The past several trading sessions have witnessed a significant sell-off in U.S. equities, especially U.S. large cap technology stocks. At the time of writing, the sell-off has accelerated into today’s session, prompting a number of talking heads to point fingers at the Fed for “failing” to cut interest rates at their July meeting last week. However, before we explore the relative merits (if any) of such claims, let’s first put the current market decline in some context.

- The Dow Jones closed down 1,034 points or -2.6% today (August 5). To put this in context: While the press has been quick to point out that this was the “15th largest point decline in Dow history,” it is actually the 432nd largest percentage decline in the Dow’s history.

- The S&P 500 finished the day down 3%. NASDAQ Composite was down 3.43%.

- Inside the market, we’ve seen the steepest sell-offs within megacap tech and growthier names; the sell-off is “less bad” in value names. For example, today the Russell 1000 Growth was down 3.52% versus 2.4% for the Russell 1000 Value. Big names like NVDA and TSLA were down 6.36% and 4.23%, respectively.

Putting 2024 Returns in Context

Through Friday’s close, the S&P 500 Index has returned 12.99% for the year — that’s even after Friday’s sell-off. Said differently, the market has delivered above-average gains thus far for 2024 with relatively minimal intra-year volatility.

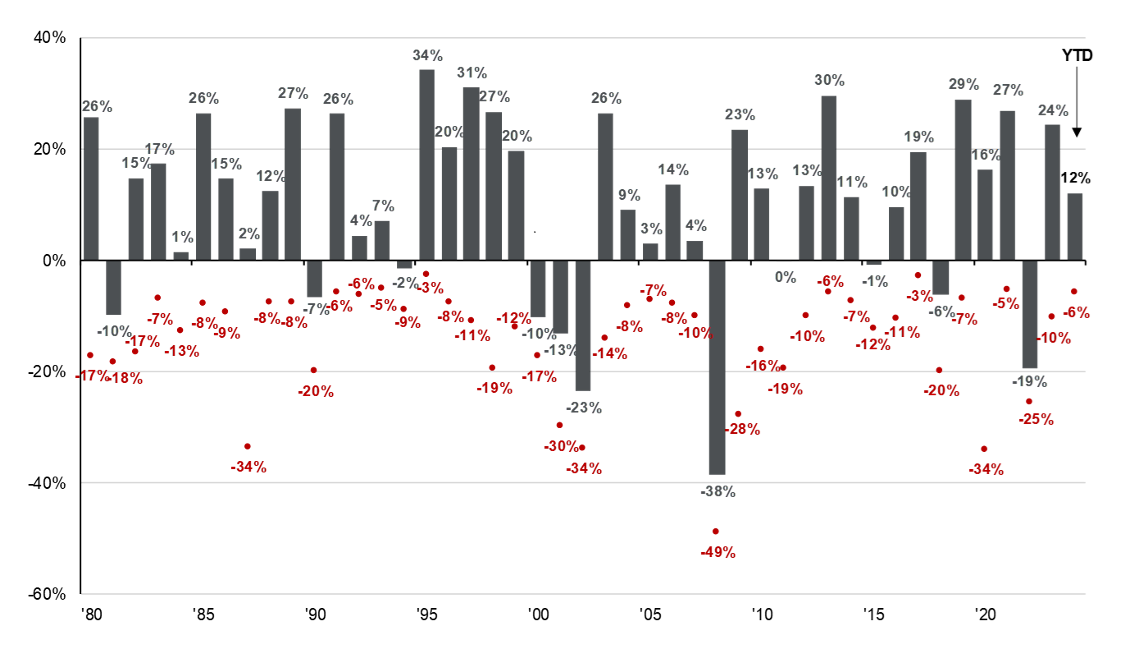

Exhibit A: S&P 500 Intra-year declines versus calendar year returns. Despite an average intra-year decline of 14.2% (since 1980), annual returns were positive in 33 out of 44 years. Source: JP Morgan Guide to the Markets, slide 16, August 5, 2024.

Returns are based on price index only and do not include dividends. Intra-year drops refers to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Returns shown are calendar year returns from 1980 to 2023, over which time period the average annual return was 10.3%.

What’s Driving the Current Sell-Off

A number of pundits claim the current sell-off is a result of the Fed’s decision last Wednesday to hold rates steady. However, if this were true, the market likely would’ve sold off significantly when news of their decision was first announced — yet it didn’t. In fact, the S&P 500 Index closed up 1.58% on the Fed’s increasingly dovish statements that suggest a September rate cut is likely. The Fed actually delivered the exact decision that markets were then expecting — to hold steady at the July meeting and hint heavily at a rate cut in September. The market got exactly what it was expecting.

