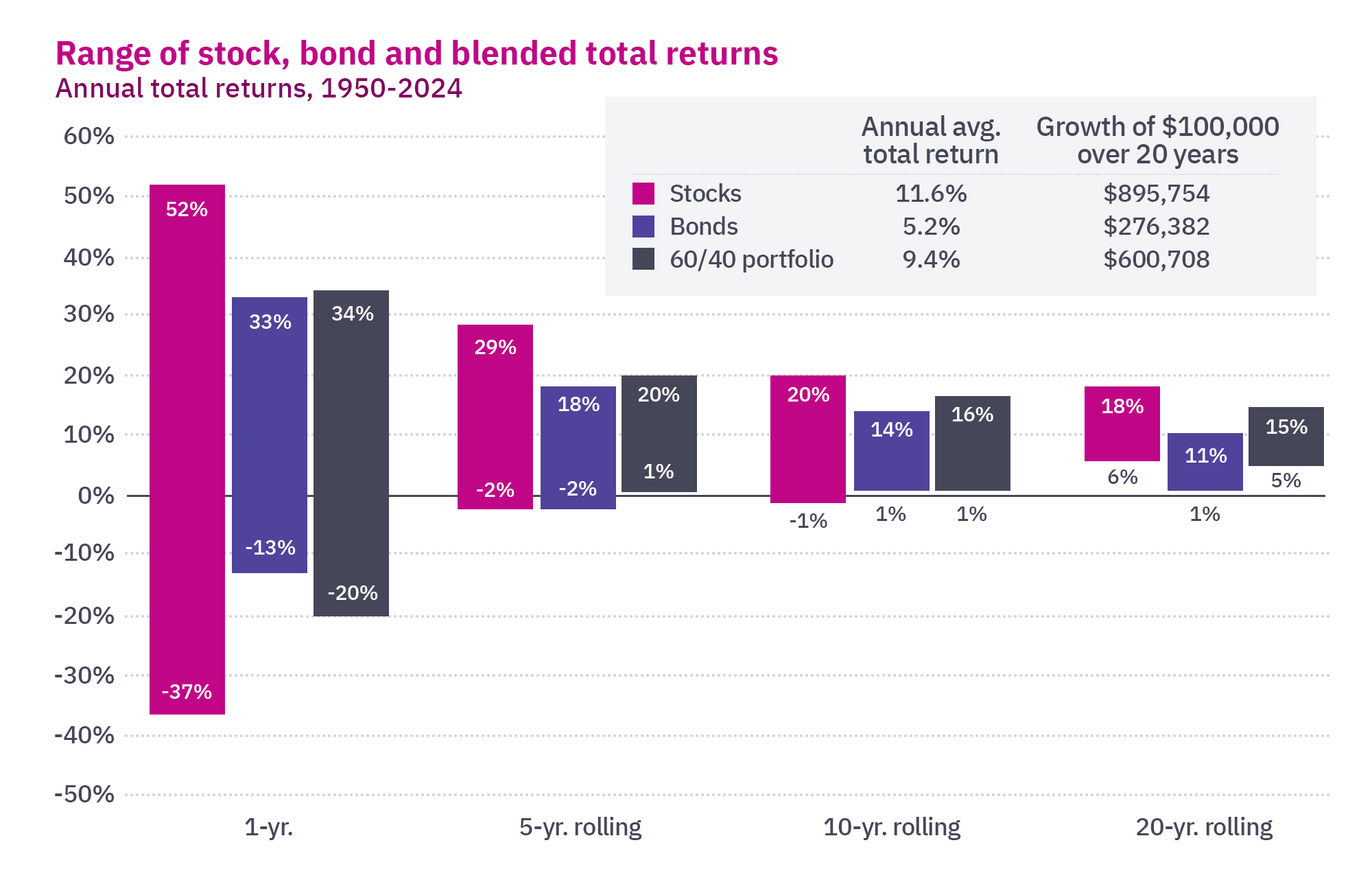

When planning your financial future, it’s important to understand your willingness and ability to take risk. Your ability to take risk depends on your cash flow needs and overall balance sheet. As the chart below shows, there are significant one-year variations in the returns for equities and fixed income1. Just like a seasoned traveler keeps some essentials handy, you should have stable investments like shorter-term bonds and money market funds to invest in equities, and other growth assets, with a longer timeframe.

Along with the ability to take risk, the willingness to take risk is equally important. Following our travel analogy, think of it this way…while some travelers enjoy the thrill of exploring uncharted territories, others prefer the comfort of well-trodden paths, investors have different levels of risk tolerance. If you’re too cautious, you might miss out on potential gains. On the other hand, taking on too much risk can lead to sleepless nights. Finding the right balance is key to a successful financial plan. As the chart above shows, the 20-year growth for equities was higher than fixed income and a balanced portfolio but had greater return variation along the way.

