Whenever stocks have an abrupt downturn, many people have the instinct to exit the market and wait until things calm down before buying back in.

We think this is a trap. Panic selling – especially after the market has had a steep tumble – is rarely a strategy that works out well for investors. With hindsight, it’s easy to look at a market crash and think how clever it would have been to sell at the peak and wait until the trough to buy back in. In practice, few people pull this off and instead end up with much worse returns than if they’ve stayed invested.

The pitfalls of trying to time the market

Timing the market’s ups and downs is not only nearly impossible, but attempting to do so can cause significant damage to long-term portfolio returns.

Note that if you’re thinking of doing this now with U.S. stocks you’ve already missed the market’s most recent peak by about seven weeks and by about 20%. The truth is that no one has a consistent track record of identifying peaks in real time and selling at the very top. We know from history that market peaks, by their nature, are moments when people feel quite optimistic about the economy and it’s not until after the market has turned that people feel glum.

Just as it is difficult to identify a peak in real time, it is difficult to identify the market’s low point. If an investor misses the trough, they may find they’ve waited too long to buy back in. The better strategy would have been staying invested.

Again, we know from history that the market’s low points are moments where people feel glum, and it’s not until the market has begun to recover that a sentiment begins to take root the market has calmed back down.

The best and worst days clump together

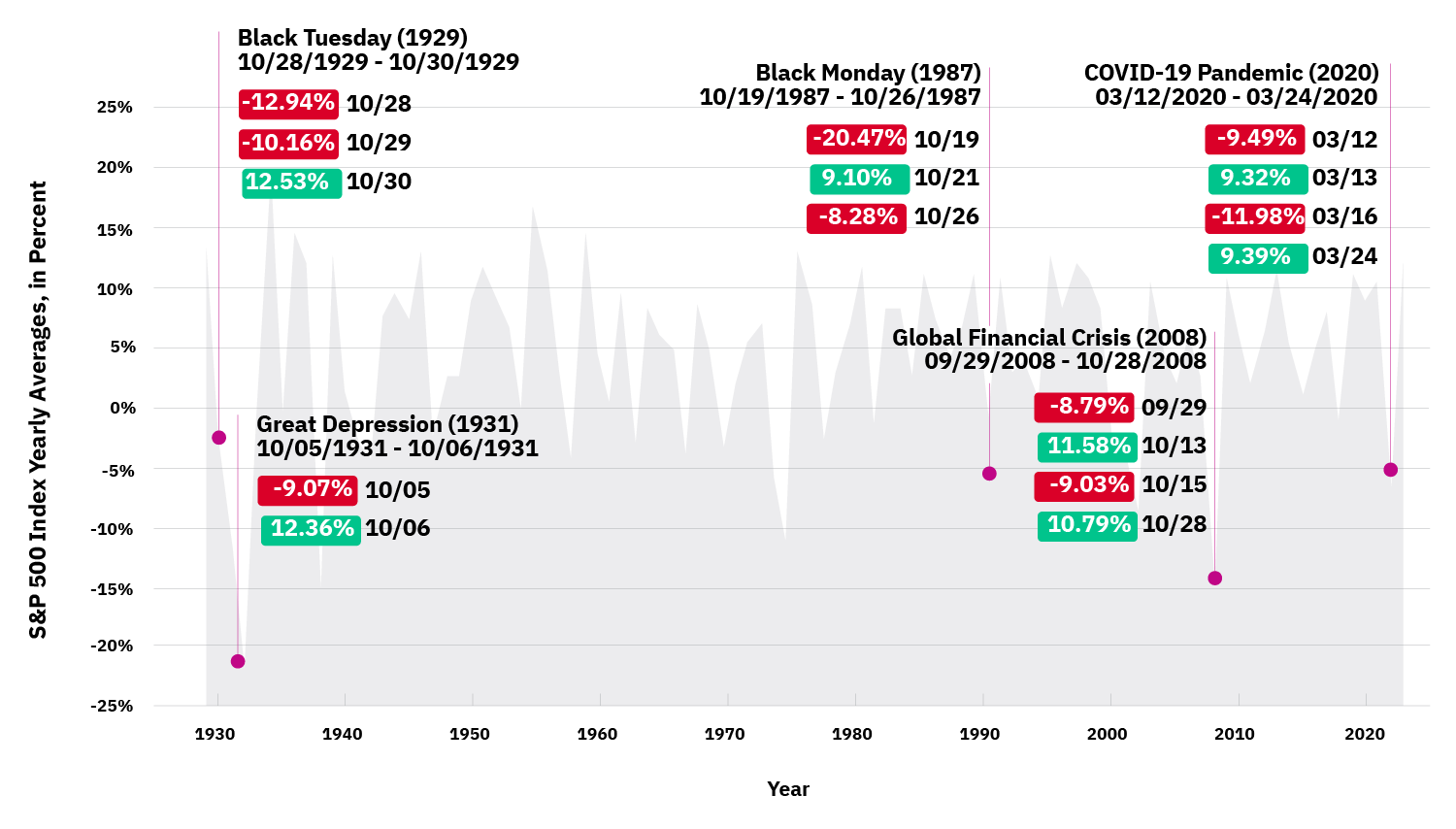

The peril of panic selling can be illustrated by the following chart.

Sources: Northern Trust Research, Bloomberg. S&P 500 daily return data

from 1/1/1928 through 3/3/2023. notherntrust.com (c) 2023 Northern Trust Corporation.

If you’re an experienced investor, you’ve certainly been advised against trying to time the market. But you may never have seen the historical data in this chart, which shows an important phenomenon: the worst days and the best days for the market often occur in close proximity to each other.

Enormous falls are often followed closely by strong rebounds. On Oct. 19, 1987, when the market crashed over 20% in a single day during Black Monday, it might have seemed sensible to get out of stocks that next day and wait for things to calm down. But just two days later, on Oct. 21, the market recovered 9.1%.

On March 16, during the early days of the COVID-19 pandemic, markets fell 12%. Yet just over a week later, on March 24, there was a 9% rebound. From that point onward, the market began to recover.

As a thought exercise, consider the situation during this period – there were serious questions about what would happen to the economy when society abruptly shuts down. The course of the pandemic was highly uncertain. By March 24, major economic or public health questions were still unresolved…yet the market was rebounding. An investor waiting for “things to calm down” would have been unlikely to realize that it was a good time to buy back in. It is only clear with hindsight.

