Ready to learn more?

Home » Insights » Personal Finance » Making Catch-Up 401(k) Contributions Can Be Key to Retirement Success — the Limits Are Changing

Jennifer Baick

MBA, CFP®, CDFA Senior Director, Financial Planning Group

Consider making 401(k) catch-up contributions to help boost your retirement savings. Learn the limits which are changing.

Are you one of the 85% of employees 50 or older NOT making catch-up contributions in a retirement plan?1 The SECURE 2.0 Act, passed in 2022, included several provisions that go into effect in 2025, including a higher catch-up contribution limit for working individuals nearing retirement that might entice you.

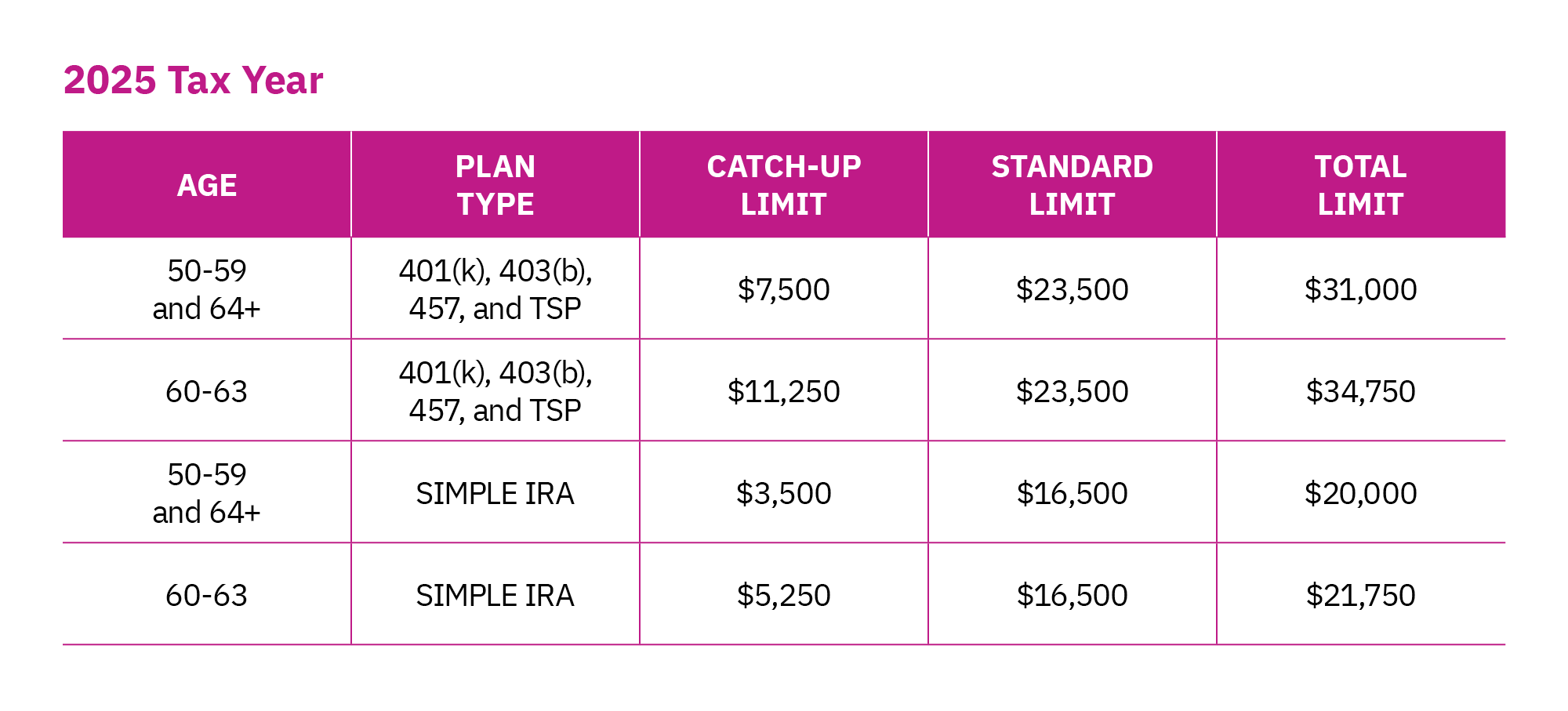

The standard catch-up contribution limit applies to everyone age 50 and older participating in a deferred contribution plan — a 401(k), 403(b), 457(b), or government Thrift Savings Plan. Beginning in 2025, however, if your age on Dec. 31 is 60, 61, 62, or 63 and you are still working, you may be allowed to contribute more as a catch-up if your employer’s plan allows it.

