Ready to learn more?

Jennifer Baick, MBA, CFP®, CDFA

VP, Financial Planning Group

Get the IRS inflation adjustments for 2025 in a quick and easy reference guide to help with your planning and income tax filing.

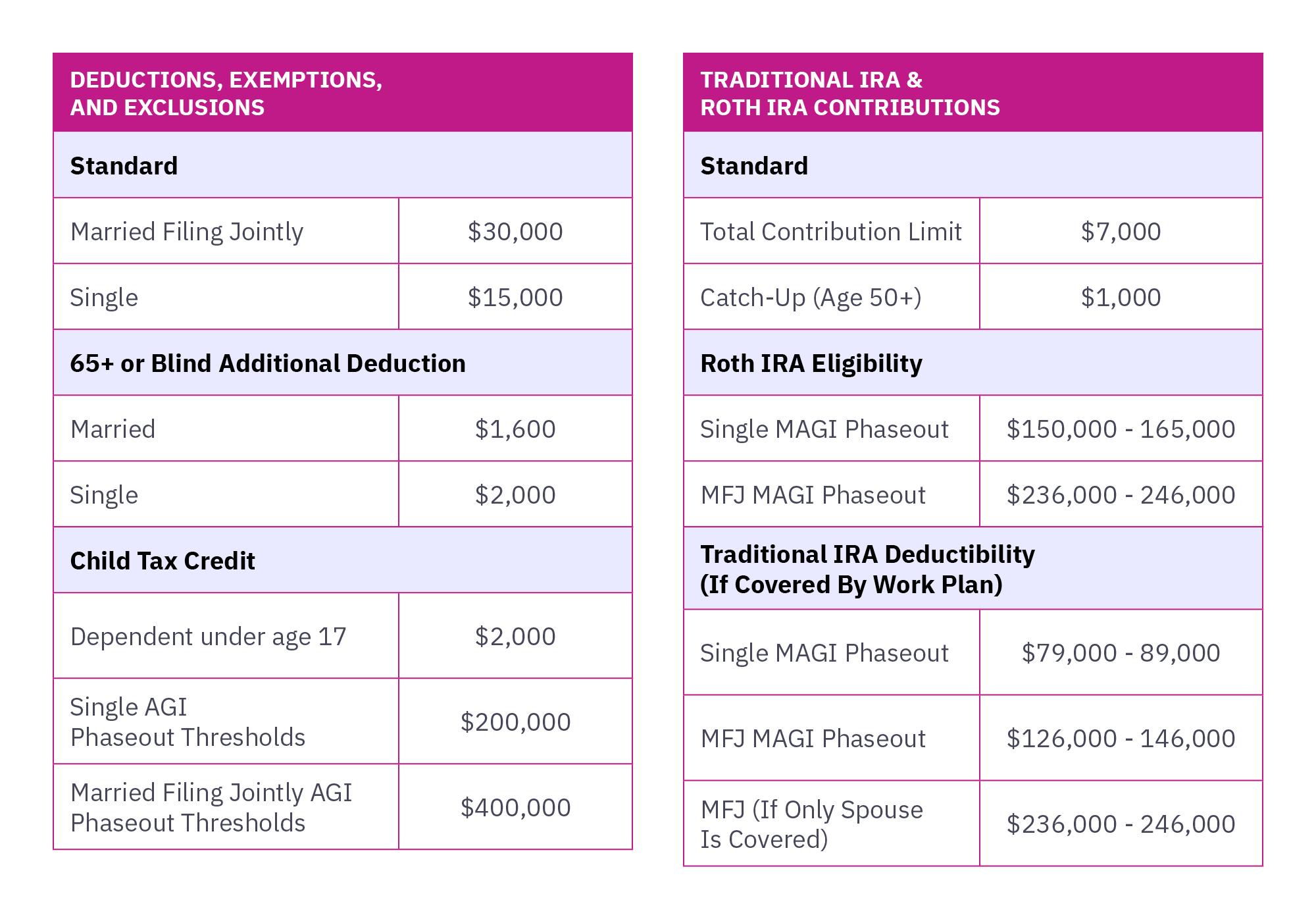

For tax year 2025, the IRS announced its annual inflation adjustments as shown below.1 These changes are for income tax returns that you would file in tax season of 2026. They include tax brackets, rates, deductions, and other important adjustments such as contribution limits for retirement accounts.

For more 2025 Income Tax Essentials, download the PDF here.

If you want to optimize your finances, we can help with your tax strategy. Our tax planning service is integral to our financial planning process which also includes investment management, estate planning, and insurance solutions. We also have tax preparation services available.

Contact your Mercer Advisors wealth advisor for more information. Not a Mercer Advisors client? Let’s talk.

1 “IRS releases tax inflation adjustments for tax year 2025,” IRS, Oct. 22, 2024.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Tax preparation and tax filing are a separate fee from our investment management and planning services. Mercer Advisors is not a law firm and does not provide legal advice to clients. All estate planning document preparation and other legal advice is provided through select third parties unaffiliated to Mercer Advisors. Mercer Global Advisors has a related insurance agency. Mercer Advisors Insurance Services, LLC (MAIS) is a wholly owned subsidiary of Mercer Advisors Inc. Employees of Mercer Global Advisors serve as officers of MAIS. MAIS provides individual life, disability, long term care coverage, and property and casualty coverage through various insurance companies. For Mercer Global Advisors clients who wish to purchase insurance products, MAIS has entered into a non-exclusive referral agreement with Strategic Partner(s), where the Strategic Partner will provide necessary services relative to the marketing, placement, and servicing of the insurance products, including without limitation preparing and presenting illustrations, supporting the underwriting process, assisting with the completion and execution of applications, delivering policies, and servicing in-force business. MAIS and the Strategic Partner will be listed as either “agents” or “co-agents” on the policies. While Mercer Global Advisors does not receive a referral fee, Strategic Partner receives a percentage of the commission revenue. MAIS and Strategic Partner do have a referral fee sharing agreement.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER® certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

The CDFA® and Certified Divorce Financial Analyst marks are the property of the Institute for Divorce Financial Analysts, which reserve sole rights to their use, and are used by permission.