A more likely explanation for current market volatility includes a combination of macroeconomic trends — a slowing U.S. economy (that still grew at a 2.8% annualized rate in Q2), declining inflation (but at 3%, still above the Fed’s 2% target), and a deteriorating jobs outlook (only 114,000 jobs added in June, though in an economy that still boasts low unemployment by historical standards). To be fair, all of these metrics are trending in directions that suggest the Fed will most certainly cut rates at some point in the very near future — but it’s far from clear that the Fed should’ve cut rates last week.

The “Magnificent 7”

The deteriorating economic backdrop comes at a time when U.S. equity markets have been propelled ever higher by a small handful of large capitalization technology stocks. Today, only seven technology stocks — dubbed the “Magnificent Seven” (Tesla, Nvidia, Alphabet, Meta (Facebook), Microsoft, Apple, and Amazon) — make up nearly one-third of the S&P 500 Index. Today the Magnificent Seven trade at high, frothy valuations — they collectively trade at more than 34 times next year’s earnings — and at a time when their collective earnings growth is declining and falling in-line with that of the broad market. Such high levels of concentration, combined with arguably deteriorating growth prospects, poses significant risk. This underscores how imperative it is for investors to diversify beyond the Magnificent Seven and the S&P 500 Index.

The Great Rotation Continues

As we discussed in a previous market communication and again on last week’s Quarterly Capital Markets call, since July 11 (when the BLS released the Consumer Price Index inflation numbers for June) markets have been undergoing a powerful rotation out of the Magnificent Seven and into less expensive value and small capitalization companies. That rotation has continued into the first trading days of August, with returns on value, small cap, and non-US stock indices continuing to outperform the Magnificent Seven, the tech-heavy NASDAQ, and S&P 500 index. Exposures to these asset classes has helped more diversified, multifactor portfolios since mid-July.

Exhibit B: Market Returns and Valuations by Index versus the Magnificent 7 (source: FactSet, Inc. as of August 5, 2024)

| Index |

Period Return

7/11 – 8/2

|

Forward PE |

| Russell 2000 Value |

5.16% |

13.5 |

| Russell 2000 |

2.84% |

23.5 |

| Russell 1000 Value |

1.63% |

15.78 |

| ACWI Ex-US |

-3.44% |

13.5 |

| S&P 500 Index |

-5.05% |

20.35 |

| NASDAQ Composite |

-10.02% |

26.19 |

| “Magnificent 7” (equally weighted) |

-13.88% |

34.34 |

| Apple |

-5.65% |

30.1 |

| Meta |

-8.71% |

21.3 |

| Microsoft |

-12.39% |

30.4 |

| Alphabet |

-12.63% |

20.2 |

| Amazon |

-16.00% |

31 |

| NVIDIA |

-20.49% |

33.4 |

| Tesla |

-21.11% |

74 |

For informational purposes only. Past performance is not a guarantee of future results. Indices are not available for direct investment.

Mercer Advisors’ Global Multifactor Equity Portfolio and the “Magnificent 7”

It’s during significant market sell-offs that we most often appreciate the value of a broadly diversified, risk-managed, global multifactor portfolio. As you can see from the nearby table, our multifactor model portfolio is underweight the Magnificent 7 relatively to the S&P 500 index and we have instead diversified across small cap, value, and non-us stocks. This is what we believe a diversified, risk-managed portfolio should look like — it should minimize the impact of any single company or individual asset class on your portfolio.

Exhibit C: Mercer Advisors’ Global Multifactor Portfolio is underweight the Magnificent 7 relative to the S&P 500 Index (Source: FactSet, Inc. Data as of August 5, 2024)

| Magnificent 7 |

S&P 500 |

Mercer Advisors Global Multifactor Portfolio |

| Microsoft |

7.02% |

2.73% |

| Apple |

6.70% |

2.23% |

| NVIDIA |

4.29% |

1.83% |

| Meta |

2.17% |

1.19% |

| Amazon |

3.56% |

1.08% |

| Alphabet |

3.97% |

1.05% |

| Tesla |

1.46% |

0.27% |

| Total Mag 7 Weight |

29.17% |

10.38% |

For informational purposes only, not intended as a solicitation or recommendation for any individual to implement any investment strategy or invest in any underlying holdings.

