The folly of forecasts

Twelve months ago, the U.S. economy seemingly faced an uphill battle. Inflationary pressures that began building in early 2021 had proved to be more than transitory. The Federal Reserve responded throughout 2022 by increasing short-term interest rates by a cumulative 425 basis points, an unprecedented pace of monetary policy tightening. Over the second half of 2022, annual growth in the consumer-price index (CPI) slowed but remained higher than the Fed’s 2% target. As 2022 ended, policymakers communicated a commitment to tighten policy further in 2023 to bring inflation under control, even if doing so meant pushing the U.S. economy into recession.

It should perhaps then come as no surprise that the consensus of most economists in late 2022 and early 2023 was that a relatively short and shallow recession (or two consecutive quarters of negative GDP growth) was likely to occur sometime later in 2023. Further, most argued that the economy would likely expand by no more than 0.3% for the full year.

Financial markets told a similar story. The Treasury yield curve remained steeply inverted (a situation where short-term rates are higher than long-term rates), both stocks and bonds had declined significantly from their 2021 highs, and mortgage interest rates had more than doubled from a year earlier. By any objective measure, the economy wasn’t poised to deliver blockbuster GDP growth in 2023.

Equity market forecasts for 2023 were similarly pessimistic. In a Bloomberg survey of 22 Wall Street strategists taken in late December 2022, the average forecast for the 2023 year-end value of the S&P 500 Index was 4,078, implying just a 6.2% rebound in the large cap index in 2023. Such a modest forecast perhaps seemed reasonable at the time, coming as it did on the heels of a 19.4% decline in 2022.

However, in the latest example of the fallibility of economic and market forecasts, none of the aforementioned came to pass. The economy significantly outperformed the dire outlook of a year ago. The economy grew by an annualized 2.2% and 2.1% in the first and second quarters, respectively, before expanding by an estimated 5.2% in the third. Current estimates, which will be finalized in late January, are that the economy grew by about 2.7% in 2023, well north of economists’ 2023 forecasts of only 0.3% GDP growth. If a recession was supposed to happen in 2023, the economy certainly didn’t get the memo.

As we shared in last year’s outlook, equity market returns tend to be much stronger in years following sharp declines. For instance, since 1926, S&P 500 returns have averaged 22.2% in years that follow annual declines of 20% or more. In this context, the mid-single digit gains expected by Wall Street strategists for 2023 were too conservative and out of step with market history.

The economy and markets overcome 2023’s Wall of Worries

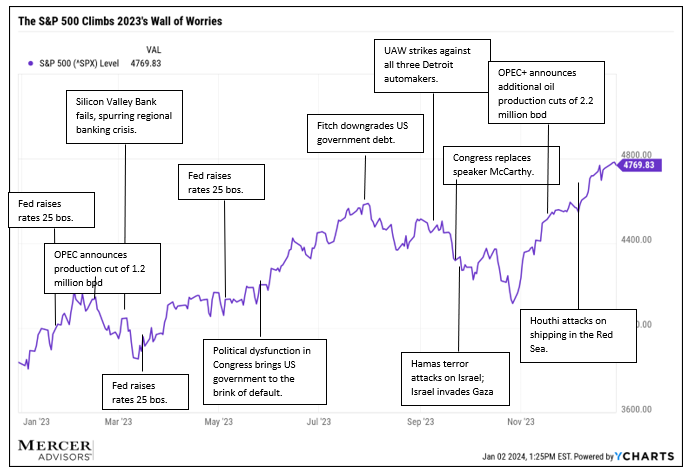

Despite strong GDP growth and robust equity market returns, 2023 was not without challenges. The ongoing war in Ukraine, the war in Gaza, political dysfunction in Washington, simmering geopolitical tensions between China and the United States, the downgrade by Fitch and Moody’s of U.S. government debt, the UAW strike against the Big Three automakers, and the Fed’s aggressive rate-hiking policy—to name but only a few—all threatened to seriously upend the economy and markets at various times over the year.

Exhibit A:

S&P 500 Climbs 2023’s Wall of Worries

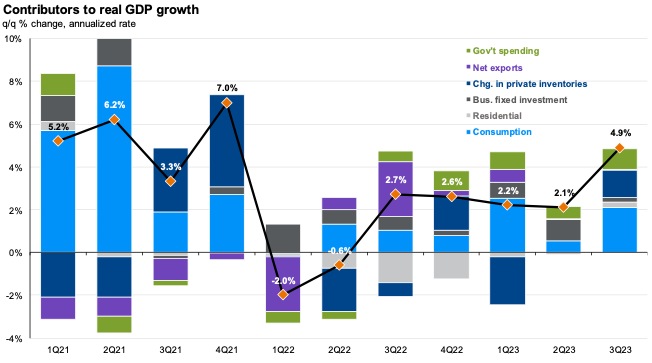

Yet, through it all, the U.S. economy and global financial markets—contrary to 2023 forecasts—were able to overcome these headwinds. The economy’s outperformance was due in no small part to the strength of the U.S. consumer (Exhibit B). Undeterred by high prices and the looming threat of recession, consumers continued to increase inflation-adjusted spending at a robust pace. This was particularly true of spending on services such as dining at restaurants and travel-related spending such as airfare and lodging.

Spending on goods, especially durable goods, wasn’t as strong. We suspect this was partially because of the high interest rate environment, which negatively impacted affordability, but also because a lot of durable goods spending was pulled forward during pandemic lockdowns when spending on services was not an option for many consumers. Whether U.S. consumers can sustain such breakneck spending in the year ahead remains to be seen.

Exhibit B:

Strong GDP growth in 2023 was propelled by strong inflation-adjusted consumer spending.

(Source: JPM Guide to the Markets, Q1 2024, Slide 16.)

Global equities roar

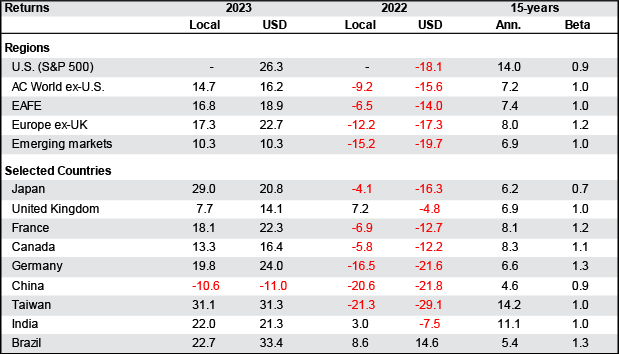

Despite such lackluster equity market forecasts, returns in broad equity markets were much stronger than expected in 2023 (Exhibit C). The S&P 500 delivered a total return of 26.3% for the year and approached an all-time high. Small cap stocks underperformed large caps for the year, but still delivered strong gains to investors with the Russell 2000 delivering a total return of 17.3% (nearly all of which came about in the final two months of 2023).

