Annuities, like politics, tend to manifest strong feelings of love or hate among investors, with little in between. This article focuses on deferred-income annuities, also called longevity annuities, which have annuitization dates during an individual’s retirement years. We’ll also discuss how these policies can be utilized in retirement accounts as qualified longevity annuity contracts (QLACs).

Deferred-income annuity

A deferred-income annuity requires a premium payment today in return for an income stream that begins in the future. The income stream can be based on a single life, joint lives, or a period certain, along with various death benefit payouts such as a cash-refund option. The income and death benefit selections are best determined with a thorough understanding of your needs in the future.

- Single-life annuities will pay the guaranteed income stream for the life of the annuitant. Payments cease upon their death.

- A joint-life annuity will pay the guaranteed income stream for the longer of the lives of the annuitants. Upon the second death, payments cease.

- Period-certain annuities pay for a set period, such as 10 or 20 years. This option is usually combined with a single- or joint-life annuity, and the payments last the longer of the period certain or the life span of the annuitant(s).

- Cash-refund option provides the beneficiaries of the annuitant with an amount equal to the premium less cumulative income payments received prior to the annuitant’s death.

Example: Mike, 58, purchases a deferred-income annuity with $50,000 today. He plans to retire at 65 and wants the income stream to begin the month after his retirement. Assuming there are no joint lives, he can opt for $423 per month in a single-life annuity, $383 per month in a single-life annuity with 20-year certain, or $408 per month in a single-life annuity with cash-refund option.¹

If Mike is not concerned with leaving behind a death benefit, his best option is to receive the highest payout over his lifetime—$423 per month.

Qualified vs. nonqualified

Annuities can be classified as qualified or nonqualified, depending on which dollars are used to purchase them. An annuity is qualified when it’s purchased with retirement plan dollars, such as from a 401(k), 403(b), 457(b), or IRA. Purchasing with money from a checking, savings, brokerage, or other nonretirement account is considered nonqualified.

The main difference between qualified and nonqualified is related to income taxation. Qualified annuity payments are generally considered fully taxable ordinary income. Nonqualified annuity payments are split between tax-free return of capital and taxable earnings. An exclusion ratio is used to discern which portion of the income payment is taxable as gain and which portion is excluded from taxation as part of the cost basis.

Qualified longevity annuity contracts

The IRS stipulated the terms of a QLAC in final regulations in 2014.² These regulations provide relief from required minimum distributions (RMDs) on the value of a deferred-income annuity that meets the following rules:

- The annuity must begin payouts no later than the month after the individual turns age 85.

- The annuity must provide fixed payouts, though it may have a cost-of-living adjustment.

- The annuity cannot have a cash-surrender value but may have a cash-refund benefit.

- The maximum premium is limited to 25% of any employer retirement plan, or 25% across all traditional IRAs.

- The maximum premium is limited to $125,000 (inflated) in total for each individual.

SECURE 2.0, passed in late December 2022, made changes to this list by eliminating rule 4 and adjusting rule 5 to a total of $200,000 in 2024. The overall limit for 2023 is $155,000.

Example: Grant is 60 years old and married. He decides to invest $200,000 in a QLAC that will begin payments as far into the future as possible—when he’s 85. The income choices include a $12,145 per month single-life annuity or a $7,063 joint-life annuity with his spouse.

