Questions are swirling about the dollar as the world’s preferred global reserve currency, its extensive usage in global trade, and the threat to the currency from the rise of China’s economy. There seems to be a growing chorus of naysayers arguing the dollar is in a long-term decline against other majors, including digital currencies. While ebbs and flows are a fact of life in global currency markets, here are some quick thoughts about recent trends in the U.S. dollar and data to put the current situation in perspective.

Why is the U.S. dollar in the news again?

The number of headlines focused on the greenback seem to rise and fall with the value of the dollar, geopolitical tensions, and the perceived health of the U.S. financial system. Recent bank failures, the battle over the U.S. debt ceiling, and the prospect of a U.S. economic recession have all undoubtedly fueled the dollar’s resurgence in the news over the past few months.

But there are also geopolitical reasons for the U.S. dollar’s return to the headlines. The West’s punishing economic sanctions against Russia for its invasion of Ukraine—among them, the seizure of Russia’s central bank reserves held in Western countries and its banishment from the SWIFT payments system—send a powerful message to potential adversaries who are economically dependent on Western currencies. China, given its saber-rattling over Taiwan, has certainly taken notice of the West’s economic isolation of Russia and signed an agreement with Brazil in late March to no longer use U.S. dollars when transacting between the two emerging market economies.

The value of the U.S. dollar

The value of a country’s currency is a function of its national economy, interest rates, political stability, transparency, rule of law, and the currency’s reliability as a stable store of value. The U.S. typically receives high marks in all these categories (though not always), a fact that largely explains its popularity as the world’s preferred global reserve currency (more on this below).

There seems to be some perception that the dollar is somehow in a long-term secular decline against other global currencies (in this narrative, the dollar is on the cusp of being replaced by the Chinese renminbi, Bitcoin, gold, or some other up and coming global currency). But this perception is not supported by the data. There is no evidence that the U.S. dollar is in some sort of long-term secular decline. In fact, over the past year, the U.S. dollar rose significantly in response to the Federal Reserve’s aggressive rate hikes (all things equal, higher interest rates make dollars more valuable) and Russia’s invasion of Ukraine (markets generally view the U.S. dollar as a safe haven asset during times of geopolitical instability).