Gains in non-U.S. developed and emerging market stocks were also strong for the year, with the MSCI EAFE and MSCI Emerging Markets indices returning 18.9% and 10.3%, respectively.

Gains for U.S. stocks were led by the so called “Magnificent 7”—Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla—which are currently the seven largest members of the S&P 500 index by market capitalization. Most of these companies benefited from excitement surrounding generative AI technology that captured investors’ attention during the year. An equal-weighted index composed of just the Magnificent 7 delivered a total return of 107% in 2023, while the equal-weighted S&P 500 index saw a total return of just 13.8%.1

Exhibit C:

Global Equity Returns, 2023.

Source: JP Morgan, Guide to the Markets, Q1 2024, Slide 42

Despite rising rates, fixed income delivers respectable returns

Importantly, avoiding a recession in 2023 didn’t require the Federal Reserve to abandon its fight against high inflation. Fed policymakers increased interest rates by an additional 100 basis points to 5.5% over the first seven months of the year before holding rates steady through year end. Annual CPI growth decelerated to 3.1% in November from 6.4% at the end of 2022. As we enter 2024, the odds of a so-called “soft landing”, where an economic expansion is preserved while inflation falls back to the Fed’s 2% target, are significantly better than a year ago.

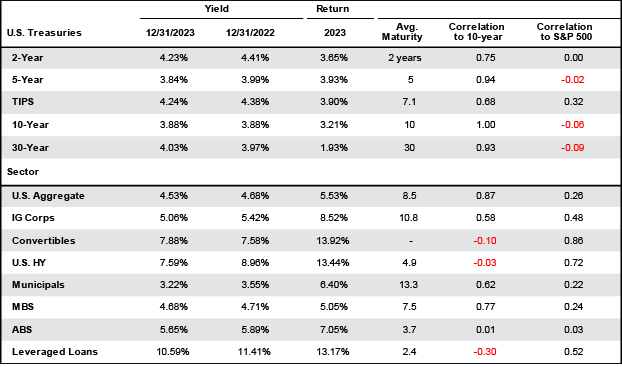

The Fed’s rate hikes pushed short-term rates higher at a fairly consistent pace. On the other hand, long-term rates saw significant volatility over the past twelve months. After beginning the year at 3.88%, the ten-year Treasury yield fell to 3.25% amid the regional banking crisis in March and April, then leapt to 5% for the first time since 2007 after the third quarter’s strong GDP report, only to decline and finish the year where it began—at 3.88% (Exhibit D). In the end, the ten-year yield remained near where it began the year and the yield curve was even more steeply inverted.

Despite rising rates, bonds reversed course from 2022 and delivered respectable returns in 2023. Two-year and 5-year Treasuries returned 3.65% and 3.93%, respectively. The Bloomberg U.S. Aggregate Bond Index, the broadest index of U.S. bonds, returned a healthy 5.53% for the year. High-yield bonds outperformed and benefitted from better-than-expected economic growth, returning 13.4% in 2023. Treasury inflation-protected securities (TIPS) underperformed, returning 3.9% (a modestly disappointing return given an average maturity of seven years), as falling inflation and stable nominal yields meant real interest rates moved sharply higher.

Exhibit D:

Fixed Income Asset Class 2023 Returns and Year-End 2023 Yields.

Source: JP Morgan, Guide to the Markets, Q1 2024, Slide 33

Cash wasn’t king in 2023

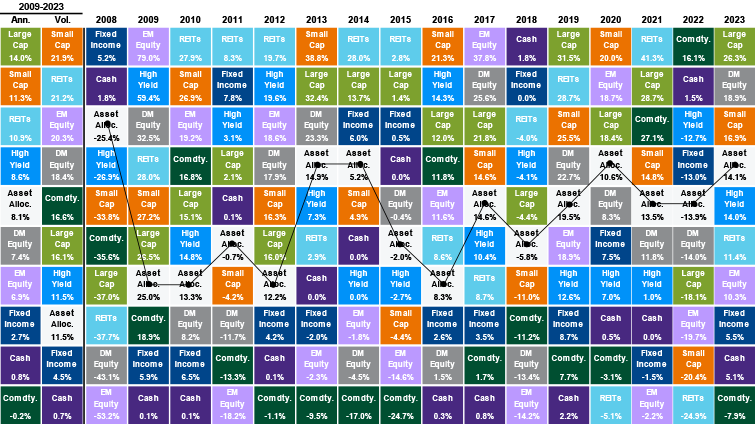

In our 2023 outlook, we advised clients to resist making portfolio changes in response to recession and inflation forecasts and to instead remain well-diversified in the year ahead. Coming on the heels of 2022’s steep market declines and sharp rise in interest rates, many investors instead elected to retreat from markets and spent 2023 sitting in cash. “Cash is king” was many investors’ new call to arms. However, if cash is king, it isn’t a very good one—it underperformed nearly every major asset class in 2023. Only commodities, a favorite of inflation hawks during periods of high inflation, performed worse. As Exhibit E shows, an illustrative diversified asset allocation portfolio outperformed cash by a full 9% in 2023 (14.1% versus 5.1%).

Exhibit E:

Public Market Asset Class Returns, 2009 to 2023.

Source: JP Morgan, Guide to the Markets, Q1 2024, Slide 60.

It’s certainly refreshing to see higher yields on cash money markets. No one is objecting to earning 5% on our recommended money market funds. However, money markets are short-term investments. Their short-duration—for example, Schwab’s Value Advantage Money Fund has a weighted average maturity of just 36 days—make them generally unsuitable as a long-term investment. When rates come down (which the Fed telegraphed at its December 2023 meeting), yields on money market funds will be quick to follow suit. In contrast, longer duration investments (e.g., 5-year bonds) rise in value as rates decline, providing investors a nice cushion to help offset lower yields. Money market funds, due to their short duration, experience no such appreciation when rates decline.

Private equity – a new focus on healthy, profitable growth

Venture capital and private equity fundraising, capital deployment, and exits slowed significantly in 2023. Crunchbase reports that transaction volumes nearly halved, fundraising activity was down, distributions slowed, and returns for investments made over the last few years are falling on the back of declining private market valuations.

