The decision to retire can be anxiety-inducing if your financial plan lacks strategies to protect your investment portfolio from depleting too quickly due to unexpected expenses, market volatility, or inflation.

When you understand how your desired income and spending goals in retirement can impact your portfolio long term, it’s easier to create a plan for weathering economic challenges that are out of your control. It also helps with taking steps to ensure your money lasts through the end of your life.

Three essential keys for retirement readiness can help you avoid worrying about your financial security in retirement.

Key #1: Establish a withdrawal rate

Your retirement strategy should begin with setting a withdrawal rate that enables your portfolio to support you and help you achieve other goals for the rest of your life. By tracking your withdrawal rate, you can identify whether you might be overspending based on the assets you own.

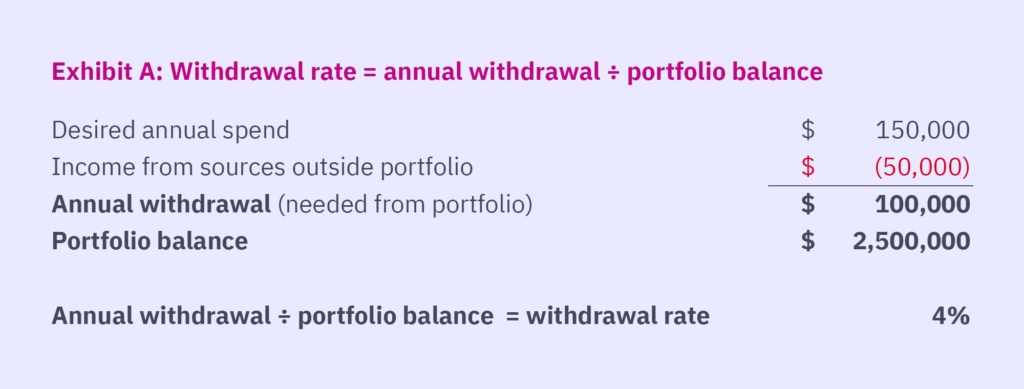

To calculate the amount you’ll need to withdraw from your portfolio each year:

- Determine how much you want to spend annually while in retirement.

- Add up the amount of income you’ll receive from sources outside of your portfolio, such as Social Security and pensions.

- Subtract your amount of outside income from your total desired spend.

The difference represents how much money you will need from your retirement account annually. Dividing that amount by your total portfolio value produces your withdrawal rate. (See the example in Exhibit A.)

An initial withdrawal rate of 4-5% is typically sustainable. Over the course of retirement, though, you should expect to increase your withdrawal amount by 2-3% per year on average to adjust for annual U.S. inflation rates. If you spend too much of your portfolio balance early in retirement, and experience poor investment performance, your money may not last as long as you need.

The impact of taxes and market volatility on your withdrawal rate

Now that you understand how to determine your withdrawal rate, it’s important to recognize that the type of retirement accounts you withdraw from can influence that rate. For example, if you need $100,000 annually from your traditional IRA, which is a tax-deferred account, the taxes on your distribution should be factored into your withdrawal rate. Also, if most of your savings are in tax-deferred accounts such as a traditional IRA or 401(k), a meaningful change in the tax code could cause profound spikes in your withdrawal rate. However, if you make withdrawals from a Roth IRA or bank saving account, which is tax-exempt, you typically won’t have to pay income taxes on withdrawals and changes in tax codes won’t matter. Diversifying with tax-deferred and tax-exempt accounts may enable you to get the same amount of cash flow without paying as much in taxes.