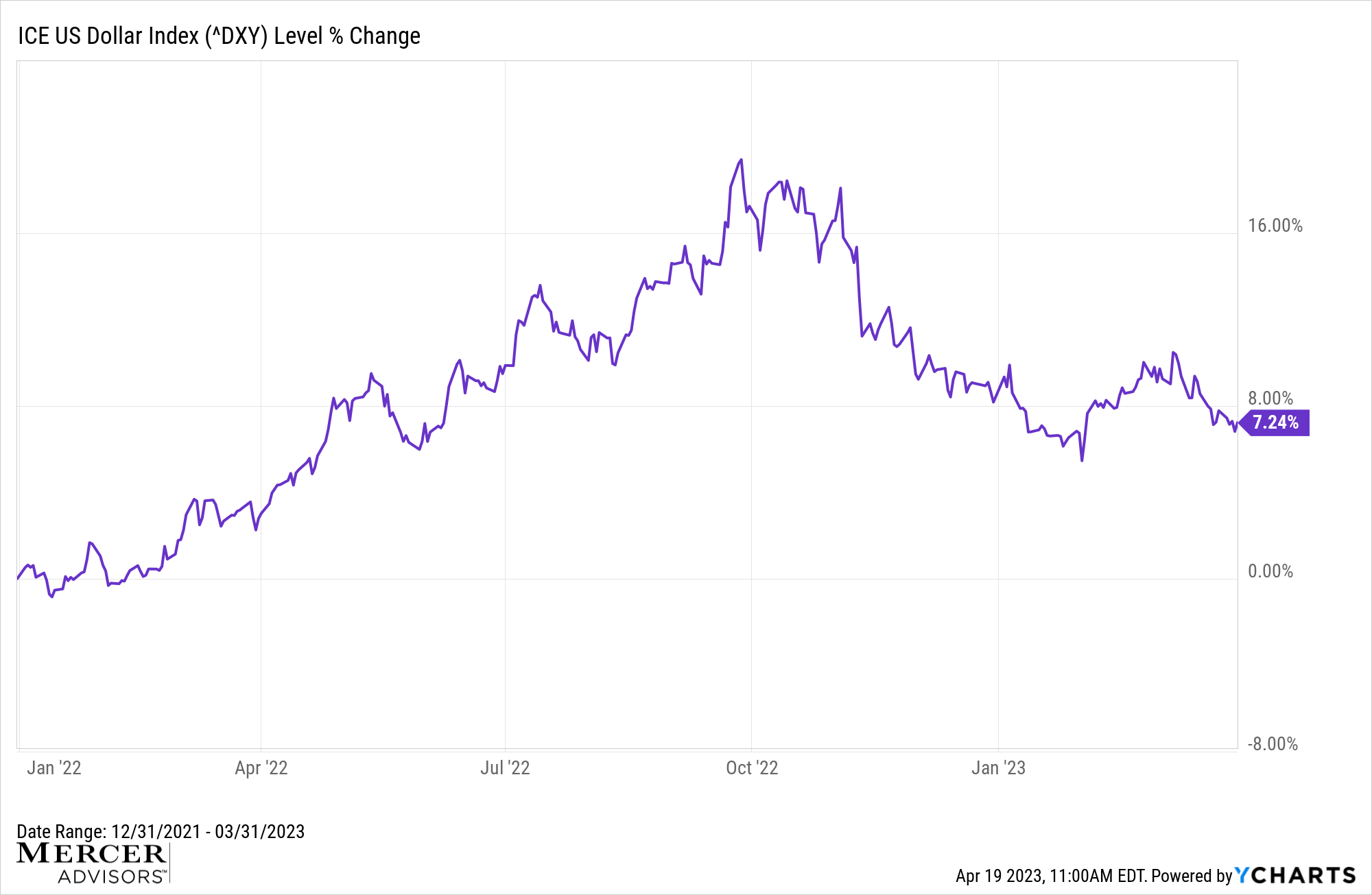

Consider Exhibit 1 below. From January 1, 2022 to September 30, 2022, the U.S. Dollar Index, which tracks the performance of the greenback against a basket of six other currencies, rose a staggering 17.25% against other major currencies. Since then, probably due to increasing expectations of a U.S. economic recession, the index has given back some of those stellar gains, declining 8.54% between October 1, 2022 and March 31, 2023, but is still up 7.24% over the past 15 months.

Exhibit 1: The U.S. Dollar Index, January 1, 2022 – March 31, 2023.

The dollar has risen in value 7.24% since January 1, 2022, but has declined 8.54% since October 1, 2022 (source).

