Ready to learn more?

Bryan Strike, MS, MTx, CFA, CFP®, CPA, PFS, CIPM, RICP®

Director, Financial Planning

Learn strategies to help reduce potentially higher taxes when TCJA laws for income taxes and standard deductions expire in 2025.

The Tax Cuts and Jobs Act (TCJA) of 2017 lowered income tax rates across most brackets, nearly doubled the standard deduction, and eliminated personal exemptions. These changes will expire at the end of 2025 if Congress does not act to extend them for 2026 and beyond.

This article is part of a series of informational articles to help you better understand which TCJA laws are scheduled to sunset and how the changes may impact your tax planning strategies. Each article that delves into the specifics of a certain tax provision is intended to educate as well as offer suggestions that can help minimize any negative tax implications.

Articles in this series include:

What’s changing with income tax rates and brackets?

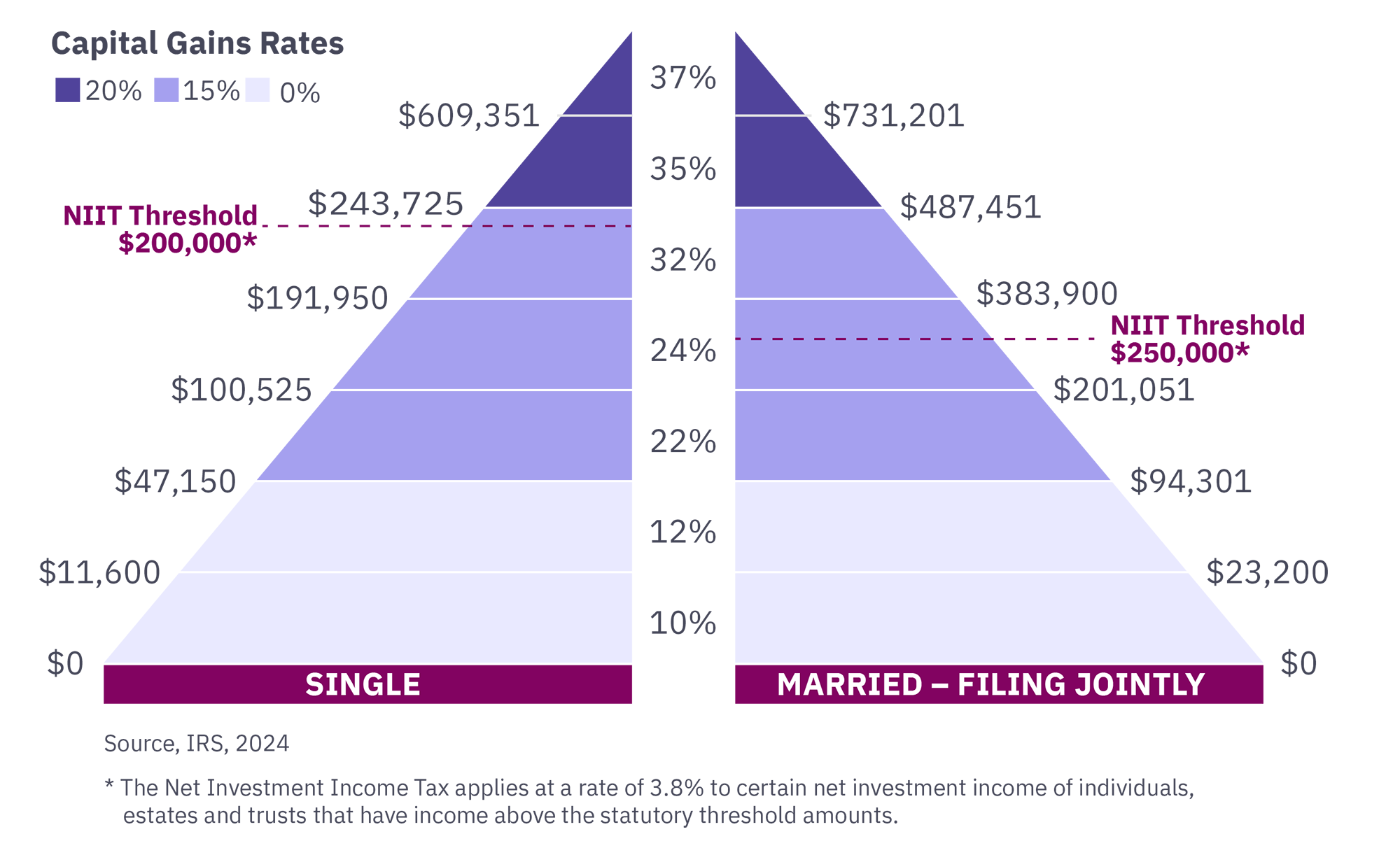

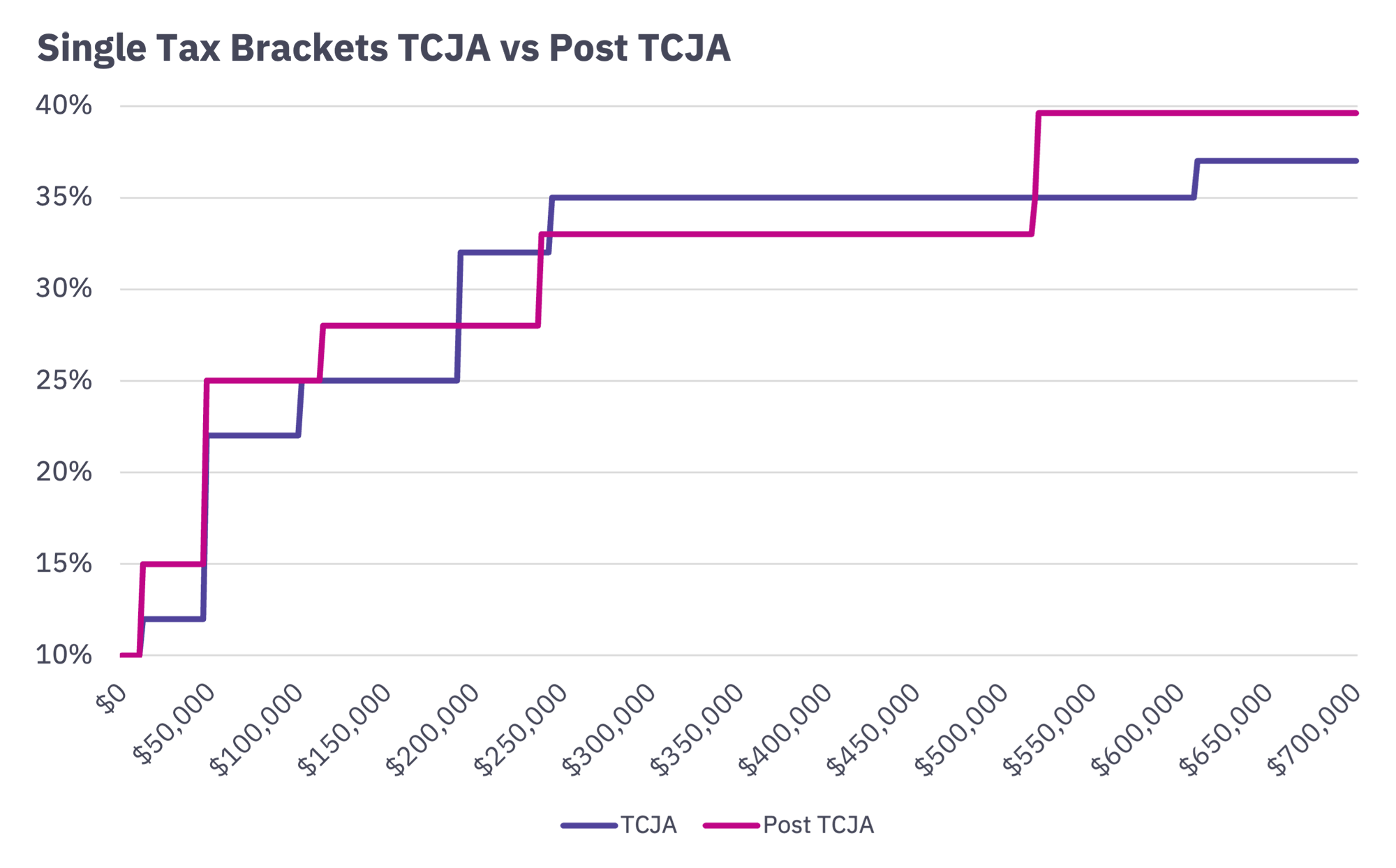

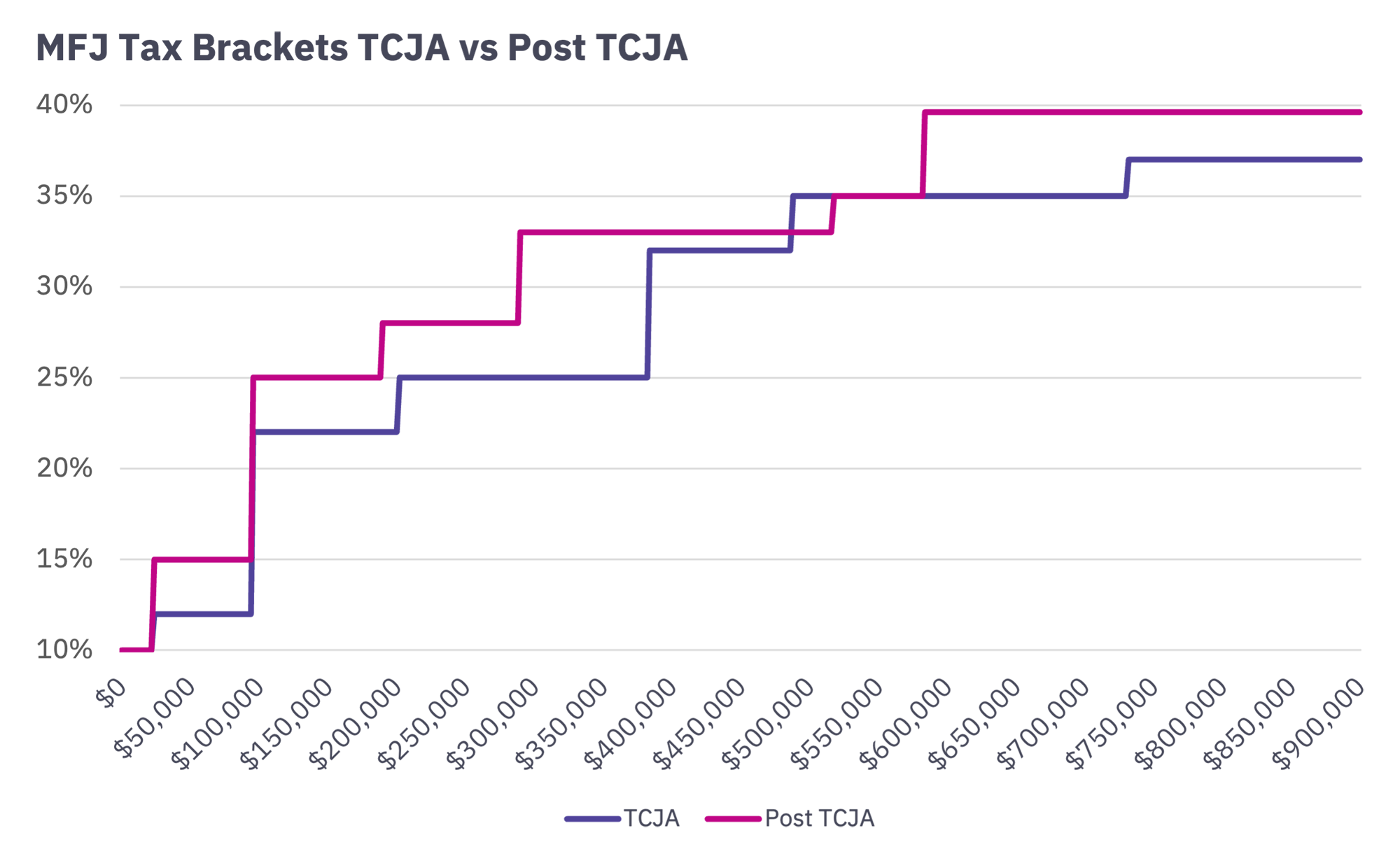