The private investment industry is returning to basics. The “growth at any price” approach exhibited during 2020 to 2022 has been replaced by one focused on profitable growth, with value creation plans grounded in fundamentals. Venture capitalists are focusing on shepherding their portfolio companies that are finding good product market fit to be cash flow positive. Private equity managers are focused on helping companies execute operational improvements rather than rely on cheap debt that was available in 2020 to 2022 to generate attractive returns. Valuations across the private asset classes are coming back down toward long-term averages.

Artificial intelligence (AI) is not new, but the recent breakthroughs in generative AI are sparking interest in a slate of private companies. The AI hype may be overblown, but it may also drive long-term improvements in productivity and profitability across private markets. Many venture investors concede that deep-pocketed public incumbents (like Microsoft) largely control the foundational layer of generative AI. That said, many venture stage and private equity backed companies will likely integrate AI tools to boost productivity and accelerate their businesses. The indirect benefits for private companies in many sectors may prove significant.

Many Wall Street firms predict that the strong performance of the public markets in the fourth quarter of 2023 will spark a flood of initial public offerings. September of 2023 marked the first time in 18 months that venture-backed technology companies braved the public markets.

Two former top venture-backed companies, Instacart and Klaviyo, experienced contrasting fortunes upon entering the public market. Instacart stumbled at its public debut, shedding 75% of its last private value. Klaviyo, on the other hand, navigated the transition more smoothly, listing at a valuation close to its previous private round. This disparity highlights the potential for volatility and uncertain outcomes in the IPO landscape. Private fund managers and Wall Street underwriters are focused on bringing resilient, profitable companies public.

Exhibit F:

Private Market Returns (IRRs), 2023, Q3 2023, and 1-Year Returns, as of September 30, 2023.

| Private Markets |

Q3 2023 |

2023 YTD |

1-Year |

| Venture Capital |

-1.08% |

-3.43% |

-8.27% |

| Private Equity (Buyout) |

2.71% |

8.79% |

13.30% |

| Private Debt |

2.29% |

7.85% |

11.14% |

| Private Real Estate |

-0.82% |

-1.00% |

0.48% |

Source: Preqin

Private real estate

Private real estate performance varied wildly across geographies and property types. While job and real income growth supported a mild recovery in many apartment, industrial, and retail markets, office investments continue to struggle. Leasing activity for office space picked up throughout the year but remains well below pre-pandemic levels nationally. Not surprisingly, the technology sector continues to lag others in office utilization. Many banks are working with private office owners to restructure debt due to the higher vacancies.

Slowing economic growth and elongated occupier decision-making are likely to keep aggregate office leasing activity subdued through early 2024. Upcoming lease expirations and lower renewal rates will support growing demand for high-quality space as the year progresses. Overall vacancy rates are expected to tick higher through the year as new supply is added and tenants upgrade, while availability in new, well-located space will remain tighter. Many private funds are already acquiring office properties in distressed sales at prices below replacement costs, a sign that assets are finally being repriced in light of economic conditions and higher interest rates.

Private credit

Historically, private credit performs well when other sources of debt and equity financing ebb. Recession fears in 2023 prompted traditional bank lending and public high-yield debt issuance to slow dramatically. Banks are particularly focused on reserving for potential loan losses in real estate portfolios.

The pullback in bank lending, collateralized loan obligation (CLO) formation, high-yield bond and leveraged loan issuance, and IPOs created a situation in which private debt was in extremely high demand. Firms are increasingly turning to the private debt markets as a viable path for funding. Pitchbook reported that $12 billion of public debt was refinanced in the private debt market in the first nine months of 2023.

The performance of private credit will be greatly affected by credit losses. Blackstone reports that credit losses remain below long-term averages. They note that private debt loss rates have compared favorably with public markets. In the second quarter of 2023, trailing 12-month loss rates for leveraged loans and high yield were 1.68% and 1.62%, respectively, versus 0.69% for direct lending, according to the Cliffwater Direct Lending Index.

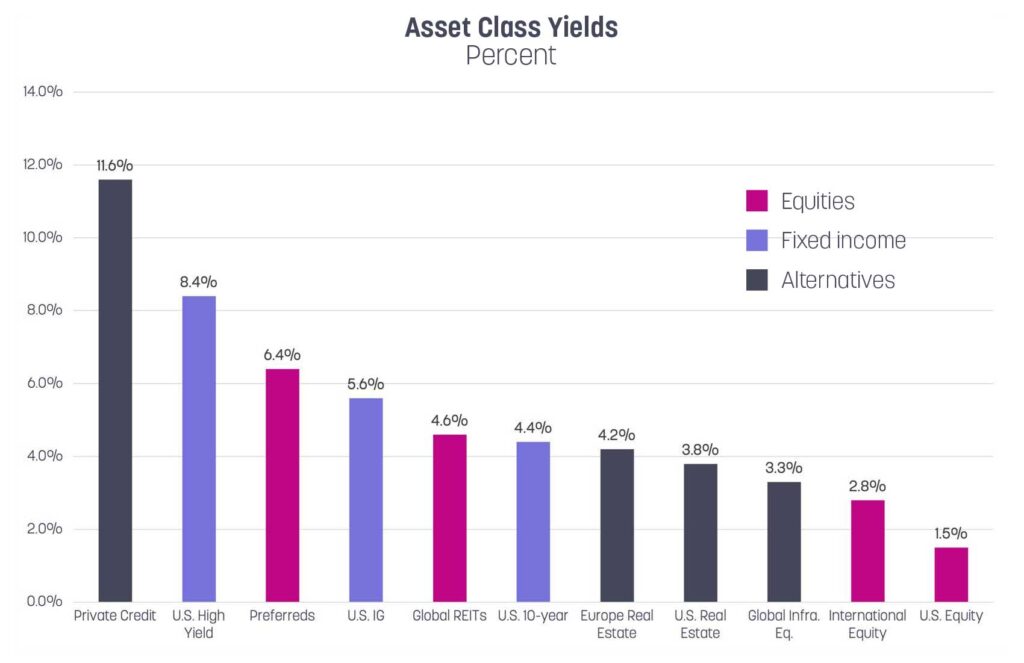

Exhibit G:

Asset Class Yields. Private Credit continues to offer attractive yields.

Source: JP Morgan Guide to Alternatives, November 2023, Slide 8.

2024 economic and market outlook

As we enter 2024, last year’s advice to keep economic and market forecasts in context remains as true and as relevant as ever. While such forecasts can be interesting and insightful, they shouldn’t lead one to change strategic asset allocation. Investors are advised to always remain well diversified in a risk-appropriate portfolio that’s aligned with their family’s need, capacity, and tolerance for investment risk. Always consult your advisor when exploring whether it’s in your best interest to make any portfolio changes.