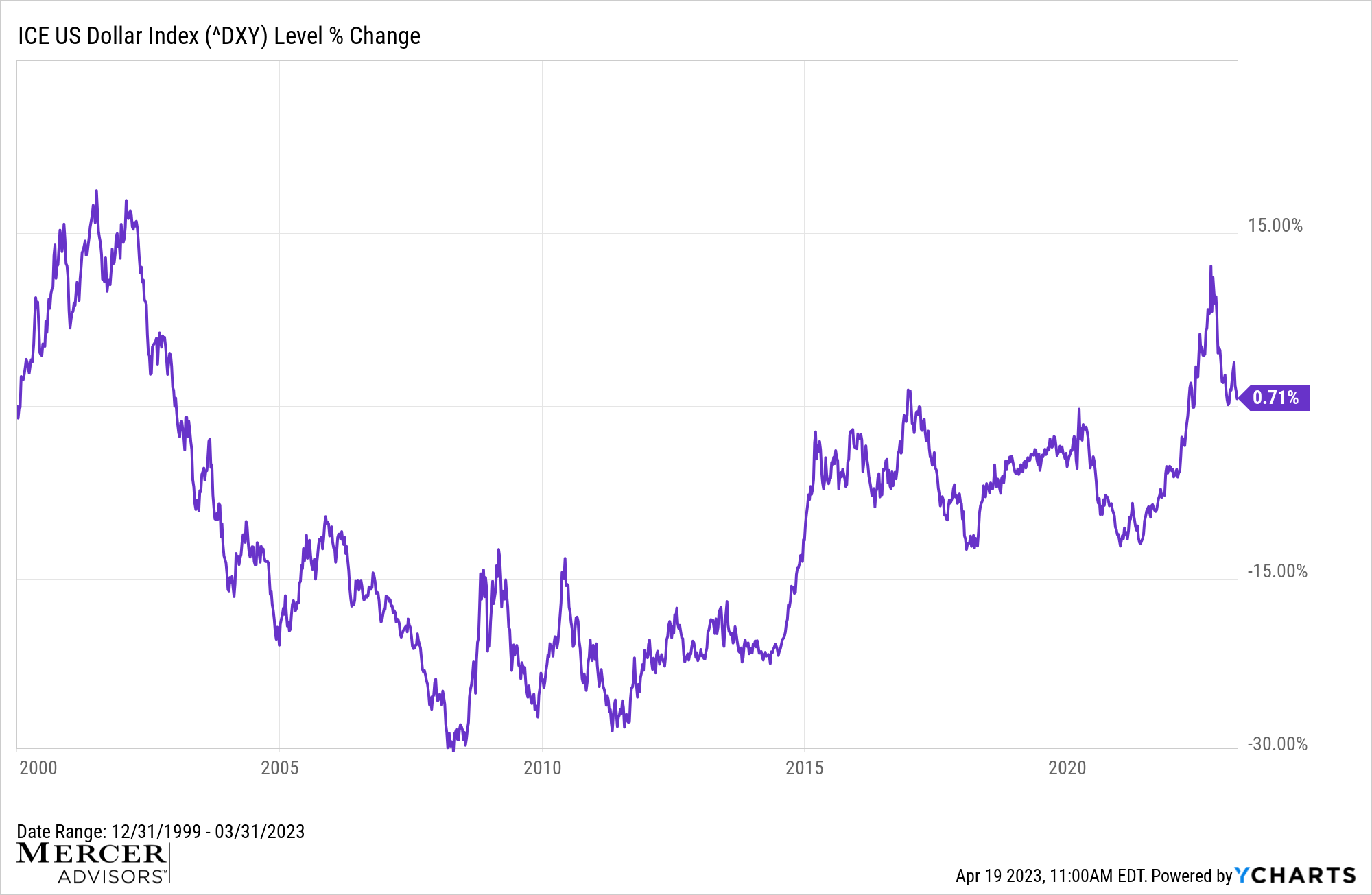

Taking a longer view, since January 2010, the U.S. Dollar Index has increased 31.77% in value against major global currencies. However, if we go back further still, to January 2000, we see (Exhibit 2) that the value of U.S. dollar is virtually unchanged against other majors over that time (the dollar index is up 0.71%). But this isn’t to say that the currency market hasn’t been volatile; it certainly has. For example, the U.S. Dollar Index declined 34.8% from July 2001 to December 2009 only to rally 26.33% from January 2010 to March 2015. But if this seems outlandishly volatile, it isn’t. Since 1972, the US Dollar Index has had an average annual standard deviation of about 4.62%, versus about 18% for stocks and 24% for gold (source: Mercer Advisors calculations).

Exhibit 2: The U.S. Dollar Index, 1/1/2000 – 3/31/2023.