Missing even a few of the best days significantly harms long-term returns

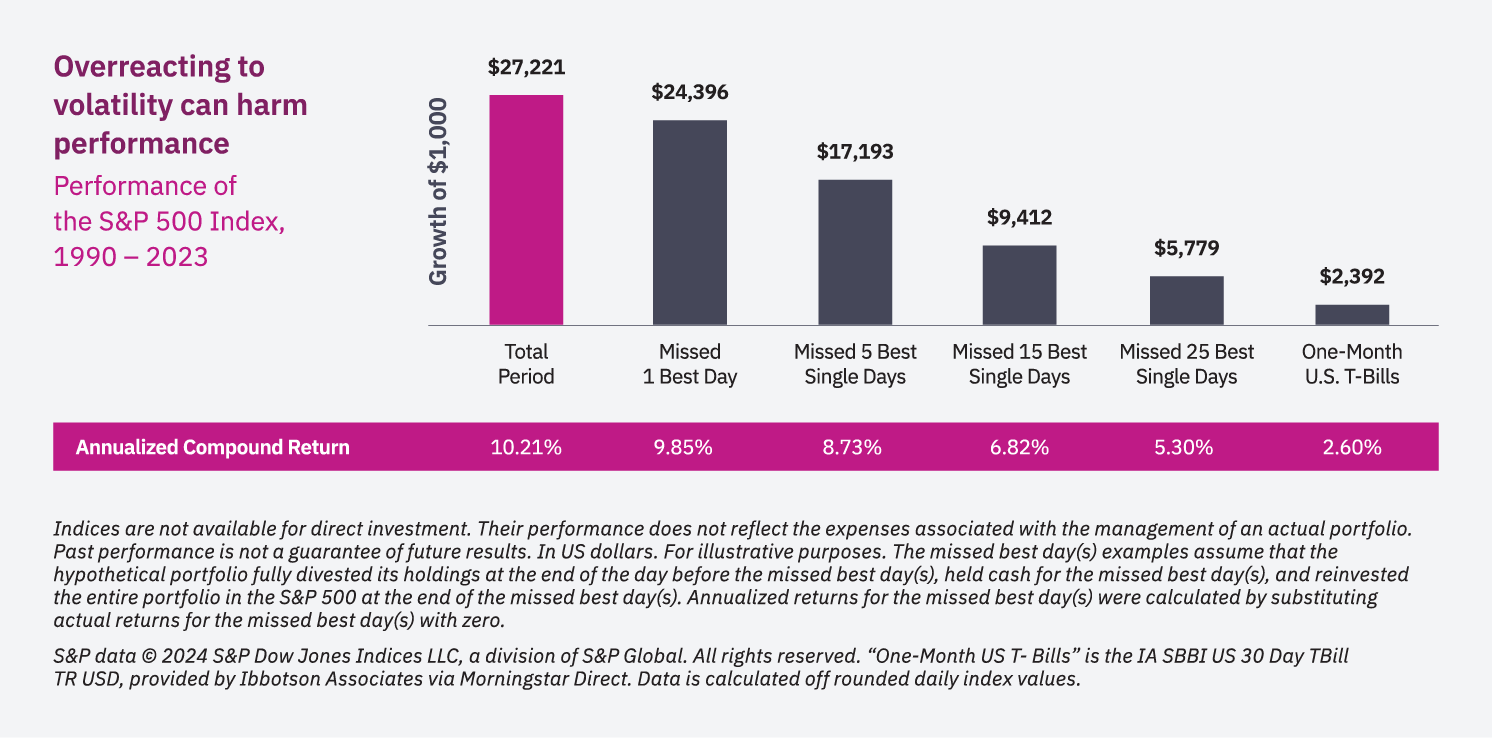

Consider the next chart:

Imagine $1,000 invested in the S&P 500 index in 1990. By the end of 2023, it would have grown to $27,221. But, an investor who missed the market’s best day, lost out on nearly $3,000 of gains for every $1,000 invested.

An investor who missed the five best single days, would only have $17,193 – losing out on over $10,000 of gains for every $1,000 invested. Missing out on the market’s best days is hugely detrimental to long-run performance.

Missing the 25 best days would have left an investor with just $5,779. When it comes to achieving long-term returns, one of the keys is remaining invested.

Is this time different?

We know from experience that when the market crashes, many investors wonder, “Is this time different? Yes, the market bounced back before, but will it do so now?”

We would submit that market downturns are generally moments where it feels like the world has forever changed, and in many cases – even with benefit of hindsight – these were major inflection points in many ways. To quote from our own recent note on market volatility, consider the events behind some of the sharp downturns in recent years:

Paul Volcker and 20% interest rates. The 1987 single-day 23% stock market crash driven by newfangled computers. A secretive hedge fund named Long-Term Capital Management exploding. The dot-com bubble and wondering how anyone could have paid so much for unprofitable startups. The global financial crisis. The Great Recession. The European debt crisis. The U.S. debt ceiling. The flash crash. The global pandemic. The point is not to be dismissive; some of these were genuinely terrifying moments.

Is this time different? In some ways, it likely is. For example, we must turn back nearly 100 years to find an episode where the U.S. raised tariffs in such a sweeping way. But on the other hand, considering the episodes above, each time is always different.

Here is another remarkable fact: Since 1980, markets have been in correction territory about 30% of the time.

Think about some of those periods, again with the benefit of hindsight – after the dot-com bubble burst or after the Global Financial Crisis – investing felt terrible to many. Yet looking at it now, these periods where the markets were slow to recover, were strong opportunities to remain invested or even to invest more.