Our base case for the economy in the year ahead is for continued progress towards a soft landing in the U.S. We expect the U.S. economic expansion to continue in 2024 as inflation trends lower. We expect solid, albeit gradually weakening, consumer spending to continue to drive U.S. economic growth. While a recession is unlikely, we think slower economic growth is very likely. Though the Fed has held the federal-funds rate at the current level since July, monetary policy is transmitted through the economy with a significant lag. It’s therefore likely that the full impact of past rate increases has yet to be realized broadly across the economy. The consensus forecast of economists is for 1.2% growth in GDP and for inflation to continue its downward trend.

Interest Rates in the Year Ahead

If the inflationary environment develops as expected, the Federal Reserve will have enough evidence of the sustained downward trend in inflation to cut interest rates some time in 2024. In the most recent set of Fed economic projections, the median forecast was for 80 basis points of cuts in 2024. However, markets expect the Fed will be significantly more aggressive in cutting rates. Pricing in the fed-funds futures market implies nearly 150 basis points of easing in 2024, with an initial rate cut expected in March.

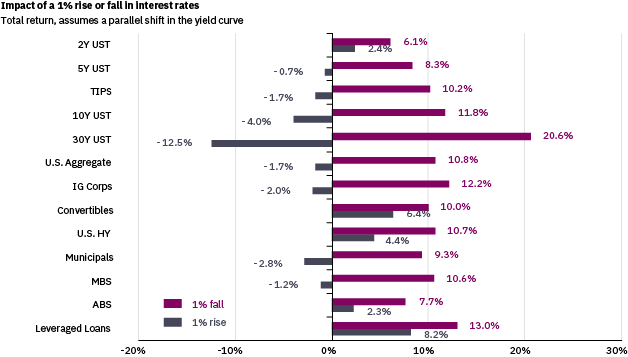

Falling inflation and monetary policy easing are expected to push rates lower across the yield curve. The median forecast for the ten-year Treasury yield in a recent Bloomberg survey forecasts a steady decline through year end. Similarly, the 2-year yield is expected to fall from 4.4% today to 3.9% at the end of the year. As mentioned earlier, falling rates should benefit longer-duration fixed income asset classes (Exhibit H).

Exhibit H:

Longer duration fixed income assets are more sensitive to changes in interest rates. For example, a 1% decline in interest rates would lead to an 8.3% increase in bond prices for 5-Year U.S. Treasury bonds.

Source: JP Morgan Guide to the Markets, Q1 2024, Slide 33.

Equity valuations and the U.S. dollar

The outlook for monetary policy in major developed economies suggests the U.S. dollar (USD) may begin to weaken after a period of strong appreciation since the pandemic began. This could make non-U.S. equities more attractive to U.S.-based investors. Research by JP Morgan found that over the last 50 years, international equity markets have tended to outperform when the value of the USD is high but weakening. Furthermore, international equity valuations appear attractive at current levels. Forward price-to-earnings (P/E) ratios in Japan (14.3x), Europe (12.4x), and China (9.5x) are all below their long-term averages, creating ample opportunity for multiple expansion to fuel returns.

Valuations seem less attractive in U.S. equity markets. The S&P 500 finished the year trading at 19.5x forward earnings, higher than a year ago and above the 30-year average of 16.6x. The ten largest members of the index—the Magnificent 7 plus Berkshire Hathaway, UnitedHealth, and Eli Lilly—are trading at 28.7x forward earnings. The rest of the index trades at just 17.2x forward earnings. At the other end of the spectrum, value stocks—unloved for much of the past decade or more—trade at 14.9x, a discount of approximately 24% to the broader market and a staggering 45% discount relative to growth stocks. This disparity is driven predominately by the high valuations of the largest names in the S&P 500. Outside of the pandemic, the last time the ten largest names in the index traded at such a high valuation was during the dot-com bubble of late 1990s.

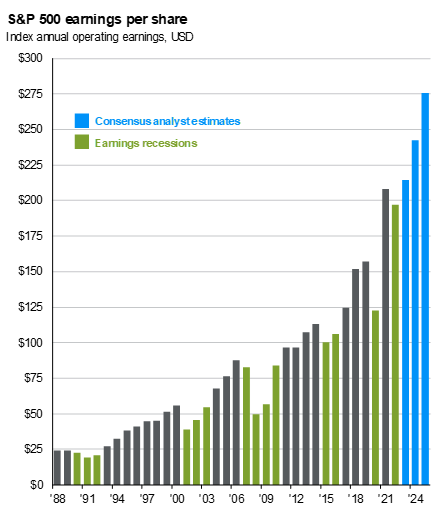

Despite relatively high valuations for growth stocks, there is cause for optimism. There are, after all, two ways for valuations to come down. The bad way is for prices to decline. A better way is through earnings growth. According to FactSet, the consensus estimate is for S&P 500 earnings to grow 11.5% in 2024. If realized, this would be the fastest pace in EPS growth for the index in a non-COVID impacted year since 2018.

Exhibit I:

Corporate Earnings and Sources of Earnings Growth.

Source: JP Morgan, Guide to the Markets, November 30, 2023. Slide 8.

S&P 500 year-end price targets, earnings growth, and valuation multiples

Earnings growth of 11.5%—assuming valuation multiples remain unchanged—means the S&P 500 would rise 11.5%. That’s pretty bullish, far above consensus, which means most forecasters must be expecting one of two things to happen in 2024—that either valuation multiples will decline, or earnings growth will come in below consensus estimates.

Declining rates are typically a tailwind for equity multiples, but there’s a sense among market observers that equity markets (and the economy as a whole) haven’t fully incorporated the Fed’s recent rate hikes. If this is the case—and that’s a big if—there’s a chance that markets (or, more likely, specific companies, say, growth stocks or the M7 stocks) might be revalued downward by the market—as and if higher rates become more fully incorporated into asset prices. In such an environment, earnings growth of 11.5%—if it comes to pass—would go a long way towards buffering, and potentially boosting, equity returns against declining multiples. Robust earnings growth is always the best approach to bring in frothy valuations.

As is our nature, we take a balanced view. To some degree, it’s probably true that the Fed’s rate hikes haven’t fully worked their way through the economy—how much, exactly, is difficult to tell. Nevertheless, we think it’s reasonable to expect equity valuations to come down a bit given a new normal that’s characterized by higher rates, higher inflation, political uncertainty in Washington, and heightened geopolitical risk.

