Ready to learn more?

Home » Insights » Personal Finance » Capital Gains Tax: What You Need To Know

Steven Elliott, MST, CPA

Tax Director

Learn about capital gains tax and how to apply the information to an effective tax planning and investment strategy.

When you sell a capital asset — which commonly include stocks, bonds, and real estate — the profit you realize on the asset’s appreciation since you bought or otherwise acquired it by gift or inheritance is considered capital gain income which can incur a tax. While the concept of capital gains tax is simple, the details when filing your taxes might get complicated, depending on how long you’ve held the asset, which state you reside in, your modified adjusted gross income (MAGI), as well as other possible factors.

Furthermore, with new lawmakers in place in 2025, there may be capital gains tax rate adjustments in the future. The Tax Cuts and Jobs Act (TCJA) of 2017 is set to expire at the end of 2025, so all or parts of that bill could be changed or extended.

Understanding the nuances related to capital gains tax is only the beginning. Building a tax planning and investment strategy that includes capital gain considerations is a key part of wealth management. For instance, donating appreciated securities helps eliminate realized capital gain taxes. Additionally, high-income earners may be subject to the net investment income tax (NIIT) of 3.8% tax above capital gains taxes.1 In this article, we break down the basics to help you determine the next steps you might take for your tax planning strategy.

Taxable capital assets

Below are some common types of capital assets that may be taxed, whether they are used for individual or business purposes. Certain tax-deferred accounts that do not incur capital gains tax include 401(k)s, IRAs, 529 plans, and Health Savings Accounts.

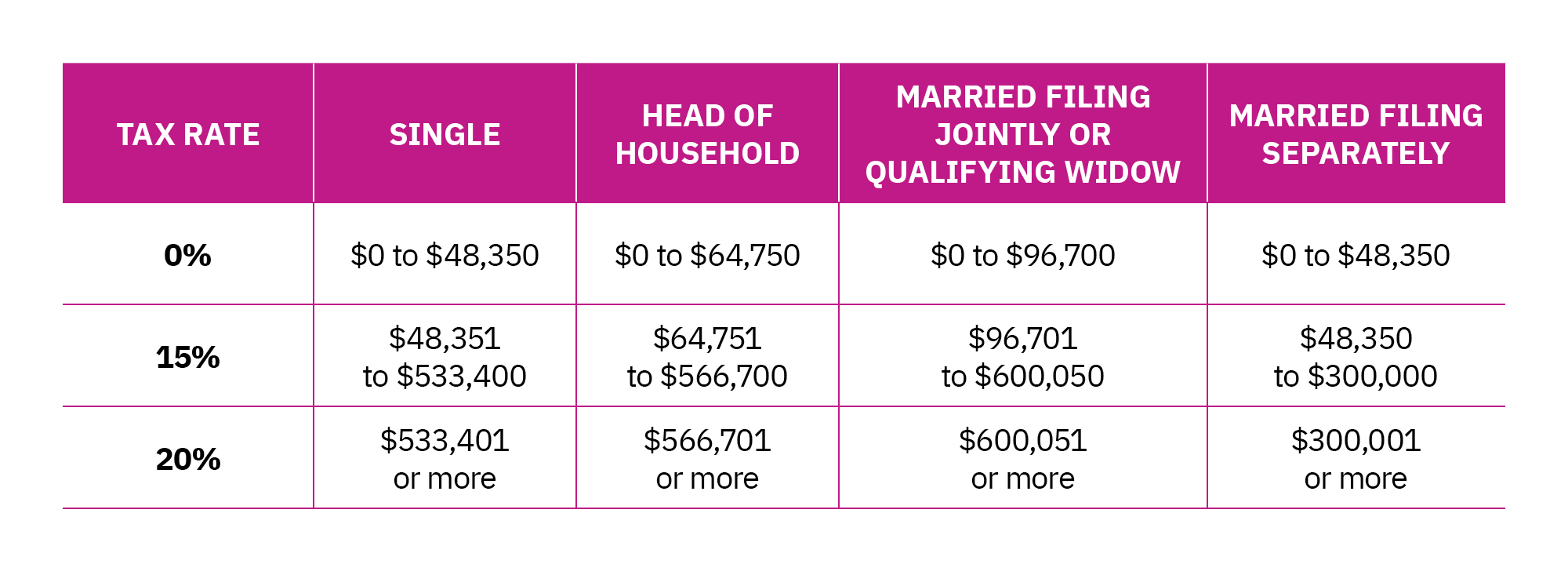

Long-term capital gains

Long-term capital gains apply to assets held for more than a year. The taxes on long-term held assets are typically more friendly to taxpayers as an incentive to stay invested.

