During your thirties and forties, it makes sense to focus on career and family in your daily life — building assets and managing household expenses. Planning for retirement in these earlier stages of life might not include anything more than contributing to an employer-sponsored 401(k) plan. But by age 50, if you haven’t already started, there are additional steps you should consider to help secure your financial future. And for different life stages, including ages 50-59 and forward, there will be evolving and changing financial needs to consider for retirement.

For instance, prior to turning age 60 is a good time to think about how you envision your retirement life, like where you will live and how you will spend your time. It’s also good to take advantage of catch-up contribution allowances for 401(k) accounts, individual retirement accounts (IRAs), and health savings accounts (HSAs). Before turning age 66, think about a realistic age to retire. Prepare by potentially adjusting tax and investment strategies as well as finalizing plans for health care and income replacement.

These life-stage checklists can serve as a guide to determine and help meet your objectives for financial success in retirement.

Ages 50-59

- Lifestyle

Calculate how much money you’ll need each month, in addition to Social Security payments, by subtracting your expenses and taxes from your monthly income. Pay down debt that does not have tax-advantaged interest, which is deemed bad debt. Mortgage debt is usually viewed as good debt since real estate can appreciate and interest may be tax deductible. Think about when you might want to retire fully or shift to part-time employment. Determine the lifestyle you want in retirement and where you want to live.

- Family

Consider how to juggle financial priorities connected to your family responsibilities. For instance, should you be paying down debts, such as student loans for your children, or adding money to savings and investment accounts? Do you have children or elderly parents who need or will need financial support? Have a plan to cover these potential needs whether it be student loans for your children, or Medicaid or long-term care insurance for your parents.

- Insurance

There are many insurance solutions to consider before and during retirement for protecting you and your family from potentially disastrous expenses. To cover health care costs, consider contributing to an HSA. If you already have an HSA, it may be time to increase contributions. Do you have family members who will need insurance after you retire? It is important to keep in mind that individuals are not eligible until age 65 for Medicare, the federal government health insurance program — and Medicare does not apply to spouses, domestic partners, or dependents. Life insurance is another solution for taking care of your family. Whether or not you have life insurance through an employer, consider a separate policy that you could potentially use as a wealth transfer tool. Are you interested in annuities as extra income in retirement? Find out the advantages and disadvantages of annuities and whether they’re right for you. Lastly, receive quotes for long-term care insurance to cover care with the use of home health care, assisted living, or nursing home care. Note that the long-term care environment has changed dramatically and there are options to have life insurance with long-term care riders. Ask your wealth advisor what is available in your state and whether it is a good option for you. Note that it is better to apply early for these coverages as you may become uninsurable once diagnosed with a medical issue.

- 401(k) and IRA accounts

Consider maximizing your employer’s retirement plan and your IRA, including making catch-up contributions. The IRS has annual contribution limits to abide by. Be aware of laws and tax rules for early withdrawals. Determine if your plan allows Roth contributions and if you should be contributing some or all of your retirement savings to your Roth 401(k).

- Asset allocations

Review and potentially adjust asset allocations for investment accounts. Does it make sense to have less aggressive allocations or not? It could depend on your life expectancy, cash needs, and your ability to handle volatility. Get recommendations on allocations from your wealth advisor.

- Taxes

There are proactive ways to manage and help reduce your lifetime tax burden, including moving out of state and converting pre-tax retirement plans to a Roth IRA. Are you doing all you can to reduce your lifetime tax liability? Consult with your wealth advisor if you aren’t sure. Keeping up with tax codes and laws can be quite challenging and there may also be strategies that make sense for you to take advantage of during this stage of your life.

- Estate planning

It isn’t too early to have an estate plan in place. If you own real estate, have retirement accounts, such as an IRA or 401(k), have children, or have insurance policies, then you most likely need an estate plan. If you don’t have children nearby or don’t want to burden them, it may be worth considering a corporate trustee for assets held in a trust.

Ages 60-65

- Lifestyle

Preparing for retirement includes making financial decisions as well as planning for how you are going to spend your time. If you connect your identity to your work or you don’t have hobbies, it is time to find new interests. Start planning for a date when it is reasonable and comfortable to retire. Consider exploring volunteer opportunities for when you are retired and have more time on your hands.

- Family

If you have a spouse who isn’t retiring at the same time, you might want to discuss how your relationship could change. If you are providing care for elderly parents or other dependents, think about how you want to allocate your time and resources in retirement. How much time, if any, do you want to spend caring for your grandchildren? Review your retirement spending plan to determine how much you want to support adult children or grandchildren financially.