The price targets in Exhibit J suggest a collective expectation that the forward P/E of the S&P 500 to fall slightly to somewhere in the range of 18.5x. We think this seems reasonable. This is about 5% below where it finished the year. If we assume a more modest earnings growth of, say, 10%, that puts the price return of the S&P 500 somewhere at around 5%—just about the median estimate of the 18 Wall Street firms surveyed in Exhibit J. We therefore would agree with a year-end 2024 price target of the S&P 500 of about 5,000.

Exhibit J:

Year-End 2024 S&P 500 Price Targets by Wall Street Firm. Source: MarketWatch as quoted by Morningstar’s Isabel Wang on December 11, 2023 in “What 2024 S&P 500 forecasts rally say about the stock market”.

| Wall Street Firm |

YE S&P 500 Target |

Price Return |

| Yardeni Research |

5,400 |

13.2% |

| Fundstrat |

5,200 |

9.0% |

| Oppenheimer |

5,200 |

9.0% |

| BMO Capital Markets |

5,100 |

6.9% |

| Citi |

5,100 |

6.9% |

| Deutsche Bank |

5,100 |

6.9% |

| Goldman Sachs |

5,100 |

6.9% |

| Bank of America |

5,000 |

4.8% |

| Federated Hermes |

5,000 |

4.8% |

| RBC Capital Markets |

5,000 |

4.8% |

| Ned Davis Research |

4,900 |

2.7% |

| Barclays |

4,800 |

0.6% |

| UBS Global Wealth |

4,700 |

-1.5% |

| Stifel |

4,650 |

-2.5% |

| Wells Fargo Securities |

4,625 |

-3.0% |

| Morgan Stanley |

4,500 |

-5.7% |

| JP Morgan |

4,200 |

-11.9% |

| BCA Research |

3,300 |

-30.8% |

| Average |

4,826 |

1.2% |

| Median |

5,000 |

4.8% |

Any number of developments can push our 2024 price target for the S&P 500 higher or lower, perhaps significantly. Higher than expected inflation, an increase in already high geopolitical tensions, a policy misstep by the Federal Reserve, severe weather impacts on energy production, or political uncertainty in the United States—to name just a few—could all work to push markets lower in the year ahead. Alternatively, stronger-than-expected earnings growth, faster or deeper-than-expected cuts to interest rates, or a cessation of hostilities in the Middle East or Ukraine could all work to push markets higher. Markets are unpredictable because the future is ultimately unknowable. The important point is that markets rapidly incorporate new information into asset prices as and if it becomes available—and that’s one prediction for 2024 that we have 100% confidence in.

Advice for investors in the new year

The events of the past year remind us of several critically important lessons that investors seem to routinely forget:

The first is that, despite our love affair with forecasts—and despite the best efforts of economists, market prognosticators, and fund managers to divine their future movements—the cold, hard facts remain that the future is always unknowable and uncertain. This stark reminder might seem odd in a year-end review that includes several forecasts, but the reality is that the future is ultimately unknowable, economic forecasting is far from a precise science, and the economy is infinitely complex. All economic and market forecasts contain a high degree of uncertainty and should be taken with more than a grain of salt.

The second lesson, in light of the first, is that investors would be wise to avoid making financial or investment decisions based on what they expectwill happen. Outlooks and forecasts are all predicated on what we expect will happen—they incorporate everything that we think we know about the future state of markets and the economy. Yet, to quote Mark Twain, “It ain’t what you don’t know that gets you into trouble; it’s what you know for sure that just ain’t so”.

We buy insurance on our homes, vehicles, and lives to protect against the unexpected. Wealth management, done well, is no different. We build financial plans and globally diversified portfolios to protect against the unexpected. It’s the hubris Mr. Twain warns us of that has destroyed more wealth than any bear market. The very best advice, then, is to hedge against hubris with a healthy dose of humility. The very best forecasters, perhaps ironically, freely, and humbly admit that their forecasts will likely miss their mark.

Finally, the most successful investors stay focused on the long game. Like a fine wine, the best investments need time to age. For all of our collective fixation with annual outlooks and forecasts, the fact remains that the best investors look out ten years, not twelve months. Apple didn’t become a $3 trillion company overnight; it spent many years in the wilderness teetering on the cusp of irrelevancy and even collapse before it became the world’s leader in smartphone technology. Fixating on economic growth and market returns over the next twelve months is at best distracting and, at its worst, disastrous. The best advice is to play the long game. Time in the market, not timing the market, is the best, most time-tested path to building and sustaining wealth.

Home » Insights » Market Commentary » Year-End Review and 2024 Outlook

Year-End Review and 2024 Outlook

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

What an interesting year 2023 proved to be. We warned clients in our 2023 outlook to ignore economic and market forecasts, to resist making portfolio changes in response to recession forecasts, and to instead remain well-diversified in the year ahead. In hindsight, that was clearly timely advice. To see why, let’s go back in time to a year ago.

The folly of forecasts

Twelve months ago, the U.S. economy seemingly faced an uphill battle. Inflationary pressures that began building in early 2021 had proved to be more than transitory. The Federal Reserve responded throughout 2022 by increasing short-term interest rates by a cumulative 425 basis points, an unprecedented pace of monetary policy tightening. Over the second half of 2022, annual growth in the consumer-price index (CPI) slowed but remained higher than the Fed’s 2% target. As 2022 ended, policymakers communicated a commitment to tighten policy further in 2023 to bring inflation under control, even if doing so meant pushing the U.S. economy into recession.

It should perhaps then come as no surprise that the consensus of most economists in late 2022 and early 2023 was that a relatively short and shallow recession (or two consecutive quarters of negative GDP growth) was likely to occur sometime later in 2023. Further, most argued that the economy would likely expand by no more than 0.3% for the full year.

Financial markets told a similar story. The Treasury yield curve remained steeply inverted (a situation where short-term rates are higher than long-term rates), both stocks and bonds had declined significantly from their 2021 highs, and mortgage interest rates had more than doubled from a year earlier. By any objective measure, the economy wasn’t poised to deliver blockbuster GDP growth in 2023.

Equity market forecasts for 2023 were similarly pessimistic. In a Bloomberg survey of 22 Wall Street strategists taken in late December 2022, the average forecast for the 2023 year-end value of the S&P 500 Index was 4,078, implying just a 6.2% rebound in the large cap index in 2023. Such a modest forecast perhaps seemed reasonable at the time, coming as it did on the heels of a 19.4% decline in 2022.