Our takeaways

It’s not easy for investors to stay composed during market downturns, but the historical record is clear that these are some of the most important moments to stay invested.

- Don’t panic and don’t try to time the market. For the reasons above, this is a dangerous trap that rarely works out and often results in far worse returns that simply staying in the market.

- Stay the course with diversification. Broadly diversified portfolios have performed well over time, providing an optimal tradeoff between risk and return. We believe this will be the case again

- This time is always different. Our world, our economy, the global trading system, it’s always changing and always different. The differences are very meaningful. But investors who have been patient during periods of change have benefited in the long run. That part, we expect to be no different than ever.

Click here for past insights about the recent market volatility and other interesting topics. Not a Mercer Advisors client but interested in more information? Let’s talk.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Diversification does not ensure a profit or guarantee against loss. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Home » Insights » Market Commentary » The Fallacy of Selling and Waiting Until Markets Calm Down: Insights From Our CIO

The Fallacy of Selling and Waiting Until Markets Calm Down: Insights From Our CIO

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

When markets turn turbulent, many investors have an instinct to sell and wait until markets are calm. CIO Don Calcagni explains why to avoid this trap.

Whenever stocks have an abrupt downturn, many people have the instinct to exit the market and wait until things calm down before buying back in.

We think this is a trap. Panic selling – especially after the market has had a steep tumble – is rarely a strategy that works out well for investors. With hindsight, it’s easy to look at a market crash and think how clever it would have been to sell at the peak and wait until the trough to buy back in. In practice, few people pull this off and instead end up with much worse returns than if they’ve stayed invested.

