Smart Planning for Your Federal Career and Beyond

Federal employees navigate many complex financial decisions: rigid benefit structures, critical pension elections, TSP investment choices, and survivor benefit planning.

Mercer Advisors can simplify your financial life by helping you understand your full range of government benefits: when to claim them, how much to expect, what choices are available, and the potential implications of those choices. With a personalized financial plan, we help provide clarity and confidence in your path toward achieving long-term financial security.

Why Federal Employees Need Specialized Financial Planning

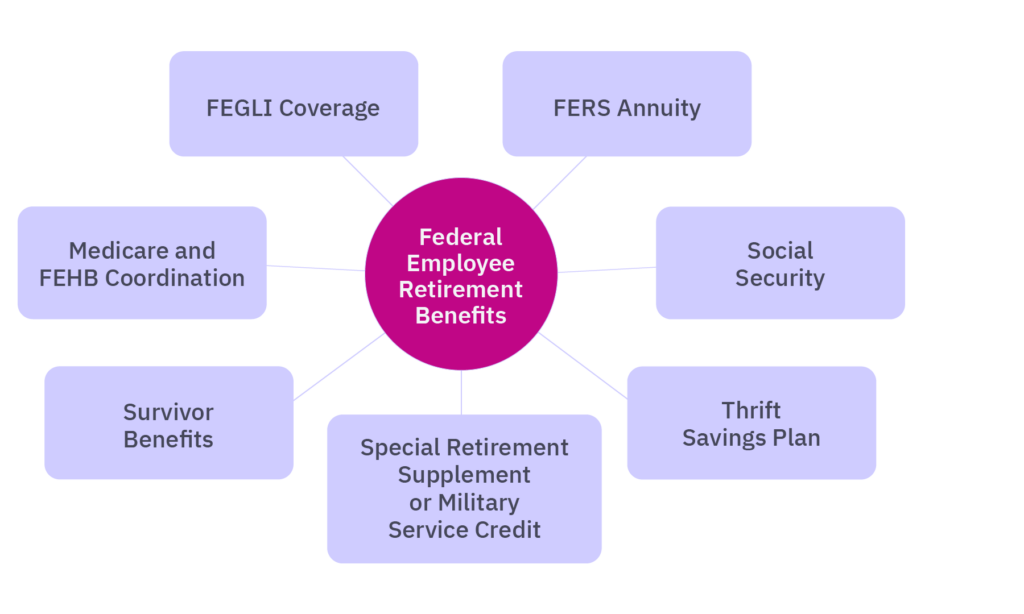

Federal employees enjoy a unique and complex set of financial benefits designed to support a secure retirement. With access to pensions, low-cost investment options through the Thrift Savings Plan (TSP), the Federal Employee Retirement System annuity (FERS), insurance programs, Social Security, and for long-time workers, the Civil Service Retirement System (CSRS), navigating these resources requires careful, specialized planning.

Unlike private-sector workers who often rely on 401(k)s and IRAs, federal employees face distinct rules, choices, and challenges that can impact their long-term financial stability. Without professional guidance, missteps can lead to costly consequences:

- Unexpected tax burdens from lump-sum distributions or improper rollover strategies

- Irreversible pension election choices that may affect survivor benefits and lifetime income

- Limited investment selections in TSP funds, which can hamper growth potential or exposing retirement savings to unnecessary risks

- Coordination issues between Social Security, Medicare, and the Federal Employees Health Benefits (FEHB) program, which can affect healthcare costs and income sustainability in retirement

How Mercer Advisors Supports TSP, Pensions & Federal Benefits

Making the most of your federal benefits programs requires a holistic where all components work together to help create long-term financial security.

At Mercer Advisors, we help federal employees navigate critical financial decisions amid changing conditions like market volatility, career transitions, or new legislation through comprehensive wealth strategies that coordinate your federal benefits, help optimize tax efficiency, and provide financial clarity.

Our deep expertise in federal retirement systems helps government employees avoid costly mistakes, capitalize on strategic opportunities, and retire with confidence.

Specialized Services for Federal Employees

- Pension election guidance (FERS, CSRS, and more)

- TSP fund selection guidance

- Tax-optimized TSP rollovers and Roth conversion strategies

- Medicare and FEHB integration planning

- Survivor benefit election modeling

- Income replacement forecasting through TSP and pension distributions

- Social Security claiming strategies

- Evaluating FEGLI coverage vs. private insurance options

Mercer Advisors is not a law firm and does not provide legal advice to clients. All estate planning document preparation and other legal advice is provided through select third parties unaffiliated to Mercer Advisors. Tax preparation and tax filing are a separate fee from our investment management and planning services.

Additional Solutions to Help Strengthen Your Federal Financial Plan

Your federal benefits are just one piece of your overall financial picture. We offer comprehensive services to help you protect and grow your wealth—whether you’re navigating retirement decisions, attempting to reduce your tax burden, or preparing your legacy.

Federal Retirement Checklist: Prepare for Your Next Chapter

Key moves to make now:

FAQs About Financial Planning for Federal Employees

-

Your FERS or CSRS pension election is permanent, so it’s crucial to choose wisely. Opting for a survivor annuity helps ensure your spouse continues receiving benefits, but it reduces your monthly pension. Consider whether life insurance or other assets can supplement survivor income while maximizing your pension payout.

-

Federal retirees can roll over their Traditional or Roth TSP into an IRA to maintain tax advantages, or into another qualified plan. Keeping funds in the TSP provides low-cost index options, but rolling into an IRA allows for more flexibility in withdrawals, Roth conversions, and estate planning. Be mindful of required minimum distributions (RMDs).

-

At age 65, enrolling in Medicare Part A (typically premium-free) is advisable while maintaining FEHB. Whether to take Part B depends on your coverage needs. While FEHB remains active, many federal retirees skip Part B to avoid extra premiums. However, enrolling can reduce out-of-pocket costs for medical expenses outside FEHB.

-

Avoid unwelcome tax surprises by strategically timing pension withdrawals and TSP distributions. Consider Roth conversions before reaching RMD age to control taxable income. Coordinating TSP withdrawals with Social Security claiming strategies can help minimize income-based Medicare surcharges and federal taxes.

-

Yes, as federal benefits do not automatically cover estate planning needs. While FEGLI life insurance, FERS/CSRS survivor benefits, and TSP beneficiary designations help, a trust or will ensures efficient wealth transfer and asset protection, particularly if you have federal long-term care insurance (FLTCIP) or property outside designated beneficiaries.