A well-diversified portfolio is key to a successful financial plan and depends on the starting place. If the portfolio is 100% cash and money market funds, implementing diversification in the portfolio is straightforward. Portfolios starting at a diversified point with many stocks may need to recognize some capital gains as part of the fine-tuning process. If a portfolio starts with a concentrated position, typically 10% – 20% or more, then the portfolio is at a much greater risk from an event in that single stock.

Concentrated positions can occur over time for various reasons:

- Not selling stock as it is going up since it is a “good company”, fear of missing out on additional return, or avoiding the capital gain recognition

- Waiting for shares in restricted stock units or stock options to vest

- Companies with employee stock purchase programs may offer a discount from market value to purchase shares, and a “look back” provision that can further lower the purchase price

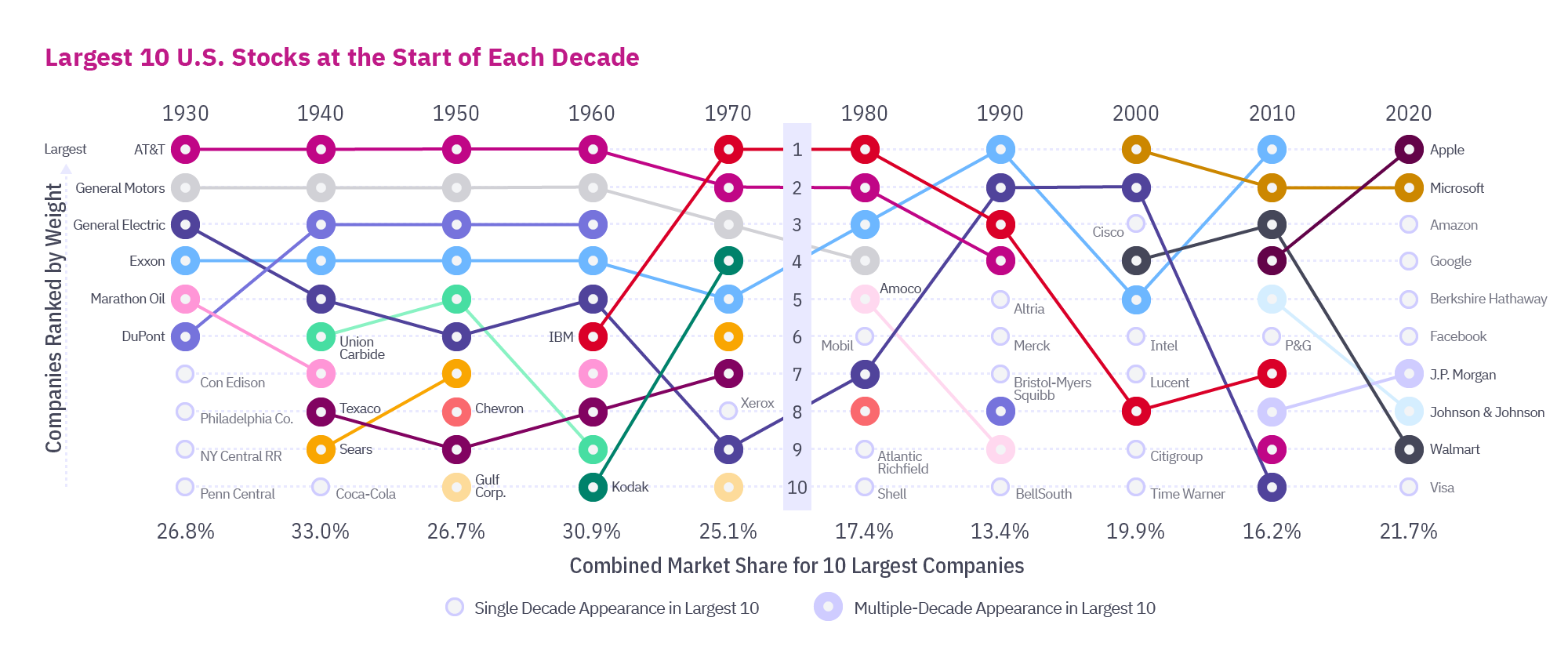

There are benefits to a portfolio and net worth for concentrating a portfolio in a stock that has done very well, but the drawbacks are much more significant if the stock has not done well. Companies that were the better performers in previous years may no longer continue to perform well. General Electric had an eighty-year run as a top-10 constituent in the S&P 500 Index from 1930 to 2010. Cisco Systems is a key company that manufactures and sells key technology infrastructure components and was one of the stars of the late-1990s technology bubble but has since dropped off. The stocks of these companies have significantly trailed the S&P 500 total return from 01/01/2000 – 06/30/2024:

- Cisco Systems had a 1.10% annualized return

- General Electric (now GE Aerospace) had 1.97% annualized return

- S&P 500 Index had a 7.50% annualized return

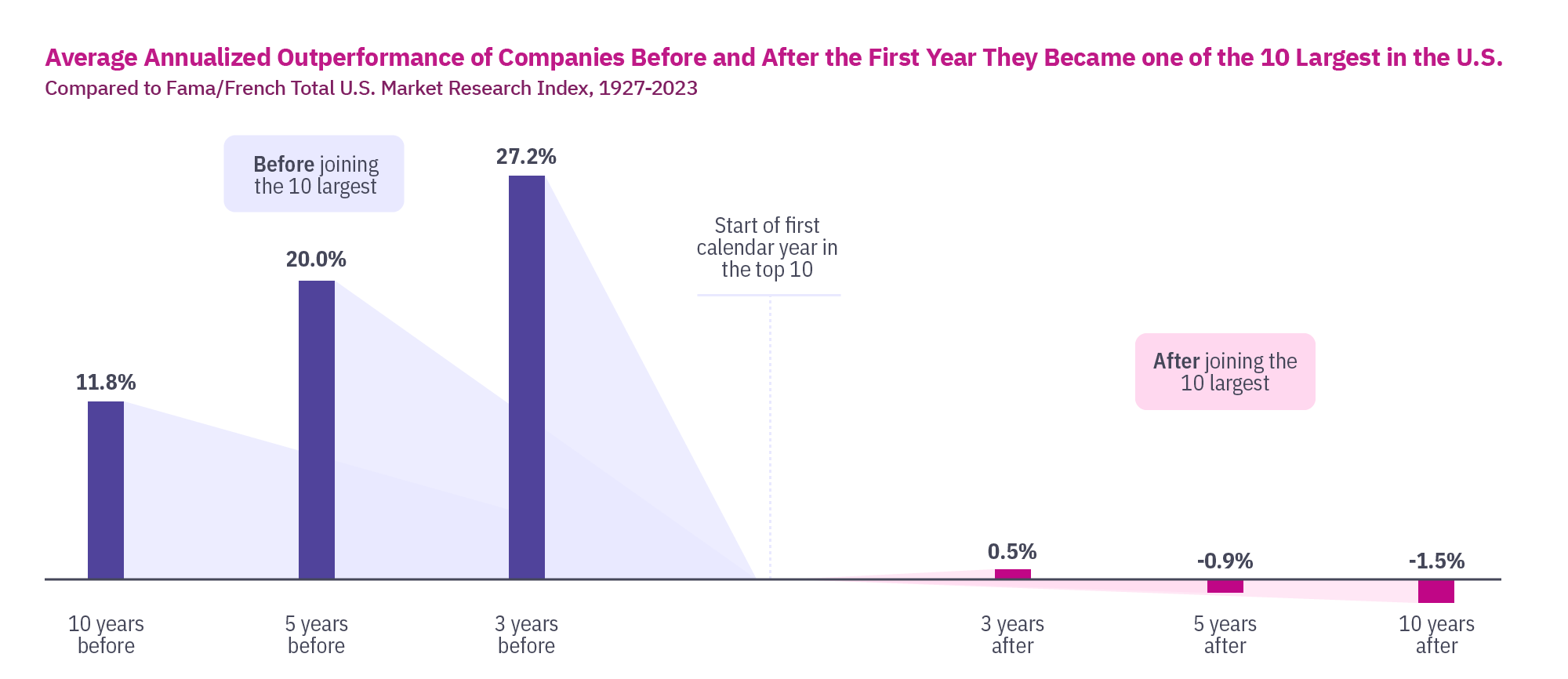

When considering the top-10 companies in the S&P 500 Index, they have seen returns exceeding that of the index overall. When considering future returns, it is important to look beyond the recent returns to examine the potential for continued returns now that these are the largest stocks in the index. It is important to remember that the stock price includes the expectations about the company’s future. Unfortunately, when looking at the data from 1927 to 2023, the annualized five-year outperformance was -0.9% after joining the top 10 of the index, while it was 20% for the five-year prior.

Since the concentrated position may hinder the portfolio’s future of the portfolio, diversification is an important step. There are multiple methods to help reduce the impact on the portfolio:

- Gifting shares to family, up to the $18,000 annual gift limit, will remove them from the portfolio. They will receive the current cost basis and after-tax proceeds will be higher for those in lower tax brackets.

- Selling the shares provides for immediate diversification. While this generates the liquidity to diversify the portfolio, this will also recognize capital gains.

- Hedging the position can limit the impact on the portfolio. A hedging strategy will typically limit the impact of the stock moving down by also limiting the benefit from the stock moving up. The common approach is to have a cashless collar whereby the cost of the downside protection is offset by selling off the upside participation.

- An Exchange Fund offers the ability to invest using the concentrated stock, to have immediate diversification. They will track an index, such as the S&P 500, and determine which stock is acceptable. After seven years, the Exchange Fund generally will be able to distribute a basket of stocks with the same cost basis as the stock used for the initial investment. There may be redemption fees if withdrawn earlier than seven years and you only receive the contributed stock back based on the return of the fund.

- Charitable donations using the concentrated stock can be accomplished using several methods. With charitable donations, the biggest impact is from donating the most appreciated portion of the concentrated position:

- Direct donation to an eligible 501(c)(3) charity. This provides the tax benefit in the year the donation is made.

- Donor-advised Fund (DAF). This vehicle allows for the tax deduction in the year of the donation but then provides the flexibility to make charitable donations in the current and future years.

- Charitable remainder trust. This trust is set up to receive donations and allows for immediate diversification. The trust will pay an annual income to the beneficiary and then donate the remaining balance at the end of the determined period, either a set length of time or at the end of life, to the named charity. Since the beneficiary receives annual income, the tax deduction is not for the full amount. In addition, the annual distributions are taxable income, based on what the trust has earned.

Visit our knowledge center for more information on concentrated stock positions and donor-advised funds, including how DAFs can help maximize giving impact and tax benefits and grow charitable giving.

While there is a need to diversify the portfolio, selling a concentrated position may come with capital gains taxes. If part of the position is sold, generating $1 million in capital gains taxes for example, the portfolio needs to overcome this to get back to where it was before. A $10 million portfolio would require a 10% return for one year or a 1.92% annualized return for five years to overcome the impact of the taxes. While this requires a return for the portfolio, this should be weighed against the potential for underperformance if the stock does not continue to see the same level of growth over the next five or ten years that it saw previously.

While there are many considerations, there is no single answer. None of the diversification methods are mutually exclusive. A well-built financial plan can use these methods together to help accomplish various goals. Spreading the diversification over several years can reduce the impact of taxes. The well-diversified target portfolio is the goal but will take a thoughtful approach to achieve it.

Your advisor can help determine how best to diversify your portfolio and which combination of methods may provide the most benefit. Not a Mercer Advisors client but interested in more information? Let’s talk.

Sources:

Rizova, Ph.D., Savina and Saito, Ph.D., Namiko. “Addressing Concentrated Stock Positions in Client Portfolios.” Dimensional Fund Advisors, June 2024.

“Large and In Charge? Giant Firms atop Market Is Nothing New.” Dimensional Fund Advisors, 17 June 2020.