The U.S. dollar: The world’s preferred global reserve currency

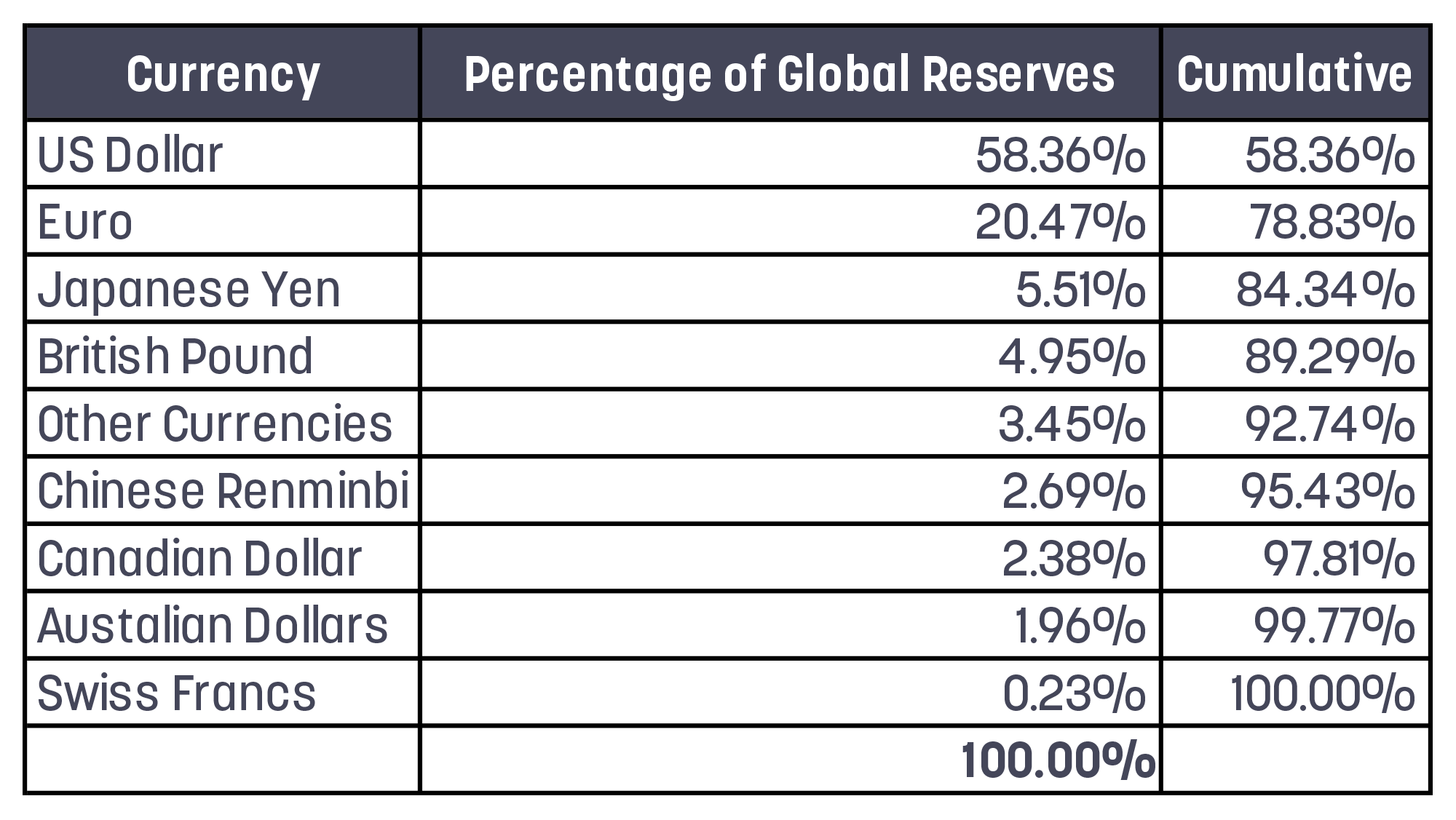

A related question has to do with the U.S. dollar as the world’s preferred reserve currency—emphasis on “preferred” because it isn’t the world’s only reserve currency. Today, the U.S. dollar makes up 58.36% of all global reserves. Other major reserve currencies include the euro (20.47%), the Japanese yen (5.51%), and the British pound (4.95%). Collectively, the dollar, yen, euro, and pound make up nearly 90% of all global reserves. When we include the Aussie and Canadian dollars, that number rises to 93.63%.To say that the currencies of Western democracies dominate global finance would clearly be an understatement.

A fact highlighted by some dollar naysayers is that the U.S. dollar has declined as a percentage of global reserves. This is true. Over the past 10 years, the share of global reserves held in U.S. dollars fell from 62.03% in Q4 2012 to 58.36% by Q4 2022. Given that the share was 71.2% in 1999, the decline over longer periods has been even more pronounced for example.

However, we should keep this decline in perspective because it doesn’t necessarily mean the value of the U.S. dollar has somehow weakened against other global currencies. We saw in Exhibits 1 and 2 that this isn’t the case; the U.S. dollar remains “strong” in terms of value. This decline, as a share of global reserves, has more to do with the rise of other major reserve currencies over that time. Consider some examples:

- The euro’s percentage of global reserves grew from 18.12% in 1999 to 20.47% in 2022.

