Ready to learn more?

Explore More

Home » Insights » Estate Planning » Using a Charitable Remainder Trust to Re-Stretch Inherited IRAs

Bryan Strike, MS, MTx, CFA, CFP®, CPA, PFS, CIPM, RICP®

Director, Financial Planning

Understand the SECURE Act’s impact on RMDs and explore the benefits of CRUTs for strategic retirement planning.

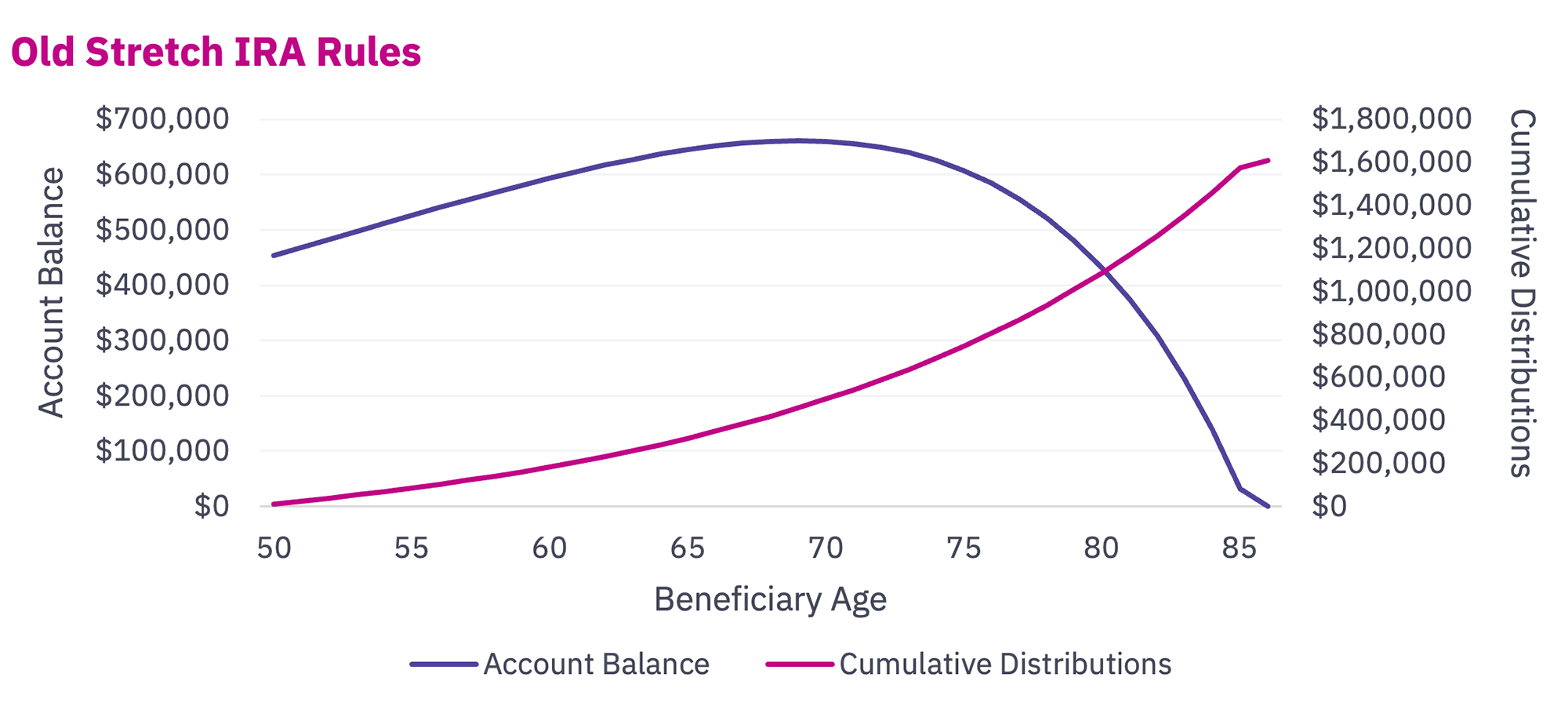

Before the SECURE Act in 2020, most non-spouse beneficiaries of retirement plans like IRAs, 401(k)s, and 403(b)s could stretch out their required minimum distributions (RMDs) over their lifetime.1 This allowed for smaller annual withdrawals and longer tax deferral.

