Step into Your New Future with Clarity

The emotional stress of a divorce can be overwhelming. And it’s often exacerbated by financial issues, which can be divisive and complicated for affluent families.

At Mercer Advisors, we provide compassionate, personalized financial guidance throughout your divorce, empowering you to embrace the opportunities ahead. We’re dedicated to helping you navigate this emotional transition and emerge ready to take control of your next chapter.

Keep reading to learn more about how Mercer Advisors can help.

Why You Need a Divorce Financial Advisor

Waiting until during or after a divorce to make critical financial decisions can have lasting negative impacts. You may be able to avoid such consequences by having a strategy in place that balances all your post-divorce financial needs and goals.

That’s why it’s important to start the divorce financial planning process as early as possible. We recommend hiring a divorce financial advisor immediately after you have a) decided to get divorced and b) hired an attorney.

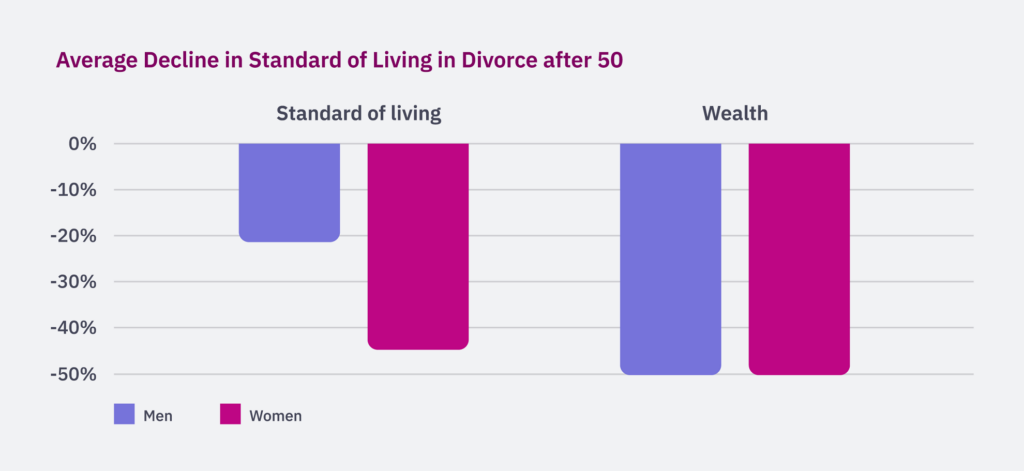

Notably, financial consequences are especially pronounced in “gray divorce,” or divorce after age 50.

Source: The Economic Consequences of Gray Divorce for Women and Men, I-Fen Lin, PhD and Susan L Brown, PhD. The Journals of Gerontology, Gerontological Society of America September 2020.

That’s where we come in. When you’re navigating divorce, your Mercer Advisors team can help you evaluate settlement proposals, assess marital assets, reset financial goals, and develop a strategic financial divorce plan that’s tailored to you.

We’ll listen — without judgment — and provide the clarity you need to take these next steps with confidence so that you can avoid disruption to your standard of living.

How Mercer Advisors Helps Divorce Clients

Often, the financial impacts of divorce don’t become clear until it’s too late. To get ahead of these impacts, you need more than a good lawyer. When you’re negotiating the end of a marriage you also need a smart and practical financial strategy.

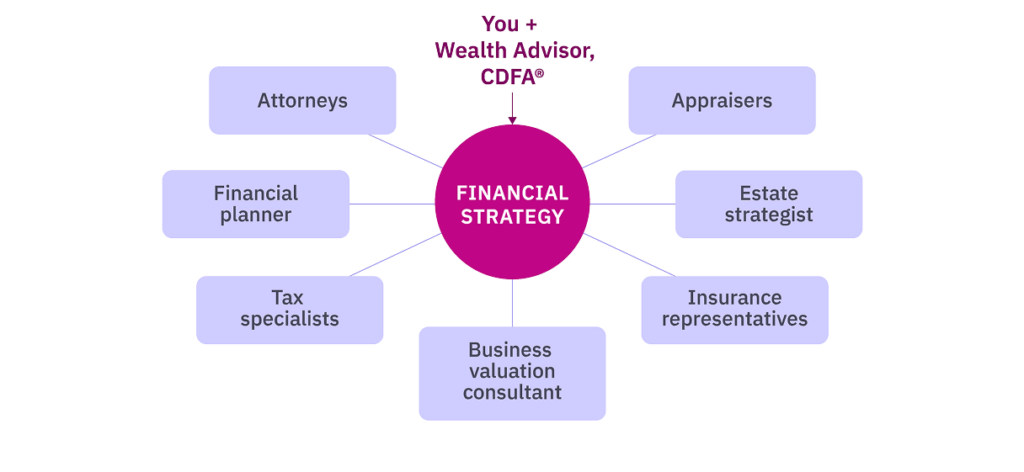

Ours involves a specific approach and process, which is supported by Certified Divorce Financial Analysts (CDFA®s) and backed by a team of financial planners, investment managers, tax accountants, insurance specialists and estate strategists.

We help divorce clients in three specific ways:

We help simplify complex issues like asset division, alimony, and more — translating them into actionable insights.

We partner with you and your attorney throughout the entire divorce process, providing both parties with data that shows the financial impact of any given settlement.

We recognize there’s more to divorce financial advice than just numbers on a balance sheet; we address your specific concerns and help empower you to make more informed decisions.

