Over the past few weeks, the U.S. stock market has gone through an abrupt rotation out of the largest capitalization tech stocks and into small cap stocks. The financial media has dubbed this a “stock market rotation of historic proportions.”1

One way to size up this rotation: Since June, the stocks in the Russell 2000 Total Return Index have outperformed the stocks in the Russell 1,000 Total Return Index by around 600 basis points. This is a significant shift in such a short amount of time.

Why is this happening now?

There are likely a few factors behind the rotation happening now. First, early evidence is mounting that the Federal Reserve may be able to justify rate cuts later this year. The latest release of the Consumer-Price Index on July 11 came in lower than expected, and the latest jobs report, which came out July 5, showed the unemployment rate climbing up ever so slightly.

The Fed probably isn’t there yet. Inflation is still running a little hotter than the Fed prefers. The unemployment rate is still quite low. But the latest economic data is pointing in the direction that would eventually prompt the Fed to cut rates.

Expectations for lower interest rates disproportionately benefit the outlook for small cap companies. About one-third of the companies in the Russell 2000 have floating point debt, and around 40% of the companies are unprofitable.

This means that if interest expense comes down, some of these companies that are currently unprofitable should be able to lower their debt payments and return to profitability. This is a key part of what’s underpinning optimism about smaller cap companies that, until recently, had been laggards.

Next, for the Megacap tech stocks which had dominated the market for the past 18 months, earnings growth is expected to fall back in line. This septet of companies – dubbed the Magnificent Seven and consisting of Tesla, Nvidia, Alphabet, Meta (Facebook), Microsoft, Apple, and Amazon – had been outperforming the market.

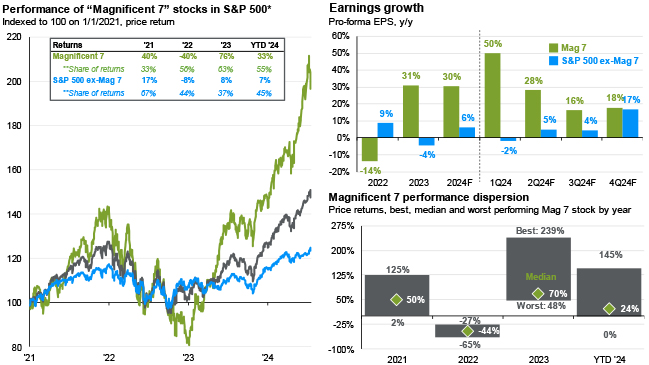

According to JPMorgan data, the Magnificent Seven have climbed 33% so far this year. The other 493 companies in the S&P 500 are up just 7%. Just those seven companies are responsible for 55% of the market’s returns since 2021. (Chart below, on left)

*Magnificent 7 includes AAPL, AMZN, GOOG, GOOGL, META, MSFT, NVDA and TSLA. Earnings estimates for 2024 are forecasts based on consensus analyst expectations. **Share of returns represent how much each group contributed to the overall return. Numbers are always positive despite negative performance in 2022. Guide to the Markets – U.S. Data are as of June 30, 2024.

These returns have not been unwarranted. In the first quarter, the Magnificent Seven had year-over-year pro-forma earnings per share growth of 50%, compared to -2% for the rest of the S&P 500.

What matters now is expected earnings growth going forward. Here the outlook provided by JPMorgan’s Guide to the Markets is relevant. By the fourth quarter, they expect the year-over-year measure of earnings per share growth to be 18% for the Magnificent Seven, and 17% for the rest of the market. (Chart above, top right)

All of this leads to a thesis that small caps might outperform large caps, especially those major tech stocks which had such high valuations. We’re seeing this happen in real time.

What should investors do, if anything, about all of this?

This July’s market rotation illustrates several important aspects of our philosophy in constructing broadly-diversified and regularly-rebalanced portfolios. When a portfolio is broadly diversified across companies, it means that if seven companies have large gains like the Magnificent Seven, then they were already in the portfolio. Such portfolios already owned the winners. The episode also underscores why rebalancing is so important. When we regularly rebalance our portfolios, it means selling those assets that were leaders, and taking those profits, and then rebalancing into assets that have been laggards but may be poised to rise. Such rebalancing is a check against human instinct. It might feel more intuitive to hold onto our recent winners and unload our recent losers, but the history of investing shows this to be folly.

Key takeaways

Maintain a long-term perspective. It’s easy to get caught up in major market movements and wish you’d perfectly anticipated it. Market leadership unpredictably rotates, and all asset classes eventually have their day. Trying to time or guess tomorrow’s winners is a fool’s errand.

Stay diversified. Portfolios should already include at least market-weight allocations to small cap and value stocks. A well-diversified portfolio, by definition, already includes allocations to small cap, mega cap tech, and much more.

Systematically rebalance. Not all asset classes move in unison, and that’s a good thing. It’s how we helps smooth out the bumps in markets over time. Rebalancing a portfolio, by definition, sells recent winners and buys recent losers. A diversified portfolio that’s systematically rebalanced within and across asset classes, over the past year, would have been selling mega cap tech (which had outperformed small cap stocks) and buying small cap stocks. That means it should be well positioned for a period in which small caps stocks outperform big tech.

Your advisor can help determine how best to diversify your portfolio to suit your needs and goals in addition to answering your questions about market rotation. Not a Mercer Advisors client but interested in more information? Let’s talk.