For 2025, these are the federal long-term capital gains tax rates:2

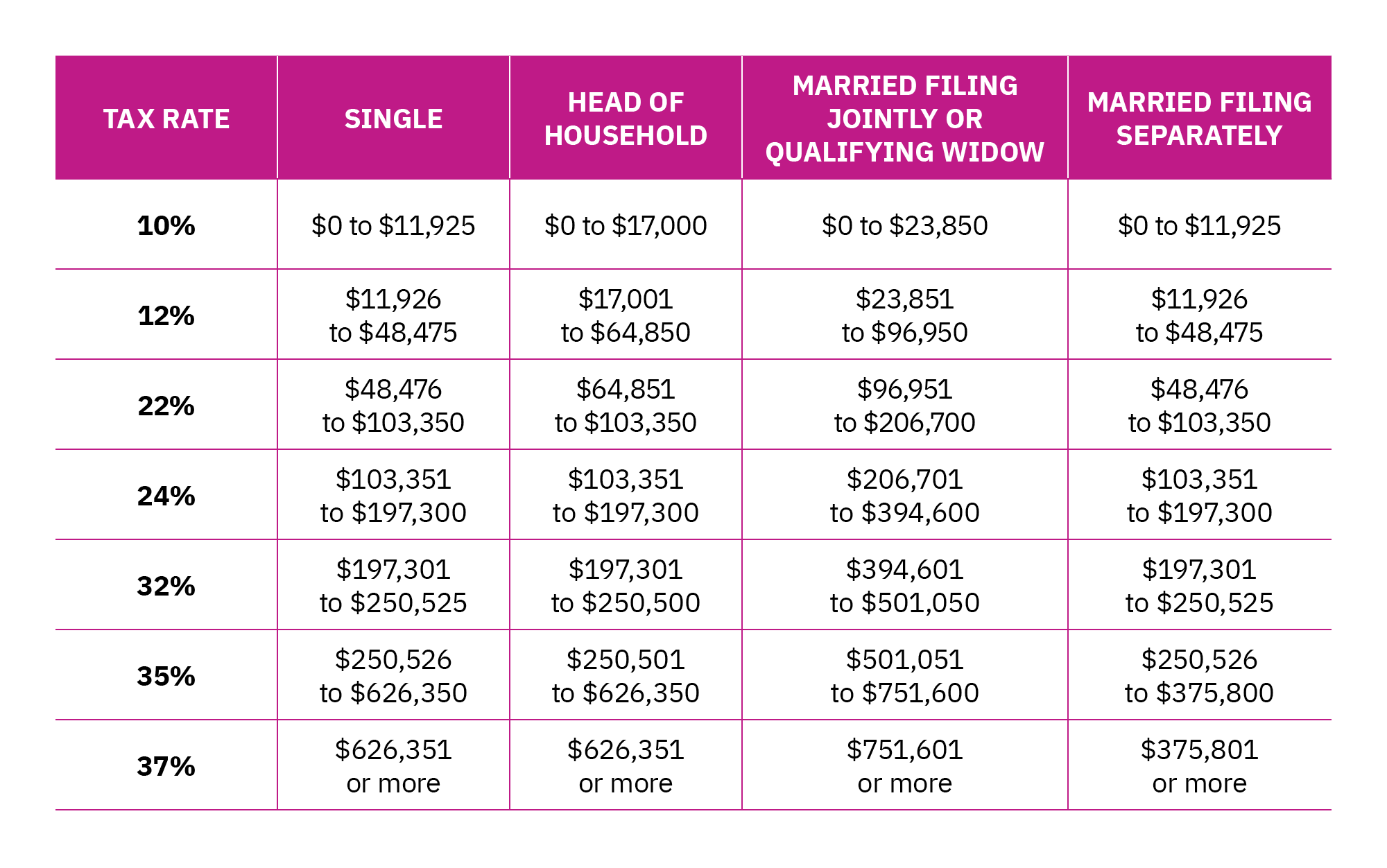

Short-term capital gains

Short-term capital gains apply to assets held for one year or less and are based on the ordinary income tax rate of the individual:3

