Will there be enough investors in future years to purchase assets (specifically stocks) from retiring baby boomers given recent demographic trends and changing age populations in the United States and abroad? That’s a question on the mind of many investors (and the subject of our recent podcast episode). The concern is understandable given recent news on declining U.S. population growth and negative growth in China’s population.

The question behind the question seems to have more to do with how to manage economic growth and the related challenges due to an aging global society, but in this article, the specific focus is on whether the number of investors will be sufficient to purchase financial assets from retirees.

Slowing U.S. population growth

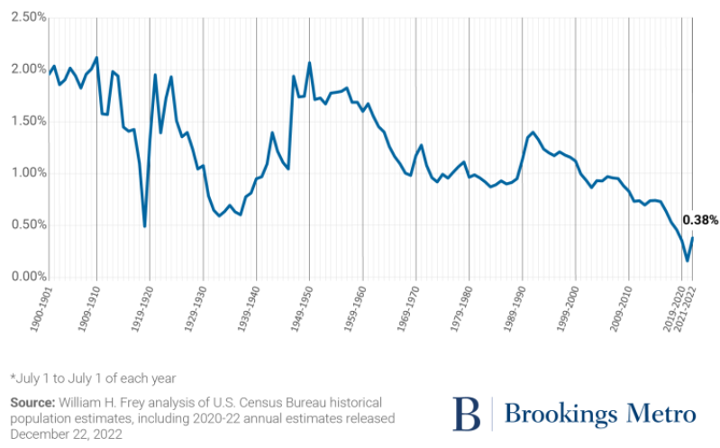

After experiencing explosive population growth during most of the 20th century, global population growth has slowed dramatically in recent years to around 1.1% annually. Within the United States, population growth hit a low of only 0.16% during the first year of the COVID-19 pandemic, increasingly slightly to 0.38% between July 2021 and July 2022. Further, China—which was until recently the world’s most populous country—experienced negative population growth of -0.6% in 2022.

The reasons why couples are choosing to have fewer children are many and complex—and likely include everything from increases in wealth (wealthier societies have fewer children) and declining male fertility (a global phenomenon linked to environmental pollution) to concerns around climate change, student debt, and job security. Nevertheless, it’s this recent decline in population growth that has led some to question whether there will be enough investors to buy financial assets from retiring baby boomers.

Exhibit A: U.S. annual population growth, 1900 – 2021

Will there be enough investors to buy stocks from retiring baby boomers?

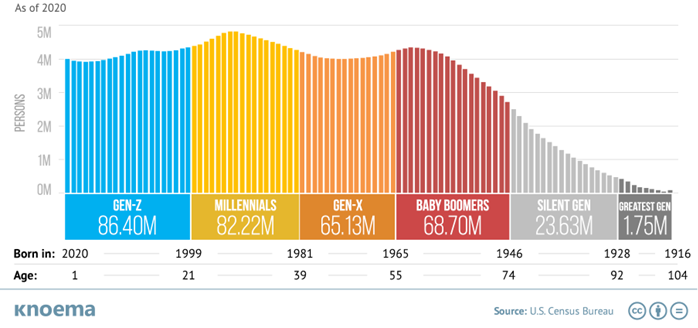

There is a misconception that baby boomers collectively are the largest U.S. generation. While this may have been true at one time, this is no longer correct. Today, the largest U.S. generation is that of Generation Z, those born between 2000 – 2020, followed by millennials (see below chart). Gen Z, millennials, and Generation X collectively make up nearly 234 million Americans—versus 68.7 million baby boomers. Said differently, there are 3.4 times as many Gen Zers, Millennials, and Gen Xers than there are baby boomers.

To be fair, members of Gen Z aren’t yet accumulating financial assets (the oldest members of Gen Z are only now 23 years of age and beginning to join the workforce). However, it’s also true that baby boomers (and indeed all retirees) are not selling all their financial assets at once. Indeed, we expect retirees to slowly sell down their financial assets over the course of what are expected to be long retirements (often lasting 20 years or more). Members of Gen Z represent future demand for financial assets, whereas millennials (the oldest of which are now in their 40s) and Gen Xers (the oldest of which are in their 50s) are both deep into accumulation mode and represent current demand.

