How Mercer Advisors Does Institutional-Grade Investing

A Team of Professionals Overseeing What’s in Your Portfolio

Investment Committee-led decision making

-

While each of our clients have an individual wealth advisor, to help ensure you get the best thinking for the investments in your portfolios, our investment decisions are made at the firm level by a centralized Investment Committee using a rigorous methodology.

Investing Based on Facts, Not Fads

Evidence-based investing

-

We base our investment decisions on external Nobel Prize-winning academic research1, rigorous data analysis, and in-house due diligence. We do not invest based on gut feelings, media headlines, or market predictions unsubstantiated by science.

Learn more about our evidence-based investing principles.

1 Harry M. Markowitz; Merton H. Miller; and William F. Sharpe (1990 Nobel Prize): For their pioneering work in the theory of financial economics. Robert C. Merton; Myron S. Scholes (1997 Nobel Prize): For a new method to determine the value of derivatives. Eugene F. Fama; Lars Peter Hansen; and Robert J. Shiller (2013 Nobel Prize): For their empirical analysis of asset prices. Richard H. Thaler (2017 Nobel Prize): For his contributions to behavioral economics. It should not be assumed that future performance of any specific investment or investment strategy will be profitable, equal any historical performance level(s), or prove successful.

Scale that Matters

Direct access to leading investors, typically with lower fees

-

We bring the total assets of our firm to the table — and make our investment decisions as a firm — we are able to secure access to some of the most exclusive, top quartile managers in the world — and typically at lower fees and minimums.

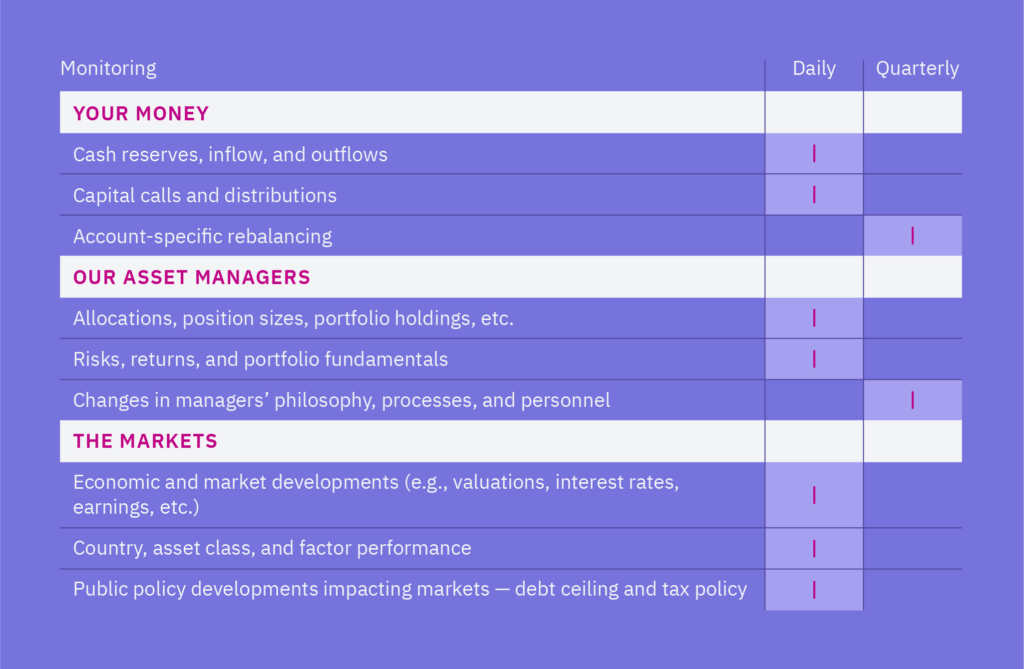

Seeking a Remarkable Level of Oversight

Full-time portfolio and market monitoring

-

Our 100+ investment team seeks to provide a level of, sophisticated portfolio and market monitoring that meets or exceeds the levels found at some of the country’s largest investment advisor groups.

Disclosure: Monitoring is dependent upon the type of account (managed or unmanaged) and client objectives, therefore specific monitoring may vary from client to client.