- Social Security

Deciding when to claim Social Security benefits will depend on your retirement age, marital status, benefit amount, additional income, and health. The monthly Social Security payment was $1,910.79 for an average retiree in 2024.1 Even if your payment is more than the average, you might consider taking Social Security benefits at a later age to receive higher payments. Keep in mind that claiming benefits before reaching full retirement age will result in a lower monthly check and potential repayment if you end up earning over the income threshold. For those born in 1960 or later, the retirement age for full Social Security benefits is 67.

- Additional income

How much income will your additional investments provide — from a pension, 401(k) or IRA — and for how long? With a rising cost of living and an average longer life expectancy, long-term planning can be critical to financial security as you age.

- Insurance

Are you prepared for health care costs after retirement and possible long-term care? Consider how you will fill the health care insurance gap if you retire before being eligible for Medicare at age 65. The average cost, according to Forbes, in 2024 for a single plan for a 60-year old on the U.S. government’s Health Insurance Marketplace® is $994 per month and $1,987 per month for a couple.2 Also, revisit your other insurance policies to ensure they are up to date and still align with your wealth management goals.

- Asset allocations

Are your investments fully diversified globally in both equities and fixed income? It also may be time again to adjust asset allocations if you favor an income strategy from investments over a growth strategy during this life stage.

- 401(k) and IRA accounts

If you are still earning income, continue to contribute to an IRA or qualified plan through your employer. Have a withdrawal strategy for when you retire. It may be worth delaying distributions if you have a pension or accelerating distributions to utilize lower income tax brackets.

- Taxes

There are often important tax strategies to weigh between ages 60-65, as those leaving the workforce typically fall into a lower tax bracket after retirement. If you have elderly parents with limited income, and you are paying their medical or long-term care expenses, you may be able to claim them as dependents and their expenses as a tax deduction. Consider talking to a certified public account (CPA) about all tax strategies.

- Estate planning

Wills and other estate plans take on greater importance during this time, as does touching base with family members about long-term financial needs. If you don’t already have an estate plan, it’s time to consider one. If you already have one, update it to address changes in life events and tax laws.

Ages 66-75

- Lifestyle

Revisit your retirement vision. Maybe you want to continue to work, either full-time or part-time. Or you might want to volunteer your time to charity. Do you and your spouse want to travel? Should you downsize your home? Consider the effects of all your decisions on your family, your finances, and your health. Most importantly, celebrate decades of diligent work by retiring to enjoy spending time the way you want.

- Family

Like earlier life stages, it’s important to evaluate how family needs factor into your financial security and retirement plan. Managing priorities for taking care of ourselves and our loved ones can get more challenging as we age. According to a March 2024 report from the Alzheimer’s Association, in the U.S., there are nearly 7 million seniors living with Alzheimer’s or dementia.3

- Insurance

Now that you are past age 65 and eligible for Medicare, you might consider supplementing the insurance with additional options. If you don’t already have a long-term care plan, consider having one to ease the financial and caregiving burdens on your loved ones. To protect your wealth, you may need excess liability for homeowners and auto insurance or umbrella insurance, which offers invaluable coverage against personal injury, property damage, and other claims.

- 401(k) and IRA accounts

Individuals older than age 73 may face required minimum distribution (RMD) rules for employer-sponsored and other qualified retirement plans, so ensure they’re a part of your plan.

- Asset allocations

Consider how comfortable you are with risk regarding asset allocations and market fluctuations in your investment accounts. Make adjustments as needed.

- Taxes

As in previous life stages, pay attention to your changing tax situation and do what you can to minimize your taxes. Consider hiring a tax accountant who has the knowledge and experience to help with the complexities of tax planning.

- Estate planning

Revisit your estate plan or create one. Check to be sure you have a current medical directive, the beneficiaries you want are accurate on your accounts, including grandchildren that may have been born since your last revision, a succession plan for your business, and protection for your digital assets. If you have savings and retirement accounts, insurance policies, real estate, large investments, or a small business, a solid estate plan can help you secure your assets as they pass on to the next generation. Consider hiring an estate attorney if you haven’t yet. In addition, it is good practice to provide your adult children a comprehensive list of your assets and accounts as well as your end of life wishes, should something happen to you.

Age 76 and Older

- Lifestyle

If you’ve worked diligently for decades on your financial planning, the late seventies and beyond is a time for relaxing and enjoying the company of friends and family. To save time for joyful activities, you might consider automating your deposits and bills. And set a routine for reviewing income and expenses, potentially with family members. Keep yourself aware and educated about fraud and scams that prey on seniors.

- Family

Discuss your wishes for your legacy with your family members, beyond your written estate planning documents. This could include asking your children to volunteer at a charity as a family, spend more time with your grandchildren, or go through old photos together. Consider gifting money to family and charities in a tax efficient manner.