[1] Langley, Karen. “A Stock-Market Rotation of Historic Proportions Is Taking Shape,” The Wall Street Journal, July 22, 2024.

Home » Insights » Market Commentary » The Great Rotation: Insights From Our CIO

The Great Rotation: Insights From Our CIO

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

Learn more about the historic shift from tech stocks to small caps, driven by Fed rate expectations and economic data.

Over the past few weeks, the U.S. stock market has gone through an abrupt rotation out of the largest capitalization tech stocks and into small cap stocks. The financial media has dubbed this a “stock market rotation of historic proportions.”1

One way to size up this rotation: Since June, the stocks in the Russell 2000 Total Return Index have outperformed the stocks in the Russell 1,000 Total Return Index by around 600 basis points. This is a significant shift in such a short amount of time.

Why is this happening now?

There are likely a few factors behind the rotation happening now. First, early evidence is mounting that the Federal Reserve may be able to justify rate cuts later this year. The latest release of the Consumer-Price Index on July 11 came in lower than expected, and the latest jobs report, which came out July 5, showed the unemployment rate climbing up ever so slightly.

The Fed probably isn’t there yet. Inflation is still running a little hotter than the Fed prefers. The unemployment rate is still quite low. But the latest economic data is pointing in the direction that would eventually prompt the Fed to cut rates.

Expectations for lower interest rates disproportionately benefit the outlook for small cap companies. About one-third of the companies in the Russell 2000 have floating point debt, and around 40% of the companies are unprofitable.

This means that if interest expense comes down, some of these companies that are currently unprofitable should be able to lower their debt payments and return to profitability. This is a key part of what’s underpinning optimism about smaller cap companies that, until recently, had been laggards.

Next, for the Megacap tech stocks which had dominated the market for the past 18 months, earnings growth is expected to fall back in line. This septet of companies – dubbed the Magnificent Seven and consisting of Tesla, Nvidia, Alphabet, Meta (Facebook), Microsoft, Apple, and Amazon – had been outperforming the market.

According to JPMorgan data, the Magnificent Seven have climbed 33% so far this year. The other 493 companies in the S&P 500 are up just 7%. Just those seven companies are responsible for 55% of the market’s returns since 2021. (Chart below, on left)

*Magnificent 7 includes AAPL, AMZN, GOOG, GOOGL, META, MSFT, NVDA and TSLA. Earnings estimates for 2024 are forecasts based on consensus analyst expectations. **Share of returns represent how much each group contributed to the overall return. Numbers are always positive despite negative performance in 2022. Guide to the Markets – U.S. Data are as of June 30, 2024.

These returns have not been unwarranted. In the first quarter, the Magnificent Seven had year-over-year pro-forma earnings per share growth of 50%, compared to -2% for the rest of the S&P 500.

What matters now is expected earnings growth going forward. Here the outlook provided by JPMorgan’s Guide to the Markets is relevant. By the fourth quarter, they expect the year-over-year measure of earnings per share growth to be 18% for the Magnificent Seven, and 17% for the rest of the market. (Chart above, top right)

All of this leads to a thesis that small caps might outperform large caps, especially those major tech stocks which had such high valuations. We’re seeing this happen in real time.

What should investors do, if anything, about all of this?

This July’s market rotation illustrates several important aspects of our philosophy in constructing broadly-diversified and regularly-rebalanced portfolios. When a portfolio is broadly diversified across companies, it means that if seven companies have large gains like the Magnificent Seven, then they were already in the portfolio. Such portfolios already owned the winners. The episode also underscores why rebalancing is so important. When we regularly rebalance our portfolios, it means selling those assets that were leaders, and taking those profits, and then rebalancing into assets that have been laggards but may be poised to rise. Such rebalancing is a check against human instinct. It might feel more intuitive to hold onto our recent winners and unload our recent losers, but the history of investing shows this to be folly.

Key takeaways

Maintain a long-term perspective. It’s easy to get caught up in major market movements and wish you’d perfectly anticipated it. Market leadership unpredictably rotates, and all asset classes eventually have their day. Trying to time or guess tomorrow’s winners is a fool’s errand.

Stay diversified. Portfolios should already include at least market-weight allocations to small cap and value stocks. A well-diversified portfolio, by definition, already includes allocations to small cap, mega cap tech, and much more.

Systematically rebalance. Not all asset classes move in unison, and that’s a good thing. It’s how we helps smooth out the bumps in markets over time. Rebalancing a portfolio, by definition, sells recent winners and buys recent losers. A diversified portfolio that’s systematically rebalanced within and across asset classes, over the past year, would have been selling mega cap tech (which had outperformed small cap stocks) and buying small cap stocks. That means it should be well positioned for a period in which small caps stocks outperform big tech.

Your advisor can help determine how best to diversify your portfolio to suit your needs and goals in addition to answering your questions about market rotation. Not a Mercer Advisors client but interested in more information? Let’s talk.

[1] Langley, Karen. “A Stock-Market Rotation of Historic Proportions Is Taking Shape,” The Wall Street Journal, July 22, 2024.

Explore More

Insurance Check In: Tips for Reviewing Existing Coverage

Estate Planning: Protecting Tangible Assets and Collectibles

Before April 15: Learn Unmarried-Couple HSA Contribution Advantage

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Portfolio management strategies such as diversification, asset allocation, and rebalancing do not ensure a profit or guarantee against loss. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER® certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.