Sequence of returns risk is also a crucial component for your financial plan. While staying invested over time is important, it’s essential not to make hasty decisions based on short-term market movements. The chart below shows that the S&P 500 returns have varied over the last 40 years, with intra-year declines often leading to higher volatility than annual returns suggest2. If your equity allocation is too high, the sequence of return potential could have a greater impact because you might be selling assets at a low price, missing out on potential recovery.

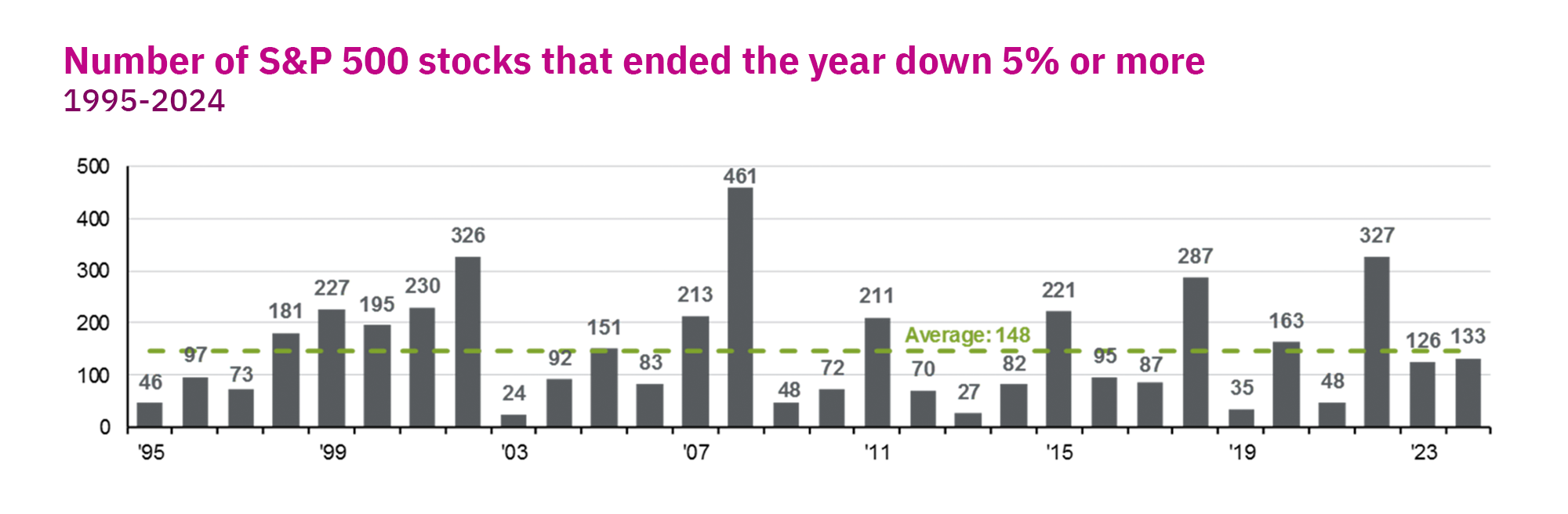

Over the long term, equities have provided substantial return potential, but they come with higher risk. Diversification does not eliminate the risk from investing in equities, but it can reduce the impact from equities that have underperformed. While the positive impact of an outperforming stock is beneficial, the negative impact from an underperforming stock can be quite harmful. For instance, in the past two years with 24% and 23% returns, nearly one-quarter of stocks in the S&P 500 were down 5% or more3. One-quarter of the index underperformed the overall return by nearly 30%! Diversification helps mitigate the risk of underperforming the asset class by spreading your investments across different securities.

Regularly reviewing your financial plan is essential. In addition, understanding the risk and return of different asset classes before investing is crucial. Monte Carlo Analysis, a tool that models a variety of risk and return outcomes, helps analyze how changes in withdrawals or equity levels might impact your plan. Most high-quality financial planning systems run thousands of risk/return scenarios in minutes, providing a comprehensive view of potential outcomes. Seeing the strength of your financial plan, supported by a well-diversified portfolio, can offer comfort during market turmoil and may even allow for greater portfolio risk to enhance your plan’s success.

At the end of the day, we work closely with our clients to develop and maintain their financial plans. Making investment recommendations without understanding a client’s financial plan, risk capacity, and risk tolerance is like setting out on a journey without a clear destination. A well-built financial plan provides a solid understanding of your investment timeframe and goals, helping to ensure that your financial journey is as smooth and successful as possible.

Your advisor can review the risks in your portfolio, as well as how to manage them, as part of your overall financial plan. Not a Mercer Advisors client but interested in more information? Let’s talk.

1Page 34 of MMU – 12/21/2024 or page 63 of JP Morgan Q1 2025 Guide to the Markets.

2Page 16 of JP Morgan Q1 2025 Guide to the Markets.

3Page 61 of JP Morgan Q1 2025 Guide to the Markets.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.