When the TCJA reduced individual income tax rates, seven tax brackets remained. The rates were generally lower, ranging from 10% to 37% (down from a maximum of 39.6%).1

As shown below, tax rates apply to each tax bracket in a progressive manner, meaning the rates increase as your taxable income increases.

Source: Internal Revenue Service

Looking at the projected 2026 tax rates shown below, the only rate expected to stay the same is the bottom rate of 10%. Not only are the rates expected to go up, but the levels of taxable income subject to those tax rates will shift as well.

What’s changing with standard deductions?

The standard deduction nearly doubled under the TCJA which then reduced the number of taxpayers itemizing deductions.

| 2017 | 2024 | Projected for 2026 | |

| Single and married filing separately | $6,350 | $14,600 | $8,300 |

| Married filing jointly | $12,700 | $29,200 | $16,600 |

As a cost offset for doubling the standard deduction, personal exemptions were eliminated with TCJA and are slated to return in 2026. The current estimate for 2026 is a $5,300 deduction per individual, spouse, and dependent. For single folks without dependents, the two deductions will result in approximately $1,000 of additional taxable income. Married taxpayers will see approximately a $2,000 increase in taxable income after the adjustment.2

What can I do today to prepare?

Here are a few strategies that may help keep higher taxes at bay:

Advanced income recognition: If possible, recognize more income in 2024 and 2025 while delaying deductions to 2026. Advancing or delaying income recognition could put you in a different tax bracket.3 For example, to move income forward sooner, you could advance billing and collections with small financial incentives if you’re self-employed.

Roth conversions: When converting to a tax-advantaged Roth IRA from a tax-deferred account, such as a 401(k) or IRA, you’ll need to pay tax on the converted amount at the time of distribution; however, the conversion can help with keeping taxes lower in the future when you may be in a higher tax bracket.

Charitable giving: Consider delaying 2025 philanthropic giving until 2026, or paying out from a donor-advised fund (DAF) for the next two years and refunding the granted money in 2026. This will allow you to take the tax deductions later when they may be needed more, while also possibly growing the fund in value with no tax consequences. The strategy of “deduction bunching” will be more powerful in 2026 when the standard deduction drops, providing a much lower hurdle to itemizing your deductions.

Next steps

The sunsetting of tax rate, tax bracket, and standard deduction laws that were enacted with the TCJA may influence your taxable income in 2026. This article covers only a few of the many ways you can plan to help avoid potentially higher taxes in the future. Contact your wealth advisor to develop a tax strategy that fits into your comprehensive wealth management solution.

If you’re not a Mercer Advisors client and want to know more about our integrated tax optimization strategies and how they can help now and beyond the 2025 expiration date for TCJA laws, let’s talk.

1 “Internal Revenue Bulletin: 2023-48,” Internal Revenue Service, Nov. 27, 2023.

2 “Navigating the 2025 Tax Landscape: Changes on the Horizon for Taxpayers,” FedSmith, May 30, 2024.

3 “Tax Strategies: Year-End Income Deferral & Expense Boost,” Green Growth CPAs, Oct. 11, 2023.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.