Takeaways for Investors

None of the above commentary is to suggest that market sell-offs aren’t worrisome and discomforting; they certainly can be, even for the most seasoned, time-tested investors. The purpose of the above commentary is to provide context and insight into current market events. With that said, we believe there are three important takeaways for investors from today’s current market volatility.

First, markets are complex. Rather than simplistically attributing any specific market decline to one singular event or data point (e.g., the Fed’s decision to leave rates unchanged), we should recognize financial markets for what they are: a means for global investors to digest massive quantities of new information in real time. Today’s market continues to incorporate new information related to the economy, markets, and individual companies in asset prices — everything from new information on GDP growth, job creation, inflation, interest rates, company valuations, expected earnings growth, and more.

Second, the best way to help protect our portfolios against the outsized impact of any particular company, set of companies, or singular asset class is through broad global diversification across many countries, asset classes, and companies. By definition, this means a diversified portfolio will need to underweight the biggest names in the S&P 500 Index. That hurts when those names perform well; it helps when they don’t.

Finally, and most importantly, we should all resist the urge to emotionally respond to dramatic headlines or short-term market events. Impulsiveness is an investor’s worst enemy. This can be quite hard; it’s precisely during these moments of market decline that we most feel the urge “to do something” when it’s — against our instincts — typically best to do nothing. To paraphrase Warren Buffett, it’s during such times when significant investor wealth is transferred from the impatient and to the patient. Sitting tight isn’t easy, but we know from decades of experience and academic research that having a trusted advisor, a well-crafted plan, and a diversified portfolio can all work wonders to help keep our emotions in check and our portfolio on track.

Your advisor can help determine how best to diversify your portfolio to suit your needs and goals in addition to answering your questions about the current market rotation and sell-off. Not a Mercer Advisors client but interested in more information? Let’s talk.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Diversification does not ensure a profit or guarantee against loss. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER® certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Home » Insights » Market Commentary » The Great Rotation Continues — Putting the Current Market Sell-Off in Context: Insights From Our CIO

The Great Rotation Continues — Putting the Current Market Sell-Off in Context: Insights From Our CIO

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

Learn more about our investment strategies during the current market downturn, which is occurring in the context of a great rotation out of tech stocks and into smaller-cap companies.

The past several trading sessions have witnessed a significant sell-off in U.S. equities, especially U.S. large cap technology stocks. At the time of writing, the sell-off has accelerated into today’s session, prompting a number of talking heads to point fingers at the Fed for “failing” to cut interest rates at their July meeting last week. However, before we explore the relative merits (if any) of such claims, let’s first put the current market decline in some context.

Putting 2024 Returns in Context

Through Friday’s close, the S&P 500 Index has returned 12.99% for the year — that’s even after Friday’s sell-off. Said differently, the market has delivered above-average gains thus far for 2024 with relatively minimal intra-year volatility.

Exhibit A: S&P 500 Intra-year declines versus calendar year returns. Despite an average intra-year decline of 14.2% (since 1980), annual returns were positive in 33 out of 44 years. Source: JP Morgan Guide to the Markets, slide 16, August 5, 2024.

Returns are based on price index only and do not include dividends. Intra-year drops refers to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Returns shown are calendar year returns from 1980 to 2023, over which time period the average annual return was 10.3%.

What’s Driving the Current Sell-Off

A number of pundits claim the current sell-off is a result of the Fed’s decision last Wednesday to hold rates steady. However, if this were true, the market likely would’ve sold off significantly when news of their decision was first announced — yet it didn’t. In fact, the S&P 500 Index closed up 1.58% on the Fed’s increasingly dovish statements that suggest a September rate cut is likely. The Fed actually delivered the exact decision that markets were then expecting — to hold steady at the July meeting and hint heavily at a rate cut in September. The market got exactly what it was expecting.

A more likely explanation for current market volatility includes a combination of macroeconomic trends — a slowing U.S. economy (that still grew at a 2.8% annualized rate in Q2), declining inflation (but at 3%, still above the Fed’s 2% target), and a deteriorating jobs outlook (only 114,000 jobs added in June, though in an economy that still boasts low unemployment by historical standards). To be fair, all of these metrics are trending in directions that suggest the Fed will most certainly cut rates at some point in the very near future — but it’s far from clear that the Fed should’ve cut rates last week.

