Ready to learn more?

Bryan Strike, MS, MTx, CFA, CFP®, CPA, PFS, CIPM, RICP®

Director, Financial Planning

Some individuals can make donations directly from an IRA via a QCD, but not everyone qualifies. See if a QCD is right for you.

The original SECURE Act was passed into law on December 20, 2019. Among other things, it eliminated the age cap for contributing to a traditional individual retirement account (IRA). Previously, you could no longer contribute to a traditional IRA after reaching age 70 ½. Now you can if you have earned income.

Qualified charitable distributions (QCDs) allow individuals aged 70 ½ and older to direct funds from their IRA to a qualified charity, free from income tax. As I explain in another article, QCDs essentially allow taxpayers to deduct charitable giving from their gross income (for adjusted gross income [AGI]) rather than treat it as an itemized deduction (below AGI).

Potential for abuse

A deduction for AGI is more beneficial than an itemized charitable deduction for several reasons. First, itemized deductions are beneficial only if they exceed the standard deduction amount for the year. The Tax Cuts and Jobs Act of 2017 nearly doubled the standard deduction, which makes it much harder for a taxpayer to benefit from typical charitable deductions. Secondly, itemized charitable deductions are generally limited to 30% or 50% of the taxpayer’s AGI, which may limit the tax benefit in a given year. QCDs, on the other hand, are limited only to the absolute amount of $108,000. Lastly, deductions that reduce AGI are beneficial in a multitude of areas – such as credits and retirement contributions – because AGI is often used to determine eligibility.

Combined with QCD rules, the new IRA contribution rule creates the potential for abuse. A taxpayer who wants to donate to charity could contribute to a traditional IRA, take a deduction for AGI, and then perform a QCD. This can create a deduction where none would’ve existed otherwise.

The solution

To overcome this potential for abuse, the SECURE Act states that taxpayers must track their cumulative deductible contributions to a traditional IRA for every year after they turn 70 ½. I’ll call this amount “post-70 ½ CDCs.”

A taxpayer’s post-70 ½ CDCs increase when contributions are made to a traditional IRA for the year the taxpayer reached age 70½ and every year after. They’re then reduced by any distribution that meets QCD rules. These distributions will be considered “rejected QCDs” until the amount of post-70 ½ CDCs drops to zero.

Rejected QCDs are treated as ordinary income for tax purposes, although the taxpayer may itemize them as charitable deductions. After the amount of a taxpayer’s post-70 ½ CDCs has fallen to zero, normal QCD tax benefits are back in play.

