Ready to learn more?

Jenna Elliott, JD, LL.M.

Director, Estate Planning

When is BOI reporting due? Find out beneficial ownership information reporting requirements.

**Since the time this article was published, enforcement and the deadline for BOI reporting was put on hold due to pending court cases. New information will be provided here when there is final resolution.**

To combat illegal financial activities, Congress enacted the Corporate Transparency Act (CTA) in 2021, mandating that many U.S. companies disclose information about their owners or controllers.1 The U.S. Department of Treasury’s intent is to reduce activities such as money laundering, drug trafficking, terrorism, and corruption, all of which can thrive in environments of corporate anonymity. The CTA reporting requirement was issued in 2022 and went into effect on Jan. 1, 2024 — it is a free and one-time reporting process (may require multiple reporting if updates need to be conveyed).

Who is required to report BOI?

The mandate generally applies to U.S. corporations, limited liability companies (LLCs), and entities that were created by filing a document with a state office or Indian tribe. Therefore, if you are an entrepreneur with an LLC or operating a small side business LLC, this law applies to you.

The required data is referred to as “beneficial ownership information (BOI)” by the Treasury Department’s Financial Crimes Enforcement Network (FinCEN) bureau, and reporting laws apply to individuals who own or control at least 25% of a company or have substantial control over it. There can be multiple BOIs of a reporting company; there is an expected minimum of one and no maximum.

Reporting companies that are required to report company applicants will also have to identify and provide information for at least one applicant. The applicant is generally an individual who directly files the document that created the company or someone who directs or controls the filing action.

There are 23 company exemptions to the law, listed in the chart below, which means the companies do not have to submit BOI reporting to FinCEN. There are more details about the exemptions found in FinCEN’s Small Entity Compliance Guide.

Exemptions to BOI Reporting Companies

| Exemption no. | Description |

| 1 | Securities reporting issuer |

| 2 | Governmental authority |

| 3 | Bank |

| 4 | Credit union |

| 5 | Depository institution holding company |

| 6 | Money services business |

| 7 | Broker or dealer in securities |

| 8 | Securities exchange or clearing agency |

| 9 | Other Exchange Act registered entity |

| 10 | Investment company or investment adviser |

| 11 | Venture capital fund adviser |

| 12 | Insurance company |

| 13 | State-licensed insurance producer |

| 14 | Commodity Exchange Act registered entity |

| 15 | Accounting firm |

| 16 | Public utility |

| 17 | Financial market utility |

| 18 | Pooled investment vehicle (foreign pooled investment vehicles have a separate reporting requirement) |

| 19 | Tax-exempt entity |

| 20 | Entity assisting a tax-exempt entity |

| 21 | Large operating company |

| 22 | Subsidiary of certain exempt entities |

| 23 | Inactive entity |

When is BOI reporting due?

According to FinCEN, if the BOI reporting requirements 2024 are not met willfully, or false or fraudulent BOI is submitted willfully, there could be civil penalties of up to $500 per day or criminal penalties including imprisonment for up to two years and/or a fine of up to $10,000.