At the death of a retirement plan’s original owner, or spouse if they elected the spousal rollover option, the non-spouse beneficiary would normally be subject to RMDs beginning in the year following the death. The distribution amount is determined using the Single Life Table in IRS Publication 590 based on the beneficiary’s attained age in the first year. After the first year, the factor is just reduced by one for each successive year.

Example: John’s father passes away in 2018 and leaves his IRA to John. John will turn 50 in 2019, so the RMD factor is 36.2 for 2019. If the IRA balance on Dec. 31, 2018, was $440,000, John’s RMD is $12,155 for 2019 ($440,000 / 36.2). In 2020, the factor is reduced to 35.2, then in 2021 it is reduced to 34.2, and so on.

Sticking with our example above, if John only takes the RMD at the end of each year and earns a steady 6% return, the IRA will be exhausted in the year he turns 86 with a cumulative distribution amount of $1,608,483!

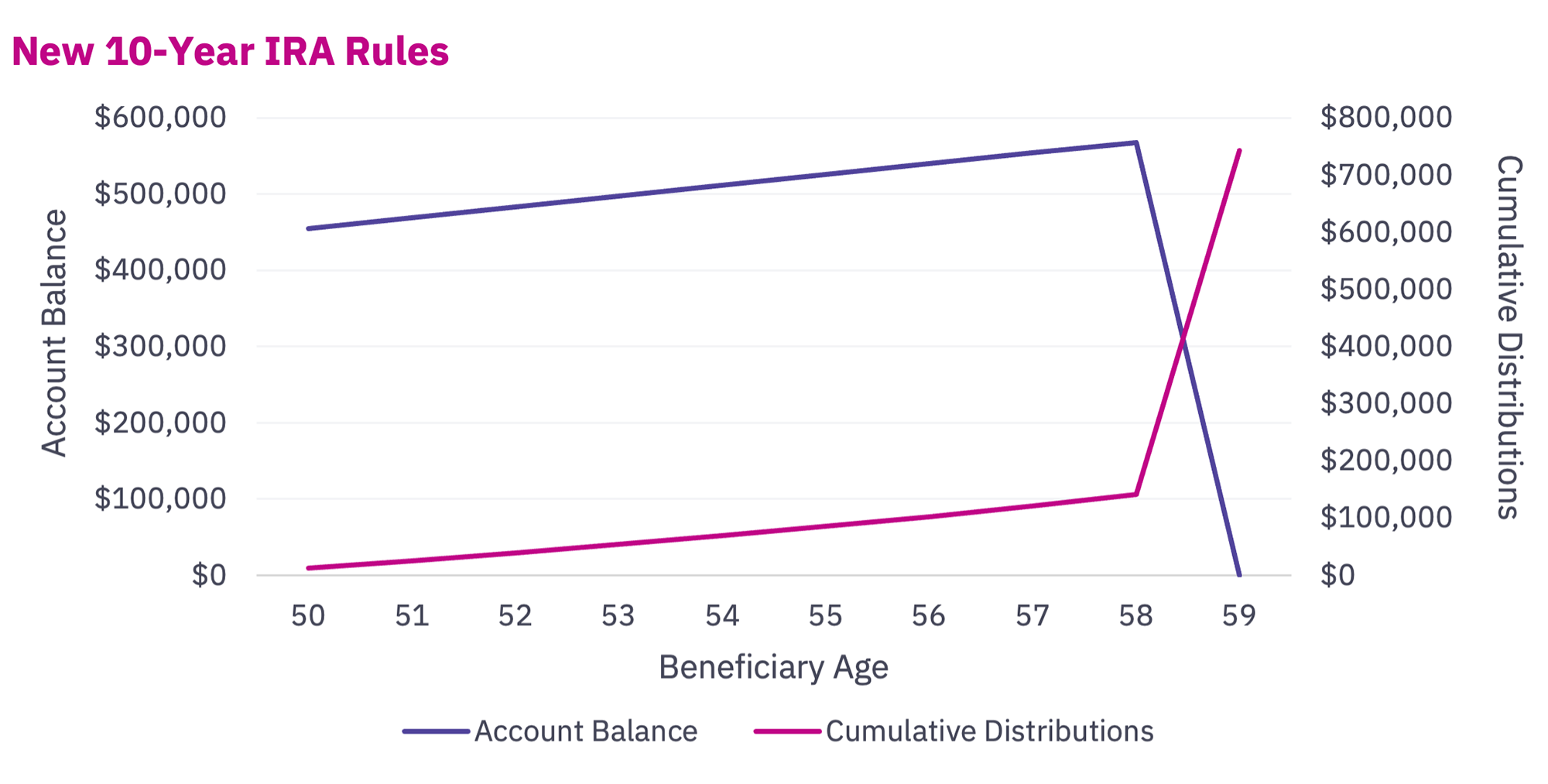

The SECURE Act changed the rules. Now, most non-spouse beneficiaries must withdraw the entire IRA within 10 years.2 This means larger withdrawals and higher taxes in the final year when the beneficiary must fully liquidate the IRA. While the minimum distributions are the same in years 1-9, taxpayers can elect to take more out during that time to reduce taxable income in year 10. However, either way, taxable income is advanced, tax deferral is significantly shortened, and planning becomes more important than ever.

