Ready to learn more?

Logan Baker, JD, LL.M., MBA

Lead, Sr. Wealth Strategist

Learn the differences between a private family foundation and a donor-advised fund to help maximize the benefits for your family.

Involving your family in charitable giving can be both personally gratifying and tax beneficial. Whether supporting a cause that helps a family member or your community, giving can provide immediate and long-term rewards, such as building relationships, creating a legacy, and making happy memories. Additionally, there can be tax deductions available to help lower your taxable income, depending on how you make donations. When exploring charitable giving options for your family, two popular investment vehicles to consider are a private family foundation or a donor-advised fund (DAF).

Comparing charitable giving options

A private family foundation is typically established as a nonprofit organization that is funded by a family or individual to support charitable activities and is often managed by family members. A DAF is a charitable giving vehicle that allows individuals, families, or organizations to make irrevocable contributions to a fund and then make recommendations for granting the assets to charitable organizations.

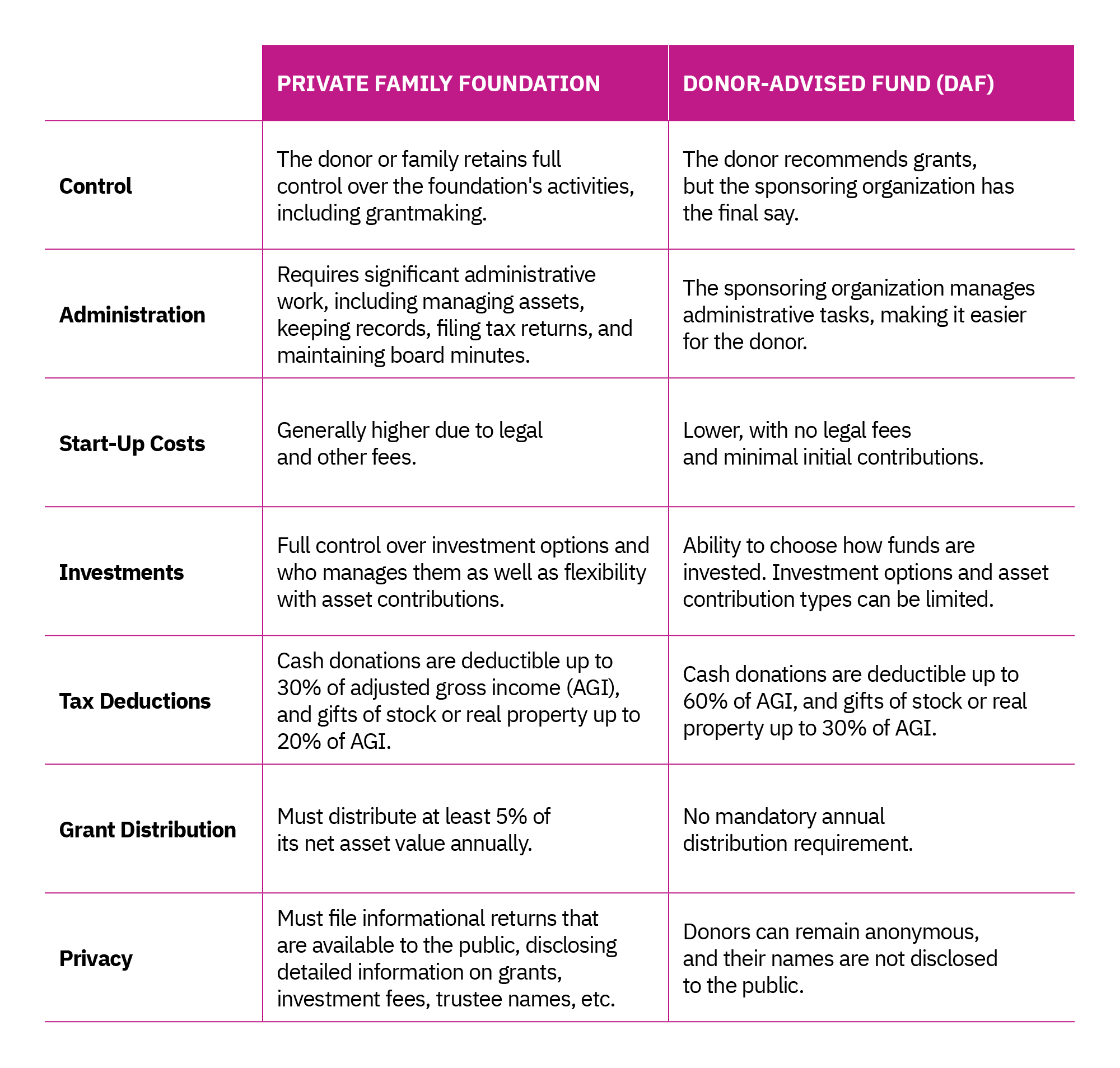

Private family foundations and DAFs have some key differences as shown in the chart below.1

Reviewing the pros and cons

The DAF has several advantages for you over the private family foundation. It’s easier to set up and less expensive — no legal fees or excise income taxes. Additionally, unlike the foundation, there are no requirements for annual distributions. You can deduct up to 60% of adjusted gross income (AGI) for cash grants and 30% for stock or real property compared to 30% for cash and 20% for stock with a private family foundation. However, while you may have more control over how funds are invested, DAFs give you less control over the final grant decisions.

Private family foundations offer more control than DAFs and can foster family involvement, but they come with higher costs and administrative responsibilities. You decide which charities to support, when, and how much, but you must distribute 5% annually of the previous year’s net assets. Regulations and requirements are stricter, and managing the account can be time-consuming for the family. However, they offer more flexibility than DAFs for accepting different types of assets into the account.

If your main goals are to foster family bonding while you’re able to enjoy it and provide an opportunity for future generations to continue the legacy of charitable giving, a private family foundation may be right for you. However, DAFs might offer more tax benefits with less work for the family.

Taking next steps

When making decisions about charitable giving vehicles for your family, it can be helpful to consult with financial and tax professionals about the options and which ones may be a good fit for your family situation. Both the private family foundation and the DAF vehicle have pros and cons to weigh depending on your goals for charitable giving as well as for transferring wealth and reducing taxable income.

Your wealth advisor at Mercer Advisors can connect you with our tax and estate planning specialists to help determine your next steps for setting up charitable giving for your family.

If you’re not a Mercer Advisors client and would like to know more about how you can efficiently donate to the causes close to your family member’s hearts while ensuring it aligns with your family’s overall financial goals, let’s talk.

1 “Comparison of Donor Advised Funds to Private Foundations.” National Philanthropic Trust, 2024.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.