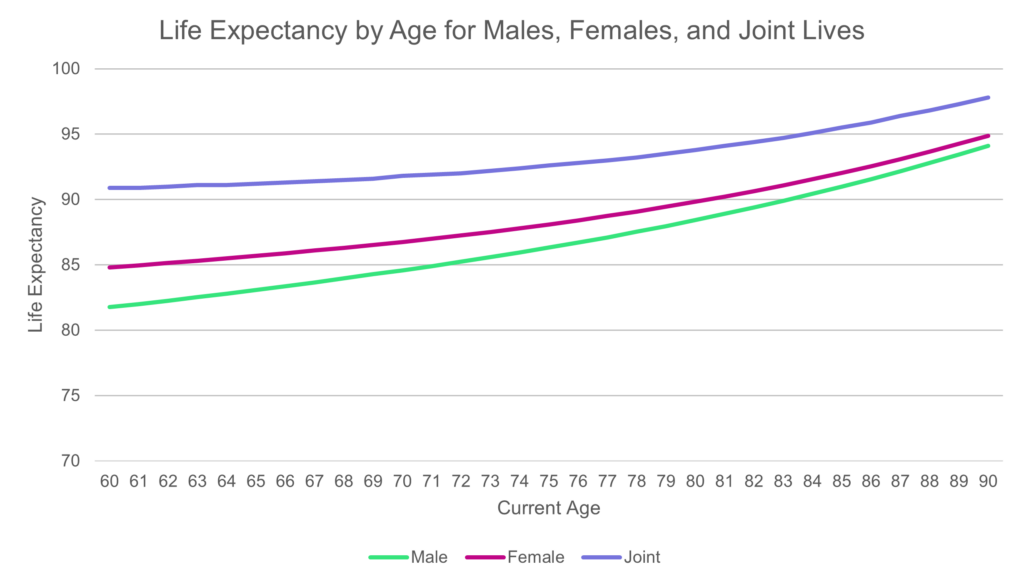

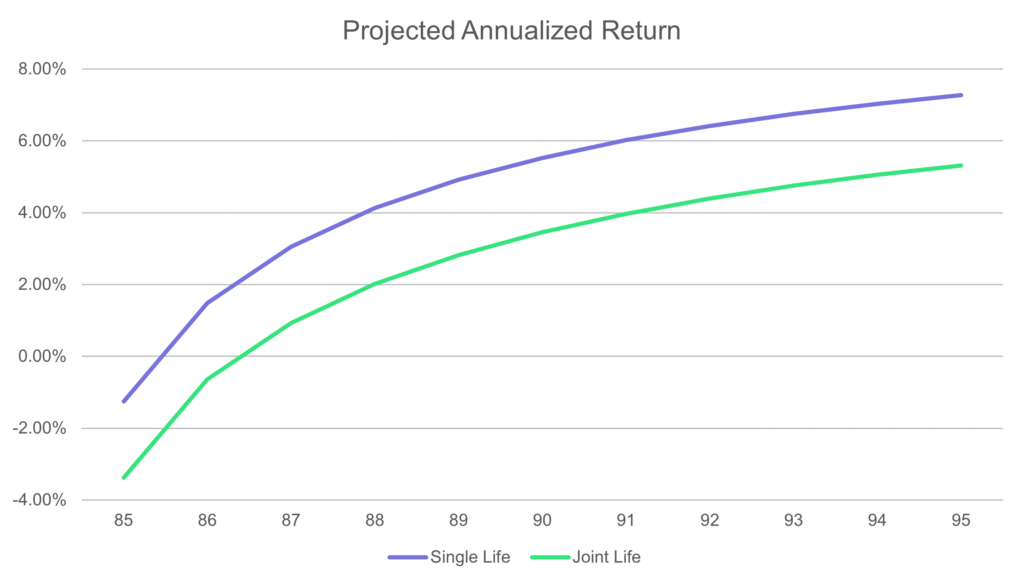

According to the life-expectancy tables (see graph below), Grant should live to about 82 years of age. This means that his anticipated return is –100%! If he does live to age 85, he’ll quickly make his money back and start earning a return in the second year. By age 95, should he live that long, the implied return is just north of 7% annualized.

If Grant chooses the joint-life annuity, the life expectancy at his and his wife’s current age of 60 is around 91. The anticipated return is almost 3.5%. If at least one of them makes it to age 95, the return jumps to a little over 5% annualized.

Chart data: https://www.ssa.gov/oact/STATS/table4c6.html and https://www.nyc.gov/assets/olr/downloads/pdf/nyceira/joint-table.pdf

Required minimum distributions

While RMDs aren’t necessary on the intrinsic value of a QLAC, it’s important to note that those distributions are merely deferred, not eliminated. When the owner begins income distributions from the policy, the amounts are deemed to satisfy the RMDs associated with the annuity only. They cannot be utilized to offset RMDs associated with other retirement plan assets.