Specialized Divorce Financial Planning Services

- End-to-end consulting, from pre- to post-divorce

- Illustrating potential financial outcomes from legal settlements

- Collaborating with your divorce attorney to provide litigation support

- Navigating how state family law can affect your options

- Analyzing financial disclosure documents for tax-efficiency opportunities

- Planning for your new financial reality: cash flow, retirement

- Enacting asset division as dictated by divorce agreement

- Advising on tax filing as single or head of household

What You Can Expect from our Divorce Financial Advisors

As soon as you’ve decided to pursue a divorce, it’s time to assemble your team. While your divorce attorney will lead the legal proceedings, hiring the right divorce financial advisor in the early stages is critical. Here’s what you can expect from our team:

Are you interested in a more custom, private family office solution?

A clear vision of the path forward.

A major question for divorce clients is if they’ll be able to maintain their lifestyle. Our personalized financial plan and detailed cash flow planning will help you understand the potential longevity of your money.Collaborative decision-making.

As your trusted partner, we’ll help you avoid making short-term financial decisions that could result in long-term consequences. Our goal: To help you set achieve the best possible long-term financial outcomes.A financial plan and portfolio that’s uniquely yours.

You have an opportunity to shape your financial life in accordance with your wishes — no one else’s. You envision your new future, and we’ll create the plan and portfolio that’ll help you get there.More FAQs about Divorce and Finances

-

It’s a good idea to organize your current financial picture — and imagine what your post-divorce financial life may look like — prior to filing for divorce. Consider the following questions:

- Which assets are jointly owned, which are in my name, and which are in my spouse’s name?

- Do I have an accurate appraisal of the value of each of our major assets?

- What debt do I have? What shared debt do we have?

- How is my current lifestyle funded?

- What might my monthly income and expenses look like after divorce?

- How much might I be able to expect in child support and/or alimony?

- How much will the divorce attorney cost?

-

Divorce finances can be complex, and when coupled with a potentially emotionally-charged situation, they can be explosive. That’s why we believe it’s in your best interests to get an object third party in the form of a divorce financial advisor to help guide you through this challenging time. Some key subjects to know about:

- Asset Division: Each state has different rules that affect how assets and debts are classified and divided (see the next section for more detail), and if you have a prenuptial agreement in place, that may also factor into the details of your divorce agreement when it comes to asset division.

- Alimony: May be awarded to a spouse to provide ongoing financial support after a divorce. The amount and duration are determined by things like marriage length, each spouse’s income/financial situation, contributions to the marriage (e.g. stay at home parent), and lifestyle during marriage.

- Child Support: If you have children, the non-custodial parent may have to pay child support to the custodial parent to help cover expenses like childcare, education, and healthcare. These often follow state guidelines.

- Financial Disclosure: Both parties are generally required to provide a full picture of their financial life, including assets and debts, plus regular income and expenses.

- Retirement Accounts: Gains in retirement accounts like 401ks may be subject to division. A Qualified Domestic Relations Order (also called a QDRO) is used to avoid tax penalties during the division. Of note: You’ll want to be sure your beneficiaries are up to date on all accounts. If your ex-spouse is still listed as the primary beneficiary on your account when you pass, they will be entitled to receive these assets, even after a divorce.

- Taxes: You may have a change in filing status after your divorce. It’s in your best interest to work with a CPA or other tax professional to determine what your tax liability could look like post-divorce. You may also have one-time or limited time taxes on asset transfers, alimony payments, etc., that you’ll need to factor into your financial plan.

-

Generally speaking, there are two legal methods to determine how assets (and debts) are divided.

- Community Property: In community property states, assets acquired during marriage are assumed to be equally owned, and are thus divided 50/50 during a divorce. Current community property states include Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin.

In the U.S., the states where community property is optional include:

- Alaska: Allows couples to opt into community property through a legal agreement.

- Florida: Couples can opt into community property through a community property trust.

- Kentucky: Couples can establish community property trusts.

- South Dakota: Couples can opt into community property through a community property trust.

- Tennessee: Couples can opt into community property through a community property trust.

- Equitable Distribution: In equitable distribution states, assets acquired during marriage to the spouse who bought them. When a marriage ends in an equitable distribution state, property is divided to reflect each spouse’s contributions and needs. A judge is typically required to ascertain factors like health, job/earning potential, and financial needs in deciding how assets and debts are to be equitably distributed.

Note: A prenuptial agreement (or a “prenup,” as they’re commonly referred to) enabled couples to superseded community property laws. If you have a prenup in place, you’ve already determined who is entitled to which property in case of divorce.

- Community Property: In community property states, assets acquired during marriage are assumed to be equally owned, and are thus divided 50/50 during a divorce. Current community property states include Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin.

The CDFA® and Certified Divorce Financial Analyst marks are the property of the Institute for Divorce Financial Analysts, which reserve sole rights to their use, and are used by permission.

Meet a Few of Our Certified Divorce Financial Analysts

Our talented advisors offer deep expertise helping individuals navigate divorce and financial planning.

Being the solo decision-maker during and after divorce is both freeing and daunting. We’re your partner in helping you make the right decisions to set yourself up for the best possible outcomes.

Once we run your financial plan, we can help you visualize what your post-divorce financial future could potentially look like. We strive to demonstrate the value we can bring to your needs.