Example: Continuing with our example above, assume John’s father passes away in 2020. John turns 50 in 2021, and the IRA balance at the end of 2020 is $440,000. Essentially, the same facts, but we are assuming John is subject to the SECURE Act rather than the old stretch rules. At the same 6% rate of return, taking only the minimum distribution will result in cumulative distributions of $742,615 and termination of the IRA in the year John reaches 59.

This may not seem too bad since John can then reinvest the proceeds in a brokerage account but consider the taxes in year 10. Assuming John’s taxable income prior to the distribution is $100,000, he is a single filer, and the 2025 rates apply, his tax bill is approximately $180,000 (not including any phaseouts or state/local taxes). This creates a significant drag on wealth accumulation over time.

Establishing a CRT allows you to transfer assets into a trust, which is a tax-exempt entity. The trust can then sell the assets with immediate taxes. The trust will then make regular payments to the beneficiary for up to 20 years or the beneficiary’s lifetime. After that, the remaining assets go to a charity that you have named.3

Benefits:

Drawbacks:

The actual dollar amount of distributions and remainder interests are based on calculations at inception, which rely on the beneficiary’s age or period certain selected, the prevailing applicable federal rate published by the IRS, return assumptions, payment frequency, etc. In short, there is not a specific distribution percentage that applies all the time.