- The British pound today makes up 4.95% of global reserves, up from 2.74% in 1999.

- The percentage of global reserves consisting of Australian and Canadian dollars was negligible in 1999, but today they collectively make up 4.34%.

What about China? China’s renminbi (or yuan) today makes up 2.69% of global reserves, up from nothing in 1999. This shouldn’t be surprising. In 1999, China’s economy was a mere fraction of what it is now. China has become the world’s second largest economy (with a GDP of about $17.7 trillion) behind the United States (about $23 trillion) and, for many countries, China is their largest trading partner. The fact that the renminbi now makes up some small share of global reserves is hardly surprising.

Exhibit 3: Global Currency Reserves, Q4 2022

(Source: International Monetary Fund)

Is China’s currency a threat to the U.S. dollar’s primacy?

Some observers fear that the rise of China’s currency presents an imminent threat to the U.S. dollar’s supremacy. While history always cautions humility, the short answer is probably not. We’ve already touched on the fact that U.S. dollar makes up nearly 60% of global reserves and, when combined with the currencies of other major Western democracies, that number rises to over 93%.

In addition to the U.S. dollar’s dominance as the world’s preferred global reserve currency, according to the IMF, approximately 90% of global foreign exchange transactions are in U.S. dollars. Further, about 50% of all cross-border loans and 50% of non-U.S. debt securities are issued in U.S. dollars, a testament to the fact that lenders strongly prefer repayment in dollars. Finally, let’s not forget commodities, the stuff of the “real” economy; most major global commodities are today priced in U.S. dollars—oil, wheat, corn, soybeans, gold, and more. The takeaway is that, at least for the foreseeable future, the primacy of the U.S. dollar seems likely to persist.

Finally, recall our earlier comment on what determines currency values. There’s a popular narrative that China’s economy, given its historic rise, will soon eclipse that of the United States and therefore, that the renminbi will replace the U.S. dollar as the world’s preferred reserve currency. However, there is a depth and breadth of economic data that strongly suggests otherwise—and that China’s best days, at least economically, are probably behind it. For example, consider the following:

- Goldman Sachs projects China’s economic growth will fall to 3.5% by 2027 and 2.5% by 2032 (down from 7.7% over the past 10 years). Should these projections come to pass, China’s economy will likely never eclipse that of the United States, which boldly contradicts the prevailing narrative that China’s economy will somehow overtake the United States sometime in the 2030s. You can read more here on Goldman’s China outlook.

- China’s working age population peaked in 2015; its total population peaked in 2021. China’s population declined by 850,000 people in 2022, the first decline since 1961. China’s population is projected to decline every year through the end of the century, a fact that will weigh heavily on the country’s prospects for economic growth. Population growth remains positive in the United States (about 0.50% annually) and, unlikely China, is driven more by net immigration than births minus deaths.

- Total factor productivity growth in China has fallen to 0.7%, about one-quarter that of its pre-global financial crisis levels. In other words, not only does China have fewer workers each year, the growth in the productivity of those same workers has also declined significantly.

- Among Western countries, both “re-shoring” and “near-shoring” trends away from China are picking up momentum, a fact that will likely make it harder for China to grow its economy in the years ahead.

- China’s economy has taken a backseat to other priorities of the Chinese Communist Party, as domestic policies favor less profitable and less productive state-owned enterprises over more profitable and innovative private ones.

The bottom line is that China’s economy has changed. Today’s China faces a plethora of deep, structural challenges—political, economic, and demographic—that, in addition to Beijing’s growing militarism, lack of transparency, and respect for the rule of law, make it highly unlikely the renminbi will replace the primacy of the U.S. dollar any time soon.

To close, none of this should be interpreted as being anti-China or pollyannaish on the U.S. dollar. We have real economic challenges here at home that need to be addressed—the debt ceiling, federal spending, and other uncertainties on the economic front. But these discussions around China, global reserves, and the U.S. dollar are often light on data and heavy on social media soundbites. Our job as advisors is to elevate the discussion with science, data, and intuition to help clients make the best-informed decisions possible for their families. The intent here is to further that mission by adding data, context, and economic intuition to the discussion.