Boomers naturally aren’t the only retirees in the United States living off their assets. The silent generation (1928 – 1945), the greatest generation (1900 – 1925), and baby boomers collectively make up 94 million Americans. If we were to think only of millennials and Gen Xers as buyers of financial assets, this would mean there are theoretically 1.79 buyers to every one seller of financial assets. And even at this ratio, U.S. stock markets have managed to hit or remain near all-time highs.

Exhibit B: Total U.S. population by age and generation

Financial markets are global markets

Baby boomers aren’t the only, or even the biggest, U.S. generation; and Americans aren’t the only, or even the majority, of investors of global assets. Markets for U.S. stocks, bonds, real estate, and even private equity and credit are global.

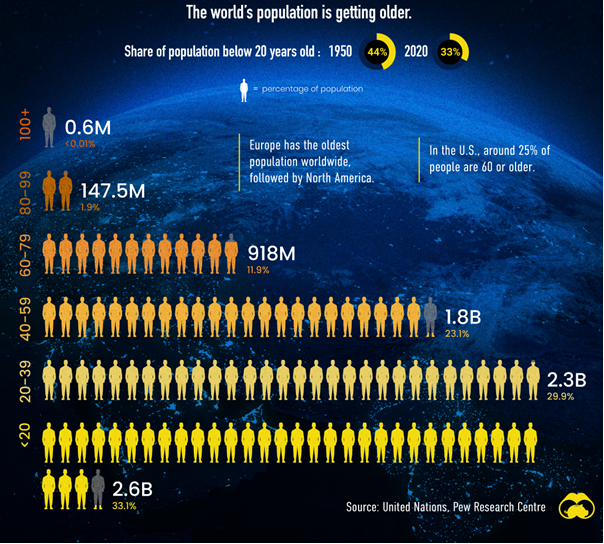

More than 8 billion humans inhabit Earth. Of them, 4.1 billion are between the ages of 20 and 59. Many are already consumers of financial services and accumulating financial assets. Many of these consumers are already participates in global financial markets and, naturally, are investors in U.S. financial assets. Said differently, this means that, theoretically, the global ratio of working age accumulators (buyers of financial assets) to retirement age decumulators (sellers of financial assets) is about 4.1 to 1.

What about future demand for financial assets? A staggering 33% of the world’s population is under the age of 20, meaning there are 2.64 billion potential new future investors in global assets (including U.S. stocks) that will come of age over the next 10 to 20 years and join the world’s financial system. As the developing world continues to join the global economy, more of these investors will become consumers of financial services and, ultimately, become buyers of global assets. We’ve seen this pattern repeat itself time and again over the past century and there’s no reason to expect it to be any different in the years ahead.

Exhibit C: The world’s population by age group

Takeaway for investors

The takeaway for all of us as investors is that, while U.S. population growth has slowed in recent years, there are clearly still billions of participants in global financial markets—both current and future participants—willing and able to invest in global assets, including U.S. stocks. Rather than fixate on any single U.S. generation or even the United States as a whole, we should instead widen our field of vision and take a global perspective on population dynamics and financial markets. When we do so, it becomes apparent that, by any objective measure, there are clearly still many, many investors available, both today and into the foreseeable future, to purchase financial assets from retiring baby boomers.

Home » Insights » Market Commentary » Will There Be Enough Investors to Buy Stocks from Retiring Baby Boomers?

Will There Be Enough Investors to Buy Stocks from Retiring Baby Boomers?

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

Why concerns about having enough investors for retiring baby boomer assets amid slowing global population growth may be overblown.

Will there be enough investors in future years to purchase assets (specifically stocks) from retiring baby boomers given recent demographic trends and changing age populations in the United States and abroad? That’s a question on the mind of many investors (and the subject of our recent podcast episode). The concern is understandable given recent news on declining U.S. population growth and negative growth in China’s population.

The question behind the question seems to have more to do with how to manage economic growth and the related challenges due to an aging global society, but in this article, the specific focus is on whether the number of investors will be sufficient to purchase financial assets from retirees.