The standard catch-up limit is $7,500 for anyone aged 50 to 59 and aged 64 or older (as it was in 2024). For those in their early 60s, the catch-up contribution is $11,250 inside 401(k), 403(b), and 457(b) plans. For small business owners or sole proprietors with a SIMPLE IRA (individual retirement account), the catch-up contribution limit for ages 60 to 63 has increased from $3,500 to $5,250. There may also be an additional 10% bump in contribution thresholds for SIMPLE plans if the employer meets qualifying criteria.

Catch-up contributions can make a difference

The catch-up contribution limit increase for 60- to 63-year-olds may not seem significant, at $3,750 for deferred compensation accounts and $1,750 for SIMPLE IRAs on top of the standard contribution limits, but the potential compounding interest and investment returns on these amounts could be key to your financial well-being throughout retirement. Additionally, making these catch-up contributions pre-tax might reduce your taxable income and place you into a lower tax bracket.

When adding the catch-up contribution to the annual limit for a defined contribution retirement plan, which is $23,500 in 2025, you could be putting up to $34,750 into your retirement funds if you’re aged 60-63. For a SIMPLE IRA, the standard contribution limit is $16,500, and adding a catch-up of $5,250 if you’re aged 60-63 brings the total to $21,750. Remember to make the catch-up contributions by Dec. 31 to get the tax benefits for that tax year.

The impact of catch-up contributions is shown in the following scenario.

More changes to catch-up contributions

Beginning in 2026, there will be further changes to the rules regarding catch-up contributions. As of 2025, you can make catch-up contributions to your defined contribution retirement plan if it allows, up to the IRS limits, regardless of your income. However, starting in the 2026 tax year, pre-tax catch-up contributions will only be allowed if you earn less than $145,000 annually.3 If you earn more than $145,000 annually (adjusted for inflation), the contributions will be designated as after-tax Roth contributions.

This change in 2026 means that, while you won’t get a tax deduction on the catch-up contribution amounts when they’re made, you can save on taxes when you make withdrawals (if you’re age 59 ½ or older and made your first standard contribution at least five years prior). Read more about the differences between a Roth 401(k) and traditional 401(k).

Next steps

Do you want to become one of the 15% of employees of retirement age to make a catch-up contribution in a retirement plan, if you aren’t already? Or maybe you want to increase your catch-up contribution next year because you’re aged 60-63. It may not be surprising that the majority of those who use the catch-up provision have the highest salaries, longest job tenures, and highest account balances. But the law changes are part of the SECURE Act 2.0, legislation passed at the end of 2022 to help more American workers — not only the ones with the highest salaries — achieve their long-range financial goals.

If you’re a working individual over age 50, consider making catch-up contributions to your retirement plan to help strengthen your retirement savings and success in retirement. If you’re aged 60-63 you can take advantage of the increase in 2025 catch-up contribution limits.

Check with your wealth advisor to determine if it’s the right choice for you, given your cash flow, retirement plan assets, and other personal circumstances. Not a Mercer Advisors client and want to discuss whether you’ve optimized your retirement funds for a long retirement? Let’s talk.

1 “How America Saves Report 2024,” Vanguard Institutional, 2024.

2 “401K Calculator,” Calculator.net, Dec. 4, 2024.

3 “IRS announces administrative transition period for new Roth catch up requirement; catch-up contributions still permitted after 2023,” Internal Revenue Service, Aug. 25, 2023.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Hypothetical examples are for illustrative purposes only. All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

The CDFA® and Certified Divorce Financial Analyst marks are the property of the Institute for Divorce Financial Analysts, which reserve sole rights to their use, and are used by permission.