However, in the latest example of the fallibility of economic and market forecasts, none of the aforementioned came to pass. The economy significantly outperformed the dire outlook of a year ago. The economy grew by an annualized 2.2% and 2.1% in the first and second quarters, respectively, before expanding by an estimated 5.2% in the third. Current estimates, which will be finalized in late January, are that the economy grew by about 2.7% in 2023, well north of economists’ 2023 forecasts of only 0.3% GDP growth. If a recession was supposed to happen in 2023, the economy certainly didn’t get the memo.

As we shared in last year’s outlook, equity market returns tend to be much stronger in years following sharp declines. For instance, since 1926, S&P 500 returns have averaged 22.2% in years that follow annual declines of 20% or more. In this context, the mid-single digit gains expected by Wall Street strategists for 2023 were too conservative and out of step with market history.

The economy and markets overcome 2023’s Wall of Worries

Despite strong GDP growth and robust equity market returns, 2023 was not without challenges. The ongoing war in Ukraine, the war in Gaza, political dysfunction in Washington, simmering geopolitical tensions between China and the United States, the downgrade by Fitch and Moody’s of U.S. government debt, the UAW strike against the Big Three automakers, and the Fed’s aggressive rate-hiking policy—to name but only a few—all threatened to seriously upend the economy and markets at various times over the year.

Exhibit A:

S&P 500 Climbs 2023’s Wall of Worries

Yet, through it all, the U.S. economy and global financial markets—contrary to 2023 forecasts—were able to overcome these headwinds. The economy’s outperformance was due in no small part to the strength of the U.S. consumer (Exhibit B). Undeterred by high prices and the looming threat of recession, consumers continued to increase inflation-adjusted spending at a robust pace. This was particularly true of spending on services such as dining at restaurants and travel-related spending such as airfare and lodging.

Spending on goods, especially durable goods, wasn’t as strong. We suspect this was partially because of the high interest rate environment, which negatively impacted affordability, but also because a lot of durable goods spending was pulled forward during pandemic lockdowns when spending on services was not an option for many consumers. Whether U.S. consumers can sustain such breakneck spending in the year ahead remains to be seen.

Exhibit B:

Strong GDP growth in 2023 was propelled by strong inflation-adjusted consumer spending.

(Source: JPM Guide to the Markets, Q1 2024, Slide 16.)

Global equities roar

Despite such lackluster equity market forecasts, returns in broad equity markets were much stronger than expected in 2023 (Exhibit C). The S&P 500 delivered a total return of 26.3% for the year and approached an all-time high. Small cap stocks underperformed large caps for the year, but still delivered strong gains to investors with the Russell 2000 delivering a total return of 17.3% (nearly all of which came about in the final two months of 2023).

Gains in non-U.S. developed and emerging market stocks were also strong for the year, with the MSCI EAFE and MSCI Emerging Markets indices returning 18.9% and 10.3%, respectively.

Gains for U.S. stocks were led by the so called “Magnificent 7”—Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla—which are currently the seven largest members of the S&P 500 index by market capitalization. Most of these companies benefited from excitement surrounding generative AI technology that captured investors’ attention during the year. An equal-weighted index composed of just the Magnificent 7 delivered a total return of 107% in 2023, while the equal-weighted S&P 500 index saw a total return of just 13.8%.1

Exhibit C:

Global Equity Returns, 2023.

Source: JP Morgan, Guide to the Markets, Q1 2024, Slide 42

Despite rising rates, fixed income delivers respectable returns

Importantly, avoiding a recession in 2023 didn’t require the Federal Reserve to abandon its fight against high inflation. Fed policymakers increased interest rates by an additional 100 basis points to 5.5% over the first seven months of the year before holding rates steady through year end. Annual CPI growth decelerated to 3.1% in November from 6.4% at the end of 2022. As we enter 2024, the odds of a so-called “soft landing”, where an economic expansion is preserved while inflation falls back to the Fed’s 2% target, are significantly better than a year ago.

The Fed’s rate hikes pushed short-term rates higher at a fairly consistent pace. On the other hand, long-term rates saw significant volatility over the past twelve months. After beginning the year at 3.88%, the ten-year Treasury yield fell to 3.25% amid the regional banking crisis in March and April, then leapt to 5% for the first time since 2007 after the third quarter’s strong GDP report, only to decline and finish the year where it began—at 3.88% (Exhibit D). In the end, the ten-year yield remained near where it began the year and the yield curve was even more steeply inverted.

Despite rising rates, bonds reversed course from 2022 and delivered respectable returns in 2023. Two-year and 5-year Treasuries returned 3.65% and 3.93%, respectively. The Bloomberg U.S. Aggregate Bond Index, the broadest index of U.S. bonds, returned a healthy 5.53% for the year. High-yield bonds outperformed and benefitted from better-than-expected economic growth, returning 13.4% in 2023. Treasury inflation-protected securities (TIPS) underperformed, returning 3.9% (a modestly disappointing return given an average maturity of seven years), as falling inflation and stable nominal yields meant real interest rates moved sharply higher.

Exhibit D:

Fixed Income Asset Class 2023 Returns and Year-End 2023 Yields.

Source: JP Morgan, Guide to the Markets, Q1 2024, Slide 33

Cash wasn’t king in 2023

In our 2023 outlook, we advised clients to resist making portfolio changes in response to recession and inflation forecasts and to instead remain well-diversified in the year ahead. Coming on the heels of 2022’s steep market declines and sharp rise in interest rates, many investors instead elected to retreat from markets and spent 2023 sitting in cash. “Cash is king” was many investors’ new call to arms. However, if cash is king, it isn’t a very good one—it underperformed nearly every major asset class in 2023. Only commodities, a favorite of inflation hawks during periods of high inflation, performed worse. As Exhibit E shows, an illustrative diversified asset allocation portfolio outperformed cash by a full 9% in 2023 (14.1% versus 5.1%).

Exhibit E:

Public Market Asset Class Returns, 2009 to 2023.

Source: JP Morgan, Guide to the Markets, Q1 2024, Slide 60.

It’s certainly refreshing to see higher yields on cash money markets. No one is objecting to earning 5% on our recommended money market funds. However, money markets are short-term investments. Their short-duration—for example, Schwab’s Value Advantage Money Fund has a weighted average maturity of just 36 days—make them generally unsuitable as a long-term investment. When rates come down (which the Fed telegraphed at its December 2023 meeting), yields on money market funds will be quick to follow suit. In contrast, longer duration investments (e.g., 5-year bonds) rise in value as rates decline, providing investors a nice cushion to help offset lower yields. Money market funds, due to their short duration, experience no such appreciation when rates decline.