Slowing U.S. population growth

After experiencing explosive population growth during most of the 20th century, global population growth has slowed dramatically in recent years to around 1.1% annually. Within the United States, population growth hit a low of only 0.16% during the first year of the COVID-19 pandemic, increasingly slightly to 0.38% between July 2021 and July 2022. Further, China—which was until recently the world’s most populous country—experienced negative population growth of -0.6% in 2022.

The reasons why couples are choosing to have fewer children are many and complex—and likely include everything from increases in wealth (wealthier societies have fewer children) and declining male fertility (a global phenomenon linked to environmental pollution) to concerns around climate change, student debt, and job security. Nevertheless, it’s this recent decline in population growth that has led some to question whether there will be enough investors to buy financial assets from retiring baby boomers.

Exhibit A: U.S. annual population growth, 1900 – 2021

Will there be enough investors to buy stocks from retiring baby boomers?

There is a misconception that baby boomers collectively are the largest U.S. generation. While this may have been true at one time, this is no longer correct. Today, the largest U.S. generation is that of Generation Z, those born between 2000 – 2020, followed by millennials (see below chart). Gen Z, millennials, and Generation X collectively make up nearly 234 million Americans—versus 68.7 million baby boomers. Said differently, there are 3.4 times as many Gen Zers, Millennials, and Gen Xers than there are baby boomers.

To be fair, members of Gen Z aren’t yet accumulating financial assets (the oldest members of Gen Z are only now 23 years of age and beginning to join the workforce). However, it’s also true that baby boomers (and indeed all retirees) are not selling all their financial assets at once. Indeed, we expect retirees to slowly sell down their financial assets over the course of what are expected to be long retirements (often lasting 20 years or more). Members of Gen Z represent future demand for financial assets, whereas millennials (the oldest of which are now in their 40s) and Gen Xers (the oldest of which are in their 50s) are both deep into accumulation mode and represent current demand.

Boomers naturally aren’t the only retirees in the United States living off their assets. The silent generation (1928 – 1945), the greatest generation (1900 – 1925), and baby boomers collectively make up 94 million Americans. If we were to think only of millennials and Gen Xers as buyers of financial assets, this would mean there are theoretically 1.79 buyers to every one seller of financial assets. And even at this ratio, U.S. stock markets have managed to hit or remain near all-time highs.

Exhibit B: Total U.S. population by age and generation

Financial markets are global markets

Baby boomers aren’t the only, or even the biggest, U.S. generation; and Americans aren’t the only, or even the majority, of investors of global assets. Markets for U.S. stocks, bonds, real estate, and even private equity and credit are global.

More than 8 billion humans inhabit Earth. Of them, 4.1 billion are between the ages of 20 and 59. Many are already consumers of financial services and accumulating financial assets. Many of these consumers are already participates in global financial markets and, naturally, are investors in U.S. financial assets. Said differently, this means that, theoretically, the global ratio of working age accumulators (buyers of financial assets) to retirement age decumulators (sellers of financial assets) is about 4.1 to 1.

What about future demand for financial assets? A staggering 33% of the world’s population is under the age of 20, meaning there are 2.64 billion potential new future investors in global assets (including U.S. stocks) that will come of age over the next 10 to 20 years and join the world’s financial system. As the developing world continues to join the global economy, more of these investors will become consumers of financial services and, ultimately, become buyers of global assets. We’ve seen this pattern repeat itself time and again over the past century and there’s no reason to expect it to be any different in the years ahead.

Exhibit C: The world’s population by age group

Takeaway for investors

The takeaway for all of us as investors is that, while U.S. population growth has slowed in recent years, there are clearly still billions of participants in global financial markets—both current and future participants—willing and able to invest in global assets, including U.S. stocks. Rather than fixate on any single U.S. generation or even the United States as a whole, we should instead widen our field of vision and take a global perspective on population dynamics and financial markets. When we do so, it becomes apparent that, by any objective measure, there are clearly still many, many investors available, both today and into the foreseeable future, to purchase financial assets from retiring baby boomers.

Explore More

Was There an AI Bubble?

Questions to Ask When Choosing a Financial Advisor

RSUs 101: A Tech Professional’s Guide to Equity, Tax Strategy, and Financial Planning

Mercer Advisors Inc. is the parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER® certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.