Home » Insights » Market Commentary » Perspectives on the U.S. Dollar

Perspectives on the U.S. Dollar

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

While ebbs and flows are a fact of life in global currency markets, here are some quick thoughts about recent trends in the U.S. dollar and data to put the current situation in perspective.

Questions are swirling about the dollar as the world’s preferred global reserve currency, its extensive usage in global trade, and the threat to the currency from the rise of China’s economy. There seems to be a growing chorus of naysayers arguing the dollar is in a long-term decline against other majors, including digital currencies. While ebbs and flows are a fact of life in global currency markets, here are some quick thoughts about recent trends in the U.S. dollar and data to put the current situation in perspective.

Why is the U.S. dollar in the news again?

The number of headlines focused on the greenback seem to rise and fall with the value of the dollar, geopolitical tensions, and the perceived health of the U.S. financial system. Recent bank failures, the battle over the U.S. debt ceiling, and the prospect of a U.S. economic recession have all undoubtedly fueled the dollar’s resurgence in the news over the past few months.

But there are also geopolitical reasons for the U.S. dollar’s return to the headlines. The West’s punishing economic sanctions against Russia for its invasion of Ukraine—among them, the seizure of Russia’s central bank reserves held in Western countries and its banishment from the SWIFT payments system—send a powerful message to potential adversaries who are economically dependent on Western currencies. China, given its saber-rattling over Taiwan, has certainly taken notice of the West’s economic isolation of Russia and signed an agreement with Brazil in late March to no longer use U.S. dollars when transacting between the two emerging market economies.

The value of the U.S. dollar

The value of a country’s currency is a function of its national economy, interest rates, political stability, transparency, rule of law, and the currency’s reliability as a stable store of value. The U.S. typically receives high marks in all these categories (though not always), a fact that largely explains its popularity as the world’s preferred global reserve currency (more on this below).

There seems to be some perception that the dollar is somehow in a long-term secular decline against other global currencies (in this narrative, the dollar is on the cusp of being replaced by the Chinese renminbi, Bitcoin, gold, or some other up and coming global currency). But this perception is not supported by the data. There is no evidence that the U.S. dollar is in some sort of long-term secular decline. In fact, over the past year, the U.S. dollar rose significantly in response to the Federal Reserve’s aggressive rate hikes (all things equal, higher interest rates make dollars more valuable) and Russia’s invasion of Ukraine (markets generally view the U.S. dollar as a safe haven asset during times of geopolitical instability).

Consider Exhibit 1 below. From January 1, 2022 to September 30, 2022, the U.S. Dollar Index, which tracks the performance of the greenback against a basket of six other currencies, rose a staggering 17.25% against other major currencies. Since then, probably due to increasing expectations of a U.S. economic recession, the index has given back some of those stellar gains, declining 8.54% between October 1, 2022 and March 31, 2023, but is still up 7.24% over the past 15 months.

Exhibit 1: The U.S. Dollar Index, January 1, 2022 – March 31, 2023.

The dollar has risen in value 7.24% since January 1, 2022, but has declined 8.54% since October 1, 2022 (source).

Taking a longer view, since January 2010, the U.S. Dollar Index has increased 31.77% in value against major global currencies. However, if we go back further still, to January 2000, we see (Exhibit 2) that the value of U.S. dollar is virtually unchanged against other majors over that time (the dollar index is up 0.71%). But this isn’t to say that the currency market hasn’t been volatile; it certainly has. For example, the U.S. Dollar Index declined 34.8% from July 2001 to December 2009 only to rally 26.33% from January 2010 to March 2015. But if this seems outlandishly volatile, it isn’t. Since 1972, the US Dollar Index has had an average annual standard deviation of about 4.62%, versus about 18% for stocks and 24% for gold (source: Mercer Advisors calculations).

Exhibit 2: The U.S. Dollar Index, 1/1/2000 – 3/31/2023.

The U.S. dollar: The world’s preferred global reserve currency

A related question has to do with the U.S. dollar as the world’s preferred reserve currency—emphasis on “preferred” because it isn’t the world’s only reserve currency. Today, the U.S. dollar makes up 58.36% of all global reserves. Other major reserve currencies include the euro (20.47%), the Japanese yen (5.51%), and the British pound (4.95%). Collectively, the dollar, yen, euro, and pound make up nearly 90% of all global reserves. When we include the Aussie and Canadian dollars, that number rises to 93.63%.To say that the currencies of Western democracies dominate global finance would clearly be an understatement.