How Our Clients Benefit

-

Our scale, buying power, and deep bench of investment professionals positions us to invest in the full range of global investment opportunities.

-

Having a single advisor responsible for portfolio management and oversight can put your portfolio in jeopardy. We put our entire 100+ investment team behind every client portfolio, mitigating this kind of key person risk.

Additionally, our approach, team, and resources provide a rigorous level of market, manager, and portfolio oversight.

-

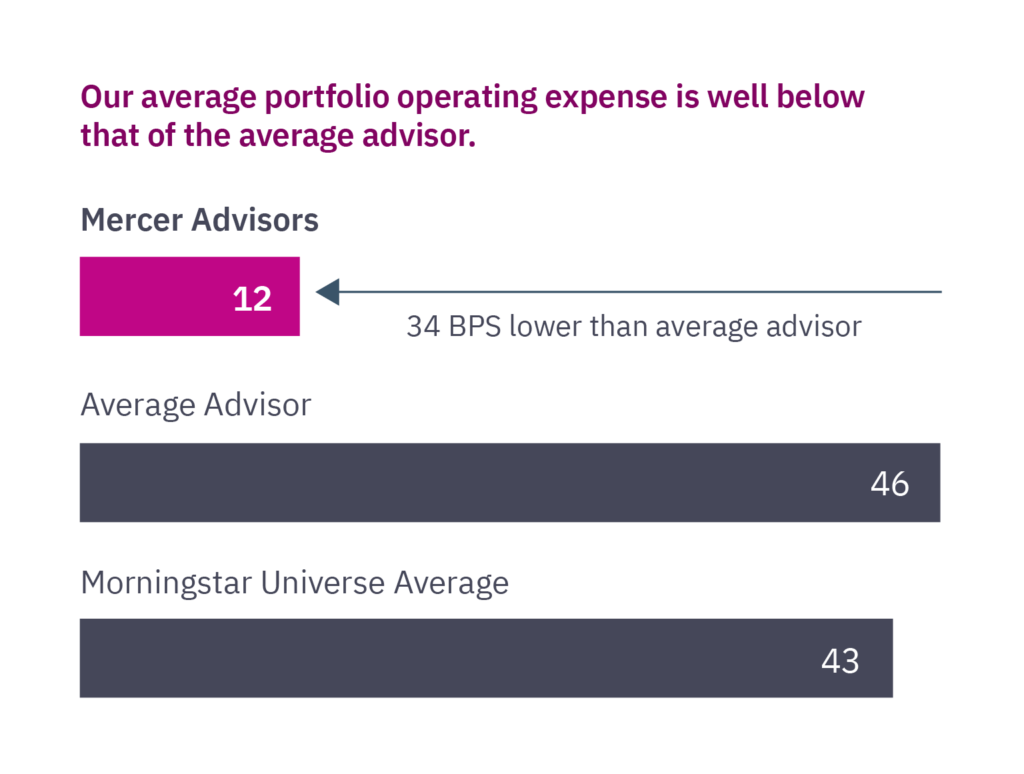

Our academically grounded investment philosophy means we don’t chase expensive celebrity fund managers. We look past the noise and hype to focus on the evidence — including the impact of fees on total returns.

Additionally, our peer-to-peer executive relationships help us negotiate access to preferred investments and pricing.

Source: BlackRock, Aladdin, Morningstar as of 12/31/23. For illustrative purposes only. Mercer Advisors and peer firm investment portfolio fees refer to the median operating expense ratios. Mercer Advisors’ investment portfolio fee is a mathematical average of all the firm’s model portfolios. Actual client fees will vary due to client customization and investment objectives. Fees discussed do not account for investment advisory fees or transaction charges that a client may typically incur in the management of their investment portfolio. No portion of the above should be construed as any guarantee that an investor will experience a certain level of results or satisfaction if Mercer Advisors is engaged, or continues to be engaged, to provide investment advisory services. Lower expense ratios are also no assurance of a satisfactory advisory experience or positive investment performance results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Mercer Advisors) or any planning or consulting services, will be profitable, equal any historical performance level(s), or prove successful.

Higher Performance Potential

The benefits of institutional-grade investing have historically added up to higher potential returns.