Private equity – a new focus on healthy, profitable growth

Venture capital and private equity fundraising, capital deployment, and exits slowed significantly in 2023. Crunchbase reports that transaction volumes nearly halved, fundraising activity was down, distributions slowed, and returns for investments made over the last few years are falling on the back of declining private market valuations.

The private investment industry is returning to basics. The “growth at any price” approach exhibited during 2020 to 2022 has been replaced by one focused on profitable growth, with value creation plans grounded in fundamentals. Venture capitalists are focusing on shepherding their portfolio companies that are finding good product market fit to be cash flow positive. Private equity managers are focused on helping companies execute operational improvements rather than rely on cheap debt that was available in 2020 to 2022 to generate attractive returns. Valuations across the private asset classes are coming back down toward long-term averages.

Artificial intelligence (AI) is not new, but the recent breakthroughs in generative AI are sparking interest in a slate of private companies. The AI hype may be overblown, but it may also drive long-term improvements in productivity and profitability across private markets. Many venture investors concede that deep-pocketed public incumbents (like Microsoft) largely control the foundational layer of generative AI. That said, many venture stage and private equity backed companies will likely integrate AI tools to boost productivity and accelerate their businesses. The indirect benefits for private companies in many sectors may prove significant.

Many Wall Street firms predict that the strong performance of the public markets in the fourth quarter of 2023 will spark a flood of initial public offerings. September of 2023 marked the first time in 18 months that venture-backed technology companies braved the public markets.

Two former top venture-backed companies, Instacart and Klaviyo, experienced contrasting fortunes upon entering the public market. Instacart stumbled at its public debut, shedding 75% of its last private value. Klaviyo, on the other hand, navigated the transition more smoothly, listing at a valuation close to its previous private round. This disparity highlights the potential for volatility and uncertain outcomes in the IPO landscape. Private fund managers and Wall Street underwriters are focused on bringing resilient, profitable companies public.

Exhibit F:

Private Market Returns (IRRs), 2023, Q3 2023, and 1-Year Returns, as of September 30, 2023.

Source: Preqin

Private real estate

Private real estate performance varied wildly across geographies and property types. While job and real income growth supported a mild recovery in many apartment, industrial, and retail markets, office investments continue to struggle. Leasing activity for office space picked up throughout the year but remains well below pre-pandemic levels nationally. Not surprisingly, the technology sector continues to lag others in office utilization. Many banks are working with private office owners to restructure debt due to the higher vacancies.

Slowing economic growth and elongated occupier decision-making are likely to keep aggregate office leasing activity subdued through early 2024. Upcoming lease expirations and lower renewal rates will support growing demand for high-quality space as the year progresses. Overall vacancy rates are expected to tick higher through the year as new supply is added and tenants upgrade, while availability in new, well-located space will remain tighter. Many private funds are already acquiring office properties in distressed sales at prices below replacement costs, a sign that assets are finally being repriced in light of economic conditions and higher interest rates.

Private credit

Historically, private credit performs well when other sources of debt and equity financing ebb. Recession fears in 2023 prompted traditional bank lending and public high-yield debt issuance to slow dramatically. Banks are particularly focused on reserving for potential loan losses in real estate portfolios.

The pullback in bank lending, collateralized loan obligation (CLO) formation, high-yield bond and leveraged loan issuance, and IPOs created a situation in which private debt was in extremely high demand. Firms are increasingly turning to the private debt markets as a viable path for funding. Pitchbook reported that $12 billion of public debt was refinanced in the private debt market in the first nine months of 2023.

The performance of private credit will be greatly affected by credit losses. Blackstone reports that credit losses remain below long-term averages. They note that private debt loss rates have compared favorably with public markets. In the second quarter of 2023, trailing 12-month loss rates for leveraged loans and high yield were 1.68% and 1.62%, respectively, versus 0.69% for direct lending, according to the Cliffwater Direct Lending Index.

Exhibit G:

Asset Class Yields. Private Credit continues to offer attractive yields.

Source: JP Morgan Guide to Alternatives, November 2023, Slide 8.

2024 economic and market outlook

As we enter 2024, last year’s advice to keep economic and market forecasts in context remains as true and as relevant as ever. While such forecasts can be interesting and insightful, they shouldn’t lead one to change strategic asset allocation. Investors are advised to always remain well diversified in a risk-appropriate portfolio that’s aligned with their family’s need, capacity, and tolerance for investment risk. Always consult your advisor when exploring whether it’s in your best interest to make any portfolio changes.

Our base case for the economy in the year ahead is for continued progress towards a soft landing in the U.S. We expect the U.S. economic expansion to continue in 2024 as inflation trends lower. We expect solid, albeit gradually weakening, consumer spending to continue to drive U.S. economic growth. While a recession is unlikely, we think slower economic growth is very likely. Though the Fed has held the federal-funds rate at the current level since July, monetary policy is transmitted through the economy with a significant lag. It’s therefore likely that the full impact of past rate increases has yet to be realized broadly across the economy. The consensus forecast of economists is for 1.2% growth in GDP and for inflation to continue its downward trend.

Interest Rates in the Year Ahead

If the inflationary environment develops as expected, the Federal Reserve will have enough evidence of the sustained downward trend in inflation to cut interest rates some time in 2024. In the most recent set of Fed economic projections, the median forecast was for 80 basis points of cuts in 2024. However, markets expect the Fed will be significantly more aggressive in cutting rates. Pricing in the fed-funds futures market implies nearly 150 basis points of easing in 2024, with an initial rate cut expected in March.

Falling inflation and monetary policy easing are expected to push rates lower across the yield curve. The median forecast for the ten-year Treasury yield in a recent Bloomberg survey forecasts a steady decline through year end. Similarly, the 2-year yield is expected to fall from 4.4% today to 3.9% at the end of the year. As mentioned earlier, falling rates should benefit longer-duration fixed income asset classes (Exhibit H).

Exhibit H:

Longer duration fixed income assets are more sensitive to changes in interest rates. For example, a 1% decline in interest rates would lead to an 8.3% increase in bond prices for 5-Year U.S. Treasury bonds.

Source: JP Morgan Guide to the Markets, Q1 2024, Slide 33.