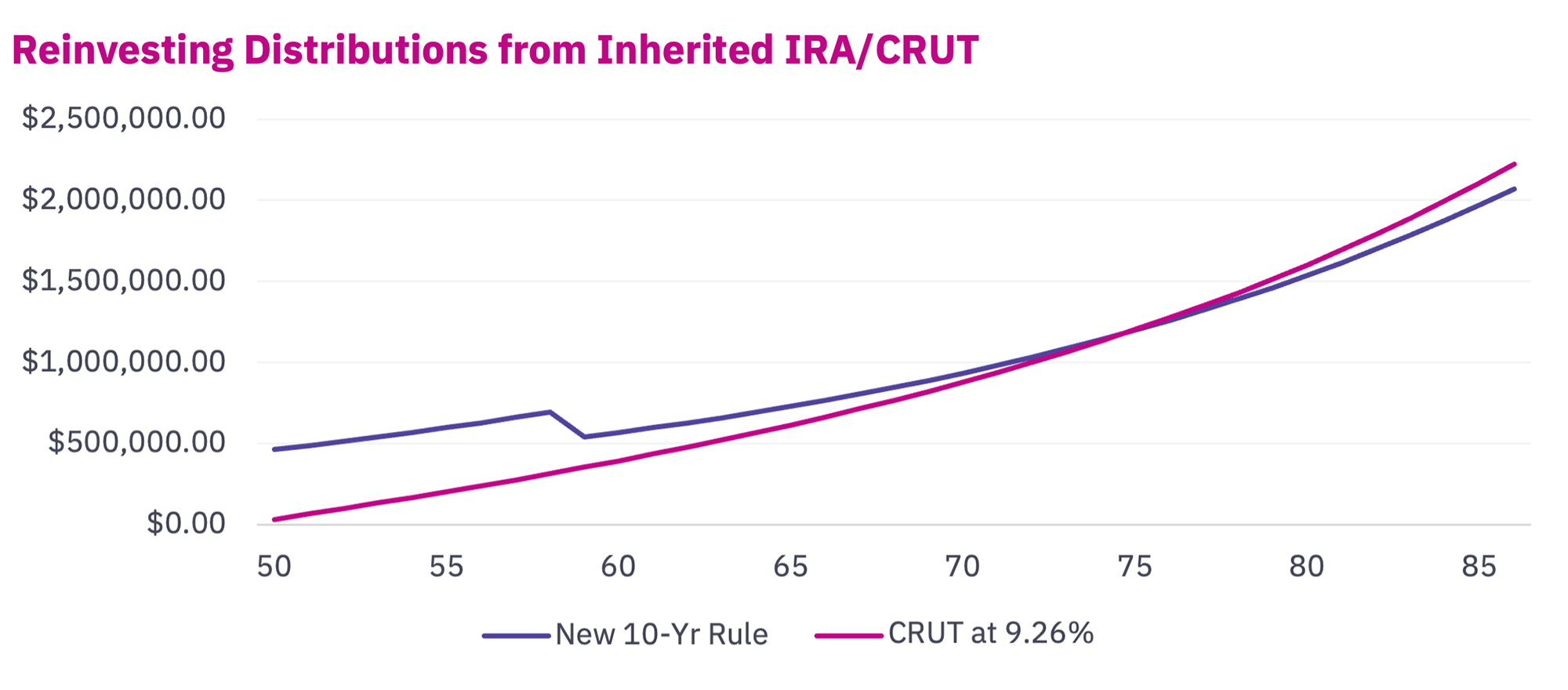

A CRT can be established in the estate documents of a decedent (known as a Testamentary Charitable Remainder UniTrust, or T-CRUT) with additional instructions to be funded by the decedent’s IRA. Instead of establishing the CRUT during life, this process gives the decedent/settlor the ability to make changes until incapacity or death.

Funding the CRUT with an IRA eliminates the inherited RMD requirement and allows the beneficiary to recognize the income distributions over a longer period than just 10 years. This alone permits the growth inside the CRT to be tax-deferred, which may compound at a faster rate than a taxable brokerage account.