The pitfalls of trying to time the market

Timing the market’s ups and downs is not only nearly impossible, but attempting to do so can cause significant damage to long-term portfolio returns.

Note that if you’re thinking of doing this now with U.S. stocks you’ve already missed the market’s most recent peak by about seven weeks and by about 20%. The truth is that no one has a consistent track record of identifying peaks in real time and selling at the very top. We know from history that market peaks, by their nature, are moments when people feel quite optimistic about the economy and it’s not until after the market has turned that people feel glum.

Just as it is difficult to identify a peak in real time, it is difficult to identify the market’s low point. If an investor misses the trough, they may find they’ve waited too long to buy back in. The better strategy would have been staying invested.

Again, we know from history that the market’s low points are moments where people feel glum, and it’s not until the market has begun to recover that a sentiment begins to take root the market has calmed back down.

The best and worst days clump together

The peril of panic selling can be illustrated by the following chart.

Sources: Northern Trust Research, Bloomberg. S&P 500 daily return data

from 1/1/1928 through 3/3/2023. notherntrust.com (c) 2023 Northern Trust Corporation.

If you’re an experienced investor, you’ve certainly been advised against trying to time the market. But you may never have seen the historical data in this chart, which shows an important phenomenon: the worst days and the best days for the market often occur in close proximity to each other.

Enormous falls are often followed closely by strong rebounds. On Oct. 19, 1987, when the market crashed over 20% in a single day during Black Monday, it might have seemed sensible to get out of stocks that next day and wait for things to calm down. But just two days later, on Oct. 21, the market recovered 9.1%.

On March 16, during the early days of the COVID-19 pandemic, markets fell 12%. Yet just over a week later, on March 24, there was a 9% rebound. From that point onward, the market began to recover.

As a thought exercise, consider the situation during this period – there were serious questions about what would happen to the economy when society abruptly shuts down. The course of the pandemic was highly uncertain. By March 24, major economic or public health questions were still unresolved…yet the market was rebounding. An investor waiting for “things to calm down” would have been unlikely to realize that it was a good time to buy back in. It is only clear with hindsight.

Missing even a few of the best days significantly harms long-term returns

Consider the next chart:

Imagine $1,000 invested in the S&P 500 index in 1990. By the end of 2023, it would have grown to $27,221. But, an investor who missed the market’s best day, lost out on nearly $3,000 of gains for every $1,000 invested.

An investor who missed the five best single days, would only have $17,193 – losing out on over $10,000 of gains for every $1,000 invested. Missing out on the market’s best days is hugely detrimental to long-run performance.

Missing the 25 best days would have left an investor with just $5,779. When it comes to achieving long-term returns, one of the keys is remaining invested.

Is this time different?

We know from experience that when the market crashes, many investors wonder, “Is this time different? Yes, the market bounced back before, but will it do so now?”

We would submit that market downturns are generally moments where it feels like the world has forever changed, and in many cases – even with benefit of hindsight – these were major inflection points in many ways. To quote from our own recent note on market volatility, consider the events behind some of the sharp downturns in recent years:

Paul Volcker and 20% interest rates. The 1987 single-day 23% stock market crash driven by newfangled computers. A secretive hedge fund named Long-Term Capital Management exploding. The dot-com bubble and wondering how anyone could have paid so much for unprofitable startups. The global financial crisis. The Great Recession. The European debt crisis. The U.S. debt ceiling. The flash crash. The global pandemic. The point is not to be dismissive; some of these were genuinely terrifying moments.

Is this time different? In some ways, it likely is. For example, we must turn back nearly 100 years to find an episode where the U.S. raised tariffs in such a sweeping way. But on the other hand, considering the episodes above, each time is always different.

Here is another remarkable fact: Since 1980, markets have been in correction territory about 30% of the time.

Think about some of those periods, again with the benefit of hindsight – after the dot-com bubble burst or after the Global Financial Crisis – investing felt terrible to many. Yet looking at it now, these periods where the markets were slow to recover, were strong opportunities to remain invested or even to invest more.

Our takeaways

It’s not easy for investors to stay composed during market downturns, but the historical record is clear that these are some of the most important moments to stay invested.

Click here for past insights about the recent market volatility and other interesting topics. Not a Mercer Advisors client but interested in more information? Let’s talk.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Diversification does not ensure a profit or guarantee against loss. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Explore More

Portfolios Built for Moments Like This: Insights From Our CIO

A Reversal for the Magnificent Seven

Investing Opportunities in Chaotic Markets