Equity valuations and the U.S. dollar

The outlook for monetary policy in major developed economies suggests the U.S. dollar (USD) may begin to weaken after a period of strong appreciation since the pandemic began. This could make non-U.S. equities more attractive to U.S.-based investors. Research by JP Morgan found that over the last 50 years, international equity markets have tended to outperform when the value of the USD is high but weakening. Furthermore, international equity valuations appear attractive at current levels. Forward price-to-earnings (P/E) ratios in Japan (14.3x), Europe (12.4x), and China (9.5x) are all below their long-term averages, creating ample opportunity for multiple expansion to fuel returns.

Valuations seem less attractive in U.S. equity markets. The S&P 500 finished the year trading at 19.5x forward earnings, higher than a year ago and above the 30-year average of 16.6x. The ten largest members of the index—the Magnificent 7 plus Berkshire Hathaway, UnitedHealth, and Eli Lilly—are trading at 28.7x forward earnings. The rest of the index trades at just 17.2x forward earnings. At the other end of the spectrum, value stocks—unloved for much of the past decade or more—trade at 14.9x, a discount of approximately 24% to the broader market and a staggering 45% discount relative to growth stocks. This disparity is driven predominately by the high valuations of the largest names in the S&P 500. Outside of the pandemic, the last time the ten largest names in the index traded at such a high valuation was during the dot-com bubble of late 1990s.

Despite relatively high valuations for growth stocks, there is cause for optimism. There are, after all, two ways for valuations to come down. The bad way is for prices to decline. A better way is through earnings growth. According to FactSet, the consensus estimate is for S&P 500 earnings to grow 11.5% in 2024. If realized, this would be the fastest pace in EPS growth for the index in a non-COVID impacted year since 2018.

Exhibit I:

Corporate Earnings and Sources of Earnings Growth.

Source: JP Morgan, Guide to the Markets, November 30, 2023. Slide 8.

S&P 500 year-end price targets, earnings growth, and valuation multiples

Earnings growth of 11.5%—assuming valuation multiples remain unchanged—means the S&P 500 would rise 11.5%. That’s pretty bullish, far above consensus, which means most forecasters must be expecting one of two things to happen in 2024—that either valuation multiples will decline, or earnings growth will come in below consensus estimates.

Declining rates are typically a tailwind for equity multiples, but there’s a sense among market observers that equity markets (and the economy as a whole) haven’t fully incorporated the Fed’s recent rate hikes. If this is the case—and that’s a big if—there’s a chance that markets (or, more likely, specific companies, say, growth stocks or the M7 stocks) might be revalued downward by the market—as and if higher rates become more fully incorporated into asset prices. In such an environment, earnings growth of 11.5%—if it comes to pass—would go a long way towards buffering, and potentially boosting, equity returns against declining multiples. Robust earnings growth is always the best approach to bring in frothy valuations.

As is our nature, we take a balanced view. To some degree, it’s probably true that the Fed’s rate hikes haven’t fully worked their way through the economy—how much, exactly, is difficult to tell. Nevertheless, we think it’s reasonable to expect equity valuations to come down a bit given a new normal that’s characterized by higher rates, higher inflation, political uncertainty in Washington, and heightened geopolitical risk.

The price targets in Exhibit J suggest a collective expectation that the forward P/E of the S&P 500 to fall slightly to somewhere in the range of 18.5x. We think this seems reasonable. This is about 5% below where it finished the year. If we assume a more modest earnings growth of, say, 10%, that puts the price return of the S&P 500 somewhere at around 5%—just about the median estimate of the 18 Wall Street firms surveyed in Exhibit J. We therefore would agree with a year-end 2024 price target of the S&P 500 of about 5,000.

Exhibit J:

Year-End 2024 S&P 500 Price Targets by Wall Street Firm. Source: MarketWatch as quoted by Morningstar’s Isabel Wang on December 11, 2023 in “What 2024 S&P 500 forecasts rally say about the stock market”.

Any number of developments can push our 2024 price target for the S&P 500 higher or lower, perhaps significantly. Higher than expected inflation, an increase in already high geopolitical tensions, a policy misstep by the Federal Reserve, severe weather impacts on energy production, or political uncertainty in the United States—to name just a few—could all work to push markets lower in the year ahead. Alternatively, stronger-than-expected earnings growth, faster or deeper-than-expected cuts to interest rates, or a cessation of hostilities in the Middle East or Ukraine could all work to push markets higher. Markets are unpredictable because the future is ultimately unknowable. The important point is that markets rapidly incorporate new information into asset prices as and if it becomes available—and that’s one prediction for 2024 that we have 100% confidence in.

Advice for investors in the new year

The events of the past year remind us of several critically important lessons that investors seem to routinely forget:

The first is that, despite our love affair with forecasts—and despite the best efforts of economists, market prognosticators, and fund managers to divine their future movements—the cold, hard facts remain that the future is always unknowable and uncertain. This stark reminder might seem odd in a year-end review that includes several forecasts, but the reality is that the future is ultimately unknowable, economic forecasting is far from a precise science, and the economy is infinitely complex. All economic and market forecasts contain a high degree of uncertainty and should be taken with more than a grain of salt.

The second lesson, in light of the first, is that investors would be wise to avoid making financial or investment decisions based on what they expectwill happen. Outlooks and forecasts are all predicated on what we expect will happen—they incorporate everything that we think we know about the future state of markets and the economy. Yet, to quote Mark Twain, “It ain’t what you don’t know that gets you into trouble; it’s what you know for sure that just ain’t so”.

We buy insurance on our homes, vehicles, and lives to protect against the unexpected. Wealth management, done well, is no different. We build financial plans and globally diversified portfolios to protect against the unexpected. It’s the hubris Mr. Twain warns us of that has destroyed more wealth than any bear market. The very best advice, then, is to hedge against hubris with a healthy dose of humility. The very best forecasters, perhaps ironically, freely, and humbly admit that their forecasts will likely miss their mark.

Finally, the most successful investors stay focused on the long game. Like a fine wine, the best investments need time to age. For all of our collective fixation with annual outlooks and forecasts, the fact remains that the best investors look out ten years, not twelve months. Apple didn’t become a $3 trillion company overnight; it spent many years in the wilderness teetering on the cusp of irrelevancy and even collapse before it became the world’s leader in smartphone technology. Fixating on economic growth and market returns over the next twelve months is at best distracting and, at its worst, disastrous. The best advice is to play the long game. Time in the market, not timing the market, is the best, most time-tested path to building and sustaining wealth.

Explore More

Q2 Market Outlook: What Does Q2 Hold for Investors?

After the Fall: Four Questions for Investors: Insights From Our CIO

The Fallacy of Selling and Waiting Until Markets Calm Down: Insights From Our CIO