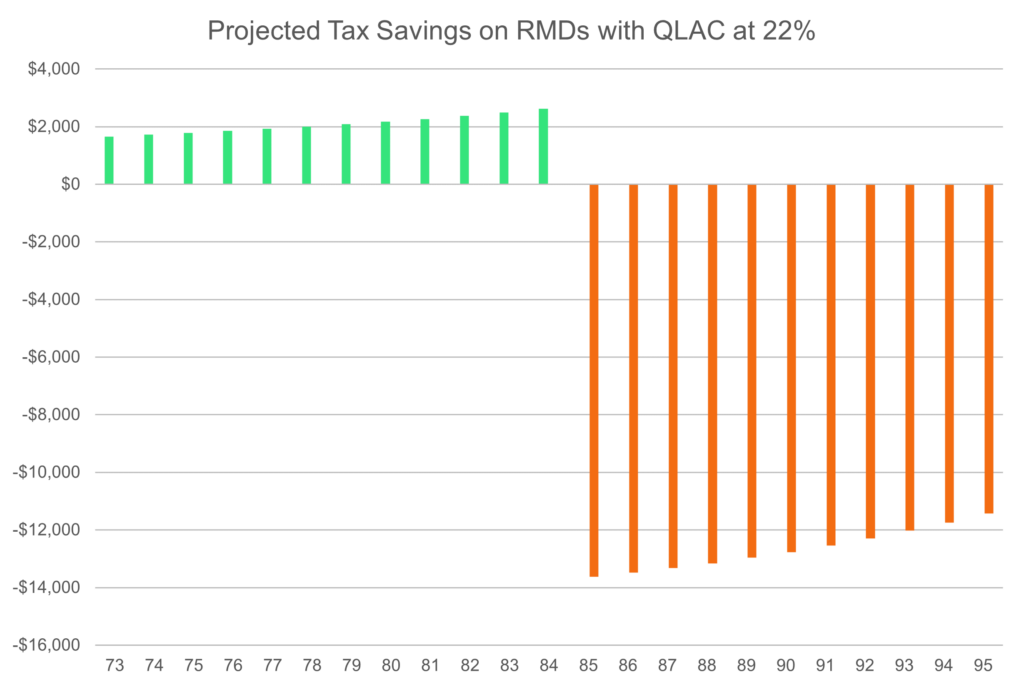

Example: Margaret is 72 and will begin RMDs next year when she reaches age 73. She decides to invest in a QLAC for $200,000 to reduce the size of her RMDs and defer the income until age 85. She’s in the 22% federal tax bracket (state tax ignored). The first RMD is reduced by $7,547 (that’s $200,000/26.5), which saves her $1,660 in income tax. Each year, the amount of RMD she doesn’t have to take increases because her life expectancy diminishes. In total, she’ll save about $25,000 in taxes within the 22% bracket over the 12 years of deferral.

The downside comes when the policy begins paying out. Her estimated payout for a single-life annuity is $74,412 per year. This will fully offset the RMD she’d have to take, calculated as $12,500 at age 85, but will not offset any additional distribution requirements. In short, she’ll have to recognize about $62,000 more taxable income than the standard RMD rules would dictate. As such, her tax benefit turns negative, requiring about $13,600 in additional taxes, still assuming a 22% tax rate!

Death of the annuitant

Since a QLAC is purchased with retirement account assets, the policy will provide various results to the beneficiary, depending on certain elections.

- Single-life income stream will end upon the annuitant’s passing. If there’s still a balance in the accumulation value, in most contracts, this is considered to also be the death benefit and would be paid to a beneficiary. If, however, the amount of income received by the initial annuitant depletes this account, then all benefits would cease upon the annuitant’s passing.

- Joint-life income stream will continue to pay out, usually to a surviving spouse for the remainder of their life.

- If a period-certain option was elected as part of the income stream, any years remaining as part of that initial timeline would be paid to the beneficiary. So, if a 20-year period certain were elected and the annuitant passes in year five, the beneficiary would receive the remaining 15 years of payments.

- Cash-refund options pay out the difference between the total premium paid and any benefits received. These payments are treated as an RMD in full in the year of receipt, without eligibility for rollover.

Example: John and Jane are married, and John buys a single-life QLAC within his IRA for $100,000. John, unfortunately, passes away at age 75 before any payments have commenced. He opted for the cash-refund option, so Jane will receive $100,000 and must recognize the full amount as taxable income immediately.

If John had not purchased the QLAC, the $100,000 value (less any RMDs taken prior to death) would transfer to Jane under the standard IRA RMD rules, effectively allowing her to stretch the distributions over the remainder of her life.

Should I buy a QLAC?

An investment in a QLAC needs to be considered primarily from the vantage point of whether an annuity is the right solution for you. Do you want the guaranteed steady stream of income at some point late in your life? Remember, longevity annuities can result in a complete loss of premium if the owner does not live long enough, which is part of the design. High loss rates are expected and help to create “mortality credits” to pay those owners who do live a long time. Hence the generally good returns hinge on the annuity holder living a relatively long life.

Purchasing a QLAC specifically for RMD deferral is usually not a wise decision. As mentioned earlier, the tax bill will come back around when income begins. If a taxpayer has high income in early retirement and expects low income in later retirement, the deferral of RMDs can make more sense. Likewise, the deferral of RMDs will make more sense if a taxpayer can reduce their adjusted gross income to eliminate higher Medicare premiums or the additional Medicare taxes on net investment income. If you’re not sure about the best solution for your situation, reach out to your advisor to discuss the options.