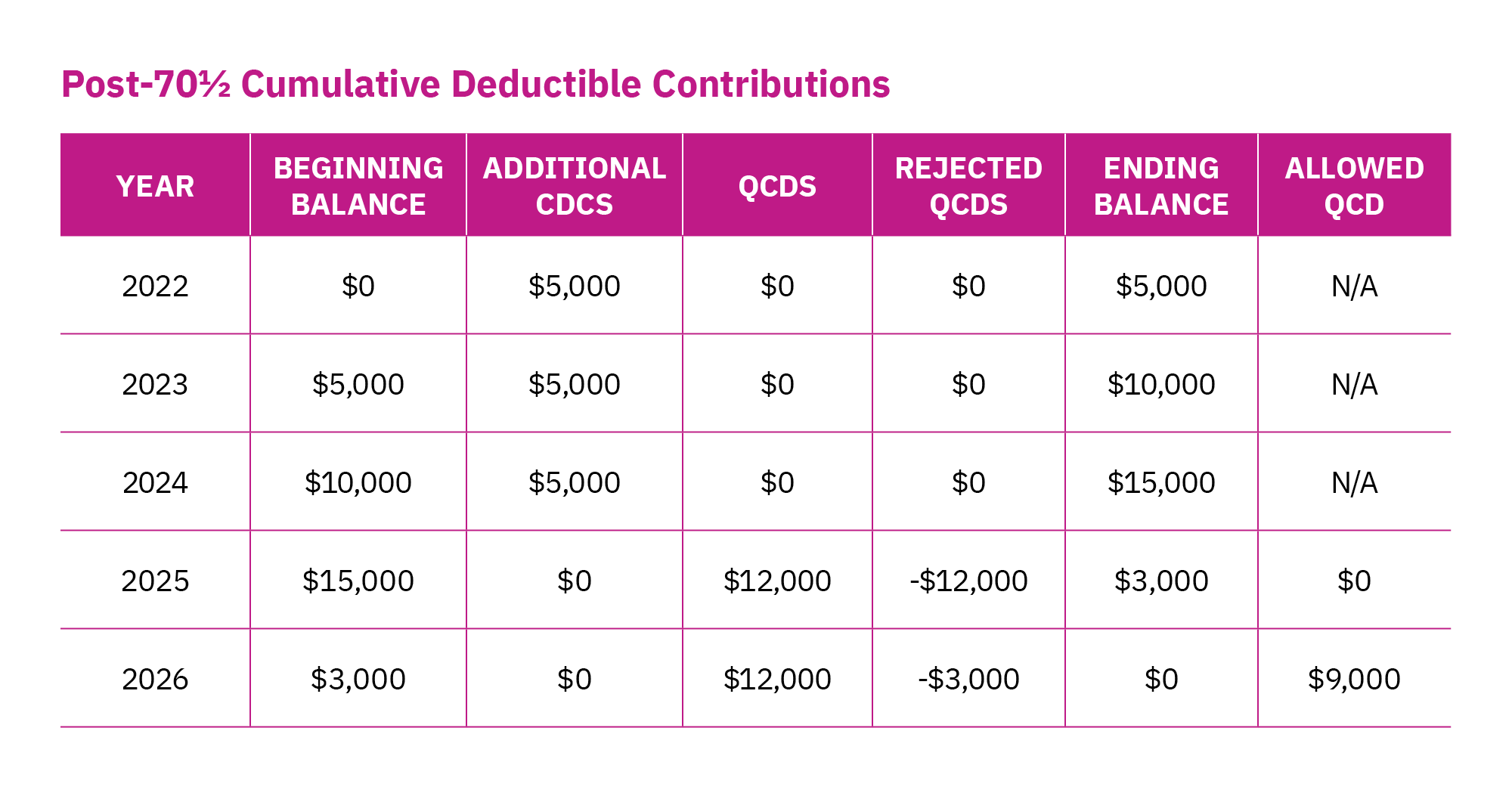

Example: Michael turned 70 ½ in February 2022. He had an IRA balance of $1 million, and he contributed $5,000 to the IRA in 2022. Likewise, he contributed $5,000 in 2023 and $5,000 in 2024, after which he retired. If Michael attempts to perform a QCD for $12,000 in 2025 and another $12,000 in 2026, what will be the tax consequences?

Because the distribution in 2025 did not reduce Michael’s post-70 ½ CDCs to zero, the full $12,000 is treated as a taxable distribution to Michael, and he may claim an itemized deduction for the charitable gift. In 2026, the amount of Michael’s post-70 ½ CDCs is reduced by $3,000. Because it may not fall below zero, this is treated as a taxable distribution, with an itemized deduction for the charitable gift. The remaining $9,000 is allowed as a QCD – a tax-free distribution with no itemized deduction.

Note: Contributions that increase a taxpayer’s post-70 ½ CDCs include those made for the year they turned 70 ½.1 Since IRA contributions can be made for a prior year up until the tax return filing date (usually April 15), the latest a taxpayer can make a deductible contribution without impacting their post-70 ½ CDCs is in the year they turn 70 ½, but it must be for the prior year.

Example: Megan turned 70 ½ in August 2023. Because she was still working and earning income, she qualified to contribute to a traditional IRA. She failed to contribute to her traditional IRA for the tax year 2022, but she had until April 15, 2023, to make a contribution and deduct it on her 2022 tax return. A contribution for 2022 was not included in her post-70 ½ CDCs. However, any deductible contribution for 2023 or subsequent years will increase the amount, creating problems if Megan wishes to make a QCD in the future.

The importance of planning

Every situation is different, so here are a few guidelines that can help determine whether a QCD from an IRA is appropriate for your situation, along with the implications for tax deductions:

QCDs enable some individuals aged 70 ½ and older to make charitable contributions directly from their IRA, without paying taxes. Thanks to the original SECURE Act, there’s no longer an age cap for contributions to an IRA, and the contributions can be used to make donations to the taxpayer’s chosen charity. QCDs will be rejected, however, if post-70 ½ CDCs are not first drawn down to zero. For that reason, a better solution for some individuals may be to contribute to a Roth IRA (deductible) or a traditional IRA (nondeductible). As always, we’re here to answer any questions you might have about IRA contributions, QCDs, or other financial planning needs.

For more information, contact your advisor. If you’re not a client, let’s talk.

1 “26 U.S. Code § 408 – Individual retirement accounts.” Cornell Law School, Legal Information Institute. Accessed Jan. 8, 2025.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Hypothetical examples are for illustrative purposes only. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.