A fact highlighted by some dollar naysayers is that the U.S. dollar has declined as a percentage of global reserves. This is true. Over the past 10 years, the share of global reserves held in U.S. dollars fell from 62.03% in Q4 2012 to 58.36% by Q4 2022. Given that the share was 71.2% in 1999, the decline over longer periods has been even more pronounced for example.

However, we should keep this decline in perspective because it doesn’t necessarily mean the value of the U.S. dollar has somehow weakened against other global currencies. We saw in Exhibits 1 and 2 that this isn’t the case; the U.S. dollar remains “strong” in terms of value. This decline, as a share of global reserves, has more to do with the rise of other major reserve currencies over that time. Consider some examples:

What about China? China’s renminbi (or yuan) today makes up 2.69% of global reserves, up from nothing in 1999. This shouldn’t be surprising. In 1999, China’s economy was a mere fraction of what it is now. China has become the world’s second largest economy (with a GDP of about $17.7 trillion) behind the United States (about $23 trillion) and, for many countries, China is their largest trading partner. The fact that the renminbi now makes up some small share of global reserves is hardly surprising.

Exhibit 3: Global Currency Reserves, Q4 2022

(Source: International Monetary Fund)

Is China’s currency a threat to the U.S. dollar’s primacy?

Some observers fear that the rise of China’s currency presents an imminent threat to the U.S. dollar’s supremacy. While history always cautions humility, the short answer is probably not. We’ve already touched on the fact that U.S. dollar makes up nearly 60% of global reserves and, when combined with the currencies of other major Western democracies, that number rises to over 93%.

In addition to the U.S. dollar’s dominance as the world’s preferred global reserve currency, according to the IMF, approximately 90% of global foreign exchange transactions are in U.S. dollars. Further, about 50% of all cross-border loans and 50% of non-U.S. debt securities are issued in U.S. dollars, a testament to the fact that lenders strongly prefer repayment in dollars. Finally, let’s not forget commodities, the stuff of the “real” economy; most major global commodities are today priced in U.S. dollars—oil, wheat, corn, soybeans, gold, and more. The takeaway is that, at least for the foreseeable future, the primacy of the U.S. dollar seems likely to persist.

Finally, recall our earlier comment on what determines currency values. There’s a popular narrative that China’s economy, given its historic rise, will soon eclipse that of the United States and therefore, that the renminbi will replace the U.S. dollar as the world’s preferred reserve currency. However, there is a depth and breadth of economic data that strongly suggests otherwise—and that China’s best days, at least economically, are probably behind it. For example, consider the following:

The bottom line is that China’s economy has changed. Today’s China faces a plethora of deep, structural challenges—political, economic, and demographic—that, in addition to Beijing’s growing militarism, lack of transparency, and respect for the rule of law, make it highly unlikely the renminbi will replace the primacy of the U.S. dollar any time soon.

To close, none of this should be interpreted as being anti-China or pollyannaish on the U.S. dollar. We have real economic challenges here at home that need to be addressed—the debt ceiling, federal spending, and other uncertainties on the economic front. But these discussions around China, global reserves, and the U.S. dollar are often light on data and heavy on social media soundbites. Our job as advisors is to elevate the discussion with science, data, and intuition to help clients make the best-informed decisions possible for their families. The intent here is to further that mission by adding data, context, and economic intuition to the discussion.

Explore More

CD Ladder vs. Treasury Ladder: Choosing a Smart Cash Strategy

Tax Planning for Creative Professionals: Simplifying Tax Complexities

Is Social Security Taxed in 2026? What Retirees Need To Know About New Rules

Mercer Global Advisors Inc. is registered with the Securities and Exchange Commission and delivers all investment-related services. Mercer Advisors Inc. is the parent company of Mercer Global Advisors Inc. and is not involved with investment services.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. The information is believed to be accurate, but is not guaranteed or warranted by Mercer Advisors. Content, research, tools, and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Indices are not available for direct investment. This content may contain forward looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.