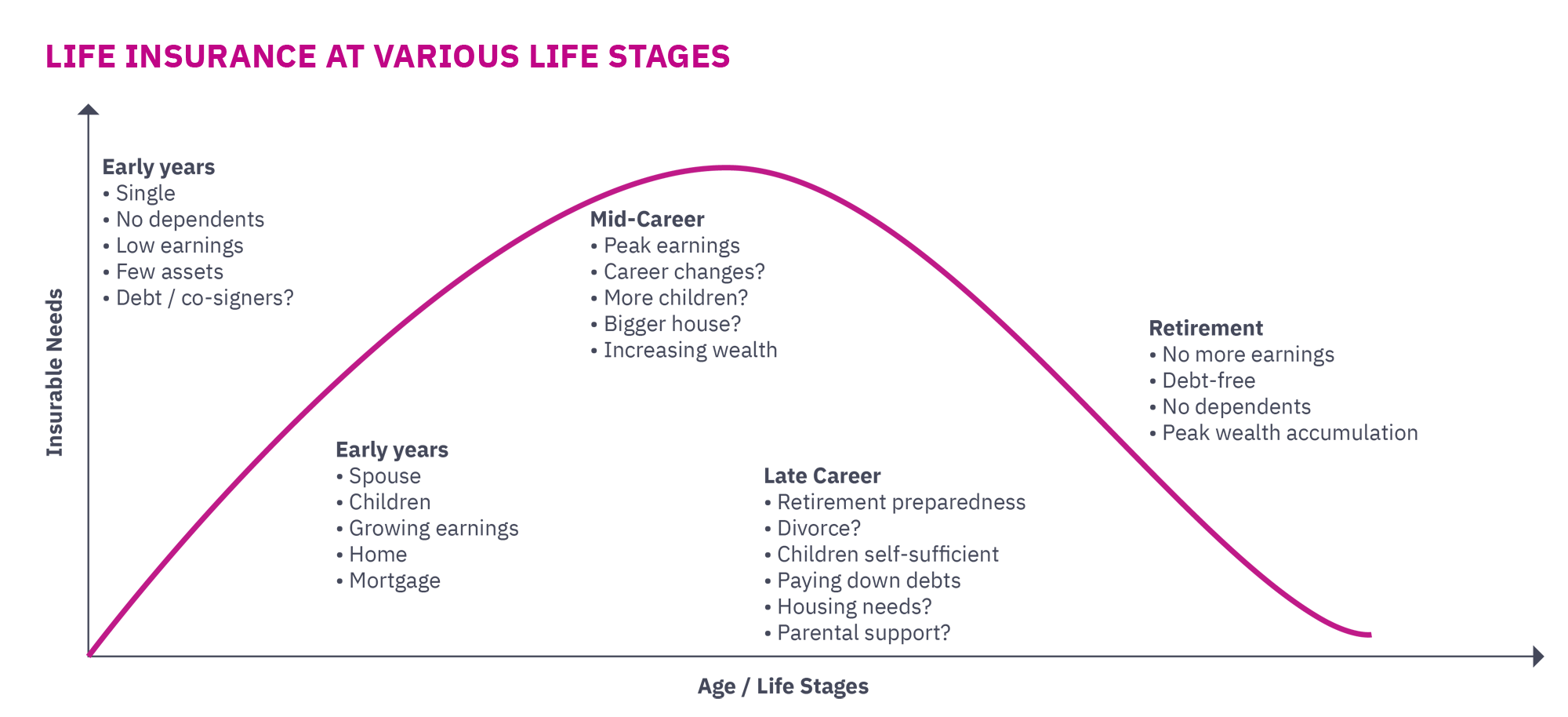

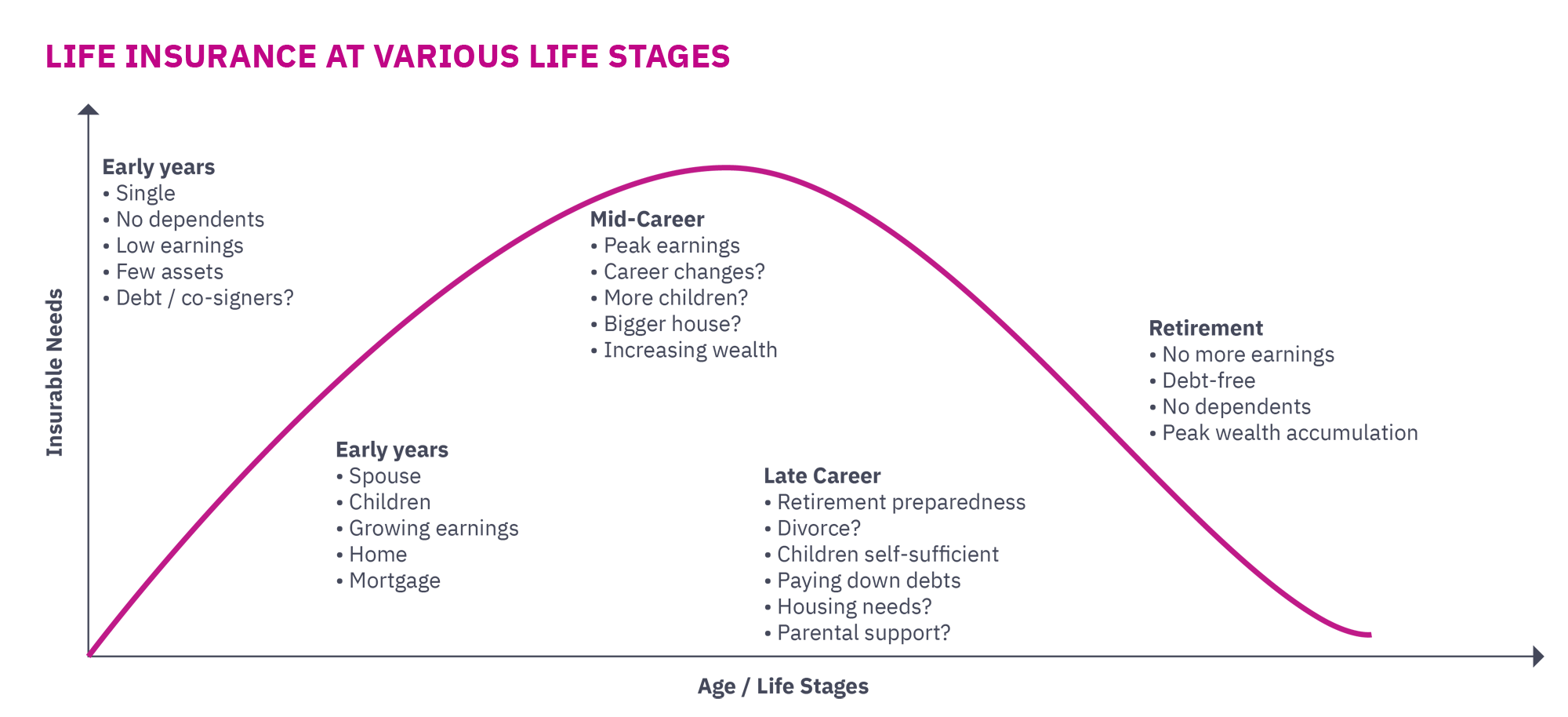

- Insurance

Have you reviewed your insurance policies lately to adjust for any changes in health, lifestyle, and financial goals? At every life stage there are different needs for life insurance, health insurance, umbrella insurance, auto insurance, and others. It’s also important to revisit pricing and length of coverage to adjust as needed. Be sure to have your insurance agent run an in-force ledger to ensure your policy will provide the intended benefits.

- Asset allocations

Asset allocations for supplying cash needs should typically be conservative and focused on income rather than growth, but the right mix of stocks and bonds will depend on plans for your estate, wealth transfers to your heirs, and any intended charitable contributions. Consider whether you are investing in a way that maximizes any inheritance for your loved ones.

- Taxes

Charitable donations may reduce taxes. To fulfill annual RMD requirements from your IRA, you might consider directing a qualified charitable donation (QCD) to charity which reduces your taxable income. If you volunteer at a charitable organization, you can deduct the miles driven during your volunteer time on your tax return, if you itemize. Because there are so many ways to lessen your tax burden, it’s best to explore them with a CPA.

- Estate planning

You create your legacy. A complete estate plan will include longevity planning, generational wealth transfers, charitable giving, and final arrangements planning. With ever-changing estate tax laws, it is best to revisit your estate plan to ensure your heirs receive the maximum benefit.

We understand that your life story — and financial objectives — are unique to you and your family. Our advisors collaborate with you on a complete approach for your retirement years that blends investment advice, financial planning, estate planning, and tax strategies. In addition, our many years of experience helping clients has given us insight into how to navigate personal matters beyond finances, such as having difficult conversations with family members or finding a new purpose in retirement.

If you aren’t yet a Mercer Advisors client and want to learn more about achieving financial success in retirement, let’s talk.

1. Monthly Statistical Snapshot, Social Security Administration, February 2024.

2. “Best Health Insurance For Retirees Of 2024”, Forbes Advisor, January 3, 2024.

3. “Nearly 7 Million Americans Have Alzheimer’s, and Caregivers Are Stressed”, MSN HealthDay, March 20, 2024.