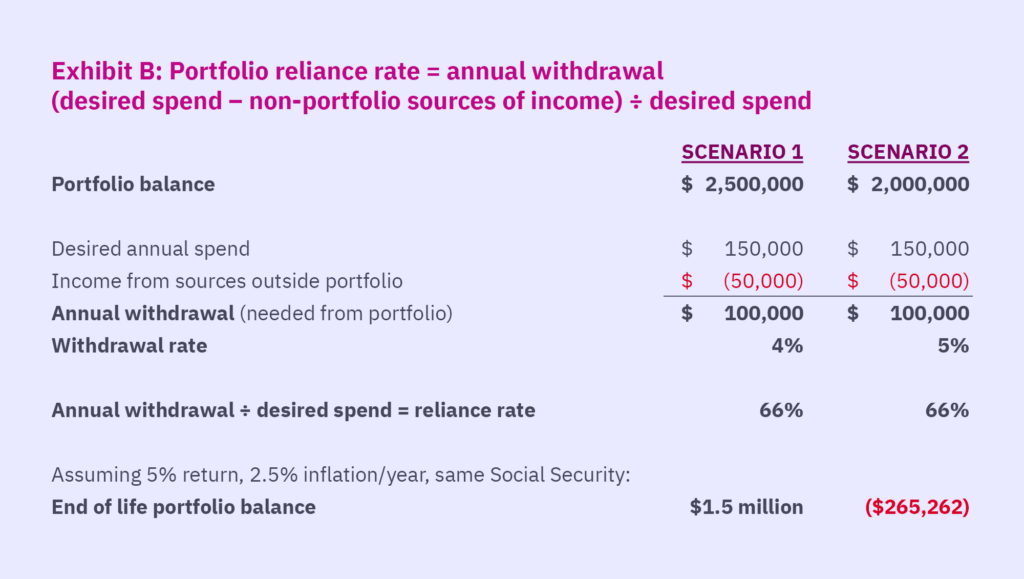

Market volatility can also impact your withdrawal rate. If your portfolio declines significantly, the withdrawal rate could represent a much larger portion of the reduced portfolio value. Per exhibit A, if the portfolio decreases from $2.5 million to $2 million, and your initial withdrawal rate is 4%, you might want to increase the rate to 5% to maintain your annual $100,000 withdrawal. But this decision could leave little room for adjusting the annual withdrawal rate when expenses get higher over the course of your retirement.

Ultimately, your target withdrawal rate should be based on multiple factors outside of tax and market considerations, such as your age, asset allocation, and goals for legacy planning. Also, keep in mind that you are likely to adjust the amount of cash you withdraw over the years. But the more conservative your withdrawal rate, the less chance there will be that you’ll have to adjust it during market declines.

Key #2: Know your portfolio reliance rate

Another critical number to know is your portfolio reliance rate, which is the percentage of your retirement that will be dependent on your investment portfolio rather than external sources.

Your portfolio reliance rate also aids in assessing how much your income will be impacted by market downturns. For example, if you are withdrawing 5% of your portfolio annually and those withdrawals provide 10% of your income, you’re probably going to be less sensitive to market declines than if the 5% withdrawal provides 90% of your income.

Look at the hypothetical examples shown in exhibit B for a client retiring at age 65.

Scenario 1:

- The initial retirement portfolio has $2.5 million with anticipated annual spending of $150,000, and income of $50,000 per year from Social Security.

- The initial annual withdrawal rate is 4% ($100,000) with a reliance rate of 66%.

- Based on the assumption of a 5% return-on-revenue, 2.5% inflation yearly, and no increase in Social Security, the client’s end-of-life portfolio balance will be $1.5 million.

Scenario 2:

- After a 20% decline in the portfolio, the initial retirement portfolio has $2.0 million.

- The initial annual withdrawal rate needs to increase to nearly 5% to support the desired income of $100,000.

- Based on the assumption of a 5% return-on-revenue, 2.5% inflation yearly, and no increase in Social Security, the client’s end-of-life portfolio balance will be –$265,262.

- Since 66% of the client’s income is derived from the portfolio, there will need to be adjustments in spending during down markets. If the client had a lower reliance rate or withdrawal rate, however, the portfolio could weather down markets and no spending adjustments would be necessary.

What reliance rate is appropriate for you?

The appropriate reliance rate depends on factors such as your retirement age, your investment returns, the size of your retirement portfolio, and the amount you hope to leave in your estate. The lower your portfolio reliance rate, the less impactful market declines tend to be. The higher your withdrawal rate, the riskier a high reliance rate might pose.

Investors with high withdrawal and reliance rates tend to make more emotionally driven decisions — such as selling depreciated equities and going to cash — during market declines (learn more about behavioral finance.) Such choices can work against investors and impact their retirement goals. When planning for retirement, the ideal goal should be building a portfolio that preserves your standard of living.

Key #3: Diversify your assets

In uncertain times, it’s tempting to opt out of the financial markets to avoid declines. But investing too heavily in cash or fixed income can be just as dangerous as investing too heavily in equities. Cash can be deceiving — it may look stable if you don’t see how it decreases in value. Over time, your purchasing power with cash can erode as annual inflation quickly eats into your retirement plan. Fixed income is suitable for short-term investing but won’t keep pace with inflation over the long term. Conversely, equities are not appropriate for short-term goals but can provide a significant boost to your retirement savings.

The key is a retirement portfolio that balances your current income needs with growth that funds your spending goals well into the future, while also considering your total returns. This can be done by investing in less-volatile securities for short-term needs and in more-volatile securities with higher potential returns for long-term goals. The right mix of shorter- and longer-term investments will vary from person to person.

Your investments might look like this:

- Short term (next 1-2 years): Cash and fixed income, offering low returns but high stability

- Intermediate (3-10 years out): Securities that generate a yield, such as bonds and high-dividend-paying stocks, which are somewhat more volatile but can be expected to outpace inflation

- Long term (beyond 10 years): Securities that are focused on growth via capital appreciation

This approach to diversifying your assets helps make your portfolio less susceptible to market declines because you are not drawing income from a single investment type that may be subject to market volatility.

Expect and prepare for challenging times

While you cannot control the markets or economic environment, you can take control of how you prepare for your retirement by making spending and income choices that protect your investment portfolio. A plan that doesn’t account for bear markets and multiyear declines is not a good plan. History has taught us to expect significant market changes from time to time. Confidence and excitement should inspire your retirement readiness, rather than anxiety.

Contact your wealth advisor if you want to stress test your retirement goals and investment portfolio now or during tumultuous periods in the market.

If you aren’t a Mercer Advisors client and want to know more about how you can retire with a comprehensive plan that puts you in much better shape to navigate challenging economic times, let’s talk.