States’ capital gains taxes

Some states have no capital gains tax, while others have rates ranging from 0% to more than 14%, which are over and above federal taxes.4 California has the highest state capital gains tax rate, up to 13.3%; New York and New Jersey follow closely behind with maximum rates of 10.9% and 10.75%, respectively. On the other hand, North Dakota has a state capital gains rate of 2.9%. States with no capital gains tax include Alaska, Florida, New Hampshire, Nevada, South Dakota, Tennessee, Texas, and Wyoming.

Principal residence capital gains exclusion

When selling your primary residence, you can exclude up to $250,000 of gain ($500,000 for joint filers) from your income. This exclusion, which is available every two years, is also not subject to the NIIT, which applies to individuals with high modified adjusted gross incomes (MAGIs) and targets investment income. However, any gain exceeding these limits, or gain from the sale of secondary residences or vacation homes, is subject to the NIIT.

Capital gain tax strategies

There are multiple strategies that can be applied for minimizing capital gain taxes, which depend on your situation as well as current tax laws. We’ll share a couple of common strategies you might use.

Tax-loss harvesting is one way to offset capital gains taxes. When selling losing stock positions, and losses exceed capital gains, you can deduct up to $3,000 of those losses (unused losses carry over to future years) and can be used to offset ordinary income from other sources. Be sure to be mindful of the wash-sale rule which prevents an investor from tax loss harvesting if the same security is purchased within 30 days of the trade that created the loss.

Another strategy to consider is contributing appreciated long-term investments to a donor-advised fund (DAF). You can help support a favorite cause by donating directly to a charity as well, while avoiding capital gains recognition. Additionally, you can claim a tax deduction for the entire fair-market value of your donation, typically up to 30% of adjusted gross income (AGI), with an additional 5-year carryover available for any unused amounts.

Planning and next steps

Though this article doesn’t capture every detail involved in planning for capital gains taxes, it gives you an idea of how important capital gains can be in tax planning, estate, gift, and investment strategies. For example, there are additional capital gains tax laws related to rental properties and inherited assets. Moreover, calculating capital gains taxes isn’t always so straight-forward. The main takeaway here should be that our ever-changing and complex tax laws, as well as each family’s personal situation, need to be evaluated for effective wealth management.

If you’d like tax planning and investment management as part of a comprehensive wealth management solution, Mercer Advisors can help! We also combine financial planning, estate planning, and insurance solutions into your plan. Ready for Mercer Advisors to help amplify and simplify your financial life? Let’s talk.

1 “Short Term Vs. Long-Term Capital Gains Taxes For 2025.” Forbes, 27 Dec. 2024.

2 “2024 and 2025 capital gains tax rates.” Fidelity, 23 Dec. 2024.

3 “IRS releases tax inflation adjustments for tax year 2025.” IRS, 22 Oct. 2024.

4 “States With Low and No Capital Gains Tax.” Kiplinger, 1 Jan. 2025.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Mercer Advisors is not a law firm and does not provide legal advice to clients. All estate planning document preparation and other legal advice is provided through select third parties unaffiliated to Mercer Advisors.

Mercer Global Advisors has a related insurance agency. Mercer Advisors Insurance Services, LLC (MAIS) is a wholly owned subsidiary of Mercer Advisors Inc. MAIS provides individual life, disability, long term care coverage, and property and casualty coverage through various insurance companies. For Mercer Global Advisors clients who wish to purchase insurance products, MAIS has entered into a non-exclusive referral agreement with Strategic Partner(s), where the Strategic Partner will provide necessary services relative to the marketing, placement, and servicing of the insurance products, including without limitation preparing and presenting illustrations, supporting the underwriting process, assisting with the completion and execution of applications, delivering policies, and servicing in-force business. MAIS and the Strategic Partner will be listed as either “agents” or “co-agents” on the policies. While Mercer Global Advisors does not receive a referral fee, Strategic Partner receives a percentage of the commission revenue. MAIS and Strategic Partner do have a revenue sharing agreement.