Beyond finances: goals and dreams

Financial planning is a moving target: goals change as life changes. The blueprint you created to reach point A may no longer be sufficient if your life journey shifts to encompass points B, C, or Z. At Mercer Advisors, comprehensive wealth management provides you with an ongoing relationship and advocacy, not just one-size-fits-all “guidance.” Going deeper than finances, our discussions also touch on your dreams—including what enriching experiences you want your money to afford you.

Traversing your dreamscape

Imagine embarking on a road trip to a dream destination. You set a date to depart, invite your traveling partners, and envision the sites you’ll visit upon arrival. A successful trip requires mapping your route in advance with GPS coordinates and then making any necessary adjustments along the way. The job of a wealth advisor is to help you navigate on your life’s journey. Our specialists ensure you have an optimized experience, by helping you evaluate different means of reaching your destination. What is the right vehicle for your journey? What if it breaks down? Do you want to take the most direct route or a scenic route? Do you prefer to drive for many hours at a time or to stop frequently? If you stop somewhere for the night and decide to stay there for a few days, how should the rest of the trip be adjusted? Maybe you discover that there is an even better place to visit, along the way. How can you change destinations midway? A navigator who accompanies you on your journey can help you refine your experience or bring things to your attention that you may not have considered.

Charting coordinates: your integrated wealth plan

You can also think of a unified, integrated wealth plan as a life itinerary: It tells you where you’re going and with whom, as well as anticipated arrival times, major points of interest, alternative routes, and required supplies. For any journey, it’s a good idea to have a trusted contact who can manage important details, anticipate next steps, and identify when additional resources may be necessary. Our collaborative team navigates these twists and turns alongside you, throughout your journey.

Our wealth advisors are professionals at helping you identify possibilities and map out itineraries, prioritizing “must-have” experiences while suggesting additional considerations. Our tax specialists ensure you have the correct documents and provide the tools you might need for next steps. Our estate planning team provides for your loved ones and your legacy, and our insurance team handles planning for contingencies. Whether you decide to change your plan or take a detour, our highly trained professionals can help with specific needs such as estate concerns, wealth planning for specific goals, and retirement planning for women. We act as one unified team to guide and support you, connecting the dots of your life’s journey.

Connecting the dots

Mercer Advisors can help you connect the dots of your wealth plan, interlocking the key components of your financial picture. Our services can include the following:

Financial planning:

A financial planner will help you evaluate your entire financial situation, including current spending habits, then propose a structure to help guide you toward reaching your goals, such as college, healthcare, or retirement planning.

Investment management:

Mercer Advisors investment strategies are underpinned by scientific research, historical market analysis, and over 35 years of comprehensive experience as a registered investment advisor (RIA). Our strategy begins and ends with one unswerving objective: build your portfolio to help deliver reliable returns and align with your long-range financial plan.

Estate planning:

With capabilities spanning foundational estate planning to managing complex assets, our estate planning attorneys work with your advisors to help you prepare for expected inheritances and unpredictable circumstances.

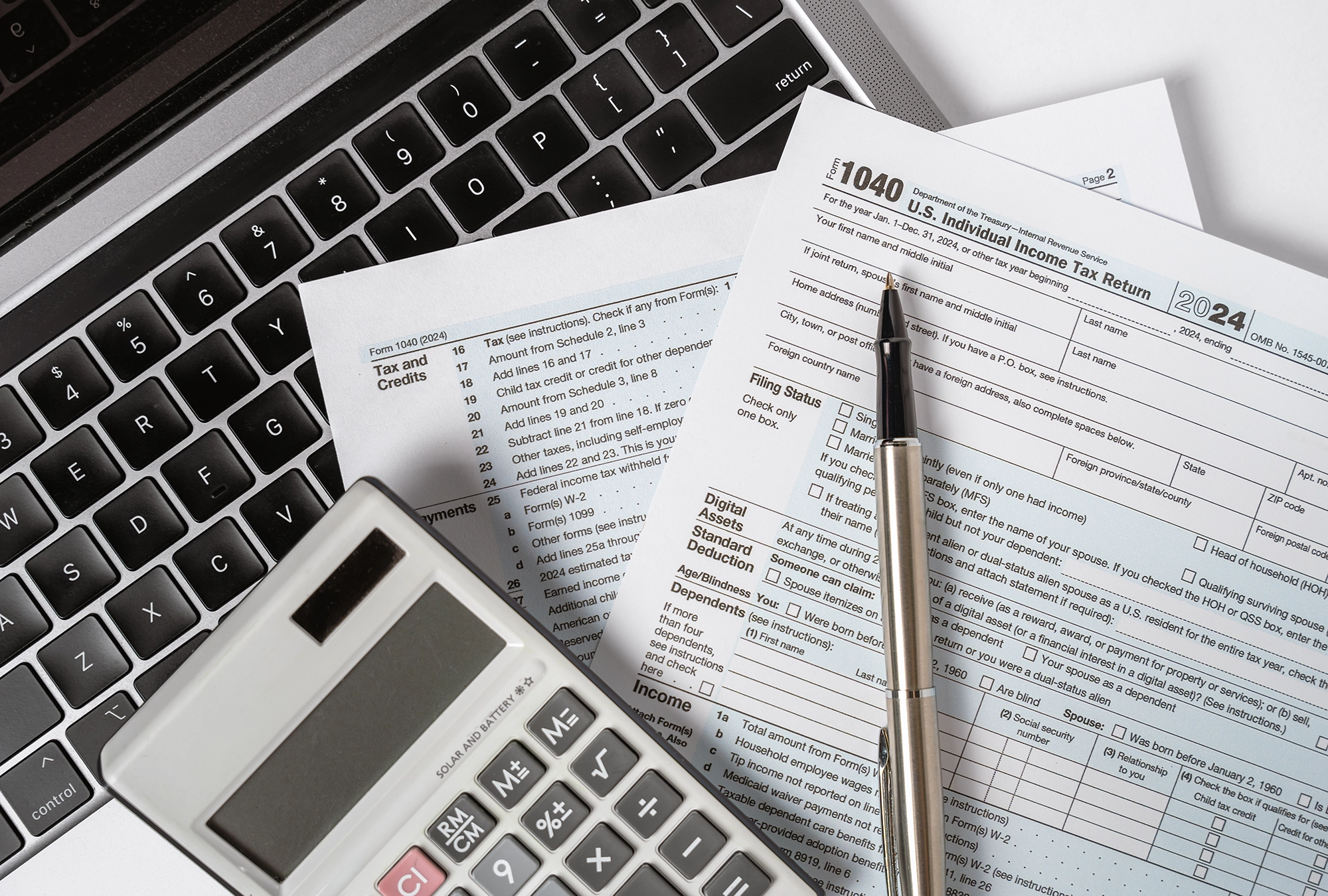

Tax planning:

Mercer Advisors takes a proactive approach to strategic tax planning and client education to help you understand how your decisions today can impact your wealth tomorrow.

Retirement planning:

Our team of professionals analyze and develop strategies to help you set and meet your retirement goals.

Insurance planning:

Mercer Advisors offers access to specialized insurance guidance and broad-ranging coverage options, helping you continue protecting what matters as your situation evolves.

Particular needs planning:

Because no two situations are alike, we tailor our solutions to your individual needs negotiating a divorce or supporting a loved one with a disability.

Mercer Advisors can not only help you define your dreams and goals, we can also create a custom blueprint that can enable you to reach them. Our collaborative in-house team tailors services to your unique needs and strategic objectives. The result is a wealth plan actively managed, throughout life’s changes, to help you reach you goals. Welcome to integrated wealth management.