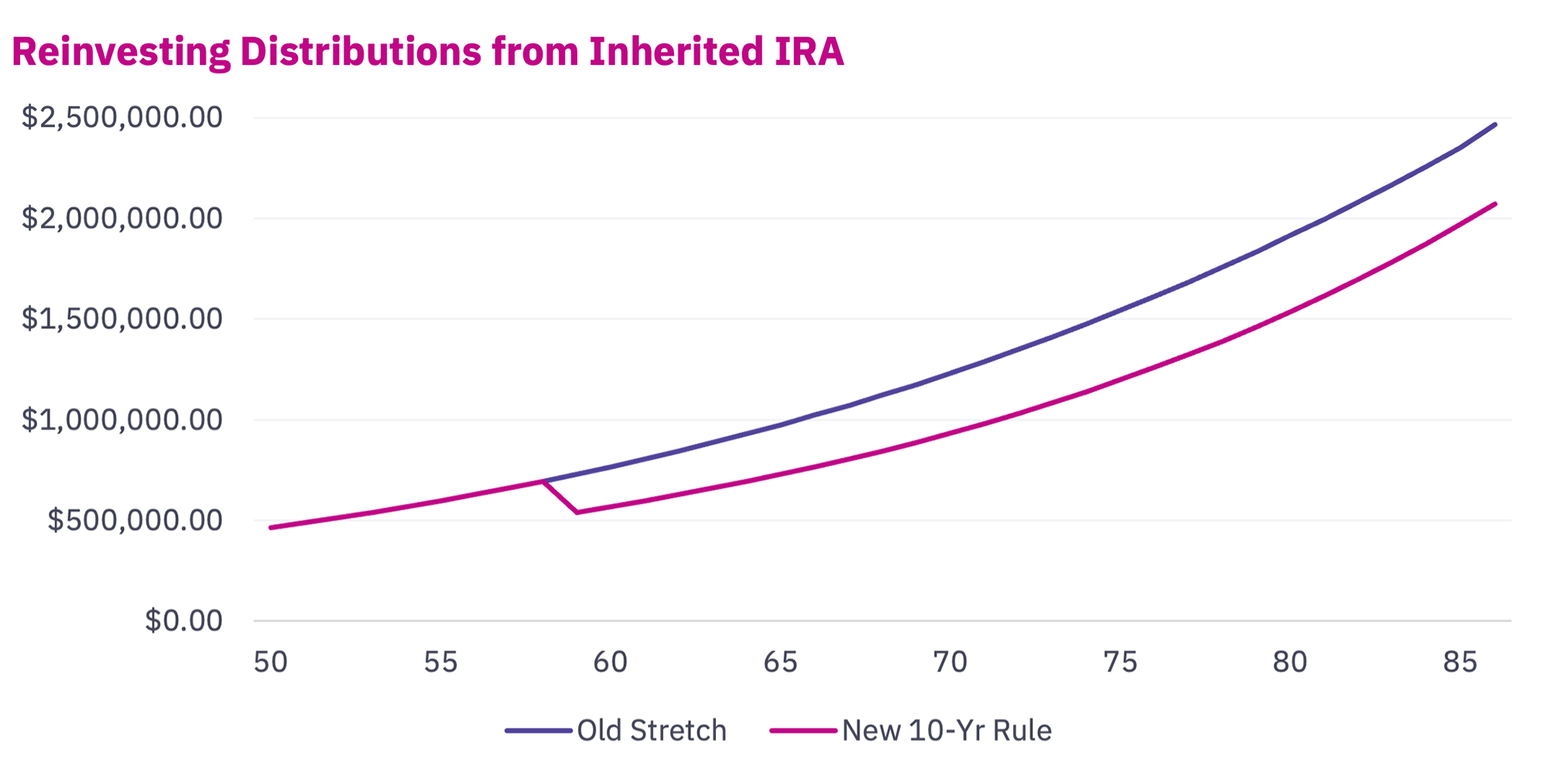

Example: Using John’s situation from the previous example, assume the distributions received from the inherited IRA are taxed at his ordinary income rate ($100,000 taxable income prior to distribution, single filer, 2025 tax rates used and inflated at 3% going forward, no state/local tax) and the after-tax proceeds are reinvested in a brokerage account earning 6%, with 15% tax drag (net annual return of 5.1%).

Alternatively, assume John’s dad set up a T-CRUT funding with the same IRA and a max distribution rate of 9.26% (current max based on this set of factors; do not assume your situation will result in the same distribution rate). Since the value of the trust at death is not technically John’s, the following chart only credits him for the value of the brokerage.

John’s breakeven age is 75, 25 years after his father passed away and just 10 years before we assume John passes. However, the terminal value of the CRT is about $129,000, which goes to charity, and John’s heirs receive about $150,000 more than under the standard 10-year rule!

The actual results would likely be even better under the T-CRUT as I assumed all distributions from the trust were treated as ordinary income, when the later years would be mostly capital appreciation subject to preferential rates.

Questions to consider when deciding if a T-CRUT is right for you:

To figure out if a charitable remainder trust is right for you, talk to your advisor. They can help you weigh the pros and cons and decide if it’s a good fit for your financial and charitable goals. Not a client? Let’s talk.

1 IRS Publication 590

2 https://public-inspection.federalregister.gov/2024-14542.pdf

3 https://www.law.cornell.edu/uscode/text/26/664

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. The above is a hypothetical example for illustrative purposes only. Actual investor results will vary. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

All investment strategies have the potential for profit or loss. C Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.