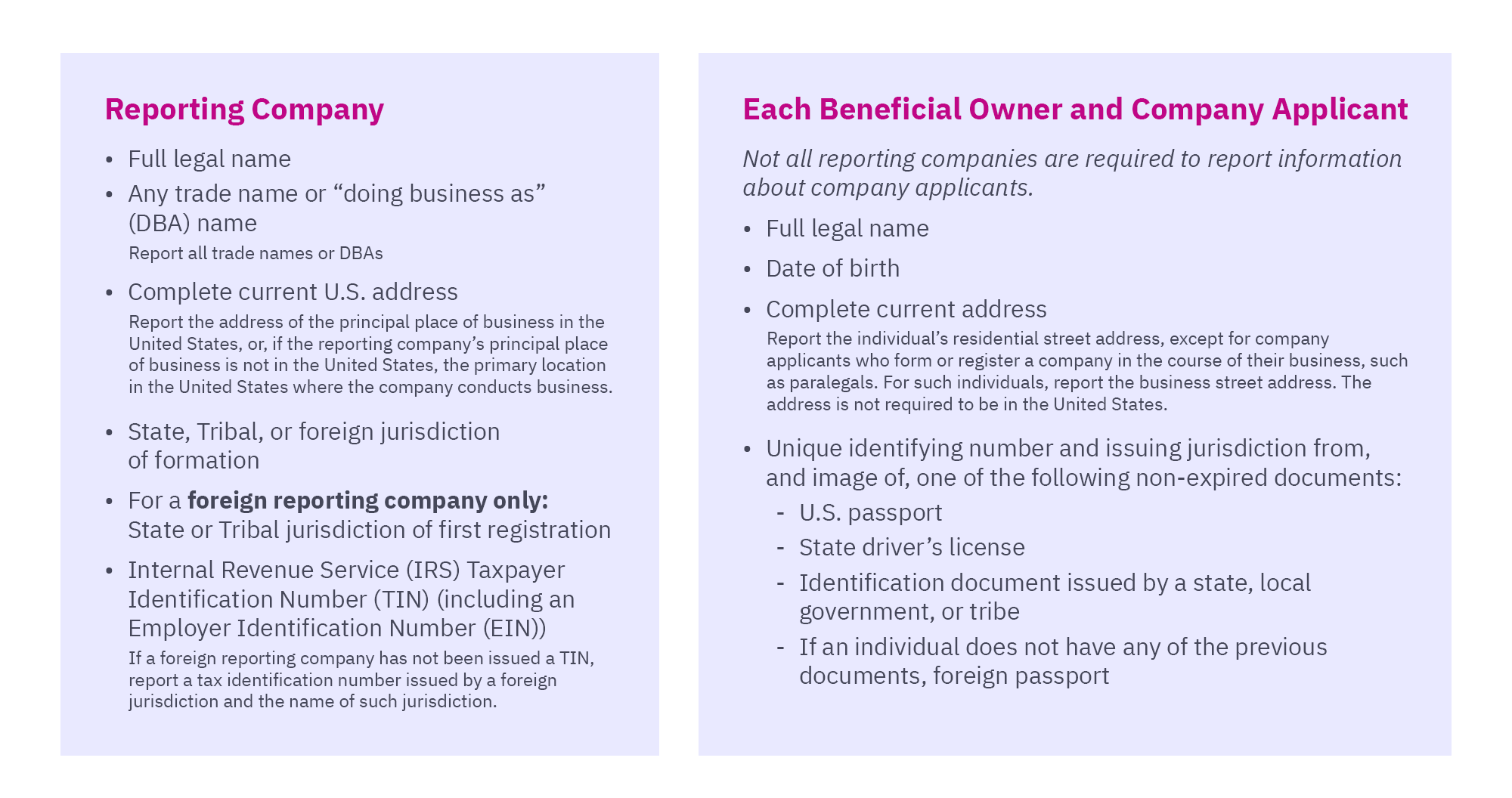

What BOI information is required?

The BOI reporting requirements include information on your company, beneficial owners, and, for companies created or registered on or after Jan. 1, 2024, company applicants. There are also four reporting rules that may apply to your company’s reporting obligations: if the company is owned by exempt entity, minor child, if it is a foreign pooled investment vehicle, and if company applicant is reporting for existing companies.

When you submit BOI reporting, you’ll be able to request a FinCEN identifier for the company which can be used in place of entering personal information in BOI reports, expediting the submission process.

If an individual has obtained a FinCEN identifier and provided it to a reporting company, the reporting company may include such FinCEN identifier in its report instead of the information required about the individual.

Source: FinCEN.gov

Who can help with questions about BOI reporting?

It may be helpful to start by reading FinCEN’s Small Entity Compliance Guide. For additional information and assistance, you are also encouraged to visit FinCEN’s BOI website or contact FinCEN through its web page.

Where is BOI reporting done?

When you’re ready to get started, here’s how to access the online reporting process:

Mercer Advisors provides customized financial solutions for professionals and business owners to help with meeting your financial goals. Our comprehensive wealth management addresses both personal and work-related needs.

If you are not a Mercer Advisors client and are interested in learning more about how we can help with selling your business, transitioning to a new role, participating in an IPO or recapitalization — as well as other business matters such as BOI reporting — let’s talk.

1. “Small Entity Compliance Guide,” Financial Crimes Enforcement Network, Dec. 2023.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

The services and third-party links are presented for information and educational purposes only. Mercer Global Advisors Inc. is not affiliated with, does not guarantee nor does it endorse any of the applications or services mentioned in this article. Utilizing the services and subscriptions mentioned above are at the total discretion of the individual and are not included with any service or fee offered through Mercer Global Advisors Inc.