The “Magnificent 7”

The deteriorating economic backdrop comes at a time when U.S. equity markets have been propelled ever higher by a small handful of large capitalization technology stocks. Today, only seven technology stocks — dubbed the “Magnificent Seven” (Tesla, Nvidia, Alphabet, Meta (Facebook), Microsoft, Apple, and Amazon) — make up nearly one-third of the S&P 500 Index. Today the Magnificent Seven trade at high, frothy valuations — they collectively trade at more than 34 times next year’s earnings — and at a time when their collective earnings growth is declining and falling in-line with that of the broad market. Such high levels of concentration, combined with arguably deteriorating growth prospects, poses significant risk. This underscores how imperative it is for investors to diversify beyond the Magnificent Seven and the S&P 500 Index.

The Great Rotation Continues

As we discussed in a previous market communication and again on last week’s Quarterly Capital Markets call, since July 11 (when the BLS released the Consumer Price Index inflation numbers for June) markets have been undergoing a powerful rotation out of the Magnificent Seven and into less expensive value and small capitalization companies. That rotation has continued into the first trading days of August, with returns on value, small cap, and non-US stock indices continuing to outperform the Magnificent Seven, the tech-heavy NASDAQ, and S&P 500 index. Exposures to these asset classes has helped more diversified, multifactor portfolios since mid-July.

Exhibit B: Market Returns and Valuations by Index versus the Magnificent 7 (source: FactSet, Inc. as of August 5, 2024)

7/11 – 8/2

For informational purposes only. Past performance is not a guarantee of future results. Indices are not available for direct investment.

Mercer Advisors’ Global Multifactor Equity Portfolio and the “Magnificent 7”

It’s during significant market sell-offs that we most often appreciate the value of a broadly diversified, risk-managed, global multifactor portfolio. As you can see from the nearby table, our multifactor model portfolio is underweight the Magnificent 7 relatively to the S&P 500 index and we have instead diversified across small cap, value, and non-us stocks. This is what we believe a diversified, risk-managed portfolio should look like — it should minimize the impact of any single company or individual asset class on your portfolio.

Exhibit C: Mercer Advisors’ Global Multifactor Portfolio is underweight the Magnificent 7 relative to the S&P 500 Index (Source: FactSet, Inc. Data as of August 5, 2024)

For informational purposes only, not intended as a solicitation or recommendation for any individual to implement any investment strategy or invest in any underlying holdings.

Takeaways for Investors

None of the above commentary is to suggest that market sell-offs aren’t worrisome and discomforting; they certainly can be, even for the most seasoned, time-tested investors. The purpose of the above commentary is to provide context and insight into current market events. With that said, we believe there are three important takeaways for investors from today’s current market volatility.

First, markets are complex. Rather than simplistically attributing any specific market decline to one singular event or data point (e.g., the Fed’s decision to leave rates unchanged), we should recognize financial markets for what they are: a means for global investors to digest massive quantities of new information in real time. Today’s market continues to incorporate new information related to the economy, markets, and individual companies in asset prices — everything from new information on GDP growth, job creation, inflation, interest rates, company valuations, expected earnings growth, and more.

Second, the best way to help protect our portfolios against the outsized impact of any particular company, set of companies, or singular asset class is through broad global diversification across many countries, asset classes, and companies. By definition, this means a diversified portfolio will need to underweight the biggest names in the S&P 500 Index. That hurts when those names perform well; it helps when they don’t.

Finally, and most importantly, we should all resist the urge to emotionally respond to dramatic headlines or short-term market events. Impulsiveness is an investor’s worst enemy. This can be quite hard; it’s precisely during these moments of market decline that we most feel the urge “to do something” when it’s — against our instincts — typically best to do nothing. To paraphrase Warren Buffett, it’s during such times when significant investor wealth is transferred from the impatient and to the patient. Sitting tight isn’t easy, but we know from decades of experience and academic research that having a trusted advisor, a well-crafted plan, and a diversified portfolio can all work wonders to help keep our emotions in check and our portfolio on track.

Your advisor can help determine how best to diversify your portfolio to suit your needs and goals in addition to answering your questions about the current market rotation and sell-off. Not a Mercer Advisors client but interested in more information? Let’s talk.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Diversification does not ensure a profit or guarantee against loss. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER® certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Explore More

CD Ladder vs. Treasury Ladder: Choosing a Smart Cash Strategy

Tax Planning for Creative Professionals: Simplifying Tax Complexities

Is Social Security Taxed in 2026? What Retirees Need To Know About New Rules